The growth in renewables including rooftop solar — and energy storage — continue to put downward pressure on wholesale electricity prices; even as the shift to electrification accelerates. Whether/when we’ll see that flow on to household electricity bills and by how much is another matter.

How Did Wholesale Electricity Prices Track In Q3, 2025?

In its Quarterly Energy Dynamics Q3 2025 report released last week, the Australian Energy Market Operator (AEMO) indicates wholesale electricity prices for the National Electricity Market (NEM)1 averaged $87 per megawatt hour (MWh) in the September quarter, a fall of 27% year-on-year and 38% since Q2 2025.

NEM State-By-State Scorecard

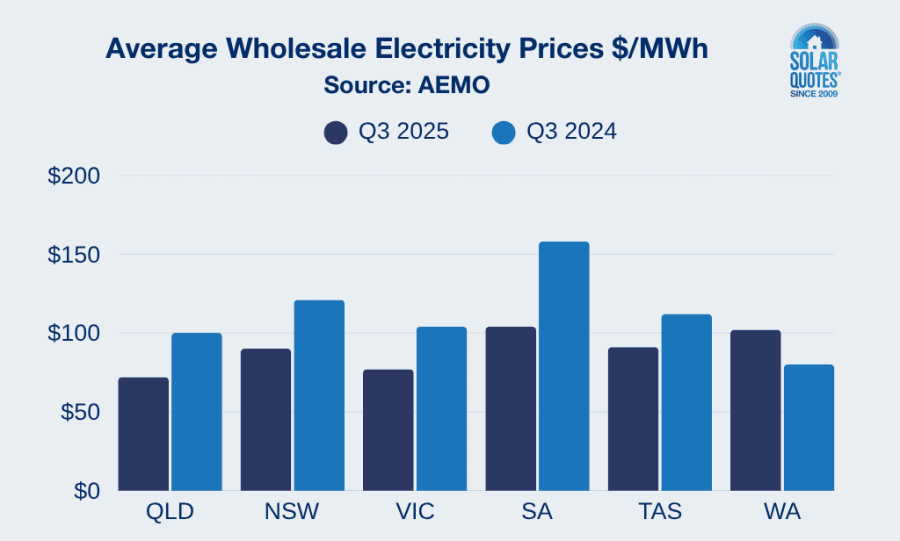

Comparing year-on-year Q3 average wholesale spot prices:

- Queensland: $72/MWh (-28%)

- Victoria: $77/MWh (-26%)

- New South Wales: $90/MWh (-25%)

- Tasmania $91/MWh (-18%)

- South Australia $104/MWh (-34%)

The AEMO says higher renewable energy output and less market volatility contributed to the decreases.

It’s worth noting that all NEM states saw significant *increases* in Q3 last year, averaging $119/MWh; up $56/MWh (+88%) on Q3 2023. The increase for that period was driven by factors including higher average and peak operational demands, reduced hydro generation, and network outages limiting interconnector flows.

Single Day Drags Down SA Performance

While coming in at the tail end of the pack in Q3 2025, almost $19/MWh of the $104/MWh average for South Australia was due to a single day.

On July 2, 2025, South Australia experienced sky-high wholesale electricity prices during the morning and evening peak periods. Wind generation was low, and imports into South Australia were restricted by transmission limitations on the Heywood interconnector. There were 68 intervals going above $3,000/MWh on that day, including seven intervals above a whopping $13,000/MWh — more than $13 per *kilowatt-hour*.

What About WA?

As with the Northern Territory, Western Australia isn’t part of the NEM, but the AEMO includes some WA reporting.

Q3 2025 wholesale prices reached an average of $101.76/MWh in Western Australia, an increase of $21.61/MWh (+27%) on Q3 2024.

“This reflects the large increase in operational demand across the quarter and changes to the FCESS Uplift framework resulting in fewer committed facilities during the middle of the day,” says the AEMO.

A graph with price movements for all the states:

Electricity Demand Up (And Down)

Demand from grid-scale generation increased 2.3% in Q3 2025 compared to Q3 2024, to average 22,323 megawatts (MW); while underlying demand (grid-scale demand and rooftop solar) was up 3.2% to a new Q3 high of 25,154 MW, says AEMO.

“The electricity demand growth was driven by colder weather, alongside broader trends of increasing electrification of homes, adoption of electric vehicles, and rising data centre consumption,” said AEMO’s Violette Mouchaileh.

