Today’s a big day for Virtual Power Plants (VPPs): a federal rebate for VPP-capable batteries is coming online, while two states are offering incentives that require joining one. So why are multiple layers of government teaming up to tempt you into handing over control of your battery to a VPP operator, and should you take the bait?

July 1 alters the economics of home batteries and VPPs in ways I’d only ever dreamed of in the past. The federal battery rebate is bursting onto the scene and making home batteries almost a must-have for millions of households. If your home is connected to the grid, batteries capable of VPP participation are required to get the rebate, but you don’t have to actually join one.

The WA government has gone a step further with its own battery rebate launching today, that insists West Australians bite the bullet and join a VPP if they want to cash in on the state-backed discount.

Meanwhile, the NSW government is ditching its battery rebate entirely and replacing it with a redesigned incentive for joining a VPP, which also kicks in from today.

Do All These Government Incentives Mean VPPs Are Worth It?

Thanks to all these developments, many newly minted battery owners will soon be asking themselves, “Should I join a VPP?”

I say: Yes!

Most households should lash their batteries to a VPP and benefit from the provided payments because they’re worth the minor drawbacks — or at least they are, provided you’ve done your homework and joined a decent one.

VPP payments aren’t great, and their net benefit is likely to be around $200 or less per year. But it adds up, and as most people won’t even notice they’re part of a VPP, it’s not bad for doing next to nothing.

Below I’ll cover the main benefit of joining a VPP — which is money — and give a rough estimate of how much joining one is likely to save you and how it may affect battery payback periods.

What’s a VPP Anyway?

If you join a VPP, your battery will occasionally be used to support the grid. In return, you’ll receive modest but still worthwhile payments. This is all for the good because it lowers the cost of running the grid, which lowers electricity prices for everyone, and it helps the country close down coal power plants. Exactly how your battery is used to support the grid and how often depends on the VPP (read a more detailed explainer on how they work here).

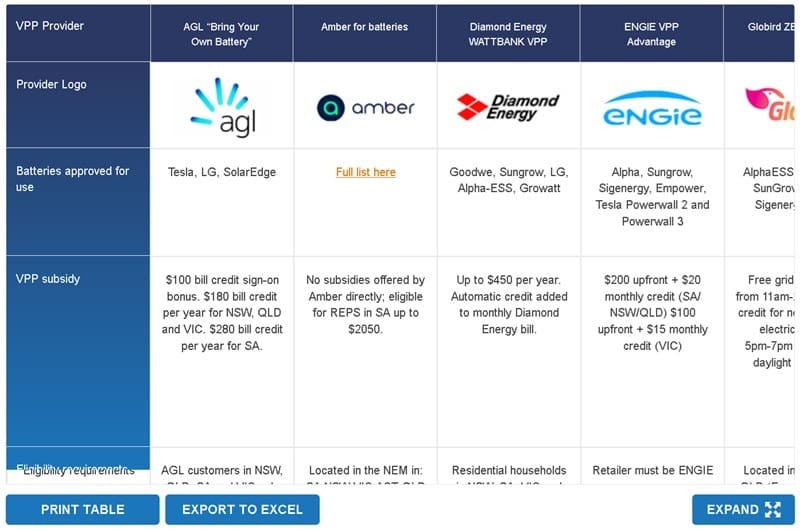

For information on the current state of VPPs, you can use our VPP Comparison Table. Alternatively, you could just look at the image of it I’ve put below, but that’s kind of dumb when you can click through to the real thing.

While we try to keep our VPP Comparison Table up to date, it’s a rapidly changing field, so we can’t guarantee it will always be spot on.

NSW’s VPP Payment

Update 4:26pm July 1 2025: VPP payment adjusted to match current ranges given by NSW government.

In NSW, there’s a payment for joining a VPP that’s expected to be around $40-$55 per usable kWh of battery capacity. So, for a 15kWh battery, it would be $600-$825. This payment can only be received if the battery has 2-28kWh of usable capacity, and so could range from as little as $80 to as much as $1,540. Because it represents a decent amount of money for a typical battery, joining a VPP should make sense to sensible NSW battery owners.

