It’s October and Australia’s wholesale electricity price crisis has entered its sixth month. Massive retail electricity price hikes in the eastern states are becoming more likely (from July 2023). These could exceed 10 cents per kilowatt-hour.

This post is a quick update on the current situation, followed by a short whinge.

Here’s a six-point summary to bring you up-to-date on the current crisis:

- Putin decided to put an end to the threat of Russia not invading Ukraine by invading Ukraine on February 20th.

- Because east coast natural gas is sold on the international market, its price soared.

- Even though Australia only generated 8.4% of its electricity from natural gas last financial year, wholesale electricity prices soared because gas is a ‘price setter’ in our electricity market.

- The cost of black coal also increased, but despite supplying 43.8% of Australia’s electricity,1 due to its inflexibility this has had a much smaller effect on wholesale prices than the gas price hike.

- Behind-the-scenes arm twisting pushed down the price of east coast natural gas from extreme levels at the end of July, but they are still well above normal.

- The situation should improve as we head into warmer spring weather and solar energy output increases, but the crisis may not end until after the war in Europe does.

Only Eastern States Affected

The wholesale price crisis only affected the eastern states. One state and two territories unaffected so far:

- Western Australia is doing fine because a portion of its gas production is reserved for domestic use and its low-quality coal isn’t sold overseas.

- NT consumers are protected by long-term gas contracts.

- ACT electricity is 100% renewable, with prices mostly set by long-term contracts and so gets off scot-free.

Huge Retail Electricity Price Hikes Likely

Wholesale electricity prices increased in April and blew through the roof in May, June, and July; then fell.

I was hoping for them to drop in September but the decline was minimal. That’s probably due to domestic gas prices at around $20 a gigajoule, roughly twice what they were a year ago.

The numbers suggest we’re on track for a huge increase in retail electricity prices when they are reset in July 2023.

To estimate the — hopefully — maximum increase, I figured out three things:

- The average wholesale market price from May 2021 through April 2022. This is roughly the period that determines today’s retail prices.

- The average wholesale price in August and September 2022.

- The difference between the two. This will be my estimate of how much wholesale electricity market prices will increase over the period used to determine electricity price increase in July 2023.

2021-2022 Wholesale Market Prices

Past wholesale market prices from the start of May 2021 to the end of April 2022 are easy to obtain from the AEMO. For the five eastern states, the average wholesale electricity market prices were:

- NSW: 9.6 cents/kWh

- QLD: 12.8 cents/kWh

- SA: 6.6 cents/kWh

- TAS: 5.2 cents/kWh

- VIC: 6.1 cents/kWh

Projected Wholesale Market Prices

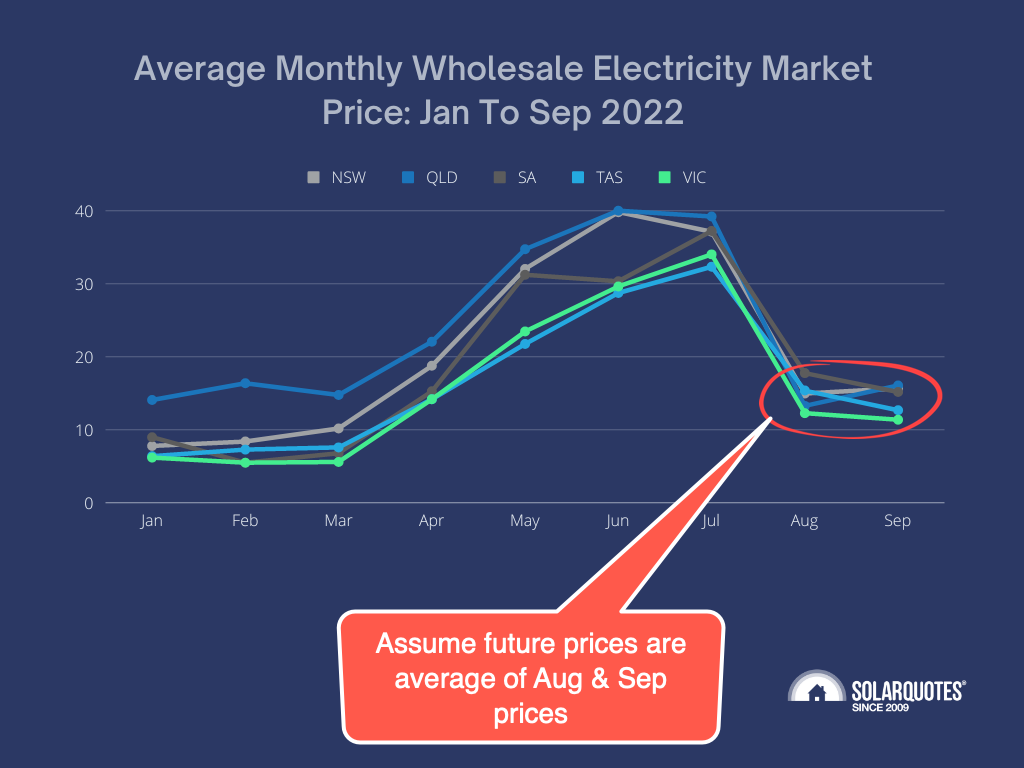

Electricity price increases in July next year will — roughly — be based on the period May 2022 through April 2023. Unfortunately, I don’t know what the wholesale market prices will be in future, so I have simply assumed that from now they will be the average of what they were in August and September. Here is the graph of what wholesale market prices will look like, assuming they follow the trend set over the previous two months:

If the August and September trend holds, then the average wholesale market price that determines next year’s retail electricity price will be:

- NSW: 20.6 cents/kWh

- QLD: 20.4 cents/kWh

- SA: 20.4 cents/kWh

- TAS: 17.6 cents/kWh

- VIC: 16 cents/kWh

Wholesale Market Increases

Subtracting 2021-2022 wholesale market prices from my projected future prices gives the wholesale price increases we can expect next year:

- NSW: +11 cents/kWh

- QLD: +7.6 cents/kWh

- SA: +13.8 cents/kWh

- TAS: +12.4 cents/kWh

- VIC: +9.9 cents/kWh

These are the increases that I’m estimating will determine next year’s retail electricity price.

Retail Price Increases Should Be Less

While wholesale market price increases are likely to be extreme, there are two reasons why retail electricity price increases in July shouldn’t be as scary:

- The international situation is showing signs of improving, so the cost of natural gas and coal could fall and lower wholesale electricity prices. But note there is also a chance — very small in my opinion — that things could get much worse.

- Most electricity is not traded on wholesale markets, but through long-term contracts and their prices are kept secret. Energy traders may have done their jobs well and locked in large quantities of electrical energy at below wholesale market prices. If this has happened, electricity price increases won’t be as bad as wholesale market prices suggest. But there is a possibility enough traders screwed up so badly the overall price increase will be higher than what wholesale markets indicate. This is extremely unlikely, but the fact some small electricity retailers have gone bust as a result of the price crisis shows not everyone got it right.

I’m optimistic electricity prices won’t rise as high as current wholesale market prices suggest. But I recommend being ready for an increase of at least 5 cents per kilowatt-hour come July 2023. Now would be a very good time to install solar panels or expand existing capacity.

Home batteries are far from being a guaranteed money saver for typical households, but those who are on the fence may want to jump into the battery ownership yard for the extra security and independence they provide.

Solar Feed-In Tariffs Should Rise

Those with solar power systems will be glad to hear feed-in tariffs should increase in July along with electricity prices. These will be based on daytime wholesale prices rather than the overall increase, so they’re not likely to go up in lockstep with grid electricity prices. But I do expect substantial rises.

Electricity Pricing Should Be More Responsive

As soon as Putin ordered the invasion of Ukraine, Australians should have started to…

- Conserve energy

- Install more solar

- Invest in home insulation and energy-efficient appliances

- Get off gas entirely where possible

- Consider buying batteries

But we’re not going to get the electricity bill price increase that will encourage us to do all these things until July next year. By then the crisis will — hopefully — be long over. Wholesale electricity prices may have plunged by that point and the price hikes will cause households to conserve electricity at a time it’s especially cheap to generate. This is not a good way to run things.

It would have made more sense to have added a Russian invasion premium to electricity prices as soon as it happened. This sort of responsiveness would improve the flexibility and resilience of our economy. But I know of no plans to introduce this kind of forward thinking.

