Honey, I shrunk the battery market

When I was a kid, the past wrote checks for the future reality couldn’t cash. I never got a flying car, let alone a jetpack, and a picture book I had promised me the 2020 Olympics would be on the moon. Well, it’s 2020 now and we don’t even have an Olympics, let alone a moon colony to hold it in.

But I’m not going to spend time complaining about childish dreams of a Buck Rogers future that never came to pass. Instead, I’m going to complain about adult predictions made just four years ago by financial analysts and other experts on how many home battery systems Australia would have by 2020. Some were so far off they were in Olympics-on-the-moon territory.

Future-hype may have left me with the bitter taste of non-existent moondust in my mouth, but the failure of battery-hype has left me feeling drained of all energy.

As a kid this looked so cool, but as an adult, all I can think is this poor guy is being forced to increase his radiation count for a goddamn photo op. Also, why does he have tubes going from his backpack to his chest? Do his nipples require a constant flow of fresh oxygen?

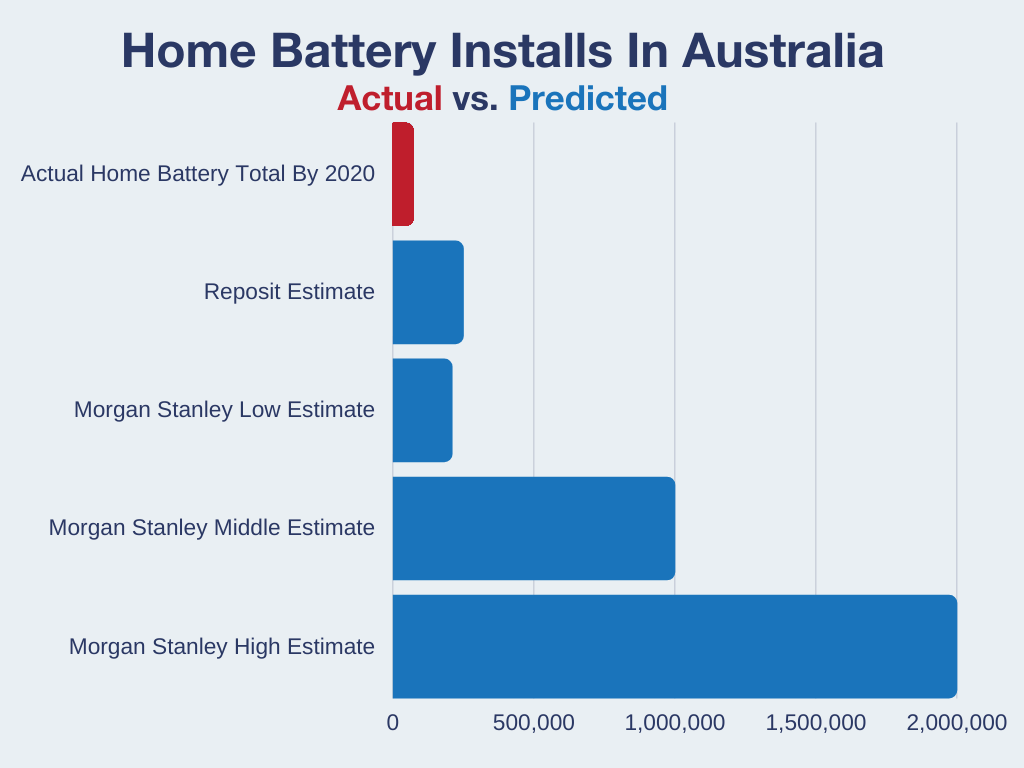

When predictions turn out to be twice as high as reality, that’s what I call optimistic, but many went way beyond that into crazy-mistic territory. Only four years ago, Morgan Stanley analysts made a middle-of-the road prediction that, by this year, 1 in 10 Australian homes would have a battery. They also had an optimistic scenario where they said it would be 1 in 5.

The actual number of home batteries installed at the start of this year was around 73,000. That’s 1 in 136 homes, so the prediction they thought was reasonable was around 14 times too high. To be fair, they did have a low uptake estimate of 210,000 home batteries. That’s only about three times too high.

In October 2016, the Chief Technical Officer of Reposit, a Canberra based battery focused biz, predicted 250,000 home batteries by 2020.

Using my awesome hindsight powers, these predictions seem ridiculous, but there are a number of good reasons why serious people thought they weren’t making fools of themselves. But there is one main reason why they were wrong and that is…

Home batteries still don’t pay for themselves.

If they were a clear money saver we’d see plenty of them being installed, but they’re not. Not at this time and not for normal households. For a typical home, they don’t pay even in South Australia with its high electricity prices and sizable battery subsidy. There may be unusual households where they currently pay and there are certainly people who find the backup power batteries can provide make them worthwhile. But as a money saver for most households, they’re not there yet. Virtual Power Plants (VPPs) may make a difference to this, but they are only just getting off the ground.

Obviously, the people making optimistic predictions must have thought batteries were on the cusp of paying for themselves back in 2016. That has not happened and the experts appear to have suffered from a bad case of premature prediction. Falling prices and payments from joining a Virtual Power Plant seem certain to make batteries eventually pay for themselves. It’s just a matter of when. And 2020 is not when.

So why were these smart, serious people so far off the mark? Firstly, I suspect their predictions were distorted from gulping down some delicious battery-hype flavoured kool-aid.

The second, bigger reason I think they were so far off is they didn’t allow for the fact that, unlike solar PV and lithium battery cells, each modest decrease in price does not result in a significant expansion of the market. The huge expansion in the market they were expecting hasn’t happened yet and won’t occur until home batteries pass the threshold where they save normal households money. The lack of an expanding market means not enough battery systems have been installed to drive rapid cost reductions and quality improvements. The point at which the market will start to expand is still months to years away.

