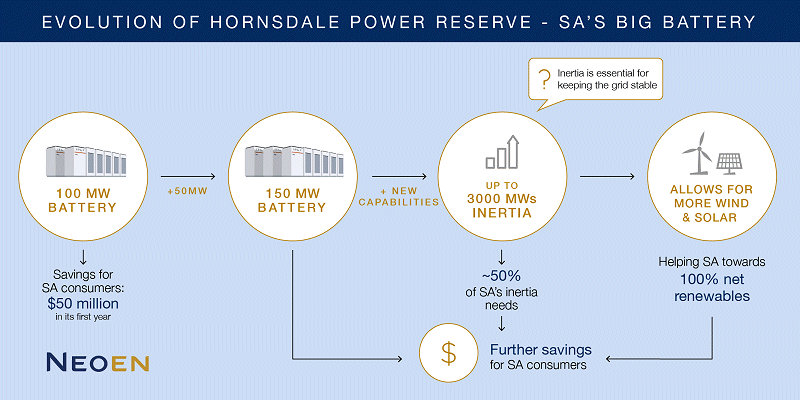

The world’s largest operating lithium-ion battery system, Hornsdale Power Reserve in South Australia, is to expand its capacity by 50%.

Also known as the Tesla Big Battery, Hornsdale Power Reserve is located approximately 15km north of Jamestown and situated adjacent to the 309MW Hornsdale Wind Farm. The energy storage facility can currently supply up to 100 megawatts of power and store 129 megawatt-hours of energy.

Hornsdale Power Reserve commenced operations on December 1, 2017. It not only made money for owner Neoen in its first year of operation, but improved grid stability and pushed down the cost of ancillary services such as frequency stabilisation; saving energy consumers an estimated $50 million.

More Services, More Savings

Now nearly two years old, Hornsdale Power Reserve is continuing to impress with its performance and will broaden its services with a 50 MW / 64.5 MWh expansion. Neoen says Hornsdale will be the first grid-scale battery in Australia to provide inertia benefits to the National Electricity Market (NEM), by emulating behaviour of existing fossil fuel-based services. Inertia testing and demonstration will be carried out in conjunction with the Australian Energy Market Operator (AEMO).

Neoen states the expansion will mean increased savings for SA electricity consumers and enable more wind and solar energy to be used in the grid.

Supporting the $71 million expansion is $8 million in funding from the Australian Renewable Energy Agency (ARENA).

“We hope this project will not only demonstrate the versatility of batteries in providing a range of grid services but also help pave the way for market reform,” said ARENA CEO Darren Miller.

The Clean Energy Finance Corporation is also participating; committing up to $50 million in project finance. Additionally, Neoen will receive $15 million over 5 years from the South Australian Government’s Grid Scale Storage Fund – the first project to be supported under the fund.

“By providing an additional 50 MW of fast ramping market capacity it is designed to reduce spot price volatility and protect the grid from network disturbances, resulting in more affordable, reliable, and secure power for all South Australians,” said SA’s Minister for Energy and Mining, Dan van Holst Pellekaan.

Construction has already commenced and is expected to be completed in the first half of 2020.

Hornsdale Power Reserve utilises Tesla Powerpack 2 batteries1, which have an expected operational life of at least 15 years. Once the Hornsdale facility is decommissioned, all battery packs and modules will be recycled by Tesla and 60% of the materials recovered for reuse.

Footnotes

- It’s not clear whether the expansion will involve more Powerpack 2 units or the Tesla Megapack ↩

RSS - Posts

RSS - Posts

The SA battery was purchased by Neoen, owners of the Horsdale Power Reserve wind farm, and funded in part by the South Australian government.

Neoen owns and maintains the battery and can use most of the capacity for its own purposes. (The South Australian government can direct up 70% of output be used to prevent load-shedding). AEMO pays Neoen AU$4.2 million per year for this service. (https://reneweconomy.com.au/tesla-big-battery-pulled-in-29-million-in-revenue-in-2018-2018/)

In 2018 Neoen made an additional AU$24 million profits on the battery by:

o arbitrage – charging it up when prices were low and selling the power during the day when prices were high,

o carrying out Frequency Control Ancillary Services (FCAS) for AEMO.