Footnotes

- Last financial year black coal supplied 43.8% of Australia’s on-grid electricity consumption, but super-disgusting brown coal also supplied 14.3%. This means coal’s total contribution was 58.1%, but because brown coal is super-disgusting it can’t be exported. ↩

RSS - Posts

RSS - Posts

As has been pointed out, in WA we are lucky as our politician with name Colin Carpenter told the multinational 15% must be reserved for domestic use, so he did not like their bluff. They walked but came back and now we have our own gas.

The excuse by the multis was that our WA gas was very deep and costly to explore.

I suspect the gas in the ES is on-shore and easier to extract – that begs the question then how and why your politicians in the ES allowed themselves to be bluffed by the multis?

I’m told a lot of the public service advisers who knew how to read gas contracts were fired by previous governments, leading to very poor advice when Julia Gillard made the decision.

Thanks, another great read, Ronald.

So once we pass a certain tipping point to renewables at a mass scale, with a transformed grid etc., will there come a time when it will make less economic sense to own your own panels? Or is household PV such an integral part of our generation capacity into the future that it will always be incentivised?

Because the retail price of electricity is always going to average higher than the wholesale price, it should always make sense to install your own panels. Especially as their cost should continue to fall. That said, daytime electricity should become cheaper for those who don’t have solar.

Thanks.

I’m thinking of the projections of minimum demand, which show it in free fall in the next few years due to the enormous household PV capacity, to the point of the grid potentially falling over. It should be great news, but highlights again how ‘baseload’ power really means the amount of demand, not supply, needed to prevent them having to cycle down coal plants. Those things are super expensive to stop and start regularly. The grid is hopelessly behind where it needs to be to distribute all of that PV capacity. Check out the graph in this piece, from the AEMO analysis.

https://www.energycouncil.com.au/analysis/a-minimum-requirement-managing-the-demand-drop/

Nick,

“The grid is hopelessly behind where it needs to be to distribute all of that PV capacity. Check out the graph in this piece, from the AEMO analysis.”

It seems to me that perhaps the AEMO may be ignoring the progress of a number of large-scale BESSs to soak up some of the excess daytime solar-PV energy.

https://www.solarquotes.com.au/blog/electricity-tariff-comparison/#comment-1499379

https://reneweconomy.com.au/big-battery-storage-map-of-australia/

And there are a few pumped hydro projects in development, but they would require longer lead-times to become operational (compared with BESSs).

https://reneweconomy.com.au/pumped-hydro-energy-storage-map-of-australia/

Unfortunately, decades of neglect by a succession of governments (both federal & state) cannot be fixed overnight.

Hi Geoff

They do talk about storage in their analysis, not sure if they’ve captured it all or not. But yep, we wasted the past 20 years with little attention to modernising the grid, while millions were installing PV capacity. And now with coal plants and generators closing well ahead of schedule, generally out of our control as they’re mostly foreign-owned, we have excellent generation capacity with renewables, but grid and storage that’s about a decade or more behind where it needs to be. And a worldwide shortage of materials and expertise in building both of those. It’s going to be a brutal next decade. It might make home batteries an even smarter investment.

Hi,

This may be in the area of “hare brained schemes” but could excess power be used to produce hydrogen which could be stored in old style gasometers adjacent to gas fired power stations?

Dave, here’s a link to Prof David Cebon, an Aussie mechanical engineer at Cambridge Uni, explaining to Robert Llewellyn on Fully Charged Plus why converting electricity to hydrogen is a terrible idea: https://youtu.be/JlOCS95Jvjc?t=908

Dave (re comments at October 11, 2022 at 11:58 am),

Hydrogen technology faces a substantial energy efficiency disadvantage in the power storage race.

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/hydrogen-technology-faces-efficiency-disadvantage-in-power-storage-race-65162028

“feed-in tariffs should increase”. Like my mother used to say: “Eerst zien, dan geloven!”, which roughly translates to “I’ll believe it when I see it!”

Outside of Western Australia, solar feed-in tariffs do change in response to changes in daytime wholesale electricity prices. It occurred this July, even if large electricity retailers didn’t necessarily pass it on:

https://www.solarquotes.com.au/blog/july-electricity-price-hikes/

Where retailer choice is available, it does pay to shop around.

Yes, I have recently moved to AGL’s solar saver, that they removed the day I joined. I am not convinced competition works the way it should, with sub-ideal feed in tariffs across the board.