Battery Uptake Graphs

Here’s a graph showing how many battery systems were installed in Australia by 2020 compared to 2016 estimates by Reposit and Morgan Stanley:

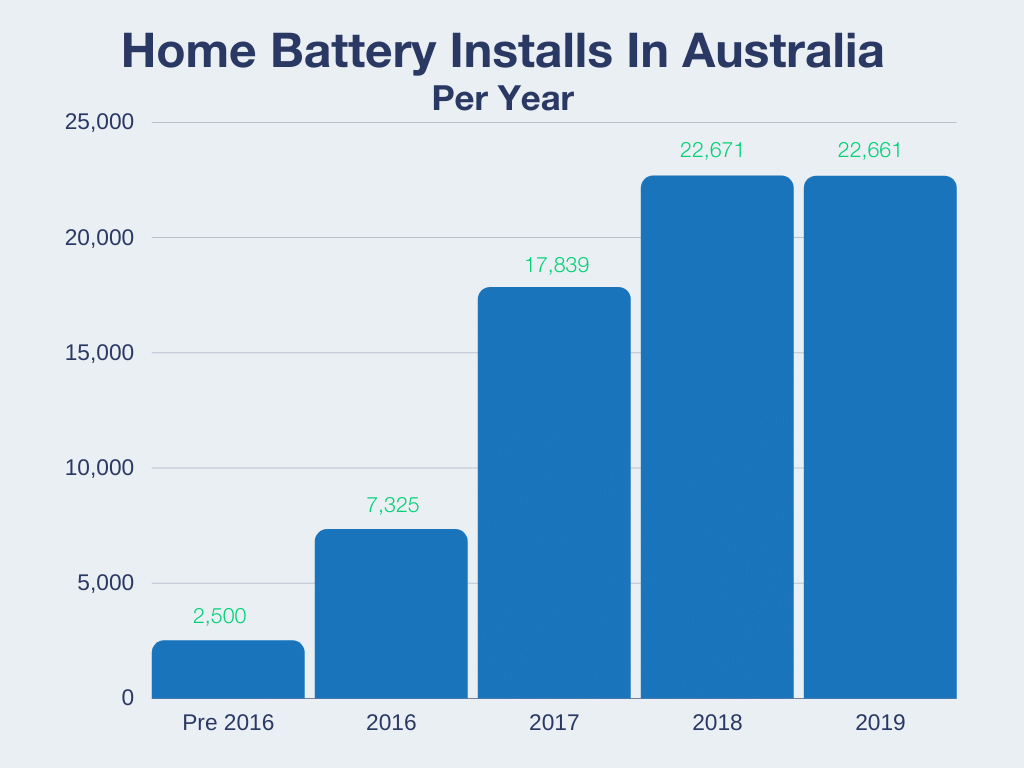

When you look at the actual figure, you can see those were some pretty optimistic predictions. But the 73,000 value for systems installed at the start of the year is, in a way, worse than it seems. If I break it down into the number of home batteries installed per year using figures from Sunwiz Energy Consultants, I get the following:

Source: Sunwiz

While home battery installations increased year on year until 2018, there was no increase in 2019. If installations level off at this rate, we won’t have Morgan Stanley’s mid-range estimate of one million installations until 2060. The zero increase was despite South Australia’s massive battery subsidy of up to $6,000 being in full swing throughout 2019. Without the subsidy, installations last year presumably would have been several thousand less, and installation numbers would be going backwards.

Three Types Of Hype

As I see it, the battery hype that seeped into analysts brains and potentially affected predictions came from three primary sources:

- Techno optimism.

- Reaction to anti-renewable sentiment.

- Deliberate market strategy.

1. Techno Optimism Hype: Most people like the idea of cheap batteries, cool electric cars and other stuff they make possible. Thus they view the prospects of home batteries through rose-tinted glasses.

I’m okay with this. Optimism about the future is better than pessimism. Sure, you may still be screwed when you get there, but at least you’ll enjoy the trip. This type of hype only becomes a problem when people in charge of other people’s money get sucked into it. For example, the South Australian government.1

2. Reaction to anti-renewable sentiment hype: If you’ve learned a little about how energy markets work — or don’t work — then you’ll know that it’s not necessary to have any energy storage at all for renewables to supply the majority of a nation’s electricity. While low-cost battery storage would be great, it’s not required.

However, most people don’t even spend a single week of their lives studying energy markets. As a result, for the past 20 years, whenever a certain type of grumpy old fart has woken up with a burning desire to make the world a worse place…

They have gone on the internet and typed something like…

“You hippies are a bunch of idiots. Solar power will never work because the sun doesn’t shine at night!”

To which, for millions of iterations, the traditional response has been along the lines of…

“That’s what batteries are for!”

Which I have to admit is a lot easier than typing…

“There are a range of methods for integrating high penetrations of variable generation into a grid, the utility of which will vary according to geography, latitude, climate, and grid characteristics…”

…and so on for 3,000 words. But the constant litany of:

GRUMPY OLD FART: Renewables suck!

PERSON WITH HEART FULL OF HOPE: Batteries!

Must have been repeated around 100 million times over the past two decades and I think it has convinced both the miserable curmudgeons and people who are pro-renewable, that battery storage is more vital for cutting emissions than it is.

3. Deliberate Market Strategy: While Australians have been interested in home batteries ever since rooftop solar power started to take off ten years ago, battery hype went into hyperdrive in April 2015 when Elon Musk revealed the original Tesla Powerwall. It failed to live up to expectations. Five years and a whole new Powerwall model number later, an unsubsidised Powerwall 2 still doesn’t pay for itself for a typical household. While I think Tesla is on the right technical track with their battery system, it’s certainly taking its time living up to Elon’s trash talk.

