Australians have been a little distracted lately – and who can blame them? But the distraction is leading to some missing out on the advantages of installing solar panels right now.

The impacts of the coronavirus COVID-19 are being increasingly felt throughout the country, but the usual bills – including electricity bills – keep rolling in. There’s a lot that really sucks financially-speaking at the moment, but there are some bright spots.

Here’s why now is a particularly good time to be considering going solar.

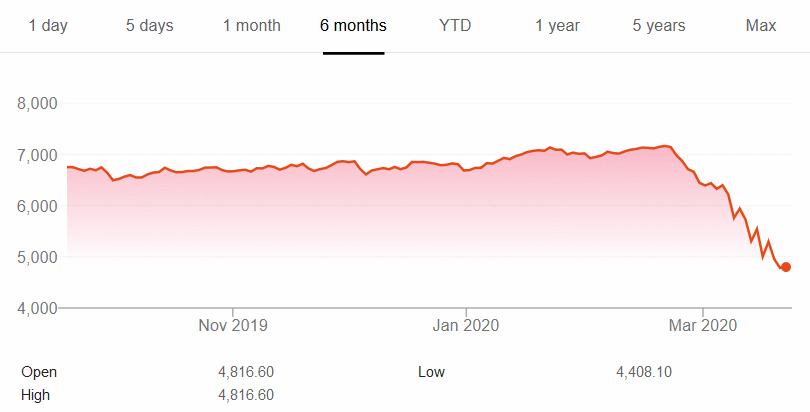

The Stock Market Sucks

It’s a brave person that takes on dueling trading algorithms in order to try and make a few bucks on the stock market during this crazy time. The ASX has been all over the place like a dog’s breakfast.

But there’s a sure-fire way to get a great return on your cash and that is acquiring a good quality, professionally installed solar power system. Try our new solar calculator – the estimated payback and returns might make your eyes pop.

For example, the following are estimated simple payback periods and savings over ten years for a 6.6kW solar system costing $6,600 installed in the various capitals; using the calculator’s default settings:

- Brisbane: 3 years (10 years savings: $22,696)

- Sydney: 3 years (10 years savings: $22,131)

- Canberra: 4 years (10 years savings: $17,482)

- Melbourne: 3 years (10 years savings: $20,815)

- Hobart: 5 years (10 years savings: $15,118)

- Adelaide: 3 years (10 years savings: $25,173)

- Perth: 5 years (10 years savings: $14,386)

- Darwin: 3 years (10 years savings: $27,911)

Term Deposit Rates Suck

Term deposit interest rates sucked before COVID-19, they suck now and will likely continue to suck once we’re past the coronavirus – and into foreseeable future. Again, you can get a much better return for your money by installing solar panels.

Like a term deposit, the best way to look at solar energy is as an investment rather than an expense (but with solar being a much better performing one).

Here’s an example – let’s say you take that $6,600 for a 6.6kW system and stick it in a one-year term deposit at 2% interest (which is pretty generous). At the end of that year, your $6,600 becomes $6,732 ($132 interest) and barely keeps up with inflation. That interest is also taxable.

However, the 6.6kW solar power system will provide savings of around $2,130 in the first year in Sydney – and those savings are tax-free.

Use SQ’s solar calculator to get a better idea of how much you can expect to save in your particular situation.

Superannuation Is Under Strain

If you haven’t logged into your superannuation account recently, you may not want to do so now as many funds are showing the strain of circumstances as they are generally tied to the strength of the economy. Compare that to the returns of a solar power system, which are tied to the strength of the sun.

