Do batteries save money with time-of-use tariffs?

Home battery systems continue to fall in price — with an exception or two — and we are getting closer to the day when they will save a typical household money without subsidy or being part of a Virtual Power Plant.

But there is one thing that almost gets batteries to pay for themselves right now: the ridiculously expensive peak rates some time-of-use electricity tariffs charge. But, without a subsidy, time-of-use tariffs and batteries will only save money for a few exceptional households. This is the case in NSW where time-of-use tariffs are high and in Western Australia where they are the most favorable for batteries.

WA Has The Highest Time-Of-Use Tariffs

When I started researching this article I was confident NSW would still have the highest time-of-use electricity tariffs, but it turns out the winner of this dubious distinction is Western Australia. The image below is from Western Australia’s Synergy website and shows their time-of-use tariff in all its expensive glory:

(Image: Synergy)

This tariff is offered by Synergy in WA’s South West Interconnected System. This is the area shown in green on the map below that I stole from Infinite Energy’s site:

Western Australia’s South West Interconnected System (Image: Infinite Energy)

Outside of the green area grid electricity is supplied by Horizon rather than Synergy and they don’t offer time-of-use tariffs.

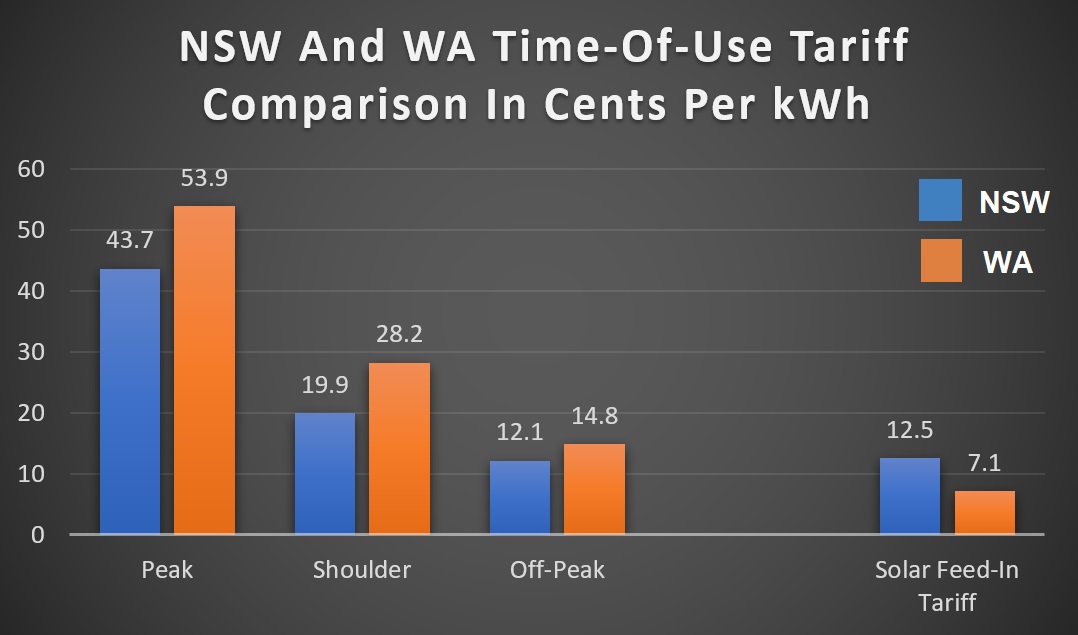

While there are time-of-use tariffs worse than Synergy’s in NSW, you’d have to be crazy to use them as there are much cheaper ones available. Here’s a graph comparing an available Sydney time-of-use tariff with Synergy’s. I’ve also added in the solar feed-in tariff so you can see it’s considerably better than what you get in WA.

While this article is going to focus on Western Australia, the basic conclusions will hold true for NSW, except batteries will be even less likely to pay for themselves there.

My Hypothetical Household

Let’s say I move to Perth and buy a house with a north facing 6.5 kilowatt solar system. And let’s also say my home uses an average of 18 kilowatt-hours of electricity a day from 3pm to 9pm, which is the weekday peak period. This is well above average as the typical Perth home uses less than this in a full day. I have no idea why my home consumes this much electricity. Maybe I married a robot.