Perhaps the hyping of the original Powerwall by Tesla was simply the result of Elon Musk’s naturally optimistic and sunny disposition? I can’t say it wasn’t, but I do know confidently acting as though your company has an advantage that will let it beat the competition is a tactic sometimes used to discourage others from trying to compete in the first place. While I don’t know what was going on in Elon’s head, that is exactly what it looked like to me.

While Elon is not the only CEO to hype batteries, he stands out in this regard. But I’m sure other companies have hyped batteries to try to obtain an advantage. The ACT’s battery subsidy may be one result of this.

The Misjudged Home Battery Market

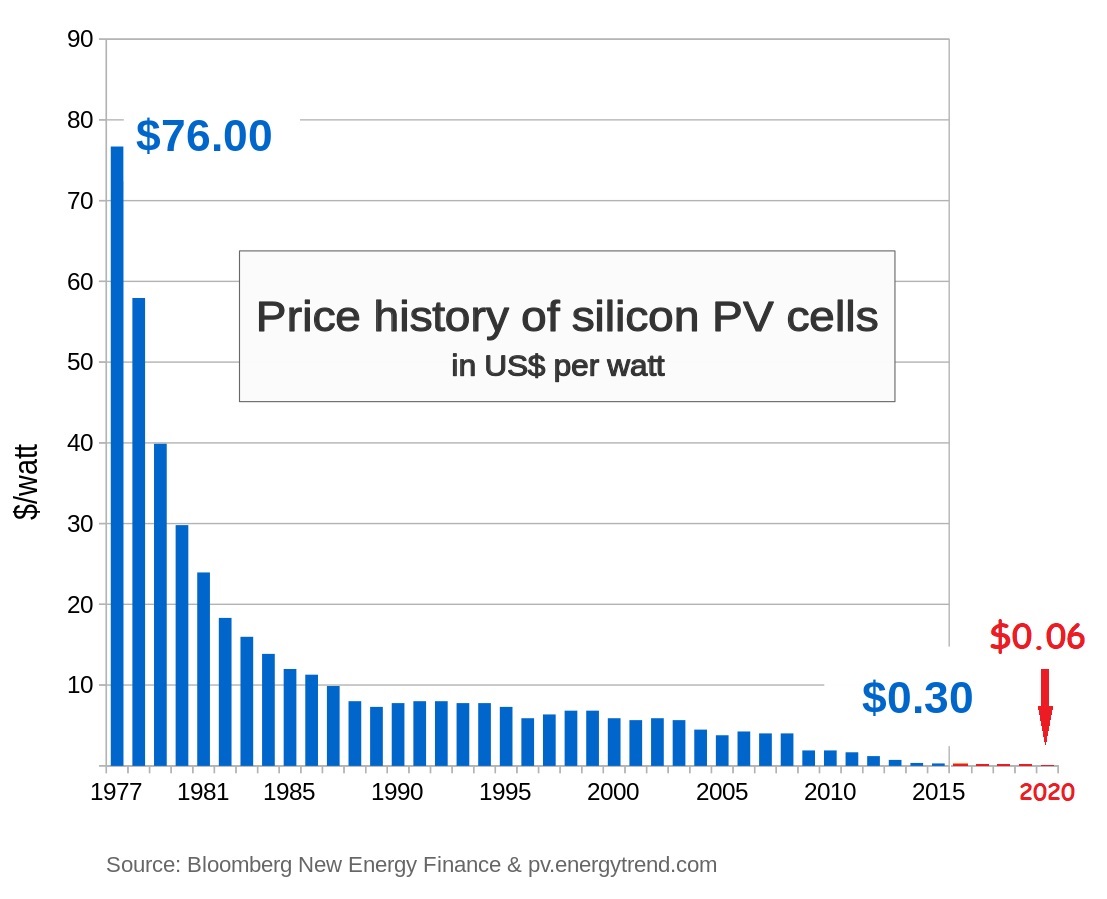

Let me show you a graph. It gives the price of solar cells in US cents per watt over the past 43 years:

The chart is from Bloomberg and originally only went up to 2015, but I’ve defaced it in red to show the price of solar cells are now down to 6 cents per watt. Solar cells now are less than one-thousandth of their cost in 1977. It’s an astounding drop, and on average the price halved every four years. Note this is just for cells. If you want a solar panel, you’ll currently pay around 17 US cents per watt at a factory gate in Shanghai.