The source of the FCAS revenue is not as clear as it might be, but https://reneweconomy.com.au/tesla-big-battery-claims-its-first-major-fossil-fuel-victim-30614/ suggests that much of this has come from owners of gas-fired generators which had been themselves gaming the system.

Regardless, last year Neoen made AU$28 million over 12 months from a low-risk (State government-backed) investment of less than AU$90 million, suggesting that there are large profits being made, ultimately paid for by industrial/domestic consumers.

I’m not criticising Neoen. The system is what it is – there is money to be made from gaming/exploiting/working within it.

I do criticise the Clean Energy Finance Corporation and ARENA. Neoen can and will make money from a battery upgrade, regardless of whether or not they tip in more subsidies. There actions are just throwing away taxpayer money

OldCynic,

You state:

“I’m not criticising Neoen. The system is what it is – there is money to be made from gaming/exploiting/working within it.”

And who are the biggest ‘gamers/exploiters’ of the “system”? I would suggest the fossil fuel industry is.

Per an analysis commissioned by the International Monetary Fund, in 2017, global fossil fuel subsidies grew to $5.2 trillion (representing 6.5% of combined global GDP). Australia’s annual subsidies total $29 billion (representing 2.3% of Australian GDP). Australian fossil fuel subsidies amount to $1,198 per person.

Australia ranked below most countries for mortality rate from pollution related illnesses, with the IMF attributing 2.6 deaths per 1,000 in Australia to local air pollution associated with fossil fuels.

See: https://reneweconomy.com.au/global-fossil-fuel-subsidies-reach-5-2-trillion-and-29-billion-in-australia-91592/

An International Institute for Sustainable Development (IISD) report found just 10-30% of the fossil fuel subsidies would pay for a global transition to clean energy.

See; https://www.theguardian.com/environment/2019/aug/01/fossil-fuel-subsidy-cash-pay-green-energy-transition

IMO, one of the biggest rent-seekers here in Australia are the current owners of Vales Point Power Station. $1 million purchase price in November 2015, valued in 2017 at around $730 million, windfall operating profits in the tens of millions of dollars per year, and few liabilities (capped at $10 million) when it ceases operations. How good’s that? And it seems they are putting their hands out for more taxpayer subsidies from the federal government.

See: https://reneweconomy.com.au/nsw-exposed-to-unquantifiable-liabilities-for-vales-point-decommissioning-documents-show-84435/

The biggest gamers/exploiters could potentially kill us all through the consequences of dangerous climate change leading to civilisation collapse – if we allow them to.

See: http://www.climatecodered.org/2019/08/at-4c-of-warming-would-billion-people.html

So, what’s your point about Neoen exactly, OldCynic? It seems to me that Neoen has made a good investment that has also reportedly made significant savings for SA consumers of AU$50 million in the first year of operation – IMO apparently a win-win for both Neoen and “industrial/domestic consumers”. What’s wrong with that, OldCynic? Is it that you don’t think Neoen should be making profits? Is it you don’t think renewables should be successful, as well as being beneficial for consumers and society?

And OldCynic, why do you “criticise the Clean Energy Finance Corporation and ARENA”? What do you think they have done wrong? It seems to me they are facilitating a better electricity supply where they can:

“…the Tesla big battery again proved itself to be an exceptionally valuable asset…”

“What we do know now is that appears to be able to deliver exactly what the battery boosters say it would – it kept the lights on in South Australia while other states reliant on older fossil fuel technologies suffered wide-spread outages.”

See: https://reneweconomy.com.au/how-the-tesla-big-battery-kept-the-lights-on-in-south-australia-20393/

OldCynic, would you rather have no ‘big batteries’, coal- and gas-fired generators continuing to ‘game the system’, higher electricity prices, a less reliable grid, and continuing down the road to civilisation collapse? You’ve already indicated you are anti-renewables previously – you’ve stated you prefer nuclear energy.

