It’s a great time to buy commercial solar power to slash your energy bills. And the new $150,000 instant asset write-off can reduce your tax bill too.

Due to the economic hit from the coronavirus COVID-19 and bushfire disasters, the Federal Government has announced a $17.6 billion economic stimulus. It includes tax deduction incentives that make commercial solar power — and other investments — even more attractive. Provided it’s for business, the incentives will improve tax deductions for solar systems of almost any size, including:

- Small solar systems of only a few kilowatts for small businesses with limited roof space.

- Large systems with thousands of panels on the roofs of factories, warehouses, and shopping centres or mounted on the ground nearby.

- Huge solar farms with hundreds of megawatts of capacity.

The incentives are front loaded. This means the greatest benefit will apply to solar systems of $150,000 or less purchased this financial year, but there will still be an incentive that applies to almost all commercial PV systems installed until the 30th of June 2021.

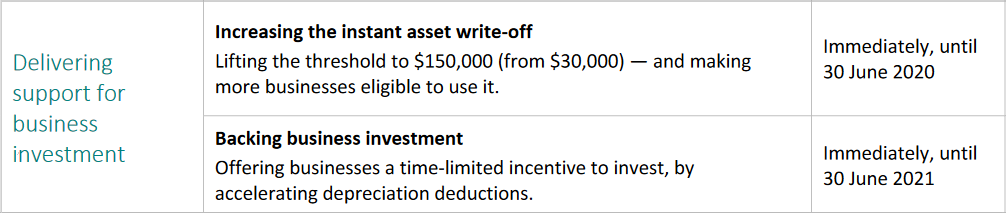

The incentives apply immediately. The image below was taken from the summary table in the Australian Government’s Economic Response To The Coronavirus document and gives the names of the tax deduction incentives and when they end:

Incentive 1: Increasing The Instant Asset Write-Off

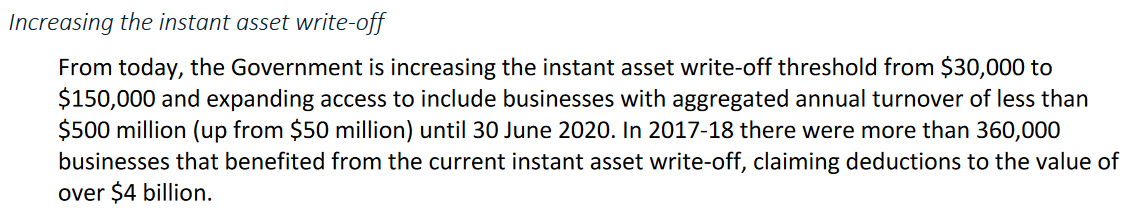

I’m not an accountant, so I’ll just copy what the government wrote below without attempting to give any advice on how it may apply to any particular business. If you want specific advice you’ll have to ask someone who is better with money than I am:

My solar focused mind interprets that as saying you can install a solar system for a business of up to $150,000 and write it all off as an instant tax deduction, provided:

- Your business has an annual turnover of less than $500 million — which is most businesses.

- You get it done this financial year — before the 30th of June 2020.

This can apply to every purchase of $150,000 or less, so it could be used for commercial solar power and as many other things as your business can afford. For example, a business could use it for insulation, an energy management system, and ways to reduce or eliminate natural gas consumption. Provided each purchase is within the $150,000 limit they can all have instant asset write-off until the end of this financial year.

$150,000 Can Easily Pay For 100 Kilowatts Of Solar Power

Generally speaking, $150,000 is more than enough to pay for 100 kilowatts of solar capacity, although it will depend on the difficulty of the installation and the location. It will also depend on the cost of the solar panels used, but there are many that have demonstrated reliability and are competitively priced. Our commercial solar guide has a graphic of all the solar panel manufacturers we have confidence in with regard to panel quality and customer service:

Solar systems of up to 100 kilowatts of panel capacity can receive STCs or Small-scale Technology Certificates that lower the cost of solar power. Provided you have enough space for the panels, I recommend getting as close to 100 kilowatts as you reasonably can.

Because solar panels have fallen so far in price it can now be worthwhile to place them in sub-optimal locations, such as south facing roofs. Unfortunately, in many locations commercial solar power will be export limited and unable to send all surplus energy it generates into the grid for a solar feed-in tariff. As this reduces the return from a larger system, it will need to be taken into account.

Commercial solar installations can be over 100 kilowatts, but rather than STCs they will receive LGCs, or Large-Scale Generation Certificates, for energy generated. The overall return from these over the next 10 years they can be created is expected to be far less than the value of STCs.1 You can find more information in our Commercial Solar 101 Guide.