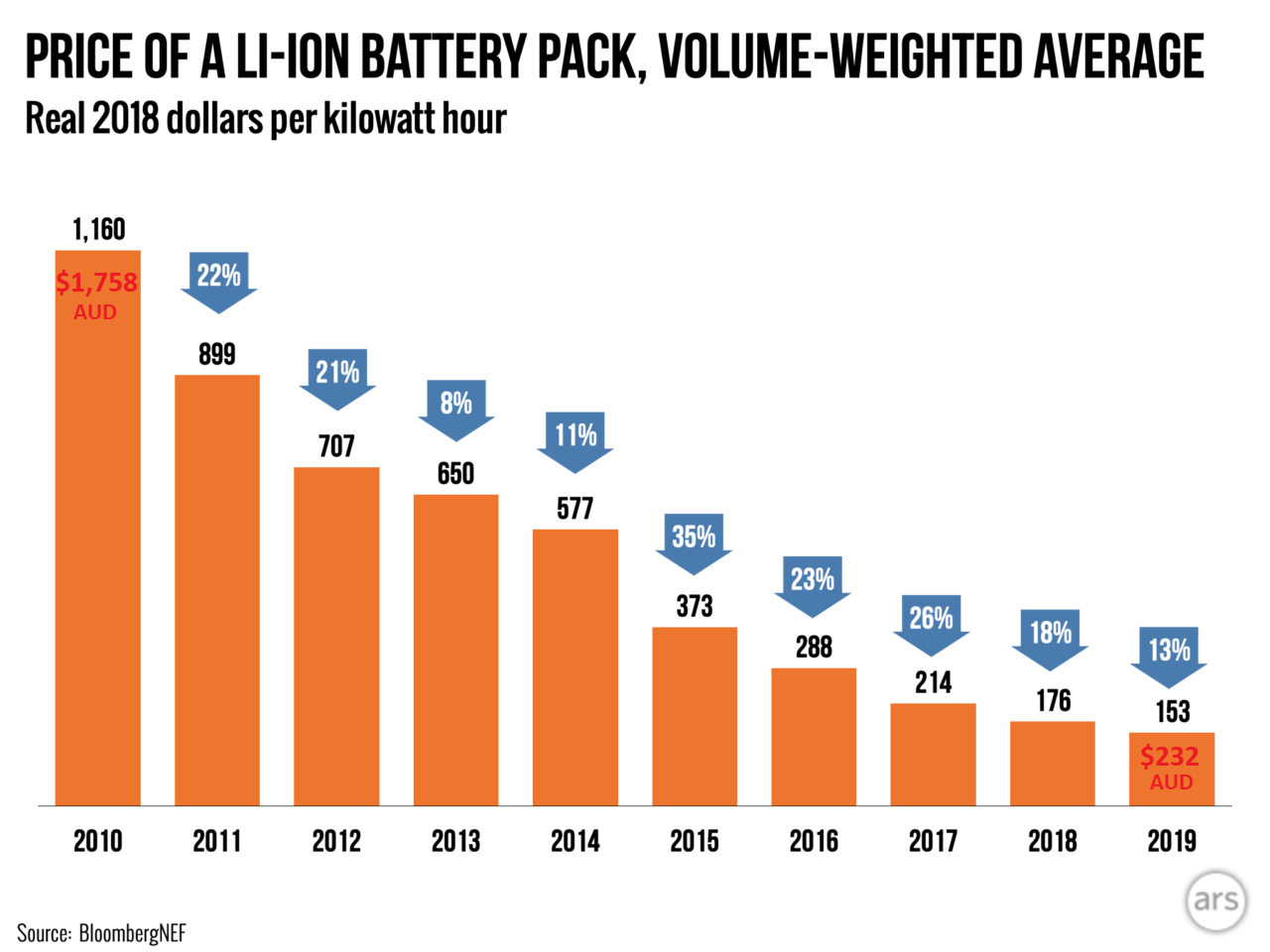

Here’s another graph. This one shows the fall in lithium battery pack prices over 10 years:

This graph is also from Bloomberg — although I actually lifted it from this Arse Technica article — and shows the fall in lithium battery pack prices. Just for fun, I added the price in Australian dollars on the first and last columns using the current exchange rate. Battery pack prices are higher than battery cells because the cells have been wired together into a unit suitable for use in an electric car or energy storage system. The graph shows battery pack prices in 2019 were nearly one eighth what they were 10 years earlier. On average it took them under 4 years to halve in price.

Only those who made optimistic predictions turned out to be right about the cost declines of PV and lithium batteries. Anyone whose estimate was “middle-of-the-road” was dead wrong, while those who made “conservative” estimates should be incredibly embarrassed about them. Unfortunately, it seems the people who made them generally lack any particles of shame.2

Given these circumstances, it might seem reasonable to have expected home energy storage to follow a similar trajectory. But this overlooks the fact that solar PV and lithium batteries had markets that grew with every single price decrease, while the market for on-grid home battery storage has been shrinking as the supply of eager early adopters decreases with every home battery purchase. And the market won’t significantly grow until home batteries start saving normal Australians money.

Expanding PV & Battery Markets

The initial market for silicon solar cells was extremely limited. After being invented in 1954, they only really took off in 1958 when they started to be shot into space as a power source for satellites and probes.3 In the 60s Japan used them for lighthouses and, starting around 1970, they were used in navigation buoys. The oil shocks of the 70s sparked a lot of interest and investment and, as the price dropped, they began to be used for communications equipment, calculators, off-grid living, on-grid living, utility-scale generation, and now there’s a giant solar farm in India with over 10 million panels.

As lithium batteries came down in price they were able to replace other battery chemistries and were used in power tools, laptops, mobile phones, flying drones, robot crones, and thousands of other uses. Starting in 2010 with the launch of the Nissan Leaf they were used in production line electric vehicles. Again, each decrease in price increased the size of the market as worthwhile applications for lithium batteries expanded.

Every time the price of PV or batteries fell increased demand, which increased production and research into how to lower their costs and improve quality further in order to get ahead of competitors. Unfortunately, home battery storage doesn’t yet benefit from this type of virtuous circle.

The Shrinking Market For Home Battery Storage

While solar PV and lithium batteries faced expanding market opportunities with every price drop, home battery storage does not. Every battery system sold right now shrinks the market. This is because there’s only a limited number of eager early adopters willing to spend money on a home battery that’s unlikely to pay for itself. Every time one’s bought, this tiny market shrinks a little more. Market saturation is why sales didn’t increase at all last year, despite a fat subsidy in South Australia, the state with the highest electricity prices.

While small price falls may encourage a few more early adopters to shell out for a system, the market’s not going to see any substantial growth until the price falls below the threshold where batteries save normal households money. After that occurs, each additional fall in price will result in the market expanding as increasing numbers of people see it’s worthwhile to get one. But after April’s 33% cut in South Australia’s battery subsidy and a sizable electricity price reduction likely in July, the point at which batteries start to pay for normal Australians may be getting further away. Payments from joining a Virtual Power Plant should help, but it will probably also take some big cuts in battery system prices to turn them into money-making machines.