But growing levels of renewables and energy storage helped keep a lid on things.

“Partially offsetting demand growth is an increasing wave of new generation and storage projects connecting to the NEM, with 1,600 MW progressing through commissioning to reach full output in Q3,” the AEMO states.

New minimum demand records for the NEM were also set during the period, thanks in part to 11% growth in rooftop solar output, and 16% more wind and grid-scale solar output.

Will Pricey Power Bills Continue?

The AEMO’s report was certainly good news, but those hoping this will soon flow on to a big reduction in their electricity bills after recent price rises may be disappointed.

Wholesale electricity costs only make up around 35% of a residential electricity bill. Then there are network (~39%), environmental (~7%) and retail/other costs (~10%), plus of course an electricity retailer margin (~6%).

Based on a $500 quarterly electricity bill on average, the wholesale cost would comprise around $175. A fall of 27% in those costs works out to be $47; less than 10% of the overall bill. Still, it’s certainly better than a poke in the eye with a sharp stick *if* that reduction was passed on.

Federal energy bill rebates have taken some of the sting out of big electricity bills in recent times. But those finish up as the year draws to a close, and there’s no indication as yet they will continue.

—-

UPDATE: 5/11/25: On a related note, the Albanese Government announced yesterday it will direct electricity retailers to provide three hours of free power every day under a standing offer for consumers with smart meters in NSW, south-east Queensland and South Australia from July next year; with plans to extend this to other jurisdictions. Learn more about the ‘Solar Sharer Offer’ (SSO) initiative here.

—-

Compare Power Plans, Install Solar (And Batteries)

As the Australian Competition and Consumer Commission highlighted last year, it can really pay to compare electricity plans to ensure you’re not being gouged (too much).

But for really tiny electricity bills, installing solar panels if you have a suitable rooftop (and control of it) is a slam-dunk move. For Australian households with solar power systems already installed wanting to minimise mains grid consumption in the early mornings, late afternoons, evenings and when weather is unfavourable, the Cheaper Home Batteries program has put residential energy storage within the grasp of many more households; slashing costs and simple payback times.

Home batteries are being installed at a rapid rate thanks to the scheme: ~ 108,000 at last count (Saturday) since the scheme formally launched in July. The benefits of these batteries will go beyond those provided to their owners; including putting additional downward pressure on peak electricity prices through reduced mains grid demand.

See how much you could save with solar (and batteries) here; and by adding a battery to an existing system here.

Footnotes

- The NEM is comprised of Queensland, New South Wales (including the Australian Capital Territory), South Australia, Victoria, and Tasmania. ↩

RSS - Posts

RSS - Posts

Amber electric claim it give theirs customer whole sell price, qnd they also claim feedin can be negative price if the grid have a lot solar electric, but is that the case or they just charge more? I save a lot more money with other electric company than amber with solar and battery at home

Thank you, Michael for providing some real numbers, too often missing in the ongoing media kerfuffle over electricity costs. Fossil fuel pushers seem to miss no opportunity to blame coal outages and network upgrade costs on renewable generation, despite that being the only negative price driver in sight.

Later in the energy transition, when fuel costs fall to zero, as we actually reach the 21st century, to power our car with a star, it’ll be clear that distributed energy abundance is economically democratising. (That’s why fossil fuel barons hate it.)

But why do some folk still try to bring on the climatic zombie apocalypse by buying fossil-only so-called HEVs, which are in no way EVs – but HICEs in sheep’s clothing, farting tonnes of CO₂ wherever they go?

The double maintenance burden of two fossil-powered propulsion systems will be a pain, but too late for many to learn, it seems.

Slow learners are inevitable, but are we to cook due to those who do not learn at all?

Erik, we’ve been in the 21 century for more than 2 decades already.

There was talk about ‘star powered vehicles’ back in the oh 50’s or so – I’ve even got some old boys annuals or the like somewhere which depict some of the atomic tanks and other craft we’ll have in the ‘future’. Obviously that never happened! 🤣

Distributed energy abundance actually isn’t economically democratising, quite the reverse. Massive grid expansion means higher costs regardless of the fuel costs involved. And with the majority of electricity consumers going self sufficient, that leaves the majority of cost to fall on the minority of users – especially those who can least afford it.