If there is no first retailer raising it, then none of them have to.

I’m afraid the system is intentionally designed to reduce competition.

I’m with AGL solar savers. So far this year they have: 1 moved me to TOU 2 increased Tarif 3 moved me back to flat rate. I did not ask for any changes. Their emails say it is to give me a cheaper bill. Anyone believe that?

Maybe give these guys a shot ? They’re a non-profit energy collective.

Also, we both get $50 credit if you use this referral code:

9047488

cooperativepower.org.au

Cooperative Power is a newly formed non-profit cooperative for Australia’s energy sector. Together we’re creating a better way to buy energy – one where we can have our say in how it’s created and how much it costs.

The revenue we generate from electricity goes to supporting our mission of fighting poverty, tackling the climate crisis and supporting communities. Last year 100% of our electricity revenue went towards mitigating the impact of COVID-19. This year our customer members are deciding how we spend our revenue.

Energy usage at wholesale rates

We will never increase our rates for profit

Support workers and communities to take the power back for the benefit of people and planet

No exit fees or lock ins

We commit to invest in community renewable energy

Profits are returned to workers and communities

Regarding #4, isn’t that rather misleading? According to the NEM dashboard on the AEMO site black coal comprised 48% but brown coal comprised 17%. Yes I read the note, though I’m not sure how many others would, but how is it that NEMO figures and your figures differ. Is it because WA and NT figures aren’t included?

Solar comprised 6%, wind 13%, however those figures varied a lot over the course of the year!

Given QLD has the highest average wholesale electricity market price, shouldn’t it have the highest FiT too? For that matter why is the power so expensive given it doesn’t rely on gas like SA and gas sets the price?!? Tis all rather confusing!!!

Wholesale prices are set to soar next year by what, 25%? (I’ve not checked the average for each state so this is a wild guesstimate.) SQ is predicting FiTs will rise next year, but they were predicting it for this year too, and that didn’t happen, so there’s no reason to assume savings\revenue will actually occur. And while a 25% rise in usage charges will be painful, I don’t think the maths yet justifies the SQ recommended hybrid option – modest battery to sustain day to day usage, grid to survive the odd day or three where solar fails to cover usage let alone recharge the battery.

George Kaplan,

“Regarding #4, isn’t that rather misleading?”

Nope. Ronald wrote:

It seems to me that’s consistent with the Reserve Bank of Australia’s Statement on Monetary Policy – August 2022, Box A: Recent Developments in Energy Prices, particularly (bold text my emphasis):

https://www.rba.gov.au/publications/smp/2022/aug/box-a-recent-developments-in-energy-prices.html

“Is it because WA and NT figures aren’t included?”

WA & NT are not part of the NEM – they are entirely separate electricity systems/markets. Also re-read Ronald’s above section headed Only Eastern States Affected

It seems to me you continue to refuse to acknowledge compelling evidence/data inconvenient for your narrative.

https://www.solarquotes.com.au/blog/queensland-energy-jobs-mb2655/#comment-1499372

Hi George.

They’re the figures from last financial year for all of Australia taken from Opennem:

https://opennem.org.au/energy/au/?range=all&interval=fin-year

I presume it’s reasonably accurate.

Geoff,

per Ronalald’s own note “… black coal supplied 43.8% of Australia’s on-grid electricity consumption, but super-disgusting brown coal also supplied 14.3%. This means coal’s total contribution was 58.1%”. How do you reconcile that with NEM dashboard figures of 48% & 17%? By my maths that’s a grand total of 65% not 58.1%.

In his article Ronald jumps between Australia’s on-grid consumption and supply, and affects on eastern state power prices. Since his power figures don’t match current NEM figures he’s relying on something else. The only options I can see are Ronald relying on whole of Australia figures from somewhere else since he doesn’t specify his figures are restricted to just the east coast, or they could be outright wrong – which seems pretty unlikely but not absolutely impossible. Is there a 3rd option I’m overlooking? (Perhaps NEM figures from a different 12 month period???)

Yes I get WA & NT aren’t part of NEM, which is why the NEM dashboard doesn’t give WA & NT figures. If NEM only covers the east coast, and Ronald’s figures only pertain to the east coast, then why don’t NEM and Ronald’s figure’s match?