Also, because I’m so sexy, I’m going to assume I can get a great deal and have a solar battery system installed for only $1,000 per usable kilowatt-hour. Because I like round figures I will spend $10,000 and get 10 kilowatt-hours of usable energy storage. This battery has a 10 year warranty, which is typical, but I am going to assume it will last 13 years. Because batteries degrade with use and time they can’t be expected to last well beyond their warranties, as things like refrigerators and laptops generally do.

To sum up I have:

- A 6.5 kilowatt solar system

- An average daily electricity consumption from 3pm to 9pm of 18 kilowatt-hours.

- A battery with 10 kilowatt-hours of usable storage that cost me $10,000.

- A battery lifespan of 13 years.

- A scary wife.

I’m also going to assume:

- Electricity prices and feed-in tariffs remain constant in real terms1 for the life of my battery. All dollar amounts are given in today’s money.

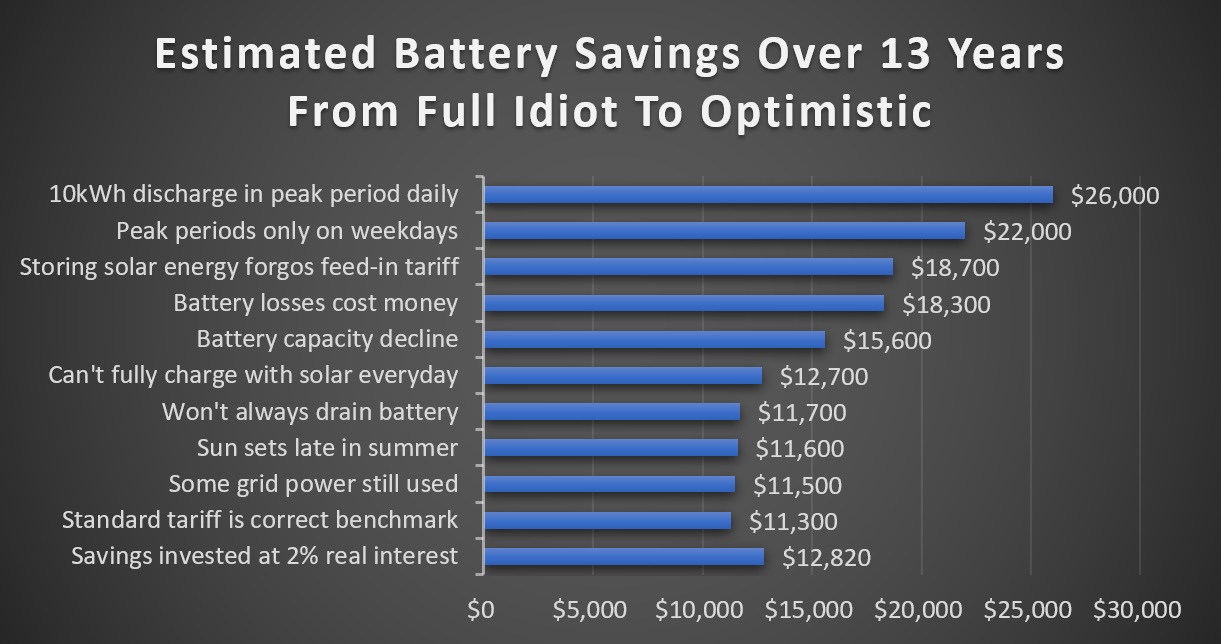

Now I have an imaginary 10 kilowatt-hours of battery storage, can I use it all during a peak period every day to save 53.9 cents off my electricity bill per kilowatt-hour of storage used and save $2,000 a year and $26,000 over 13 years?

No, I can’t. It’s impossible! And there are plenty of reasons why.

Peak Periods Are Only On Weekdays

The first problem I have is peak periods only occur on weekdays. This means if I fully discharge my battery from 3pm to 9pm every day I will only save an average of 46.5 cents per stored kilowatt-hour I use. This results in my electricity bills savings over 13 years dropping to $22,000.

Storing Solar Energy Costs Me The Feed-In Tariff

If I store solar energy in my battery and use it in the evening I can’t also receive a feed-in tariff for it. In south west WA the feed-in tariff is 7.1 cents so I’ll only save 39.4 cents per kilowatt-hour of stored energy I use. This will make my savings over 13 years drop to $18,700.