WA Battery Rebate Requires A VPP

WA has Australia’s only state-level battery rebate, and its coolest feature is that it can be combined with the federal battery rebate, making home batteries in WA nearly a no-brainer. But it has the condition that you must join a VPP. This basically makes the WA state rebate one big VPP incentive. And it is pretty big. In the southwest Synergy area, it’s worth $130 per usable kWh of battery capacity, up to a maximum of $1,300. But in regional areas, it’s $380 per usable kWh, up to a maximum of $3,800.

While there’s an existing VPP in WA, new state-provided VPPs will likely be the most popular. The one available to the most people is the Synergy Battery Rewards VPP. This promises to discharge your battery to the grid no more than 30 times per year in return for 70c per kWh discharged. The VPP also promises you won’t be out of pocket for the energy used, which is better than some VPPs.

In the example they give, a battery is drained of 90% of its full usable capacity. If this is done 30 times a year for a 15kWh battery, then the maximum VPP payment would come to $284. Even if you allow 10c per kWh for wear and tear, that’s still $243 per year. While there’s no guarantee your battery will be drained by 90% a total of 30 times a year, it does look like WA VPPs will provide a reasonable payment in comparison to eastern state VPPs. Considering how badly Western Australians have been screwed over when it comes to electricity over the years, this is surprising.

VPP Payment Estimates By State

To get a rough estimate of how much you may save in different states by joining a VPP, I’ve assumed signing up will save $200 a year. I’ve also averaged the NSW VPP payment and the WA state battery rebate out over 10 years, which is the minimum amount of time a decent quality battery should last. This gives the following estimates for a 15kWh battery:

- NSW: $270 annually or $2,700 over 10 years

- NT: nothing currently

- QLD: $200 annually or $2,000 over 10 years

- SA: $200 annually or $2,000 over 10 years

- TAS: nothing currently

- VIC: $200 annually or $2,000 over 10 years

- WA: $330 annually or $3,300 over 10 years

So if you pay $10,000 for your battery, over 10 years VPP payments will — hopefully — cover at least 20% of its cost in most states and considerably more in NSW and WA.

VPPs & Battery Payback Periods

Joining a VPP can significantly reduce battery payback periods. But by just how much is difficult to pin down, as battery payback times are affected by battery cost, household consumption patterns, electricity prices, solar feed-in tariffs, and solar system size.

To give an idea of how VPPs can affect payback periods, I’ve put a rough estimate of the simple payback time for a typical household that installs a 15kWh battery that costs $10,000 in each capital city. The simple payback time is how long it takes for savings and/or credit on electricity bills to equal the installed cost of the battery. I’ve then given the simple payback period with VPP payments of $200 per year. The effects of the NSW VPP payment and the WA battery rebate are included. While no VPPs are currently available in TAS or NT, because this could change, I’ve assumed VPPs that pay $200 per year become available there:

| Annual Savings and Simple Payback Periods for $10,000 15kWh Battery With & Without VPP Payments | ||

|---|---|---|

| Capitals | Without VPP | With VPP |

| Adelaide ($200/year VPP) | 7.6 years | 6.6 years |

| Brisbane ($200/year VPP) | 9.3 years | 7.9 years |

| Canberra ($200/year VPP) | 14.7 years | 11.4 years |

| Darwin ($200/year VPP) | 17.9 years | 13.2 years |

| Hobart ($200/year VPP) | 27.4 years | 17.7 years |

| Melbourne ($200/year VPP) | 14.1 years | 11 years |

| Perth ($200/year VPP) | 8.9 years | 7.1 years |

| Sydney ($200/year VPP) | 9.3 years | 7.3 years |

With the above estimates, joining a VPP will knock a minimum of one year off battery simple payback periods in every capital. The largest reduction occurs in Hobart, where joining a VPP knocks nearly 10 years off that city’s excessively long simple payback time. Where batteries already provide a good return, VPPs improve it, and they can make batteries worthwhile in locations such as Canberra and Melbourne, where payback periods might otherwise be considered too long.

Who Shouldn’t Join A VPP?

There are a few people who probably shouldn’t join a VPP. They may be of no interest to people who are determined to maintain complete control over their batteries and who either can’t join or couldn’t be bothered with the couple that leave you in full control of discharging.