Amusing as it is to see you refer to the narrative, you don’t seem to be addressing the core of my post – the disparity between Ronald’s figures & the NEM figures. If you can’t provide an explanation, it may be better to leave it to Ronald to clarify.

George Kaplan,

“…you don’t seem to be addressing the core of my post – the disparity between Ronald’s figures & the NEM figures.”

I was addressing your first question.

If you are challenging Ronald’s figures I’d suggest you need to be clearer & more precise with what you mean by “the NEM figures” by including the relevant data & time period you are referencing (& a URL would be nice too).

What would be handy is for Ronald to include a URL with his footnote #1 so that we can all know where the figures given came from.

Per the Australian Government’s Department of Climate Change, Energy, the Environment and Water, for the calendar year 2021 (NOT financial year 2021-22), Australian electricity generation fuel mix in shares:

* 38.9% for black coal (compared with 40.0% in 2020-21)

* 12.5% for brown coal (12.8% in 2020-21)

* 17.8% for natural gas (18.7% in 2022-21)

* 29.1% for renewables (26.7% in 2022-21)

* 1.8% for other (1.8% in 2021-21)

https://www.energy.gov.au/data/australian-electricity-generation-fuel-mix

IMO, quibbling about the magnitude of the numbers, where they came from and over what time period doesn’t negate that the gas price hike had a much bigger effect on wholesale electricity prices than coal did, particularly in the eastern states – the point I think Ronald was clearly making in #4, that you were suggesting (& I was referencing in my previous comment) was misleading in your first question.

Unless you have super high demand I still wouldn’t invest in a residential battery.

$10k for a 10kw battery with interesting warranty terms and potentially long service lead times. Never pay for itself.

The problem with Australia no companies investing in large batteries. Big companies with clout to make sure they get good warranty and service from vendors (unlike residential consumers) and it cheaper for them to charge it up between 12 – 2pm and sell it during the peak. Generators won’t do it because they want to maximise the return on their old gas / coal stations.

Some clarity is needed here about the international energy prices. The huge increases have been caused directly by sanctions imposed on Russian energy by the US and EU that have drastically reduced the supply and caused the huge price increases – not by any deliberate restriction of supply or prince increase by Russia. Those are the verifiable facts.

Only when those sanctions are removed by the US and EU will there be any possibility of an increase in supply and reduction of price.

Unfortunately for everyone affected it appears unlikely at the moment that those sanctions will be removed even if the war stops tomorrow.

Australian east coast natural gas consumption has dropped dramatically thanks to high prices over the past six years after the LNG export hub at Gladstone came into operation. The same will happen in Europe and, even in the absence of Russian gas, will lower prices. The shift away from gas will occur even if gas prices fall to very low levels for both risk and environmental reasons. The destruction of the Nord Stream 1 & 2 pipelines has rubbed in how vulnerable natural gas infrastructure is.

Southern Europe has great potential for solar. In Gibraltar even middle of winter can be sunny and 18C. In addition grid scale storage would be a great solution.

Europe just needs to get on their way. How many times have the west thought that engaging unfriendly regimes would bring them into the fold. Russia & China is key examples.

I would like to see salt water batteries come back. There is so much unused space / below floors / basements etc.

Well, I would have thought Germany and Japan would have been the key examples.

Okinawa is a good place as it is sub tropical therefore plenty of sun.

Absolutely, from my point of view, if paying a bit more for power is the cost of supporting Ukraine, then I’m happy to do so.

WillD,

“The huge increases have been caused directly by sanctions imposed on Russian energy by the US and EU that have drastically reduced the supply and caused the huge price increases – not by any deliberate restriction of supply or prince increase by Russia.”

Thermal coal prices have steadily risen from about US$50/tonne in 2020 to US$238/tonne on 23 Feb 2022 (the day before the Russian invasion of Ukraine). It peaked at US$457.80/tonne on 5 Sep 2022 & is now down around US$386.

https://tradingeconomics.com/commodity/coal

Global gasoil & diesel fuel production has declined from around 26 million barrels per day (Mb/d) to below 23 Mb/d in mid-2021, well before the Russian invasion.

https://crashoil.blogspot.com/2021/11/el-pico-del-diesel-edicion-de-2021.html

US natural gas prices have steadily risen from around US$1.80/MMBtu in late Jul 2020, spiking to US$6.1980/MMBtu on 27 Oct 2021, through to US$4.5930/MMBtu on 23 Feb 2022. It peaked at US$9.71/MMBtu on 22 Aug 2022 & is now down to around US$6.53/MMBtu.

https://tradingeconomics.com/commodity/natural-gas

Australian wholesale gas prices were also rising well before the Russian invasion.

https://www.aer.gov.au/wholesale-markets/wholesale-statistics/gas-market-prices

Substantial price rises for thermal coal & natural gas markets (& declining global diesel supply) were already happening well before Russia invaded Ukraine.

