Solar panel image: B137,CC BY-SA 4.0

A sudden reduction in the value of certificates upon which solar subsidies in Australia are based has resulted in some solar companies needing to re-issue recent quotes.

Australia’s major subsidy for small-scale systems, sometimes referred to as the “solar rebate“, shouldn’t be confused with solar feed in tariffs – those have generally increased recently. The subsidy isn’t a rebate as such, but is usually offered as a point of sale discount that can knock thousands of dollars off the up-front cost of solar panels.

The incentive is based on Small Scale Technology Certificates (STCs) that accompany the purchase of a solar power system. The number of STCs issued depends on the size of the system and where in Australia it will be installed.

Instead of system purchasers being faced with the hassle of redeeming the value of the certificates themselves, most solar installation companies offer to do so and calculate the value of the STCs into their solar quotes.

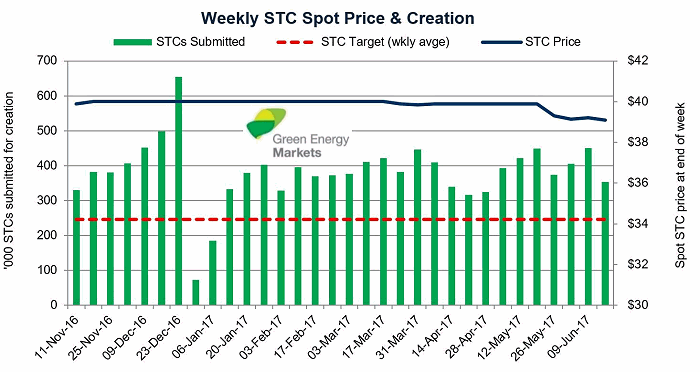

The value of these certificates fluctuates depending on supply and demand. Up until recently, STCs had been trading at close to their maximum value of $40 for quite some time; even though there was a consistent oversupply.

Source: Green Energy Markets

The oversupply has been due to a spike in uptake of small scale solar power systems (boosted further by recent electricity price increases) combined with an underestimate from the Clean Energy Regulator as to how many certificates would be created when it set STC targets for 2017.

The oversupply situation began having a significant impact in May. The situation has deteriorated further and yesterday, prices as low as $26 (ex. GST) were seen.

At the maximum value of $40 per STC, the subsidy worked out to around $700 per kilowatt of solar panels (depending on installation location); so approximately $3,500 on a 5kW system. At a price of $26, it’s around $2,500.

Quoting on solar is an easier task while STC values remain stable and any minor volatility is usually soaked up by the company providing the quote. However, this recent situation is a very different beast – the drop in STC prices is simply too much for some installers to absorb and they are finding themselves in the difficult position of having to re-quote. Even those with forward contracts will be eyeing the situation with some trepidation.

Solar quotes will often contain wording indicating the price quoted is based on a stable STC value, but while the potential for change is flagged, it still puts businesses in a very uncomfortable position when the need to do so arises.

How Low Will STC Prices Go?

Which way STC prices will go from here is difficult to determine at this point. The closing spot price yesterday from Green Energy Markets was $29.50.

As a historical point of reference, STC prices hit as low as $17.50 a few years ago when the Australian government of the time threatened to abolish the subsidy entirely, which triggered a huge rush for solar power systems that led to a major oversupply of STCs.

Given the recent volatility, solar companies stating they can only hold prices quoted for a short period may not be a dodgy sales tactic, but just the reality of the situation.

Don’t Panic Buy

Regardless of current circumstances, solar power remains a very good investment for many Australian households.

One of the other problems with the situation is it may encourage some of the less ethical solar companies in Australia to encourage panic buying of what may be lesser quality systems and installation. It’s still very important for system buyers to do their due diligence when choosing a solar power system and installation company before signing on the dotted line – as it’s a purchase decision they’ll be living with for a very long time.

RSS - Posts

RSS - Posts

Hi,

I’ve been looking to get solar. I’ve got a few quotes and they are all around $7,000-$9,000 mark for a Fronius inverter with 5.6kw of REC panels.

With the drop in STCs the prices will go up around $800.

Would it be worth my while trying to sell my STCs myself at the STC Clearing house for $40. Is that even possible?

Thanks,

Travis

Sorry Travis, it can’t be done. I’d be buying a lot of STCs right now if that was possible. You could hang onto your STCs and hope they will go up in the future, but it would be a gamble.

Hi,

On the CER website it says “Selling through the STC clearing house –

Householders and registered agents have the option to sell STCs through the STC clearing house for a fixed price of $40 (excl GST).Before small-scale technology certificates can be sold through the STC clearing house they must be validated and registered.”

Am I not a householder? I’m not talking about buying STCs and selling them. I’m talking about just selling the STCs that would be allocated to me when I set up a solar system.

Thanks

Travis

I don’t see why anyone would buy them at $40 given they can buy them at today’s price of $30, so I don’t think they would clear.

PS. I’m also aware that it would be a gamble. Since their are STCs sitting there for sale since 6th of June. So if I did try and sell them on there it may take several months or even years to sell. But they would be guaranteed to sell at $40. Or do I have it all wrong?

My understanding is someone has to buy them for them to clear, and no one will buy them as the current price is low.

You are incorrect. It can be done, however it will take time. The market is in surplus and maybe for some time. There are however variations to this and STCs listed on the registry will eventually move. With the present disparity between the spot price and the official $40 set price, it would in fact be a great return on investment even if they sat there for 2 years. You also have the option to remove them from the Clearance house and sell them on the open market if the spot price starts to lift.

Hi Peter,

That’s my thinking too. So only large energy suppliers purchase from the Clearing House and at the moment there are plenty of STCs available at a much cheaper price on the open market. But should that change and they don’t have access to cheaper STCs in the market then they would be required to purchase from the Clearing House. The biggest risk then would be if the price never recovered. Some scenarios I can imagine are possible actions by the Energy Regulator:

– They don’t adjust the targets next year on the energy suppliers so the price remains low.

– They set a new highest limit below $40

– The government abandons the STC scheme altogether

But as it stands at the moment I see my options are;

– I get a rebate now around $3200 or

– I put my STCs in the clearing house and hope that within a year or 2 I get $4000.

This is very interesting and definitely something I should look into. Thank you.

I have always thought that liable entities have to purchase a portion of their quarterly liability from the clearing house.

A QLD based solar company recently dumped about $300,000 worth of stored STCs into the list, pushing out the wait list.

I’m fairly sure that is the case, that larger entities must buy some STCs at $40.

This seems like a stock market nowadays. One big STC holder releases huge amount of STC to get rid of the rest of small competitors, as it already sets a deal with few companies with fixed price. When STC value goes down, then that big guy buys STC from small guys with cheap price.

Same thing happens again. Hold for a while and release in bulk to change the market value.

It is all about the money. The big can kill the small. It is just my personal opinion but couldn’t come up with any other thought.

OK, getting some contrary advise. We are in a newly built house in which I installed 3 phase power to suit a ducted AC system. After being beaten up by my wife for not ordering solar system in June, and seeing prices jump due to STC drop, I still have to pick between a 1 phase and 3 phase inverter (lower cost brand now!). A 3 phase inverter makes sense tome, but some providers are still pushing one phase. Any ideas?

Hi Paddy,

If you can spend an extra $300ish then I would definitely recommend getting a 3 phase inverter.

Here’s why:

https://support.solarquotes.com.au/hc/en-us/articles/115001462573-I-have-3-phase-power-Should-I-use-a-3-phase-inverter-or-a-single-phase-inverter-

Hope That Helps,

Finn