Also, those who place very high value on having backup power may not want to join a VPP because of the small risk of it draining their battery just before a blackout. But these people should first consider if joining a VPP would allow them to buy a bigger battery and improve their overall ability to power through blackouts.

There may also be people who just don’t consider VPP payments high enough to be worth the effort of joining. But if money is not enough to motivate you, because joining a VPP will improve the grid’s ability to integrate renewable energy and hasten the closure of coal power stations, so the environmental benefit may provide you with enough incentive to sign up.

VPPs Are Worthwhile

While VPPs don’t pay as much as I’d like and choice is limited, they pay enough to be worthwhile. While they’re making you modest amounts of money, they also help the country quit fossil fuels, so they’re all for the good. Provided a non-terrible VPP is available that accepts your battery is available, I definitely recommend giving it a go. In NSW and WA, not joining one really only makes sense if you don’t like money.

If you’re still uncertain and want more detail about the issues some VPP schemes present, I’ll be going into more detail about these in a follow-up article next week. Sign up to our free weekly newsletter to ensure you get to read it.

In the meantime, read up on the fine print on the VPP-linked federal and state battery incentives launching today in our comprehensive explainer.

RSS - Posts

RSS - Posts

Until the price for a 10 KW battery goes down to $2700, installed, it just isn’t value! We installed a Sungrow 10 KW battery, only because we were paying a green loan company, instead of an electricity retailer.

It’s been worth it, purely for backup during the blackouts we have had.

I would think about another 10 KW add-on to the Sungrow modular system, and install a changeover switch to go off-grid. A VPP is the last thing you want in a blackout!

VPP only take a small % of the battery, and with solar that should cover the VPP amount. Should be fine.

From the solar quotes comparison page Ronald linked, seems that most VPPs in our area reserve the right to take between 80% and 100% of our stored capacity. That’s not a small amount by any measure. I’m definitely one who values battery backup; as I type this, our local area is blacked out while we are running off our battery. We didn’t notice the blackout until the inverter pinged my phone with the error message. That’s beyond price for me.

VPP only take a small % of the battery, and with solar that should cover the VPP amount. Should be fine.

You can set the % in the app. If they are taking that much then there likely paying $$$$$ due to a large shortage.

sorry Stu but as far as I can tell that’s not right. The Ausgrid-region VPPs I’ve looked into all reserve the right to take up to 80-100% of the battery and you can’t stop them. Amber is different (although its smartshift is still missing some necessary levers) but I’m not sure that Amber would be an acceptable VPP for the purposes of the NSW subsidy

We recently had two early evening battery draws by the AGL VPP that took 80% of our battery just before dark. I know that sounds like still 20% left but in reality only 15% because the Powerwall 2 protects itself with the last 5%, that’s just not enough to get through the night. There is no self control in the app that restricts them from doing this. The settings in the app are overridden by the VPP. This is the worst we have seen while we have been part of their VPP for 7 years. Normally the draws are small and almost unnoticeable.

We have left the VPP for now as this left us feeling vulnerable and lacking control.

If the max draw was restricted to 50% then with a second Powerwall 2 coming online soon we would consider rejoining but not at 80%!

Stu you entirely missed the important point that Helen was wanting to make!

So here it is again: “seems that most VPPs in our area reserve the right to take between 80% and 100% of our stored capacity”.

And that is stipulated term in her VPP / Owner Contact.

Lawrence Coomber

Is there any consideration given to how additional drain + recharge cycles could contribute to lower lifespan/effectiveness of the battery? Or is this negligible?

No point saving 2 years on payback if you’ll have to replace the battery 3-5 years sooner than if you didn’t join VPP.

Got an email from AGL yesterday (my current supplier)

Let us use you battery, we will give you “UPTO $600” a year in “giftcards” in addition to your 4c kw feed in rate! (which they have actually dropped to 3c, so they cant even get their paltry offer correct).

The conditions – as long as you export at least 700kwh to the grid in peak times every 3 months. So that would be completely draining my battery a minimum of 55 times in 90 days, leaving me to buy power until the next day.

So flogging my battery, giving them 2800kw over a year, discharging my battery fully over 200 times and they will give me “UPTO” $600 in gift cards – A maximum of 21c a kw while they charge my neighbour on a time of use tariff 2 to 3 times that amount for that power?

yeah nah.