Battery Losses Cost Me Money

No battery is 100% efficient. I expect the round trip efficiency of a typical battery will be under 90% but I’ll be reasonably optimistic and assume a figure of 90%. This means I’ll need to put 1.11 kilowatt-hours of solar electricity into the battery to get one kilowatt-hour out. This increases the amount of feed-in tariff I lose and drops my savings per kilowatt-hour of storage used down to 38.6 cents per kilowatt-hour. Savings over 13 years becomes $18,300.

Battery Capacity Will Decline

Almost all batteries degrade with use and often degrade over time even if not used. Lithium batteries are the most common type used for home solar storage and they definitely deteriorate. Some warranties allow for a 30% deterioration in capacity within 10 years while others allow for 40%. I will assume my battery will have fallen to 70% of its original capacity by the end of its 13 year lifespan. If its average usable capacity is 85% of its original amount then the savings per kilowatt-hour of stored energy used remain the same, but savings over its lifespan fall to $15,6002.

I Can’t Fully Charge With Solar Every Day

Perth is a sunny place and my north facing 6.5 kilowatt solar system should produce an average of around 28 kilowatt-hours a day. While this average is more than adequate for charging the battery, in practice there will be considerable variation in the amount of solar energy available for charging depending on the weather and how much solar electricity my home consumes during the day.

Perth has an average of 100 cloudy days a year where the skies are either overcast or at least 75% cloud covered. If I optimistically assume I can fully charge the battery with solar power on the 265 days a year the skies are are either partially cloudy or clear and still manage to charge it an average of 30% on cloudy days, then then my savings over 13 years will fall to $12,600.

If it is known in advance the day is likely to be cloudy then it would be possible to charge or partially charge the battery with off-peak electricity early in the morning. This is more costly than using solar power and it would be difficult to charge the battery with just the right amount of energy so no more is spent on off-peak electricity than is required. If I assume half the battery capacity left unused due to cloudy days is charged with off-peak power, it raises my savings over 13 years to $12,700.

I Won’t Always Drain The Battery

I’ve said my household uses an average of 18 kilowatt-hours during peak periods but this isn’t going to be constant. If we go on vacation or I go out searching for my wife after she has rampaged across the countryside, then the amount of battery storage used could be nothing or next to nothing. This variation in consumption means not all the battery storage will be used during some peak periods. If I assume that 5% of stored energy is used during shoulder periods rather than peak periods and 5% isn’t used until the next evening, then savings over 13 years falls to $11,700.

The Sun Sets Late In Summer

In January the sun can set as late as 7:26pm in Perth. This means the solar power system will still be producing electricity well into the peak period. Because I’ve said my household’s average electricity use is high and because solar output drops off rapidly late in the afternoon I will assume this will only have a minor effect and reduce my savings over over 13 years down to $11,600. But the effect is likely to be larger for average households.

Batteries Don’t Eliminate All Grid Electricity Use

Battery control systems are not perfect. They don’t perfectly match the battery’s discharge power to the house consumption. So even if your battery has enough stored energy and power to satisfy your home’s demand at any point in time, some grid electricity will still sneak into your home and you will be charged for that. Some batteries are much better than others in their speed of response, but I’ll assume a little over 1% of my electricity use at night will sneak in from the grid, reducing my savings over 13 years to $11,500.

A Standard Tariff Will Often Be The Correct Benchmark

My imaginary Perth house had a 6.5 kilowatt solar system when my potentially imaginary robo-spouse and I moved in. Because the solar power system would reduce grid electricity consumption during the day and because I’ve assumed we use a lot of electricity during the peak period, it is likely that before the battery we would have been better off on a standard tariff, not a time-of-use tariff. Just how much better off would depend on our electricity consumption habits, but as long as our pre-battery bill would be less with a standard tariff then that figure is the correct one to use in any before/after comparison. So if we would have been $200 a year better off on a standard tariff before the battery, then that reduces my savings over 13 years down to $11,300.

Cost Of Capital

So far my home battery is set to save $11,300 over 13 years. Since this is all in today’s money this will put me $1,300 ahead after I subtract the $10,000 cost of the investment. But if I could have made more by investing that money elsewhere then I will have lost money by spending it on a battery.