Incentive 2: Backing Business Investment

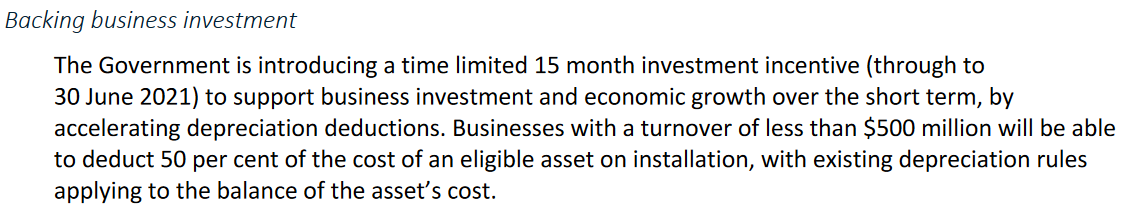

The second tax incentive is called “Backing Business Investment”. The Economic Response document states:

If a business investment of up to $150,000 is made this financial year it can use the instant asset write-off incentive, but any investment — regardless of its expense — can deduct 50% of its price with normal depreciation applying to the rest, just so long as:

- The business has an annual turnover of less than $500 million.

- It occurs before the end of next financial year — the 30th of June 2021.

Large Scale Solar Farms Can Deduct 50%

The Backing Business Investment incentive can apply to investments of up to any size within the $500 million a year business turnover limit. This makes it suitable for large scale solar farms of potentially hundreds of megawatts. So if you want to build a solar farm or commercial solar of over 100 kilowatts capacity, this tax incentive could be very useful.

Weak Dollar & Supply Disruptions

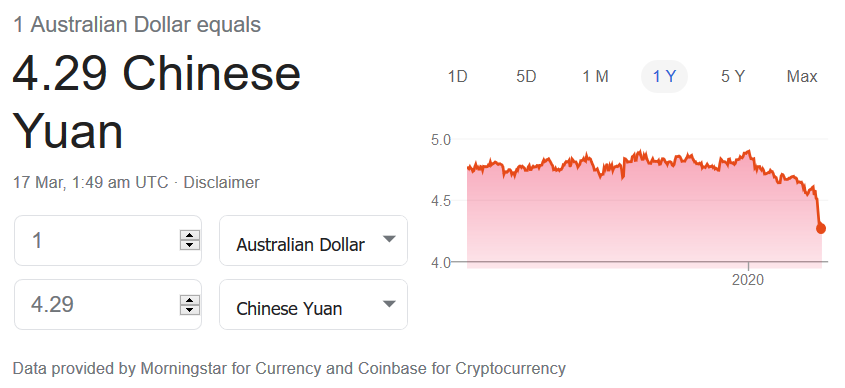

The Australian dollar has fallen to its lowest point against the Chinese Yuan for at least 10 years. This is the currency that matters the most for solar energy because China produces the bulk of the world’s solar panels and inverters.

While I expect the Australian dollar will recover, it may not happen this financial year and it may be weak through the next financial year. This means the cost of solar hardware may increase slightly. But commercial solar power will still be a very effective investment for many businesses.

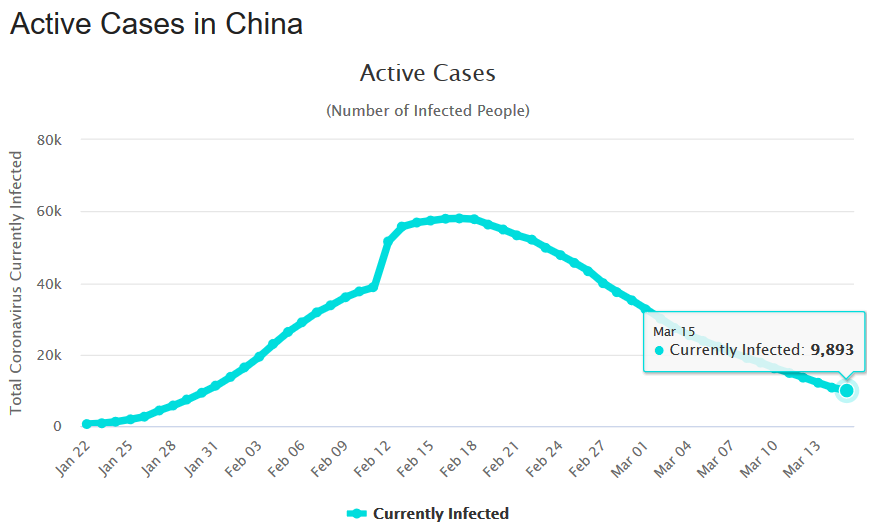

Another factor that can influence the availability of solar hardware are supply disruptions caused by the virus shutting down factories. The good news here is China has done very well in combating the virus, despite a worrying start. China’s active infections — people who suffering from the coronavirus now — have fallen to about one sixth their peak:

(Image: Worldometer)

This hopefully means Chinese production will soon recover and — given how China normally operates — they are likely to try to meet export demand before domestic demand.