Cheaper Batteries Are Coming

With PV and lithium battery cells we had a world of consumers creating a huge market for these products. But the market for modern home battery systems is mostly just Australia. While there are also Americans, Europeans, and others buying them, their suppliers generally aren’t competing on price and so aren’t doing as good a job of pushing down costs as the numbers sold may suggest. You only have to look at the high cost of rooftop solar power in the US to see what happens when something is marketed as a “lifestyle choice” rather than it being sold because it saves people money.

The miserable market size means we’re not seeing the rapid improvements in home battery technology we would if production numbers were higher. Because of delays in their development, they have the potential to fall a long way in price.

The three main components of an AC coupled battery system that can be retrofitted to any home with solar panels are:

- An inverter to change DC power from solar panels and batteries to the AC power homes use — and vice versa.

- A converter that adjusts DC voltage and allows batteries to be charged and discharged.

- A battery pack.

These days a reliable 5 kilowatt solar inverter may cost around $1,500 at the factory gate. Throw in the converter and we’ll say it’s a nice round $2,000. According to the graph of battery prices I included above, in 2019 they cost $232 Australian per kilowatt-hour. If we assume in 2020 they are now 13% cheaper, then 10 kilowatt-hours will cost $2,000. If we add a 20% retail margin, 10% GST, and allow $1,200 for installation and after-sales service4 then we’re looking at around $6,500 for a fully installed 10 kilowatt-hour battery system.

I know a guy with a Powerwall 2 and it saves him on average under $2 a day on his electricity bills. But some households will get more value from a battery system than he does and it should also be possible to get some value out of joining a Virtual Power Plant, so a battery system at this price should be able to pay for itself. What’s more, it requires no advances in technology, all it requires is for the components to be put together in a well designed, reliable unit and mass-produced at low cost. So home batteries that pay for themselves are already baked into the technology cake. It’s just a matter of when we will get them.

As for when they’ll arrive, your guess is as good as mine. Actually, it’s better than mine, since you’ll know what your guess is while I’m too chicken to tell you my prediction after putting so much effort into mocking bad predictions.

Footnotes

- You would think that after the giant blunder of naming their state South Australia when 3 out of 5 states are even more southerly, they’d be careful not to make any more significant mistakes. ↩

- There’s plenty of old graphs out there that show solar getting cheaper for a couple more years and then mysteriously levelling off as if $2 a watt was the best that could be dreamt of in our philosophy. ↩

- But no one probed Uranus using solar cells. Even today I wouldn’t probe Uranus with them. I’d definitely want a radioisotope thermoelectric generator for that job. Preferably at the end of a long boom. But I would consider probing Saturn with solar cells. ↩

- Allowing $1,200 for installation and after-sales service isn’t much, but I’m assuming future battery systems will be much simpler to install and much more reliable than current systems that require a much higher installation cost to keep the installer’s business viable. ↩

RSS - Posts

RSS - Posts

Good article as always! Have you considered the payback for batteries if you have access to wholesale electricity prices, such as offered by Amber? The extreme variability in wholesale prices, which occasionally are even negative, and can get up to about $16 per kWh, coupled with a system that charged or discharged the battery based on the prevailing price, would potentially have a big impact on the payback time.

I’m in the process of installing a household battery (not Li-ion, which is the cheapest but far from the best for this application, but rather Zn-Br flow technology), and I have not considered financial ROI in my decision. I’m doing it because: (a) I can; and (b) it’s better, and cheaper, for everybody if we upgrade to distributed generation.

There is MUCH more development required of batteries, which means that the bleeding-edge technology will maintain its early-adopter price tag for some years yet.

In the meantime, there are already household batteries available that are effective and practical, if still somewhat expensive.

Like all aspects of zero-marginal-cost, zero-marginal-emissions, uiltra-reliable, more secure, more consistent, higher-quality distributed generation, the take-up of household batteries would seem to be currently impeded by the fact that household energy trading is not yet possible in Australia, except for a handful of (ring-fenced) project trial sites.

I suspect that enabling household energy trading will provide the incentive for maximising household PV and energy storage capacity.

nice article.

for me, other than the fact that the payback period is longer than the expected life of the battery-pack, I blame the power-grid.

It’s stable – mostly.

Yes, there are things like cars and trucks that bring down power poles, or storms blowing trees over power-lines, and such, but in general, overall, the power grid is pretty darn stable.

With that reliability, who needs a ‘backup battery’? At least in the major (and many not-so-major) population areas.

It’s possible that in the next few years, the grid may become less stable, which will make a battery backup (or perhaps a natural-gas powered generator?) more desirable.

I would love to be able to pump my excess solar generation into a battery-pack and draw on it overnight – well, until after the “peak period” is over, anyway 😉 But even with that factored in, batteries are not (yet) economic.

Harry: “…the payback period is longer than the expected life of the battery-pack.”

Yes, that’s been a stumbling block. Wondering if Musk might soon announce (on Battery Day) that the million-mile battery has been achieved. I suspect Tesla is almost there… .

I’m also hopeful that our Cybertruck may be V2G by 2022.

If so, we’ll run both houses on our rural property using V2G.

Easier to manage / juggle that in retirement, I know… .

I realise this may echo Olympics-on-the-Moon, but I remain, yours truly, a

Techno-Optimist… .

Well the other main reason for the lack of fall in prices for batteries is the ever increasing demand for batteries for EV’s. Tesla said in their last full year earnings call that they were cell starved with the unprecedented initial demand for the Model 3. So why would they try and make a cheaper Powerwall when they couldn’t produce enough cells for their major product.