People opt for ICEVs, hybrids, and PHEVs because they offer performance that EVs simply don’t. Not sure what double maintenance burden you’re thinking of though.

You seem to be assuming we’re all learning the same lessons. Many people have a diametrically opposite perspective (and concerns) to you, and vote likewise.

You forget that.all that is needed to make solar panels needs to be mined.so people are quite happy to destroy the earth to save the climate.

Hi Phillip,

Batteries, solar panels and wind turbines are all being recycled now, so you mine them once and keep reusing them.

However fossils are burnt once and leave pollution behind.

They are 40% or more of world shipping and while we export many, we also sponsor extremist theocracies in the middle east with billions upon billions every year buying in 90% of our transport fuels.

Even if you’re willfully ignorant of climate risk, your insurance company isn’t and the simple economics of sovereign fuel supplies make perfect sense.

Less gas- & coal-fired generators in the NEM mix leads to cheaper wholesale electricity prices.

https://reneweconomy.com.au/gas-and-high-coal-penetration-are-the-drivers-of-expensive-volatile-power-prices/

Absolute flawed logic here. Wholesale prices are higher when coal and gas make up a greater share of the total generation mainly due to solar and wind lacking at that given moment. So lack of renewable generation overall which has pushed up wholesale prices and given a bigger % to coal and gas. It has nothing to do with the fact that coal and gas are prominent at that moment, but more so total generation is lacking. This isnt a dig at renewables, its how the market operates which is signaling more renewables and storage are needed.

On Amber in SA that is not the case. Look Mum, no base load !

https://explore.openelectricity.org.au/energy/sa1/?range=7d&interval=30m&view=discrete-time&group=Detailed

Wait, so Queensland coal is providing the lowest prices while SA wind and gas is the highest? That’s interesting!!! Odd that Tasmanian hydro is so expensive though. Shouldn’t rainwater be the cheapest option, at least in Tasmania?

Of course if wholesale power prices only comprise a third of the bill, and grid costs comprise another third plus, we probably ought to be paying more a lot more attention to the cost of wires, widgets, and maintenance. By my rough calculation the wholesale price is actually LESS THAN a quarter of my retail price. That means either the proportions are way off, there’s a huge ‘error margin’ in retail prices to allow for significant swing, or there’s another cost not listed e.g. 30% taxes. No I don’t believe Australia has taxes that high on power, but some other nations’ power bills are half or more taxation.

Hi John,

Over the last three days averages;

Queensland black coal is valued at $72.56, wind is $68.97 & rooftop solar is $5.43

In SA there is no coal (aside from some small percentage of Victorian imports) rooftop solar in SA is negative $56.62 while gas is between $32.47 & $115.83

SA has been running 83.4% renewable on a rolling 3 day average and as I type at 1:30pm AEST is running 125% renewable, ie exporting & undercutting interstate fossils.

Spot on. While SAPN decide to put an export charge of 1c/kWh to keep their Hong Kong masters happy.

“….imports into South Australia were restricted by transmission limitations on the Heywood interconnector.”

Thereby feeding the huge increase in wholesale prices.

Call me a cynic but how convenient was that to then distort the whole period average?

Were the interconnector limitations always there, planned in advance, or just ‘events dear boy’?

That’s why you should move to Amber Electric where the costs per month are around $20 for Amber $30 for network connection and the rest is wholesale trading and up to you to make the best of. If you have solar and battery then you can play the NEM. However with these wholesale prices going down and the network so stable it’s getting harder to make a profit.

Harder to make a profit for who ? The Distributed Network Services Provider (DNSP) – poles and wires company ?

No harder for me to make a profit. When you’re with amber you are a generator and generators make money when things are unstable and priceses are fluctuating in the NEM.

When the price for electricity goes to $20/kWh the generators that can respond make a bomb.

But lately the price for electricity is very low. Doesn’t seem to go above 25c much in the evening these days and is very low through the day at 3 or 4c to buy and -3c to sell. Good for charging the EV though.

But I still break even with these low prices.