If I put the $10,000 in a term deposit, after adjusting for inflation I would get a real return of around 1%. But this is unrealistically low because most people have better things to do with their money. Instead, I am going to assume I can get a real return of 2%3.

After 13 years at 2% real interest $10,000 would be worth $12,970 in today’s money.

If I instead bought the battery system and invested all the savings it gave me at the same 2% real interest rate, then after 13 years I would have $12,820.

So under my optimistic set of assumptions I would lose out by about $150 bucks if I invested in a battery system. About a 1% difference, so I’m okay with calling this a draw.

A Normal Household Isn’t Likely To Save Money

You might be wondering, since I just showed it should possible to break even by buying a battery, why I didn’t mention this in the title of the article? The reason is I didn’t want to be responsible for causing anyone financial hardship by prompting them to rush out and get a battery when it it’s only likely to lose a normal household money. The reason getting a battery is unlikely to be a remunerative activity is because most households use less electricity than my example. Probably due to not marrying a robot. At the moment it would also be difficult to get a battery that will be trouble-free for years past its warranty at an installed cost of only $1,000 per usable kilowatt-hour. But battery systems will continue to fall in price so you may not have to wait long for this.

Two things that look like they could help the payback of batteries, but probably won’t — at least in Western Australia — are:

- Larger solar system sizes, and…

- Smaller batteries

Surplus Solar Power Can & Will Be Stolen In WA

In Western Australia only solar systems that have an inverter of 5 kilowatts or less can receive a feed-in tariff, or REBS4 as they call it. If you want a larger solar inverter you will need 3 phase power and special permission. If you have both of them you may be allowed to install an inverter of up to 15 kilowatts. But this will result in no feed-in tariff for the surplus solar electricity you send into the grid. Personally, I think profiting by taking valuable stuff without paying for it looks like theft. If you want to put a positive spin on it you can say you are subsidizing the cost of grid electricity for everyone else5

If you are not getting a feed in tariff then a battery will be more valuable to you, as you can store your surplus solar electricity instead of giving it away for nothing.

Smaller Batteries Cost More Per Kilowatt-Hour

If the battery I used in my example was smaller it would be much easier to fully charge it with solar energy and fully discharge it during a peak period. Unfortunately, the smaller the battery the higher the unit cost. A half sized battery system might cost 50% more per kilowatt-hour of capacity. This is more than enough to eliminate all the advantages of being itty bitty.

Companies Can And Will Go Bust

Something that should be considered before buying a battery is the chance its manufacturer and/or installer will go bust. When there are many companies providing new technology it’s inevitable some of them will go bankrupt. I think you should assume there will be at least a 5% chance your battery system will be written off as a result of companies folding and failing to provide support required to keep it operating. You can lower your risk by buying from a very sound company or greatly increase it by choosing batteries on price.

Electricity Prices May Fall & Feed-In Tariffs Rise

Currently it appears there is no hope of Western Australians receiving any relief from their high electricity prices over the next year, but given the cost of solar panels is continuing to fall and how sunny Western Australia is, grid electricity prices seem certain to drop at some point. If solar feed-in tariffs fall by a similar amount that will help prevent installed batteries become unprofitable but it is possible feed-in tariffs will instead increase. But one thing is certain — as more battery capacity is installed they will do their job and the difference between peak and off-peak rates will diminish, reducing the benefit provided to batteries by time-of-use tariffs.

Sweetening The Deal

The good news is there are some things that improve the profitability of batteries. A subsidy is an obvious one. A few others are:

- Charging with off-peak power to meet morning demand. This is something I didn’t include in my example because it’s not necessarily a good idea. With a 90% efficient battery it would reduce electricity bills by 11.7 cents for each kilowatt-hour of stored energy used. For some batteries this may not be worth the resulting wear and tear and it would be more cost effective to limit the use of stored energy to peak periods. But for batteries with a high cycle life this can provide a modest boost to their ability to pay for themselves.

- Joining a Virtual Power Plant can improve the economics of a battery allowing electricity to be bought and sold at wholesale market rates and payments be received for providing grid stabilization services.

