Image: Cromwell Property Group

Australia’s Clean Energy Finance Corporation announced yesterday it is investing in a seniors’ living project in Canberra with a focus on sustainability.

The LDK Greenway Seniors’ Living Village project in Tuggeranong is turning a disused office park into a retirement facility boasting more than 380 one, two and three-bedroom apartments. Amenities at the facility will include community dining and alfresco areas, a 130-seat auditorium, corner store, café, chapel and activities, arts and craft room.

An emphasis has been placed on energy efficiency, with the Village to feature:

- More than 700kw of solar power capacity installed on rooftops and car parking areas.

- Energy efficient lighting and smart controls.

- A focus on high efficiency heating, ventilation and air conditioning, along with heat recovery systems.

- High performance wall, underfloor and roof insulation and window glazing.

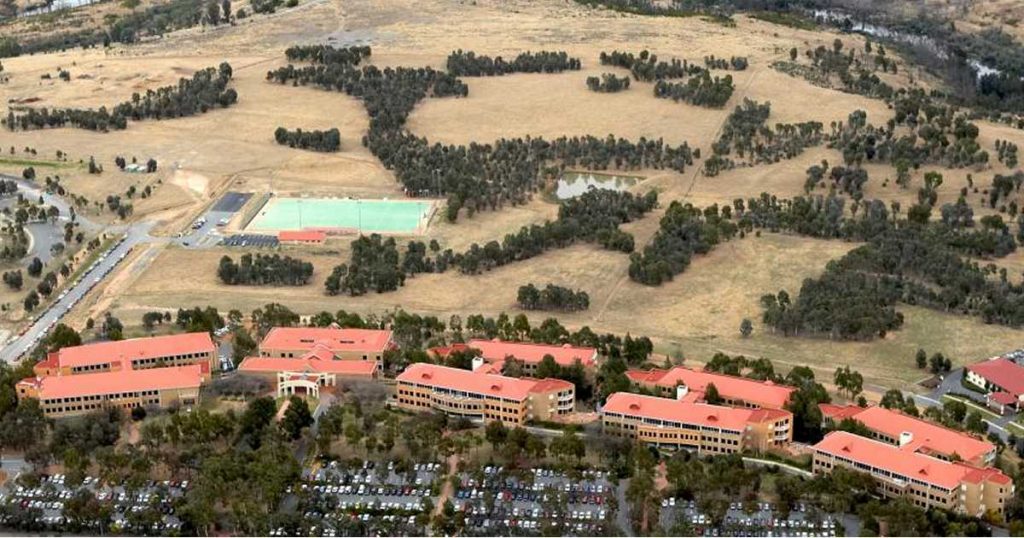

Tuggeranong Office park was originally constructed in 1991 to provide office accommodation for the Commonwealth Government. The eight-hectare site incorporates five individual buildings.

“Across the property sector, we see the repurposing of commercial office space as an untapped opportunity,” said CEFC Property Sector Lead Chris Wade. “The emissions savings for this retirement and aged care village are expected to reach almost 30,000 tonnes over the lifecycle of the development.”

The development is a joint venture between Brisbane-based LDK Healthcare and Cromwell Property Group.

The CEFC’s $60 million investment in the village is its first related to seniors’ living and builds on the Corporation’s existing $470 million residential portfolio that includes student, community and build-to-rent housing.

About The Clean Energy Finance Corporation

While this investment has a solar power element, the CEFC has also invested heavily in solar-focused projects. The Corporation had supported more than 1GW of large-scale solar capacity by the end of 2017.

As well as solar energy and built environment, the CEFC also invests in wind, biomass and energy storage; agribusiness, manufacturing and green vehicles, plus a variety of financing solutions for small-scale renewables, early stage clean-tech companies and other projects.

The CEFC doesn’t hand out “free money” (the Australian Renewable Energy Agency – ARENA – is a grants body), it expects a return on its investments. Looking at its most recently published quarterly report for the quarter ending March 31, projects supported during Q1 have varying expected rates of return; from 3.4% to >10%. At 30 June 2018, its core portfolio return since it kicked off was 4.44 per cent, against a Portfolio Benchmark Return (PBR) target of 5.51-6.51 per cent.

The CEFC was established by the Australian Government under the Clean Energy Finance Corporation Act 2012. It hasn’t always been smooth sailing for the Corporation – it was in the crosshairs of Tony Abbott (as was ARENA), who wanted it abolished.

RSS - Posts

RSS - Posts

Speak Your Mind