Meanwhile, last week the OPEC+ alliance decided to sharply cut crude oil production to support sagging oil prices, reducing production by 2 Mb/d starting in November.

https://oilprice.com/Energy/Crude-Oil/OPEC-To-Cut-Oil-Production-By-2-Million-Barrels-Per-Day.html

What if the cut is also partly an attempt to hide that OPEC+ is struggling & perhaps unable to meet their current production quotas?

Has Saudi Arabia maxed out its crude production average of circa 11 Mb/d in August 2022, and it now needs to pull back to 10.5 Mb/d to reduce the strain?

The recent ‘signalling’ by Alinta Energy that ‘retail electricity prices’ could rise by a minimum of 35% next year’ seems another indicator of the overall ‘energy crisis occurring world wide.

https://www.abc.net.au/news/2022-10-11/energy-suppliers-say-costs-to-rise-another-35/14081156

There;s a mixture of international and local influences involved, which makes it dead easy for anyone to single out ‘some-one’ or ‘something’ to ‘specifically blame’ as being by far the worst out of a vast pool of potential ‘culprits’, in order to advance some objective of theirs that has in some cases no relation at all to either commonsense or reality.

Alinta’s price increase simply reflects reality. Their costs have gone up. They have to pass those on or go broke.

I’m not going to tell others what to do, other than suggest they may need to be far more careful about who they vote for in future, and the sources of information they use to arrive at that decision.

Maybe simplistic, but given government has about a decade to modernise the grid to make renewables fully scalable, and that will be a Herculean effort with worldwide shortage of expertise and materials, and about $100 billion in cost, wouldn’t it make sense for them to start subsidising home storage now as an interim measure, to run in parallel? If they’ll struggle to connect the big surge in home PV to the wider grid, why not store more of it locally as a stopgap, and incentivise that? Just as they incentivised the panels which created the healthy surge.

Looking to Government & Regulators to provide ‘solutions’ won’t work. While what you suggest may seem ‘feasible’, the reality is that adopting yet another interim or stop-gap solution that involves ‘storage’ will very likely end up being around for far longer than anticipated. Which leaves the door open for endless debate about nuclear vs hydro vs wind vs tidal etc to continue unabated.

It seems to me that there’s far more immediate benefit for large numbers of people to be gained by simply putting as many solar panels as we can on as many roof’s as we can find and at least enabling them to reduce their daily billable consumption dramatically.

There’s a fundamental issue involved. Do we want a ‘distributed’ system where there are no really large generators involved.. Or… do we want much the same centralised set-up as we have now?

The events in Ukraine, the UK, France and Europe seems to me to be a real world example of the unsuitability of centralisation of energy supply in today’s uncertain world. Those same events also give an indication of just how many things can go really bad really quickly, especially when climate change impacts are also factored in.

We can’t solve all of the problems all at once of course. But putting solar panels on roofs seems to me a better first step. We can see the benefits of that already in some undeveloped countries.

The point I’m making is that the ‘over-developed’ nations with a high standard of living are all ;’hostage’ to the availability of energy. If that goes, the downward progression to ‘poverty stricken nation’ with a collapsed economy begins to rapidly occur.

If households and businesses can access a good supply of electricity on most days during daylight hours, then many of the negative impacts from a suddenly broken centralised system can be considerably mitigated.

I think over-reliance upon distributed OR centralised systems lacks resilience. Distributed systems work well with centralised coordination, and centralised systems work well with a healthy amount of distributed effort. A grid too focused upon local, distributed generation becomes a nightmare for the electrical engineers to manage, as well as raising issues of ongoing maintenance and upkeep of the national generation capacity. For example, can we rely upon people to replace or update panels, inverters etc. when their useful life expires? Really complex governance and engineering questions here.

