How I got a $71 power bill with solar – even with a crappy 8c net feed-in tariff

By Finn Peacock – Chartered Electrical Engineer, ex-CSIRO & Founder of SolarQuotes.com.au

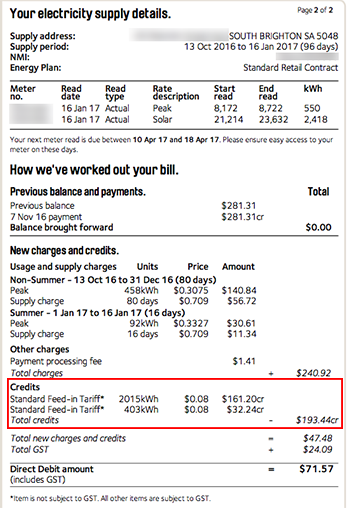

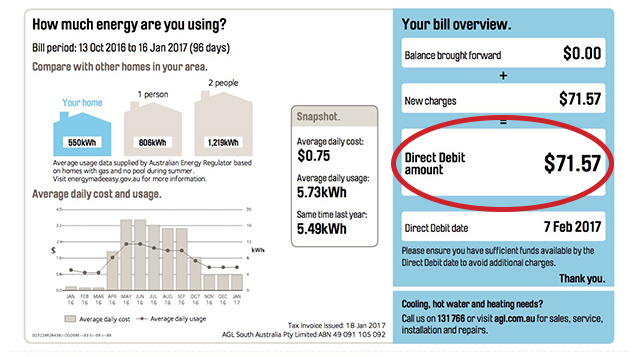

Here’s a screenshot of one of my electricity bills for my 5-person household with a 6kW solar system on an 8c net feed-in tariff (period October 2016 – January 2017):

A $71 power bill for a family of 5 – not too shabby!

Before I get you thinking that you, too, can get a bill as low as mine if you install solar panels – let me stop you. Or at least, slow you down.

Firstly – this is a summer power bill. Solar systems will always have the highest performance in the summer periods (and thus deliver the best returns).

The eagle eyed will see from page 2 of my bill (linked below) that my winter bill was $280 – still not bad considering family of 5, small business and – crucially – an 8kW Finnish Sauna that I use a lot!

Secondly – my home is very energy efficient. You can see on the bill that I use about 6kWh of energy per day – the average Aussie home uses between 16-20 kWh per day.

Lots of folks who have heard about my bills say that they have a similar sized system and still have a bill of a few hundred (or more) a quarter.

They seemed to imply that, unless you can get an almost zero dollar bill, solar was not worth it.

My response to that is “Imagine what your bill would be like without solar!”. If you have a 5kW+ system, you paid a fair price for it, and it is working properly then you should be getting an excellent return financially, whether your bill is $71 or $710 per quarter.

The problem with calculating solar savings, once installed, is that the most of the savings are hidden from the electricity bill. The average solar power system owner has no way of knowing how much they are saving!

In this article, I’ll show you how to expose those hidden savings.

Mistakes Many Solar Owners Make When Calculating Their Savings

Your solar savings are a lot more that the part of your bill that shows a credit for solar power! Here’s that part of my bill highlighted in red:

You can see that I got a credit of $193.44 for my 3 months worth of exports. Many people read this as:

“Hmmmm. $200 savings every 3 months. That’s only $800 of savings per year. The bloody salesman said I’d save over $2,000 per year! What a crook! My $8,000 solar system is gonna take 10 years to pay off before I start seeing any return on my investment! Solar is a complete con!”

This common analysis is wrong on a number of levels:

#1: The 8c rate is a Net feed-in tariff. This means that you are only paid 8c kWh for solar electricity that you export. Solar energy that is not exported (i.e. consumed in my home) saves me around 31c per kWh (at current electricity pricing), because I don’t need to buy it from the grid. I explain how this works in great detail here.

#2: Your savings from a solar system are much more than just the amount your electricity company credits you on your bill for your exported electricity (in my case, the red highlighted section in the image above). In fact, most of your savings are likely to be totally absent from the breakdown on your bill.

Funny that – it’s almost as if electricity companies want the benefits of solar power to look a lot smaller than they really are.

Lets use an example to explain:

Say your household uses 3,000 kWh of electricity per quarter. If you don’t have solar panels, this means that you’re paying around 31c per kWh for every kWh.