- Some people greatly value the backup power some batteries can supply but you should consider if you’d be better off with a small generator instead.

A Few Could Benefit From Batteries Now In WA

If you’re in Western Australia and your electricity consumption is high or your solar power system is too large to receive a feed-in tariff — or preferably both — then you may be able to come out ahead by installing a battery now, just so long as you don’t mind taking on the risk that the company you buy from will go bust and your battery potentially turn into a very large brick.

But there is no point in buying a battery before you are certain it will save you money. If you wait for the cost of battery systems to fall by another 20% then the chance they’ll save you money will be significantly better, we’ll have more of an idea which battery systems and companies are reliable, and we’ll know more about what’s happening with electricity prices. Because home batteries at the moment don’t have a clear environmental benefit like solar power, there’s no need to rush.

Footnotes

- This means electricity prices keep pace with inflation. ↩

- For people who are very picky I have assumed the decline isn’t quite linear for reasons of convenience. (That’s another way of saying I am lazy.) ↩

- This would be roughly equivalent to using the money to pay off a home loan. ↩

- REBS stands for Renewable Energy Buyback Scheme. ↩

- I’m sure Perth’s billionaires will appreciate it. They may even drink a toast to you from a sapphire tumbler. ↩

RSS - Posts

RSS - Posts

Glad to see you considering the risk of bankrupt suppliers and manufacturers in considering the worth of long warranties. Many installers will have retired and liquidated their businesses within 10 years, of have gone bust. Some of the battery companies will also have closed down and been stripped of all their assets. Long waranties are of dubious value to the consumer, particularly from companies without an international consumer oriented brand name on them.

The long warranties are also a reason to consider what liabilities might be building up in battery manufacturers, suppliers and installers before investing in them for a “set and forget” portfolio. Buyers of small businesses might be better of not buying any existing company but rather buying all the intellectual property, plant and equipment and the right to use the trading name. Buying the existing company brings all its contingent liabilities for the warrnties with their very long tails.

“Home battery systems continue to fall in price — with an exception or two — and we are getting closer to the day when they will save a typical household money without subsidy or being part of a Virtual Power Plant.”

Ahh, No !

For the last 12 months China’s Tianqui has been trying to buying a quarter of Chile’s SQM (to give them 15% of the world’s lithium production capacity). The deal was approved earlier this month. Now there’s a legal challenge, but my money is on Tianqui getting what it wants sooner or later. Tianqui also operates a mine in Oz with Albermarle (the world’s largest lithium producer). Question: What do you get when there are small numbers of dominant suppliers for a product – for which demand is escalating? Answer: High prices.

The smart researchers should be looking at sodium batteries rather than lithium batteries. Sure, they are heavier and bigger and not much use in cars or camcorders, but for houses – where you don’t have to move them around – they are ideal.

In my opinion, until the lemming researchers start thinking “sodium”, there is no chance of battery prices falling significantly. So the chances for batteries becoming economically viable for home use are receding by the day.

I’m not worried. While it is possible to manipulate commodity prices — years ago pretty much one guy drove up the price of copper — there are plenty of sources of lithium in the world. And even if a company or conglomerate did manage to double the price of lithium it wouldn’t have a huge effect on the price of batteries as so little lithium is used per kilowatt-hour of capacity.

Hi Ronald

Just wondering about the WA tariff figures you got?

I live in Perth, and have a holiday house in our South-West.

In the June-July period, our Home Plan (A1) tariff increased from 24.0673 cents per unit, to 25.752 c/unit, flat, no peak rate – far less than the 53.9 c/unit you have used. We have a 6.24kW system facing east and west, and a 3-phase 5 kW inverter at our Perth home.

Our July-August bill shows we imported an average of 6.2 units/day, and exported an average of 12.4 units per day. We do had a solar HWS, and also try to use most of our power during the day, so the 6.2 units is mostly for cooking and running lights, TV, and the refridgerator at night. This period has been quite cloudy, and a few days ago we produced 37 units of energy and this will go up to a peak of about 45 units on a good day soon.