These offers of so many dollars a year reminds me of the FIT payments of 60 cents KWH incentive to fit solar panels.

As time went by the amount dwindled to 20 cents to 10 cents and currently 4 or 2 cents.

Do you trust politicians or CEOs of power companies because I don’t, you will end up with a flat battery and paying higher rates for power.

This is all part of Bowens green fantasy.

The FIT was an incentive to install solar and use it, it had the desired effect but it was never meant to be a money making scheme. When I installed my first system, it cost $5000.00 for a 1.5kW setup, so prices have changed a bit and it is a no brainer to install solar thses days if your place is suitable. Green energy works very well and is not a fantasy, your ideology shines through with that statement. There will challenges for sure, but the technology is getting better all the time, as it always has.

I would look at the life span and gradually degradation of the battery to know when a new battery needs to be purchased. I f your battery loses 30% of charge over time you may be compromised when blackouts occur. Re Eric’s comment above I went off grid with a changeover to grid for long overcast periods. Cost was not the criteria we did this. 17 years later we are still happy to look after our nehbours food in our fridges. during blackouts.

Hence why i over spec’d my battery by 30%. Its not rocket science. Same for solar. It degrades so do ya calcs. VPPs do degrade batteries faster, so its a double edge sword. I wont sign up to a VPP unless a great deal.

It might technically not be a VPP but I’m surprised that this article didn’t mention Amber. With Amber, you can have your cake (full control of your battery) and eat it (be paid a good FIT when wholesale prices are high). I’m making more money out of my battery with time shifting and arbritage in winter (buying cheaply during the day and consuming during the peak, discharging into wholesale price peaks) than I do in summer charging from solar.

Consider who brough solar quotes for the answer on why they wont talk about Amber and instead want you on a standard VPP where the power company gets all the upside of your batteries that your paying for.

Hi Leslie,

Click here for at least 8 articles on Amber…

Plus more on smart shift with our man Jonno.

Cheers

Does signing for VPP make it more difficult to swap providers?

Yes I believe so – you need to confirm you have been removed from your current VPP before you can switch providers is my experience.

Depends on the VPP – Shinehub is a retailer agnostic VPP.

In WA, any VPP payment goes straight to credit your electricity account, so for someone like me who has a large credit on my account already, and never has to pay a bill anymore, it is of no value whatsoever. I can only use my Synergy credit for paying my bill – nothing else.

The only reason I want a battery is for backup purposes, and the last thing I want is for the VPP to drain my battery in a high demand time when the blackouts are most likely to occur. This defeats the purpose totally.

The federal rebate on its own, while good, isn’t enough to justify a battery just for backup purposes – at least, not at current battery prices.

The credit that you have on your Synergy account can be claimed by contacting them. Back in the days of the 40c FIT I used to contact Synergy annually and get a cheque for my credit to be sent to me. It would add up to about $1500 per annum. I assume you can still do the same these days.

Not anymore, I have a massive credit but you cannot cash it out.

If it is large, in QLD I just moved providers to have the credit paid to me before moving back once I got the credit. Not sure if its the same in every state though…

I have no intention of using my infrastructure to assist those who do not. We saw on current affairs last month a VPP being drained to 20% during the day and the home owner being slugged for peak usage at night- why not hand over your car keys at night so a random person can borrow it?

It is not our job to support base load for a retailer or generator.

What savings does a VPP give you? A once off rebate and No one will reimburse you for your solar equipment maintenance nor replacement in 10 years .

I dont see any generator saying ‘Yes we will replace your VPP that we used and killed it early’ What tax benefits do I get for being a VPP ?

Avoid VPP unless you work for a retailer or electricity retailer. In that case : Got those car keys handy – I just need the car for a quick trip ?

Hi Chris B,

You’d be interested to know there’s many different ways you can turn a buck out of your car. Seeing as it spends 95% of it’s life parked, there’s good reasons to make use of a depreciating asset, in return for some economic returns.

As taxpayers, should we have zero intention of using our infrastructure to assist those who do not?