For the purpose of the argument, there are two sources of usage cost in the amber bill, – 50% from the wholesale market (NEM) and 50% from the DNSP/polls and wires company as follows. The DNSP in SA is SAPN

Type……………………………………………………..Source………..Percentage cost

Usage Fees (Time of Use on a 24hr basis) ..SAPN………………..23.3

Daily supply charge – network………………….SAPN………………..19.7

Daily supply charge………………………………..Amber………………..17.2

Wholesale usage fees – NEM…………………..Amber………………..11.4

Usage fees…………………………………………….Amber………………….7.0

Daily supply charge -metering………………….BlueCurrent………….7.0

GST………………………………………………………Gov……………………10.0

Usage fees……………………………………………AEMO………………….1.0

There are two constant costs, one variable cost and one variable profit.

The two constants:

1. Amber fee – approx $20 per month

2. Network connection – approx $30 per month

The variables:

3. Supply cost – kWh used by supply tariff (calculated every 5 mins)

4. Feed-in profit – kWh supplied by feed-in tariff (calc every 5 mins)

The constant costs can’t be changed so we manipulate 3 and 4 to move from positive cost to negative cost (aka profit).

To do this:

a. Move the large loads, like EV charging, pool pump, hot water etc., to the middle of the day (belly of the duck curve).

b. Move battery energy exports to the evenings and mornings (duck head and tail).

The duck curve has been getting bigger every year leading to bigger profits for generators that can take advantage of it (amber customers).

However I suspect its starting to reverse with all the batteries being installed flattening the duck curve.

https://leadingedgeenergy.com.au/analysis-and-tools/duck-curve-charts/

@Robert Cruikshank

Interesting your curves stop at 2010.

Anthony, you say that at the moment SA is exporting and thus undercutting interstate fossils, but is it?

According to Open Electricity aka OpenNEM:

– NSW is currently importing 441 MW of 10,695 MW with about 100 MW of battery charging.

– QLD is exporting 605 MW out of 11,294 MW being produced (311 MW exported, 243 MW pumps, 51 MW battery charging) plus 210 MW of wind and solar curtailment happening.

– SA is exporting 539 MW, 271 MW going to batteries, and 516 MW of wind and solar being curtailed.

– Tasmania is importing 150 MW

– Victoria is importing 544 MW, but 283 MW exports, 117 MW of battery charging.

(This assumes I’m following the data correctly, and it’s not too skewed by delays in reading it)

Wind and coal seem to have similar average prices in NSW, QLD, and Victoria, while SA and Tasmania don’t have coal to compare with. Solar is usually significantly cheaper than wind, but the comparison may be unfair because output is highly variable per 24 hours.

Hi John,

If you have a look using a long lens you’ll see there’s a trend here…

https://explore.openelectricity.org.au/energy/sa1/?range=all&interval=half-year&view=discrete-time&group=Detailed

SA is getting to the point where only one 40MW gas unit remains online when the wind is up.

And we hit 147% instantaneous renewables this season.

When 47% goes into the broader NEM, less coal & gas get burnt.

And it’s happening more often.

We have two broken markets in electricity:

1. Market failure every night during the peak, whereby gas sets the price for all fuels. And the gas fuel market itself is a cartel. So-called energy economists seem totally OK with the complete disconnect between the electricity price and the actual cost of production. Chris Bowen appears clueless that this is why cheaper renewables are having so little effect on the average wholesale price – they should be murdering it, not shaving it.

2. Networks get to set usurous and inappropriate fees while earning a regulated rate of return. Their charges do not reflect the new reality of localised production & consumption that could reduce costs for prosumers and consumers local to the prosumers. Again, Bowen appears clueless.

So Chris gets a “could do better if he tried” mark from me. Not a complete fail – that goes to the Not Nut Zero Luny Natural Gaslighting COALition.

Political donations and gas lobby manipulation make gas industry reform dangerous for politicians. Polies on both sides know this and must tread carefully.

With net zero support at 60/40 the government must use marketing techniques like “3 hours free electricity in the middle of the day” headlines to put renewables in favour.

Meanwhile those with a battery and the smarts to move to a good VPP can take advantage of the gas industry manipulation of electricity generation. When the gas industry make money from generation in Aus, so do I.

I think this is on the way down with so many batteries taking advantage of the fat duck now and she’s losing weight quickly. We’ll see this summer anyway.

Example: In May 2010, Kevin Rudd announced the Resource Super Profits Tax (RSPT 40% tax on super profits). Disaster followed.

# Massive advertising blitz

# Coordinated media strategy

# Political donations & direct pressure

# Manipulation of public opinion

Tax reform dead in the water