When capacity ramps up (all the big players are investing heavily in increased capacity – LG Chem, Samsung, CATL, Tesla, the big Chinese manufacturers and now Panasonic) prices will fall.

I don’t think those predictors took into account the huge uptake in EVs.

“Arse Technica” should be “Ars Technica”

no, it was right the first time

When you see a ROI for a Home Battery system being 10yrs and the guaranteed lifetime of same being 10yrs, there is no profit for the home owner under current pricing. Even batteries that are almost 100% recyclable (aka REDFLOW) can’t bring down the cost enough to make Home Battery ownership viable or attractive. Unlike corporate use of Batteries which is mostly tantamount to UPS style continuation of service modelling, the home buyer is seeking as you say a way to reduce costs, the battery industry is not there as yet, Watch the first company to reduce costs by 50% be the company that corners the market.

Hi Ronald

I suspect another 2 reasons the “experts” so grossly overestimated the take-up of batteries could be:

1. Batteries have been in heavy commercial use for eons – so have already had huge research expenditure to improve life, reduce costs, improve reliabilty, lower specific weight (kWh/kg), lower specific volume, reduce maintenance requirements, find better chemistries, etc., etc. So they are already a mature product, meaning their room to improve is less than that of only relatively recently commercialised solar PV. Look at how the costs of PV have plummeted!

2. The outcome is self-fulfilling. PV costs have been plummeting, so the cost of power has remained lower than it might otherwise have been. If power prices were much, much more expensive, it would be much easier to justify batteries, regardless of their current limitations (warranty life, cost).

SA has done a pretty good job of keeping power prices high, so that is why with a large subsidy batteries approach being economic to the average punter. Not so much here in WA – although I suspect our very low FiT actually helps the cause by making battery savings (tariff – FiT) greater.

FYI

kWh/kg is gravimetric energy density.

Specific weight is its inverse, which is kg/kWh.

😉

Ok.

Research aims to make that figure lower (or energy density higher).

Can anyone tell me why there are no cheap NiFe batteries on the market? Even though they are less efficient, they have big advantages. They are simple, should be easy to build, take almost any mistreatment and last literally forever. No toxic materials are used. Been around for longer than a century. Nickel and Iron is plenty around. They should be cheap. They are heavy but weight is not an issue for a solar system. What am I missing here?

Hi,

They require topping up with distilled water. Mine need a top up about once a month. 30litres. Takes about 40 minutes with a small 12V pump. Can’t see many householders wanting to do that. The failure to do that will result in stuffed cells. Probably a bigger bank, and with a lower Absorb voltage it would last longer. Also, you have to either buy, or make and store, distilled water.

Not only heavy, but need a bit of space.

I do think they would be great in very large banks, with automatic top of water.

Collect the Hyrdogen produced when charging to supply heat for distillation.

dRdoS7

Also they are only 65% efficient (I believe some modern cells might be better but that’s from the Wiki and that’s truly terrible, much worse than Lead Acid). That means you need a much larger solar system than you would for an LiFe bank, plus they cost more – not sure why, probably because they’ve never been popular enough to make them a mass market item.

Hi,

I’ve had 75% (logged Ah in vs Ah out daily, over several months) when I reduced the absorb voltage. Used less water too. This is OK over summer, but in winter it needs to be set higher to get them charged as quick as possible.

Mine cost the same as an equivelent LFP bank at the time. But with a longer life span. In theory.

dRdoS7

You put the wrong price in AUD for 10 years ago. It was way cheaper in AUD due to a better exchange rate. And it was even better in 2011 and 2012. So, all calculations about price drop are overly optimistic.

I got my batteries 6 years ago. When I look on the same product now – it is more expensive than it was then.

Prices on lithium batteries go down very slow in USD and but they even go up in AUD due to low exchange rate and “Australia tax”. At the same time, disposable income goes down. True unemployment rate goes up (even before COVID). There will be no uptake for batteries for any foreseeable future.

What’s the “Australia tax” where battery products are concerned?

It’s the same as for any imported item. It is well known that Australia is one of the wealthiest countries in the world, and also we are quite lazy, and that our expectations are quite low. Hence the success of Coles, Woolworths, and Bunnings in Australia.

My expectations are really high, but I can’t afford them.

There is a battery that will;

– OUTLAST all others

– has a cost of energy below that of the wholesale supply cost

– that WILL pay for itself within its warranted period

– that will more than likely continue to perform beyond the lifespan of the person buying it.

Do more homework and check out the Zenaji Aeon battery

And you totally ignore the bastardry of the energy companies who fiddle with prices and contracts, hide facts about contracts and generally make anything solar more expensive. My experience with our solar panels is that I doubt they will ever be paid off. I would not do it again with my hindsight.

I rate the power resellers as the biggest crooks and rival banks and telcos for that crown. But it does not expand a market. After solar panels, who would risk good money for batteries? I simply do not trust the politicians and companies to do the right thing. Their self interest is my biggest problem. In ten years we have a complete shambles for any investment in energy. Even the super company crooks are avoiding such investments.

Luckily for me I get to factor in that I don’t pay rent in my costs for payback on my batteries. I couldn’t live in my truck for free without them. Payback is under 4 years for me.

There are references to NA and Europe battery take-up. Does anybody know what the consumer price of electricity at the home is for several other countries in NA/Europe in comparison to what we’re typically paying in Australia?

If you do have this info then please post it here.

Thanks

I’m about to build a new house in WA and Western Power is charging almost $5000 to connect to the grid. So for me battery storage is more viable economically if I take the grid connection cost into consideration and try to go off grid completely.

Hi Wayne

Unfortunately $5,000 doesn’t come close to covering the cost of a battery system that provides anything approaching the convenience of being on-grid.