The question is can we trust government and the energy companies over that period of time. When I put my solar system in I was getting 21c kwh and it has progressively dropped now down to 4.5 c kwh yes there is an offset that I am avoiding the higher energy prices over that time but most of my usage is at night so the payback for my system has certainly lengthened. At the previous feed in rate I was in an annual credit even at about 15c I was over a year basically breakeven now that is no longer the case by quite a lot. A battery with the federal rebates now makes sense where it didn’t before in terms of payback with my current nighttime usage and the current electricity rates but will the VPP cause a faster degradation in the life of my battery particularly if the energy companies start regularly drawing out of it and what is the chance that they drain the battery significantly enough that I don’t get the use of the power I have stored.

So, curious, how does a VPP control the battery discharge? Is it by IP or OTW signal?

Hi Craig,

Depends on the system but generally it’s via customer owned internet. Some networks inject signals into the grid to control off peak supplies (ripple control) while Qld uses audio frequency over the grid to curtail some solar using a GSD device.

So… We can simply block the internet traffic to it after signing up to the VPP.

As Chris B pointed out above, the case of Peter Anderson and AGL suggests extreme caution when entering a VPP agreement.

Mr Anderson discovered that, at peak periods, AGL was draining his battery down to 5%. AGL thus avoided paying very high wholesale rates, while paying him peanuts.

Worse, it then charged him at peak prices for the power he needed to buy because AGL had just flattened his battery. So he lost money, and his battery suffered wear and tear and degradation.

Now that’s a nice little earner (for AGL)!

VPPs should be offering us higher payment when they take power from our batteries, because they only do so during peak periods when wholesale prices are high.

And while I appreciate the argument that we should ‘just do it’ for the sake of the country and climate change, I’m not so keen on enriching AGL. Perhaps AGL should ‘just do it’–by paying fairly.

See: https://www.abc.net.au/news/2025-05-09/claims-agl-drained-household-batteries-spark-trust-warning/105234050

Look into Amber and how their system works.

Yes the VPP offers may very well cost you money its why I have only started using my batteries with Amber about 2 months back after 2 years of having batteries.

I ran the numbers on a bunch of VPP offers before this and realised I would end up paying my retailer for them to use my batteries and turn a big profit in most cases.

Most of the offers are heavily stacked against you.

The NSW rebate for VPP connection (BESS2) is not really as described.

“In NSW, there’s a payment for joining a VPP that’s expected to be around $55 per usable kWh of battery capacity. So, for a 15kWh battery, it would be $825”

This is based on the NSW Govt Position Paper price of a PRC of $2.50 (as at April 25), however the price of the PRC’s have now increased to over $3, having increased in price you would expect to rebate to increase….

However what the Government did not mention is that they have outsourced the processing of the rebate to Mac Trade Services so you must go through Mac Trade to get the rebate (cannot get it anywhere else), the catch is that Mac Trade are paying no where near $3 for a PRC, they appear to be paying around $1.64!!! so a rebate (even at the old PRC price of $2.50) that was $857 is actually only $565 (for a 15.6 Kwh battery).

Mac Trade have a calculator on their web site and a 15Kwh battery rather than being $825 is in fact only $540…

Thanks for the info, Grant. I had not heard that MAC Trade Services were the only game in town for for NSW VPP payments. Looking at their site, I see what they offer is nearly 10% less than the minimum amount the NSW government says it is on their page on the payment. But a silver lining is they say this is based on 10th of June prices, which was just before a big rise in PRC prices. So there is hope the actual amount given will be higher. If anyone is offered less than the minimum of $40 per kWh, which is the bottom of the range given by the NSW government, I recommend raising a stink.

I noticed that it was 10 June based and that was before the big increase, but even on 10 Jun it was $2.60 and the numbers I used is based on $2.50 so they took a large chunk of the payment, hopefully it will increase with the latest PRC prices as you say, but if they took 40% before they are likely to take 40% again, it would be an improvement but still well below what the Government used in their example of $55 per Kwh and what I think most people are counting on when deciding to join a VPP for the rebate.

Think I’ll just go bigger on the batteries rather than be limited to 28Kwh for the moving BESS2 rebate, at least then I get the battery rebate on the extra batteries which is more than the BESS2 anyway.

Like your optimism though 🙂

I’ll admit I was taken aback when the WA offer changed to include the mandatory VPP… but after thinking about it I am happy to embrace it.