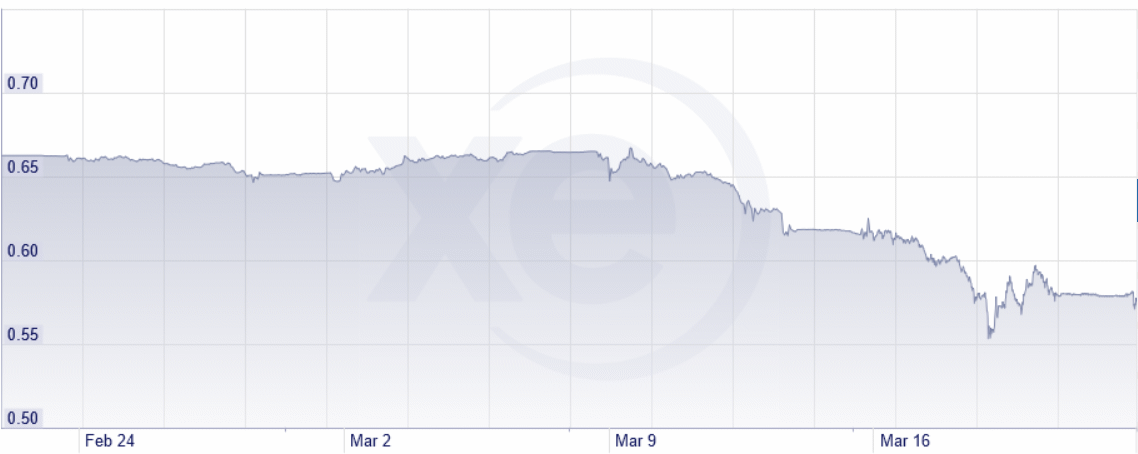

Currency Exchange Rate Sucks

The Australian dollar wasn’t particularly strong against the U.S. dollar going into the coronavirus crisis and it’s almost as though it’s caught the dreaded lurgy itself since. Here’s how it has been faring recently against the greenback.

AUD to USD exchange rate | Image: XE.com

Why is this important and what does it have to do with solar power?

Most of the world’s solar components are manufactured China, and China trades with overseas partners primarily in U.S. dollars. This means solar panels, inverters and other components will start costing more very soon as new stock is ordered.

Paying Electricity Companies (Always) Sucks

This applies at any time, regardless of the circumstances. Each month you put off installing panels is another month you’re locking yourself into electricity bills that will be much higher than they need to be. In fact, with an appropriately sized system, the figures you’ll most often see on your electricity bills after getting solar panels should be credits; assuming your energy consumption profile remains the same.

Generous Subsidies Still Available

It’s still a bit more than 8 months before Australia’s solar rebate reduces again, but procrastination has a bad habit of biting us on the butt. Why put off to tomorrow what can be done today?

Supporting Local Jobs

Contrary to what some are reporting, we have solid information indicating that (good) installers are seeing a slowdown in new installation enquiries. By going solar now, you’ll be helping to support a local business and its employees through this difficult time, while benefiting from a great deal and an even higher degree of customer service.

A Coronavirus Cooties-Free Experience

Arranging to install solar power is not a contact sport, nor does it need to involve you getting up close and personal with anyone. Much of the process can occur online or over the phone, and a site visit by a prospective installer doesn’t have to involve that person being inside your home.

The same situation applies on the day of installation – the installers will be on your rooftop for the most part, not in your lounge-room.

The companies SolarQuotes works with are very aware Australians are now sensitive to having others inside their home – and are more than happy to work within and over-and-above social-distancing guidelines.

Bear in mind too that even in a worst-case scenario of all businesses being suddenly ordered to suspend operations, when things fire back up you’ll be ahead of the demand that will likely follow.

The Elephant In The Room: Paying A Deposit In Such Uncertain Times

In normal times we’d recommend ensuring any contract you sign covers various scenarios playing out and not paying more than a 10% deposit.

But in these uncertain times, everyone has to be flexible. Most good solar installers will be willing to reduce the deposit to a token amount as an acknowledgement of that.

How To Get Started

You can get started on your bill-busting system today by requesting up to three quotes from pre-vetted installers we trust. Or if you’re eager to learn more about the ins and outs of buying solar in Australia, check out Finn’s book, The Good Solar Guide; free to read online.

RSS - Posts

RSS - Posts

While it makes sense to get solar first, as it can provide a better return that the sharemarket average, and even if where it doesn’t it provides a much steadier and reliable return, but I think now is a great time to invest in shares and I’m going to put $20,000 in as soon as I can get the funds together.

Michael, can I borrow $19,680? Don’t worry, I won’t stiff you on interest. I’m willing to pay twice the RBA cash rate.

good move!!! the stockmarket has recovered rapidly since Mar 23 (~33% in 4 months as I speak) Michael Bloch would have missed out on the greatest recovery in history from being scared & pessimistic during the covid19 Feb-Mar fall.