I think incentivising storage now will get a lot more distributed storage into the system, at a time where storage is lacking. Incentivising generation got us the panels. If modernising the grid is delayed, it will at least mean there’s somewhere for that huge surge of PV generation to go. Of course there are the technical issues that most home battery systems seem to be pretty unreliable right now, but that should evolve quickly.

Des Scahill,

“Those same events also give an indication of just how many things can go really bad really quickly, especially when climate change impacts are also factored in.”

Indeed, perhaps with climate changing quicker than you may think. ICYMI, Dr James Hansen & colleagues published their August 2022 Temperature Update on 22 Sep 2022. Figure 3 caught my attention, with their accompanying ‘predictions’ that:

1. For year 2022, the final four months this year should average warmer than the same months last year – meaning the 2022 global mean surface temperature should be about level with 2017, vying for (equal?) fourth warmest year on record;

2. Year 2023 should be warmer than 2022, rivalling the two warmest years on record (2016 & 2020); and

3. Year 2024 is likely to be “off the chart”. A classical, strong El Nino in 2023-24 could push the global mean surface temperature to about +1.5 °C relative to the 1880-1920 mean (baseline).

http://www.columbia.edu/~jeh1/mailings/2022/AugustTemperatureUpdate.22September2022.pdf

“We can’t solve all of the problems all at once of course.”

I’d suggest we/humanity need to if we want civilisation to continue to prevail beyond the next few decades. The time to act effectively is fast running out.

Dr Saul Griffith was on ABC TV’s 7:30 program this evening with some interesting and provocative comments.

https://www.abc.net.au/7.30/dr-saul-griffith-%E2%80%93-decarbonisation-for-australia/14082550

“I’d suggest we/humanity need to if we want civilisation to continue to prevail beyond the next few decades. The time to act effectively is fast running out”

True. But to believe we can continue to live the lifestyles we live now and solve it with technology is not quite possible.

Simple example is size of homes, they are getting bigger and more power hungry. In the electric home facebook groups there is people doing 24kwh a day. I live in a 13sq 3BR home (3 people) and we’re on about 5kwh a day (gas cooking and hot water), worse case was middle of winter with rain and RCAC on all day at 18C using 8kwh. These people don’t have 15 member families.

I agree those container size stand alone storage units (like batteries packed into 40ft, 20ft and 10ft containers) and locate them locally would be helpful. But there is no incentive for the companies to do it.

Subsidizing residential batteries is probably more about vote buying than anything else. Consumers get the worst in terms of warranty and support.

The Australian Energy Regulator (AER) published its Wholesale Markets Quarterly Q3 2022: July-September, on 18 Nov 2022. It included:

Electricity markets at a glance Q3 2022:

* Spot prices: Average quarterly prices double previous Q3 records but down from Q2

* Demand: Winter demand eased. Record Q3 high demand in Qld followed by record Q3 low demand in SA and Victoria

* Outlook: 2023 prices expected to remain high, especially in NSW and QLD

* Generation: Supply side pressures remain – high international fuel prices, aging coal plant, imminent Liddell closure and wet weather

* Fuel costs: Coal prices still high, gas prices halved from record highs

* New capacity:

Gas markets at a glance Q3 2022:

* Spot prices: Local prices in August & September reduced significantly from record July levels, but remain historically high

* High price expectations: ASX futures pricing indicates ~$30/GJ gas in Q2 and Q3 2023

* Spot trade: Downstream trade quantities exceeded last quarter’s record, complimented by record Gas Supply Hub deliveries upstream

* Day ahead auction: Q3 2022 auction quantity won exceeded last quarter’s record reaching 21.6 PJ

* Gas storage: Gas storage at record low levels, while southern storage at Iona increased over August

* New capacity Certificates Regime: Capacity certificates will replace the AMDQ regime from 1 January 2023 in Victoria

https://www.energy.gov.au/news-media/news/aer-report-examines-most-tumultuous-months-history-australias-energy-markets

At today’s National Press Club Address, with the Minister for Industry & Science, Ed Husic MP, ABC’s political editor Andrew Probyn said that Origin Energy told its shareholders that its gas production breaks even at $3.50/GJ, and yet a NSW steelmaker was offered $35/GJ for 12 months supply of gas. He asked Ed Husic, was a domestic supply gas price cap at $10/GJ fair?

Good summary. Especially at the end where the government is basically doing nothing.