– Blackouts are so infrequent that I never considered this a selling point (and if I was really worried about the fridge getting warm I can plug it into my V2L)

– Even if they use the maximum 30 days, they will run down the battery on days when I’d run it down myself. Either way it reduces the load on the fossil power plants, regardless of whether it’s my AC or someone else’s, both of which will be switched on that night…

– … so if there is any acceleration of battery deterioration, it’s by a few hours compared to what I would have done anyway

– If it ultimately means better utilisation of the sun falling on my panels, great – I will probably have less power wasted through the export limit

– 70c per kWh exported is over twice the price of what I’d have to buy back if I want to run my AC overnight and there’s no charge left in the battery

– I’d be importing in the middle of the night when there’s surplus power from baseload generation (otherwise wasted), trading that off against helping avoid peak load generation the previous evening

– Even with the bigger solar system I recently installed… we still have winters here in Perth so yes the credits to my power bill will be used

– I installed a system in the first place to reduce fossil power generation, for me AND for everyone else, seems selfish to limit the benefit for humanity in order to keep my battery slightly fuller

Bravo Sgt,

I find it amazing when the supposed “lifters” have their hand out for a subsidy and simultaneously begrudge the “leaners” from deriving any network benefit from the government largesse.

So you dont think the “Leaners” are deriving any benefit from a less loaded network because of the potentially thousands of batteries that will be installed because of the subsidy? No reduced peak loads meaning less gouging for peak price power generation and potentially lower bills for the “Leaners” then?

If that is the case, I wonder why the government is providing the subsidy at all ?

Hi Andrew,

You’ve got a great handle on the issue. Curtailing excess solar when conditions are perfect is cheaper than network upgrades (ie the AEMO mandated emergency backstop) So to curtailing consumption when the grid is under excess load is cheaper than building out an even heavier duty network and peaking generators to power it. (ie NSW PDRS scheme. SAPN & Energy Queensland run DRM schemes to limit EV charging and air conditioning at peak times)

Everyone benefits when we’re all in this together.

Those who think “I’m all right Jack” and refuse to share are horrendously short sighted.

I have not found a VPP that supports the Enphase products and I am wondering why? They have great equipment; but maybe their market share is small, or they resist VPP integration, any ideas?

Hi Marc,

Enphase effectively run a walled garden. They charge too much money for access to their API so nobody wants to play with them.

CatchPower tried but it wasn’t cost effective.

Complain to Enphase by all means but I would not expect they’re listening sadly.

Things will change quickly as the deliberately not maintained coal generators all fall in a heap: there will be no baseload generators creating overnight surpluses, encouraging VPPs to become even more predatory.

What has not been discussed is that a VPP is a legal contract between two entities one being a system owner.

The system owner must formally agree to the terms of the contract that the major party has devised and stipulated.

I am surprised this subject has not raised red flags, and has not been analysed in fine detail by Solar Quotes.

It includes technical performance standards that the system owner must agree to uphold or be penalised.

That is what contracts are all about when they are constructed solely by one party in a two party agreement.

Get the complete pdf contract terms Ron and dig a little deeper mate. You used to be famous for fine detail?

Lawrence Coomber

🙂 Indeed Lawrence! Very close examination would be a wise move as the big players are highly unlikely to put themselves at ANY risk / disadvantage.

The words ‘Considering how badly Western Australians have been screwed over when it comes to electricity over the years, this is surprising’ make the sceptic wary.

I wonder how it would work if you sold houses after joining VPP. I suppose early termination clauses with exit fees would come into play? Could new owners take over a plan?

It’s worth noting that the WA VPP also includes “energy offset credits” for the 2-hour activation period BEFORE an event starts which reads as below:

“To make sure you’re never worse off from sharing your stored battery power, you’ll also receive energy offset credits* to cover energy costs during the activation standby window. This is up to the maximum capacity of your battery during the standby window, which is where your stored capacity is placed on hold before a Battery Rewards event. With Battery Rewards, you’re compensated for the energy used to charge your battery AND the energy that you would have used from the battery during this time with energy offset credits*.”

I’m not sure how clear that is to the layperson, let alone to a solar nerd like me. I’m guessing it’s a direct offset of your kWh used at unit price.

Either way, the incentive still feels like i should get myself MORE battery, rather than less, to maximise VPP returns as well as the maximum upfront rebate.