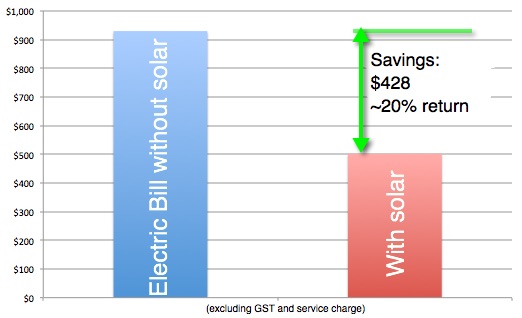

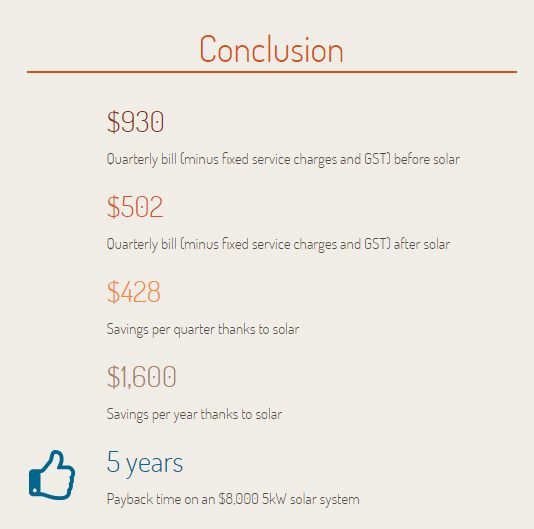

3,000 kWh x 31c per kWh = A $930 quarterly bill for the non-solar owner (before fixed service charges and GST).

Now, let’s bring solar into the equation

If you generate electricity with your solar system and don’t feed it back into the grid (because you’ve used it to power something in your home), the electricity is ‘free’, or 0c per kWh. The sun isn’t out 24 hours a day, though – so this means that you can only get your ‘free’ electricity from around 8am – 6pm.

Still, let’s make the assumption that 40% of your electricity consumption is between the hours of 8am-6pm (when the sun is up and your system is generating electricity).

40% of 3,000 kWh = 1,200 kWh of self consumed solar.

This means that you’ve only had to buy 1,800 kWh from the grid at a price of 31c per kWh.

So the solar owner has only used $556 (31c/kWh x 1,800kWh = $556) of grid electricity.

Then, we credit the 8c per kWh for the solar energy that you’ve exported.

If this is a 5kW system, you’d probably have exported about 700kWh of your solar. You would be credited 8c x 700kWh = $54.

$556 (bill with solar) – $54 (credit from exports) = $502 (net quarterly bill with solar).

Your new bill is therefore going to be $502 (before fixed service charges and GST).

You are actually saving $428 per quarter ($930 – $502 = $428), or over $1,600 per year with solar.

Once you combine the ‘invisible’ savings (from not needing to purchase electricity from the grid) with the net feed-in tariff, the amount of money solar power saves you can translate to a very respectable return on investment.

For example: The 5kW system in the example above would cost about $8,000 at today’s prices.

That’s giving you a 20% return. And assuming electricity prices rise every year (a pretty safe bet), your return will increase every year for the 25+ years your solar system lasts. Try getting that from the bank!

Is $1,600 per year a good return on a 5kW solar system?

A good 5kW system, at the time of writing (Feb 2017), will cost you about $8k installed.

So $1,600 of annual savings is a simple payback of just over 5 years.

And this is where we come to another misconception about the returns from an investment in solar panels. Many folks believe that a payback of 5 years means that they see no financial benefit for 5 years.

This is wrong, wrong wrong! We need to take cash flow into account.

When you work out the actual cash flows, many folks find that they are actually losing money by not having solar (Oh dear – I really am starting to sound like a sleazy salesman – sorry – but please bear with me because this is true!)

Working out the simple cash flow for a $1,600 per year return on a $8,000 spend.

Most people either pay for solar out of savings or add it to their mortgage.

If you have $8,000 in the bank right now it is probably earning about 4% interest. Let’s call it 5% to make the maths easy.

If you add $8,000 to your mortgage you are probably paying about 5% interest on it.

Either way you have an “opportunity cost” or “cost of finance” of 5%, ($400 per year) if you splash $8k on buying solar.

But outweighing this is the $1,600 per year you would be saving with solar.

(And if you add it to your mortgage it should cost you about $10 per week to buy the solar system but save you $30 per week. Wow.)

And just to be clear – I’m not saying you will get this return if you buy solar panels. You may get less, you may get more. Your savings will absolutely depend on how much electricity you consume in daylight hours.

The best way to see if you can get the kinds of returns illustrated in this example is to get a number of independent solar installers to do the maths for you based on your unique situation. Then you can decide if solar will work for you financially.

If you’re considering installing solar panels for your home or business, SolarQuotes can help you get quotes from high-quality installers quickly and easily:

“Many thanks…

I was a lost sheep in a field of wolves without your help”