See your comment: https://www.solarquotes.com.au/blog/finkel-hydrogen-coal/#comment-484845

…and my response: https://www.solarquotes.com.au/blog/finkel-hydrogen-coal/#comment-484984

OldCynic, perhaps you’d prefer much more taxpayer money being squandered on ridiculously expensive and very slow to deploy nuclear power?

Is it any wonder you continue to hide behind a pseudonym?

Geoff Miell

An overseas investor (such as Neonen) would be forced to categorize ANY investment in the Australian energy sector and associated industries as being a ‘high-risk’. That’s regardless of whether the investment is in coal, nuclear power, pumped hydro, hydrogen, PV, or whatever.

That ‘high risk’ partly arises because Australia is now beginning to fit rather neatly into the definition of a ‘banana republic’ which political science politely describes as ‘a politically unstable country with an economy dependent upon the exportation of a limited-resource product, such as bananas or minerals.’

see https://en.wikipedia.org/wiki/Banana_republic

The large gain achieved by Neoen via arbitrage in the electricity market is exactly what markets are intended for. Neoen have highlighted the fact that the existing ‘electricity market’ is in fact quite inefficient and sends wrong price signals which can be exploited in some circumstances.

And that state of affairs is now clearly out in the open for all to see.

Neoen will no doubt continue to exploit ‘wrong price signals’ of all kinds in either direction (up or down), so long as two conditions are met – (a) the other far more significant volume players in the market provide them with opportunities to do so and (b) the commitments they’ve made to their own customers aren’t breached.

It’s really up to the other players to price correctly. Up till now they’ve been a minor example of the predatory pricing of essential commodities found in a typical banana republic, toward which the government of the day turns a blind eye.

Thankfully, we’ve got same way to go before Australia goes ‘completely bananas’ in the more colloquial sense, although Queensland (via the Adani project and as well the indirect support of high density beachfront residential developments at sea level) is setting everyone a fine example of just how quickly progress toward that state of mind can be made if one puts their mind to it.

Des Scahill,

You state:

“Thankfully, we’ve got same way to go before Australia goes ‘completely bananas’ in the more colloquial sense…”

I suspect you meant to say: “…we’ve got some way to go…”? I think there are some trigger points that could potentially shift Australia into a rapid decline.

The current drought, if it continues to deepen further, is one potential trigger point. This is escalating a major downturn in agricultural output, raising food prices because of increasing scarcity, gutting regional economies, and depleting livestock bloodlines – that could have long-term consequences.

The knock-on effect is major fires at multiple sites with long fire-lines, stretching the firefighting resources to their limits (and potentially beyond) and potentially destroying many properties and agricultural infrastructure and livestock. Insurance premiums will increase – my house insurance renewal was up by 15.8% this month compared with same time last year.

If the drought continues, for perhaps two more years, then many eastern Australia regional towns’ water supplies will be literally dry (beyond ‘day zero’), and so could Australia’s most populated area: Sydney-Illawarra-Blue Mountains-Southern Highlands (Greater Sydney water catchment region). Building new dams are now too late if there is inadequate rain. Desal plants need to be near the ocean and require lots of energy to operate with, and this country doesn’t have a coherent energy policy! And it seems all our pollies can offer are their “thoughts and prayers”.

Another potential trigger is a significant constraint on Australia’s petroleum fuel supplies. IMO, Australia is currently so ill-prepared for it. Without an adequate petroleum fuel supply – critically diesel – Australia would simply stop running within a few weeks. I witnessed first hand how a country can be severely disrupted in September 2000 when fuel supply deliveries were cut-off in most of the UK, due to protests that were thankfully resolved within weeks.

See: https://en.wikipedia.org/wiki/Fuel_protests_in_the_United_Kingdom

A military conflict (or major cyclone(s) damaging major refineries) that disrupted Australia’s fuel supplies could potentially last months to years. The Australian government is supposedly doing (or done?) this year a strategic review on Australia’s liquid fuel supply vulnerabilities, but I suspect the most effective solutions are probably too hard for the feds to implement.