Clearly, if we had batteries our strategy would be to use some of the exported power for charging, then run on the batteries at night – the saving being 25.752 – 7.135 (feed-in) = 18.617 x 6.2 = $1.15 per day. Assuming this “shoulder season” rate over the entire year (ambitious), for 10 years, we will recover $1.15 x 365 x 10 = $ 4,198. Hardly enough to justify the cost of batteries, any necessary electronics (management, battery charger, battery inverter?), and installation costs!

Have I got this wrong?

People with solar and no battery are almost always better off on a standard tariff. But having a battery can change that as it can allow a home to (mostly) use stored solar power during the expensive peak periods and it gives the benefit of low cost grid electricity during off-peak times. If you got a battery system installed then you may find you are better off switching to the time-of-use tariff. But depending on the battery characteristics and your generation/consumption patterns it is still possible you’d be better off on the standard tariff. Looking at your fairly low grid electricity consumption I’d say you are a long way from a battery paying for itself as your options are to either get a large battery and fail to use it at a high enough capacity for it to pay for itself or pay such a high cost per kilowatt-hour of storage for a small battery that it will never pay for itself. Being part of a Virtual Power Plant may change the economics, but it’s still not clear how that will work.

The mystery of battery costs – Tesla say they will soon approach $100 a Kw, the all up cost of batteries in the likes of a Nissan Leaf must be under $500 a Kw and the manufacturer of a zinc-air batteries, (NantEnergy), say they are under the $100 mark.

Despite this most ESSs are over $1000a Kw and Tesla ups its price, probably because they need all batteries they can get for their EVs.

Seems it could be long time before we can included $5000 for a 10Kw ESS and make it financially worthwhile. Demand and limited manufacturing capacity will win out over improving technology for a good many years to come?

Ron thank you for your article on the subject of battery storage.

With your considerable power generation solutions design knowledge though there might be something your not letting on about, so it’s probably time you came out of the closet by providing us all with the benefit of your experience in creative and innovative generation solutions design theory, based on what’s happening around the renewable energy solutions fringes that you know about, or perhaps what’s not happening but could be.

In particular I am referring to the important benefits made impossible to ignore by creative system designers and integrators out there, through (1) the now mainstream very low price of PV and (2) because of point (1) the considerable overall system benefits now presented for exploiting by employing DC coupled solar and battery (as a controlled load) charging solutions, rather than the traditional (single system) higher cost and obviously less efficient AC coupled charging strategies.

Some system designers would refer to this as a ‘split power source’ solution, which is OK but not accurate; as it actually describes two “isolated” systems working independently but through ‘smart controls’ provide for a more efficient and cost effective overall customer power management outcome (which is a good system design imperative for young engineers).

Importantly this design strategy satisfies all of the regulatory and network requirements, including access to additional government subsidies for the home owner also.

There are many systems like this around, particularly in rural and regional industrial situations (single high current circuits/equipment for example that determine the overall maximum demand tariff applicable to the overall account) but not many in standard domestic circumstances to my knowledge, but there are no compelling feasible reasons why this should remain the case.

Thanks Ron.

Lawrence Coomber

PS: You would benefit by getting closer to the coal face with some battery stack manufacturers key decision makers Ron to get a better understanding of battery warranties (which unfortunately won’t be possible of course). There are some important strategies in play around monitored systems including storage that move the goalposts (when and if required) considerably on this subject.

With my “considerable power generation solutions design knowledge”? Thanks, but I’m afraid I’m really just at the stage of asking — if this is installed according to its manufacturer’s instructions is it capable of saving/making anyone money? But I do what I can.

If you could send me some links to information on ‘split power source’ solutions I will gladly look into them, although if they use battery storage on a controlled load it’s hard to think how could benefit a household as networks seems to be pretty strict about the battery only being able to supply power to the hardwired controlled load device. But there are still some pretty cheap controlled loads available in some locations so I guess it could make sense for some applications. But given how high many controlled loads have been raised over the past couple of years it does seem to be a risky option.

Thanks Ron.

I was referring to two isolated systems (not one) in play at a single premises, factory or commercial site Ron. This is a popular design strategy particularly in rural on-grid situations where pumping and irrigation is common, or where single use “large current machines” with low duty cycle operations, distort the overall maximum demand tariff for the overall account.

The imperative for the solution design engineer Ron naturally enough, is to achieve the best financial solution whilst ensuring high overall power generation system(s) performance standards; and a high standard of compliance in every aspect of design,for the customer.