In my case grid connection cost would be more than $30,000. I got solar system and lithium batteries for $22,000. No bills even. I’m not sure how to calculate payback in this case 🙂

Hi i was considering if it was viable in SA to install, if it is possible to unplug a percentage of battery pack and utilise in caravan.

I dont know if any manufacturers have made it that flexible ?

Good article

To get the SA battery subsidy the installation has to be suitable for use with a Virtual Power Plant, so no mobile applications with the subsidy, I’m afraid. The cost of batteries for caravans and similar applications should be coming down, but some prices I currently see in that area are extremely high, so be careful when shopping around.

I live on a rural property in Central Queensland and we have had up to 380 power outages in a 12 month period so I can’t say the grid is reliable. I have 6kw of solar connected to my house and would be happy to see the battery’s become cheaper.

I have a friend who bought a farm 5 years ago with no house or electricity. He got a quote from Ergon Electricity to have power connected to a new house that he built and this was $107000. After some investigations, he had solar and battery installed for $25000 and is very happy with the result. 5 years later he has not had to use a generator and never has a power bill to pay. His battery pack is the old-style Gel battery

The Australian solar industry including government owned entities has a vested interest in maintaining its profitability, and that doesn’t necessarily gel with the best interests of householders. That said, the average householder doesn’t want to think outside the square, consequently they are certain to pay through the nose. Batteries have actually been affordable and cost-effective for many years, although one is likely to get a somewhat different impression if the only source of information is an Australian retailer. The $25,000 installation mentioned above might well suit an owner with relatively limited power consumption and more awareness of the limitations of batteries than the typical city-dweller with a tribe of rug-rats. Then again, we wouldn’t have the climate change problems we have if more Australians got their heads around their responsibility for saving the planet. The comment ‘old style’ gel battery suggests a preference for ‘modern style’ Tesla / LG lithium batteries, however I am far from convinced that ‘modern style’ is the holy grail. Among other issues, this kind of thinking leads people into the ‘batteries are too expensive to be cost-effective’ trap.

You are correct that the $25000 would not be enough for most, as he is a single person, only living at this house 5 days a week, no airconditioning, cooking etc but says the battery’s are fully charged by 9am. He has 2 inverters and recently 1 ceased working so is only running on half and is still good. He has solar hot water also

I am all in for solar, as I have 17kw on my farm and export a lot of power.

About 2 years ago our Hall in the local small town installed 10.8kw of panels and a 10kw Tesla 2 battery to save some of the electricity bill to run a cold room and some fridges.

Good article Ronald. It would be even better when looking at business cases to also factor in the value of reducing carbon emissions. Some people are willing to pay a premium to reduce their own carbon emissions (eg some pay for carbon offsets when the fly, some drive hybrid cars etc). Also some people are willing to pay a further premium for the immediacy of an item eg – I could probably offset my carbon footprint by paying to have trees planted, but I would be prepared to pay a premium that is 2 or 3 time more for something that’s more “immediate” and “direct”- like a battery. You might not care about carbon emissions and global warming, but if you do, then you might present your business cases differently to give people options to pay a premium for reducing their carbon footprint and understand what that premium is. That premium is different for different people.

The “Usborne Book Of The Future”! I had a copy of this awesome book as a kid too… and after many years it’s now back on my shelf 🙂

Some of their 1980s predictions for the domestic and everyday stuff have come true: flat panel TVs, online grocery shopping, email, GPS enabled mobile phones (although they thought that digital watches would develop into phones with multi functions).

The space exploration stuff was way out there, my favourite probably the plan to hollow out an Asteroid and convert it into a long distance starship to transport a human colony in cryogenic suspension to another galaxy 😀

Back on topic – I think the slow uptake of home batteries is a blessing in disguise. Unlike solar PV, home batteries need careful selection and on-going, informed management or they get ruined. Most home owners don’t have the attention span or technical knowledge to make good use of them.

If there had been a battery rush, we would now be sending the first generation of junked batteries to landfill in their thousands.

Now that rooftop solar PV is maturing and improving in quality … lots of business main-chancers and speculators have switched to batteries as the next hope for windfall profit growth – your “hype type 3”.

you can see the Osborne book on line after all these years

https://archive.org/details/Usborne_Book_of_the_Future_1979_pointlessmuseum/page/n7/mode/2up

its awesome !

Noice!

Thanks.

Thanks for that link Robert! Some pages from it had been shared online in the past, but were then taken down due to copyright action (kind of pointless for a book that’s long out of print)!

A significant issue that has been ignored in this debate is the cost-effectiveness of batteries privately imported directly from the manufacturers (typically in China, but what other country manufactures anything these days) ? Quite obviously some folk will immediately start ranting about chinese crap even though the sexiest batteries and battery electric vehicles on planet earth are manufactured in China. As an example, I purchased a set of batteries some years ago at around a third of the cost of the same item sourced from a local re-seller. My return on investment has certainly been far better than some ‘experts’ would have had me believe. Currently I’m looking at acquiring PV panels directly from China at around half the cost (including shipping and government charges) of the same items from a local supplier. Despite the argument that one can’t take advantage of the RET or whatever with privately imported components, it seems to me that the considerable cost advantage of private imports more than compensates for the unavailability of government subsidies. For what its worth, I’ve had this conversation with the consumer liaison folk at the Clean Energy Council, who appeared to comprehend where I was coming from. Subsidies are all very well, but ultimately someone is paying for them. We all know what happened to the billions of dollars the federal government threw at the Australian car manufacturing companies …. certainly none of it benefited Australian motorists. I’m not suggesting that all Clean Energy Council accredited PV installers are as avaricious as certain car manufacturers, but I have no doubt that some take unfair advantage of subsidies to enhance their bottom line. A lot of homeowners may well be happier to pay through the nose for a PV installation that is hopefully backed by the Clean Energy Council, and that is their perogative. On the other hand, those with Scots / Jewish ancestry could possibly be open to another perspective on both batteries and PV panels.