See: https://www.environment.gov.au/energy/liquid-fuel-security-review-consultation

And another potential trigger is the inevitable onset of a post- ‘peak oil’ (and post- ‘peak gas) world. Again, Australia is so ill-prepared for it. It appears to me that many infrastructure projects still assume petroleum fuel (and natural gas) supplies will remain affordable and abundant into the 2020s and beyond – wilful denial of climate change and the finite and rapidly depleting nature of oil and gas reserves.

IMO, it’s only dumb luck we’ve got this far relatively unscathed. We are certainly not planning to mitigate for these critical risk factors. IMO, “thoughts and prayers” are not good enough.

Geoff you need to lay off the straw-man attacks, it doesn’t strengthen your opinion against OldCynic’s case by constantly needling he/she personally. I for one would love to see a full conversion to rebuildable power sources like wind and solar, but the reality is it’s not going to happen with our current lavish end use. Storage is an even more complex problem and one which is far from being resolved.

The lithium-ion battery system at Hornsdale cost 90 million and claims an operational life of at least 15 years. I have never heard of a LiPO battery in constant use lasting past 7 myself and certainly by year 7 the capacity is seriously degraded. The claim is like many today, a Marketing ploy to sell product, and not a realistic estimate.

In one year the facility generated AU$28 in profit but a good portion of that will need to be set aside, and it won’t be, to pay for replacement of the battery in probably less than 7 years time. These aren’t magic batteries, at the macro level we see big shiny boxes but deep inside are tens of thousands of standard 18650 cells, just like the testla powerwalls have. Tesla assembles its product at the Fremont facility in the US but I assure you the individual Panasonic cells come from China like all the rest on the market. There is nothing special about Testla products aside from the marketing.

A coal fired power station on the other hand does not need replacing every 7 years, it is good for 50 or 60 if regularly maintained and is a lot more reliable. Solar and wind in microgrids for sure, but trying to use it to supply power across our vast nation is a fools errand. What we are seeing with the Big Battery and the wind farms is not the beginning of a transition to a rebuildable grid. It is gimmicks designed to keep the population satisfied until the supplies of fossil fuels are so depleted we are forced into a lifestyle that does not permit the extravagant waste of electricity we see and take for normal today.

Our nation is blighted with ugly power transmission poles and wires and I for one would be glad to see them gone for good and our homes running efficiently off stand alone rooftop solar installations with minimal night time power useage. So be proactive and get your solar panels on your roof and help lead the transition away from our dependence on so much coal burning. Focus on the 50 year old proven technology of solar panels, and not on the marketing ploys of a billionaire spruker who cares about nothing but his own ego.

I have a reasonably large home solar system. It works fine and has reduced my power bill considerably to anywhere between $20 and $200 per month. I don’t intend to get a battery for two reasons.

1. Too expensive to reduce what is a small monthly bill top ossicle zero.

2. The battery is another layer of technology to maintain and replace in 5-10 years.

Solar and wind and batteries are never going to provide the energy to run todays infrastructure, domestic use and industry. The worlds population and energy demands will likely double in the next 50 years As it has in the last 50 years. Fossil fuels will still be plentiful in 50 years and they will continue to be mined but obviously are finite. The only real solution going forward is to have an energy mix of “all of the above” to feed and accomodate a world population of 16 Billion up from todays 8 billion. The world does not have the luxury to pick and choose.

As to CO2 in the atmosphere a steady increase has way more positives than negatives. Can you imagine earth before whatever cataclysmic event started vegetation all over the earth on the path to fossilise that vegetation into massive reserves of coal, oil and gas. What we do need is to embrace water storage as they did in the old days. There are few countries, cities, towns and homes all over the world that don’t rely on some form of stored water. Obviously nuclear will play a big part in supplying energy. But truly it is an “all of the above” solution that will solve future energy needs.