Quote: Baron Rothschild, an 18th-century British nobleman and member of the Rothschild banking family, is credited with saying that “the time to buy is when there’s blood in the streets.”

People have far more important things to worry about at the moment. Whatever shrinking funds people have left they are focussed on keeping them for the basics of life like food, medical supplies, security and keeping their families safe.

This sort of ill timed tripe devalues the blog.

If you are having trouble obtaining the basics you need to stay safe and healthy, there is assistance available from Centrelink and some charities. A range of new measures have been announced to help households as part of the Coronavirus stimulus:

https://treasury.gov.au/coronavirus/households

If you are in Adelaide and have an immediate problem I can lead a hand. I have supplies I can spare. Not medicine though. I do have some aspirin.

Fortunately, this doesn’t reflect the situation of most Australians. As far as I know, everyone I know is concerned but okay. This article is aimed at people who are okay and quite possibly bored.

I’m thinking of the ~2 million Australians who will soon be unemployed and the hundreds of thousands who were trying to obtain vital assistance today after the fustercluck of messaging by the government. At this rate we are heading for a return of “the Hungry Mile”. Many will die.

Thank you for your kind offer. Personally I will be OK (and I’m not in SA). Unless I and those near/dear to me fall ill as they are immunocompromised. Viruses don’t discriminate.

I just felt the tone and timing of the article were off considering what we are facing as a nation right now. Not quite to Gerry Harvey’s level of nauseatingly bad, but somewhere along the spectrum. Perhaps I’m being over sensitive.

Alex if solar installers are still working, isn’t now a great time to give them our business – when lots of other prospective customers are (unfortunately) having to sit on their hands?

It’s interesting to note the alternative points of view. Preserving life & health are the obvious priorities, and then conserving cash for those who have lost or will lose their jobs.

But the article is timely for a (lucky?) segment of the population who are in a different position. My wife & I are 68/69 and still having to work to maintain a reasonable standard of living, and had a miserly $100,000 in total super. But we just lost $30,000 of that last week ($5,000 in one night) and will find it difficult to make that up.

We had an order in place to install solar (from a firm recommended by SolarQuotes) and briefly considered cancelling but knew the returns would be there for us (even though the cost is over $10,000).

The guys are up on the roof installing right now and I’m excited that it will be up & running by this afternoon. As this article points out, the returns will be far better than super, term deposits or even paying off a mortgage.

For those who can do it – do it. For those who can’t, spend what you have wisely and protect your family from these horrific (but hopefully temporary) conditions.

Glad to hear it, Chris, and I’d like to thank you on behalf of the economy.

Thanks Ronald.

To be honest I hadn’t thought about the benefits to the economy but the 3 guys who installed it were grateful for the work – they were the age to have young families and big mortgages and expressed concern that some people had been obliged to cancel their orders and they (the installers) thought they might be out of work by next week.

As Peter Fagan says above, it’s a great time to help them out if we can.

Chris please stop looking at your super balance, you haven’t lost your money, it’s just devalued, and it will recover. During the GFC my meagre super balance went down greatly, but putting it into a a/c based allocated pension on retirement has meant the balance goes up and down and my Centrelink pension does the same, and no tax liability.

Spending money on solar is a great move. Enjoy retirement when it comes, and don’t worry!

6.6 kw and no power bills for 10 years…

Spoiler alert: Rampant speculation ahead.

I wonder how long it will take the economy to recover from the huge spends our Govt is embarking upon to try and maintain some semblance of “normality”? We can see our exports (including coal) dropping as industries around the world go into hibernation, if not terminal decline. Perhaps, despite the cries of anguish from the Qld pollies, it may become very difficult to justify spending bucketloads of taxpayer$$ on supporting new coal mines, or even new coal/gas fired generation capacity.

Another reason to go solar now? Well, with much of the fossil fuel generation infrastructure wearing out, sooner or later (maybe sooner) FF electricity will become a scarce commodity.

As I say, just speculating.

I reckon they will use this as a way of finally guaranteeing Adani permission to go ahead.

Gotta keep them Aussie miners in work!

Dont forget to add with so many working from home and using electricity during the day that they dont usually do is also a great reason to have solar on right now.

Especially if they are on a “time of use” tariff scheme when “peak” power costs a bucketload more than “off peak”.