Your comment, Yes Minister – “Subsidies are all very well, but ultimately someone is paying for them” – is spot on.

I had understood our STC’s got sold to companies wishing to offset their CO2 production – these might typically be filthy coal or dirty gas generators. Do we really think they would respond to their necessary purchase of carbon credits, by reducing our power tariffs? I think it was Des Scahill who pointed out we continue to pay for our systemseven after our initial outlay has been recovered, which just means we finish up paying the full price – one way or another.

But, I think this becomes more insidious than that – rather than the coal generators effectively paying a “penalty” for their production of CO2 (and many other noxious chemicals) – by having to purchase STC’s to offest that production – in fact they are being offered an incentive. When we put our system in, the STC’s approximately halved the total cost – and by now we have nearly recovered our half of the investment. But the coal generators could also consider their contribution as a similar “investment” – and I’d think one with a pretty good return (to them) as well.

Their return? They buy my FiT at 7.235 c/kWh, and sell it at 26.2 c/kWh (here in WA), thereby making a tidy profit. The Government gets 10% GST on the sale as well. Plus, the coal guys reduce the cost of their coal burn (a good thing, but they get the added benefit as well).

Given my export (FiT) of energy annually is 385% of my import, I’d say their Return on Investment (ROI) is magnificent – especially in these times of low interest costs. And, it will continue on for several years yet (I hope!).

So – it appears to me that the STC programme, rather than being a disincentive to coal, is acting as a great incentive to maintaining the status quo.

Someone please tell me where I’ve got this wrong…!

I installed a Tesla in November 2019 as I was sick of power outages, blinks etc.

Two days after instal 7/11/19 our power went out due to bushfires for 39 hours. We were the only ones in the village with constant electricity. Off for another 16 hours ofter power being back on for half a day. Then again off another 14 hours 24hrs later. To date, we have had 72 hours backup. We also have no grid usage through the day, evening or night as Tesla supplies the house. 6.6kw panels and a 5k Fronius inverter. We do use controlled load hot water at 18.19c but get 21c FIT at present. ABout to change to 18c FIT.

Wont pay for itself ( not quite) but quality of life with no outages is great.

Hi All,

I enjoyed great conversations here that continue to explore potential and reality. Thank you!

I am off grid remote Blue Mountains with holiday accommodation.

The solar is approx 40 yo (belongs in a museum) and 12v batteries are bits and pieces. Most appliances are gas operated.

Having read a number of comments (thanks to all contributors), it is clear to me hydro power is the ultimate as it generates power 24/7 without need for a storage bank (batteries).

Is hydro power evolving as I have waterways that could be utilised, however they are 300+ metres from the cottages?

The only time the river stopped flowing in known history was last Summer during the bushfires, as water was constantly drained by helicopters for water bombing.

I’m very interested in any information on micro hydro systems.

Thanks,

Donna

ps the off grid business provides guests with first hand solar/battery and back up generator experience, which I’m most grateful for, as personal experience is the only true teacher.

Donna,

You ask:

“Is hydro power evolving as I have waterways that could be utilised, however they are 300+ metres from the cottages?”

How much power/energy do you need?

What is the water flow rate and vertical fall of the river near you? How consistent is the water flow on a seasonal basis? Is some of the river on your land?

What’s your budget?

Would a DA be required?

These are some questions I’d suggest you need to resolve.

A quick web-search found a website for turbulent submersible hydro generators ranging from 5 to 200 kW capacity generating up to a range of 40 MWh to 1.6 GWh per annum. The website includes some helpful downloads and technical specs.

See: https://www.turbulent.be/people

Disclaimer: I have no association with this organisation.

Check out the YouTube video: “Whirlpool Turbines Can Provide 24/7 Renewable Energy For Dozens Of Homes” – is that helpful? Good luck,

Still can’t get it right, I see…. 🙂

I agree that batteries are not yet viable. In WA 60% of power is still from coal. This increases at night as there is less renewables. A battery reduces carbon emissions. Also why run an electric car off coal (all carbon) rather than run petrol car, 2 hydrogens per each carbon. A battery gives a way to harvest sun, for example, to allow a car to be charged in the evening from solar rather than coal. For us to properly transition we will need more solar and solar storage such as batteries. There is no point moving from CnH2n petrol cars to Coal powered electricity cars. We have to have a low carbon method to charge electric cars such as solar or stored solar. Lets hope battery prices fall at least in half soon.

Hi Michael. Yes coal has more C and less H than petrol. But ICE cars are 30% efficient if you are lucky, and that is not including the losses in extraction, transport and refining of the oil. The process of turning coal into a moving car (turbines, powerlines, batteries, electric motor etc) is likely to be much more efficient. Someone smarter than me might know the cradle to grave emissions of petrol versus e-cars. Anyway, coal is on the way out, renewables are increasing, so things will get even more favourable for electric cars.

Yes, a million people have taken the time to do the complete comparison of resources, single-use waste, and carbon footprints of ICEV versus BEV over the last couple of years. Anyone who wants to would be able to find a number of them.

The biggest issue is that dropping battery pack prices are not getting passed on as dropping home battery solutions.

If a battery costs $1000/kwh and is warrantied for 10 years, with expected charge / discharge once per day, the cost per kwh is 1000 / (10 * 365) = 27c per kwh, which doesn’t make economic sense when you consider the time cost of money.

If they could stop gouging customers so much and merely charge 2 or 3x the cost of battery packs for these things, and make them at $500/kwh with a 10 year warranty, there would be an explosion in uptake, as you would still be waving money after adding that installation cost onto your mortgage and paying interest on it.