How have we been screwed in WA for power over the years?

I thought we had some of the lowest energy prices in the country.

Got enrolled without our knowledge into a VPP. We have never been asked nor received a confirmation that we were part of a VPP.

The installer and the manufacturer can’t (don’t want?) to confirm which one it is.

The installer registered the battery with a VPP and the manufacturer. While I understand the need to keep the battery manufacturer in the loop so they can monitor the health of the system, I do not understand the registration with a VPP.

Battery is drained every second day and we have to pay for pick time energy tariff.

VPP market is still the wild west and is proving to be a bad experience for us.

No VPP for us!!

Hi Sarah,

I am the editor at SolarQuotes. This sounds very concerning. Would it be ok for me to email you to ask for further detail? Your email address was registered to make this comment so no need to provide it here.

Best,

Max

Hi Max,

Yes sure.

Sarah

Another concern with this battery rebate is that the battery must be VPP compliant but they say that you don’t have to sign up to a VPP.

What if I purchase the battery for my own use is there any guarantee that you cannot be forced to sign up as part of your contract with the energy supplier.

I suspect that energy retailers are just waiting to pounce on your battery so their profits will rise.

Les you have misunderstood the scheme fine detail concerning rebates.

1 The rebate will only be payable to those customers WHO APPLY FOR IT, and for those who take this route, they must agree to follow and comply with the terms of the rebate scheme when it comes to hardware and its operability requirements moving forward. Simple to undersatnd.

2. For those who want to install a battery and NOT be interested in any rebate schemes, they can also do so, as long as they comply with other rules and regulations, principally AS3000 which references other standards relevant to battery installation, as well as network rules and regulations regarding installing batteries. And that’s it, also simple to understand.

Lawrence Coomber

Anyone know how long you must be a member of a VPP if you take up the WA battery rebate? Until the battery is decommissioned?

Under the Synergy Battery Rewards VPP, Synergy would manage your battery for a two year term, with up to 30 activation events per year during peak demand periods when the energy system needs to draw on household energy assets, such as the hottest or coldest days of the year. Each activation event can last up to 6 hours and involves a single charge/discharge cycle . All other times, your battery remains available for your own use and benefit.

I am looking at a battery. My goal is simple, to have the battery be able handle my retailers peak pricing periods. I don’t mind having to use grid power at lower rates and would consider using grid to recharge the battery. In effect time shifting my usage.

Green concerns are a would be nice, but the end goal is lowering my total cost of energy.

Hi Max,

Yes sure.

Sarah

As a consumer it feels like we are the ones constantly being played here. The energy industry wanted people to install solar decades ago to reduce the grid demand in the heat of summer. So people did. Did industry make an effort to change its infrastructure? Not really. But electricity prices still went up. Decades later, they say get a battery reduce the load on the grid, there’s too much solar but not enough storage. People need power after sundown. Okay people start doing that. Electricity prices still going up. Industry says consumers are to blame. Not enough batteries. Infrastructure can’t support the load or demand. So consumers should invest in installing an energy product that is not without risks, consumers should look after and manage the product, cover the cost of installation , maintenance, internet connection…but sign a contract that gives at least 80% control of that energy product to the industry who is saying…it will support grid demand and will reduce prices. Lol

Hi Katie,

First world infrastructure maintained by first world labour is expensive, however I think this image has a message for all of us.

The energy retailers want to use your battery so they save money and increase profits.

The legislation for the battery subsidies says the battery must be VPP compatible but you don’t have to sign up for a VPP.

People interested in batteries want to do so to save money on energy as prices will continue to rise, but with the energy companies draining the batteries there will be no savings for the owner.

If the government really wants people to install batteries why don’t they legislate that the companies have to pay a rate similar to what it costs them now for the peak periods.

That way it would be a win win situation as the owner saves money and the company does not have to purchase these huge batteries like South Australia.

We all know that eventually if you have a battery you will be forced to sign up for a VPP as it will be part of the condition to supply electricity.

I had first contact with installer requesting price and details brands of parts, instalations details, work and materials warranty, etc. I am getting scare of providind AGL with my investment, they being courting me for a while and I had resisted/ignored their offers.