Installers Are Likely To Meet Demand — If You Don’t Leave It Too Late

Australia and the world are currently in an economic slowdown and so, at the moment most businesses — including solar installers — are looking for work. The purpose of the Government’s economic stimulus is to keep people employed by encouraging investment. But because there is less than two and a half months to take advantage of the Increased Instant Write-Off tax incentive it is possible there will be a rush to buy commercial solar systems before July 1st.

What you will need to watch out for are installers who are not up to the job, but trying to take advantage of the short term opportunity the tax incentive provides. (Expect to see ads telling you to rush before the incentive runs out.) If you find a commercial solar installer through SolarQuotes, we will only recommend those we know do quality work and have been personally vetted by my boss, Finn.

If you are considering solar powering your business, then we have a comprehensive guide to getting quotes for commercial solar power here. You’ll be a confident commercial solar buyer in under 10 minutes.

And when you are ready to get quotes from installers who have lots of commercial experience, you can get up to 3 quotes for commercial solar here.

Footnotes

- LGCs are currently worth around 3.4 cents per kilowatt-hour generated, but may only be worth around 1 cent per kilowatt-hour in 2 years. ↩

RSS - Posts

RSS - Posts

Thanks Ron very comprehensive well done.

One very important point needs correcting though:-

You said: “This means the greatest benefit will apply to solar systems of $150,000 or less installed this financial year…..”

You need to change this to read: This means that the greatest benefit will apply to solar systems of $150,000 or less purchased this financial year…..”

Installed and Purchased a very different animals and the distinction is very important for customers and installers to understand.

Thanks Ronald.

Lawrence Coomber

A very good point. Thank you for pointing that out. I have updated the article.

So, as always, the feral government looks after its rich mates (and large “donors” to the respective political parties and MP’s?), by diverting public money to them, to take their pirated money offshore while evading Australian taxes applicable to the plebs.

The funds would have been far better used, firstly, by providing toilet paper and other essential groceries that are no longer available in Australia, to the plebs.

When the plebs have food and toilet paper and other luxuries that the ruling class and their rich mates (and party “donors”) take for granted, then, and only then, should the “boost to the economy” (which is instead, clearly a boost only to big businesses, to increase their tax-free profits, to increase “donations” to the political parties and the MP’s), be implemented.

But, such a boost to the economy, needs to be made to the plebs, rather than to the “donors” and rich mates of the government.

Instead of further massive tax write-offs for big businesses, who pay extremely little, if any, taxes, anyway, the funds should be used to provide grants, or, better still, interest-free loans (which allow the funds to be directly recycled, in addition to the flow on benefits to small businesses and the economy), to provide for householders to install domestic rooftop photovoltaic systems with up to the maximum limit of panels capacity, and, up to 25kWh of battery storage. And, those funds should be distributed by postcode of residence, proportional to the population within the postcode.

But, instead, as always, the feral government looks after its rich mates and party “donors”, while deliberately causing harm to the plebs.

And, of course, if the feral parliament had any members representing WA, or, representing any other common people (as opposed to simply representing their rich mates and party “donors”) of Australia, the members of the feral parliament would immediately block what the fiddler on the roof has done, and, instead, implement an emergency measure to immediately boost the economy, by, firstly, ensuring that essential groceries are available to the plebs, and, NOT at exploitative prices (we want normal toilet paper, at normal prices, not paying prices applicable to the gilt-edged toilet paper printed with the prime ministers portrait, like they no doubt have in the feral parliamentary dunnies), and, then, dividing the amount of the “$17.6 billion economic stimulus” to be paid to each Australian resident (so, if the population is 35.2 million, then, $500 for each person), which could help each household pay for necessities, and, with the flow-on effects, really implement a stimulus to the economy, and, a more effective stimulus, than simply giving the “$17.6 billion economic stimulus” to the prime minister’s rich mates and party “donors”, for them to take offshore.

And, for people like the lazy sod who dismissed my previous reference to the Alaska Permanent Fund, without bothering to look it up, go to

https://en.wikipedia.org/wiki/Alaska_Permanent_Fund

and read the article, especially relating to the Dividend.

And, plenty more informative articles are published about it, on the World Wide Web.