Solar panel image: plonk66

Mastercard and M-KOPA have partnered on a program to expand pay-as-you-go solar power access to households without mains electricity in Africa.

In Sub-Saharan Africa, 625 million people lack access to mains grid power. Up until recently, these people have relied almost exclusively on fossil fuels such as kerosene for lighting, which is expensive, polluting and dangerous. Charging of handheld devices has often meant time-consuming trips to fee-based charging stations.

The rise of micro solar power systems coupled with pay-as-you go programs is changing this. Under the model, companies rent a small home system that is usually comprised of a solar panel, charge controller, battery, lights and charging points for small devices such as mobile phones. The customer uses their mobile phone1 to make payments for the system on a regular basis.

Structured correctly, the cost involved is less than what a household would be spend on kerosene, and some programs operate on a rent-to-buy basis.

Yesterday, Mastercard announced it was entering this market through a partnership with M-KOPA, which is already providing pay-as-you go solar power to 3 million people in East Africa.

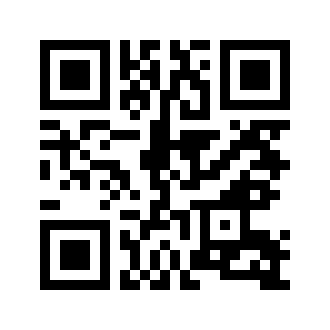

The venture will see M-KOPA pilot Mastercard’s Quick Response (QR) payment technology in Uganda. Customers will be able to make daily payments or top up their solar accounts by either using their mobile phone to scan a Quick Response (QR) code embedded on the solar equipment or by entering the merchant ID associated with the QR code into their phone. Here’s what a QR code looks like:

Some phones have QR code recognition built into their camera applications and free apps available for smart phones that don’t. A QR code can contain or be linked to all sorts of info – the above example code represents the website address of SolarQuotes.

Under the Mastercard/M-KOPA initiative, customers won’t need to have conventional bank accounts as the program will operate using “mobile money”, where credits are purchased in advance and tied to a phone number.

Assuming the pilot is successful, Mastercard and M-KOPA plan to extend the program across East Africa.

“We’ve proven that the pay-as-you-go solar model works in East Africa, but the off-grid market in Africa is tremendous. Our partnership with Mastercard provides the roadway for more solar services and infrastructure across the continent,” said Nick Hughes, co-founder and chief product officer, M-KOPA Solar.

The cost of the entry-level M-KOPA 5 Solar Home System in Uganda, which includes an 8 watt panel, lithium battery and controller, LED lights, rechargeable torch and radio plus charging cables, works out to a deposit of around AUD $42 at current exchange rates and then 87c a day for a year, after which the customer owns the system. In other African countries where M-KOPA operates, the same system appears to be significantly cheaper. For example, in Kenya the deposit is approximately AUD $37 and then 63c a day.

Such a small system mightn’t seem like much here, but it can make a world of difference to an African family without mains grid power; enhancing communications, education and business as well as making life a little more pleasant generally.

Footnotes

- More than 600 million Africans subscribe to mobile services ↩

RSS - Posts

RSS - Posts

Speak Your Mind