I sort of asked the installer (one quote so far), if I was required to be VPP group and sort of understood this was no compulsory.

I wouldn’t put batery, I got a plan with 0.48c feed in tariff and I am happy how this is working.

Any suggestions before I go in with my eyes closed?

I have the same question re NSW

Interesting that people think that by closing coal-fired power plants we are somehow being “green”. That would be the case if the coal was being exported to another planet, but the reality is we are simply providing cheap energy to other countries that import (and burn) Australian coal and gas, while we pay more for alternatives. Add the cost of the additional infrastructure for the wind and solar farm distribution network that does not yet exist, plus the cost to the taxpayer of all the panels and batteries they are buying privately, and I can think of a cheaper, greener alternative that lasts a lot longer than 10 years before needing complete replacement, especially as we have not worked out yet what to do with all those decaying batteries. My incentive for a battery is that power outages will become more prevalent in a system with little baseload generation planned, and the rebates are being paid for by my taxes, so yes I am going to make the most of that by getting a battery.

Hi Andy,

Multiple 2025 data points confirm that renewables—especially solar and wind—are the clear priority both in investment and capacity expansion:

In 2024, China’s clean energy investment topped USD 625 billion, marking a dramatic rise focused primarily on renewables.

New capacity additions in early 2025 show overwhelming dominance of renewables: In the first four months, 89% of new generation capacity was from wind and solar, with only 9% for thermal sources (coal, gas, etc.), and solar alone outpacing thermal by a factor of more than eight.

Cumulative installed renewable capacity (wind and solar) surpassed thermal (coal, gas, oil) for the first time in early 2025, with wind and solar reaching 1,456 GW—43% of total capacity

Anthony, I can’t dispute your figures. Chine also has approx. 289 coal fired power stations in construction to add to the existing estimated 1100 already working. Australia’s second biggest export behind iron ore is coal, and we are the 4th largest exporter of coal in the world. Whitehaven Coals’ latest open cut coal mine will increase their output by 80% by the mid-2030s, enough to (allegedly) power Australia’ s 25-ish coal fired power stations until 2062, if they are still working. I’m just saying that shutting down Australia’s coal fired power stations and changing to renewables is not doing anything ‘green’ at all – we just export the coal instead. I live in South Australia where electricity is approximately 73% generated by renewables. SA also has the highest electricity cost in the National Electricity Market because of the infrastructure upgrades required. I am investing thousands in a battery (therefore contributing to your figures) because I have no economic alternative.

Hi Andy,

Electricity in SA has always been expensive. Originally coal was shipped into PtAdelaide.

Then poor quality dirt was railed 550km from Leigh Ck & later 250km to Pt Augusta, plus 300km transmission losses.

Torrens Island is 50+ years old with only half the inefficient gas steam plant left.

SAs largest single load is at Roxby, the demand generally is incredibly peaky, so the network is expensive to build for the handful of hours it runs at full load.

With a footprint equal to Victoria we have only 25% of the population to pay for it.

Electricity can’t not be expensive here, especially when it’s been privatised.

The thing is that as more renewables have been deployed, reliability has been proven better than ever.

WA is ensuring all households benefit from a government-funded battery subsidy. Here’s why NSW approach of relying solely on a small financial incentive is more risky. Focussing people’s attention on the small individual financial benefits they can gain from joining a VPP highlights how little the market values the other benefits the article highlights: keeping bills lower for all households and reducing carbon emissions. This sends a signal that signing up and not signing up are “morally equivalent”. Following the logic of the article, which aligns with the network externality effects at play here, not signing up for a VPP would increase bills for all households and harm the environment compared to signing up. Motivation crowding research has shown introducing a financial cost for not ‘doing the right thing’ (e.g. for choosing not to sign up for a VPP) sends the message that paying this cost is the moral equivalent of ‘doing the right thing’. Great to see how both approaches fare IRL.

Kevin please don’t lock yourself into the false premise that all those who favour one particular pathway in any subject; such as consumers embracing VPP’s moving forward occupy a higher moral space, than those who may favour other technology solutions ahead of VPP’s moving forward.

I don’t know anything about your age, life skills, or experiences Kevin, but my recommendation to you is learn more about the subject. It is a global one, not merely an Australian one; and it is vast.

Lawrence Coomber