Sys (1) is the network partnered on-grid mode system (traditional solar DC Bus and on-grid mode PCE). No interaction with system storage is required.

Sys (2) is an off-grid mode (solar DC Bus; DC coupled battery storage, and off-grid PCE). Managed as an independent “dynamic smart system” servicing selected load circuits (network isolated) as required and determined in logic on the fly.

There are considerable performance and financial advantages in this strategy at effectively no extra cost to a single on-grid partnership arrangement with all of its network limitations and time of use and other tariff issues imposed on users.

The minor duplicity in solar PV servicing independent and isolated DC Buses is more than offset by the system smarts (dynamic tariff management logic control on the fly), as well as the additional Government subsidies available for owners.

Lawrence Coomber

I see what you are getting at now. I’m definitely interested in learning more about them but it is something I’ll have to put in my “for later” basket for now.

Howdy Stranger.

Dont’cha love that ad on TV where the little girl goes off at a power company?! I get a bit that way when I see all sorts of convoluted and generally uninformed (because the people who trade in batteries seldom let the cat out of the bag and/or circumstances can be arbitrarily altered in a trice) guesswork regarding the battery ‘controversy’.

Once again:- Why subject yourselves to the machinations of people/systems over whom you have no control ~ and, I might add, charge more to account for their wages etc. AND PRODUCE NOTHING THAT GENERATES/CREATES WEALTH. Would you own a car but catch a taxi to wherever you’re going…. and leave the availability of the cab, and the price of the fare, entirely at the whim of the driver??

Earlier on I demonstrated time and again that a decent set of lead/acid batteries will EASILY pay for themselves AND keep you clear of the tampering of assorted wheelers-and-dealers who are there to control/acquire YOUR money and provide absolutely nothing of any value themselves.

Go and have a yarn to your horse; horse-sense cannot be underrated.

…or do you get paid by the word????? 🙂

I’ve looked at lead-acid batteries both on-grid and using them to go off-grid and they don’t save people money. Lithium doesn’t either at the moment. If you do the all the work yourself then that is an entirely different kettle of scaley sea creatures.

Hi Jackson

I think you must be able to source lead-acid batteries at a very competitive price – do you mind giving me the tip?

I reckon I’d break-even if I spent no more than $3,500 to buy a battery, and the associated charging, inverter, and management system necessary to integrate this into my present 3-phase system – and would need a 10-12 kWh battery to make thsi work. I can do much of the work myself – relying on an electrician to make the final link-up. But from the price each of 1 kWh AGM 12v batteries, I for the life of me can’t see how this would work out. Any suggestions.

I agree with you 100% – there is an awefully large amount of mis-information, missleading information, and uninformed comment out there – and I mean on both sides of the fence (renewable, vs nuclear/coal/hydro/etc.).

So far, our non-battery PV seems to be doing ok – I just wish our utility would bump the feed-in tariff up in line with inflation – they have been bumping our connection fee, and the tariff several times (death of a thousand cuts).

I don’t know all the facts, but worry renewables will increase power costs to the point that batteries will become a self-fulfilling result!

@ Jackson,

I don’t know if you are aware but lead acid battery suffer a performance problem called Peukert’s Law and this affects all lead acid batteries whether they are AGM, Gel, Flooded.

Peukert’s Law states that as the discharge rate increases, the available energy is decreased in a lead acid battery. This is nothing new.

For example, a 12V 100AH battery rated at C20, should be able to deliver 5A for 20 hours, delivering about 1200VAh.

But say, the lead acid battery delivers at 20A, the delivery time is not linear, i.e, 1/4 or 5 hours of the C20 discharge rate. It’s more likely to be between 2.5-3 hours depending on the battery type. So, best case scenario is that it delivers 720VAh. That’s a 28% performance loss, just for drawing more current. And it gets worse the more current you draw. And the value is worse for a flooded battery vs a Gel or AGM battery. They each have their own constant value of loss. And to prove this point, why don’t lithium batteries have C rates? It only applies to lead acid batteries as it determines how the lead battery will perform at a set rate, and usually at 5A (the C20 rate).

Whereas lithium-ion batteries don’t generally lose their delivery capacity at any rate of discharge which makes them ideal for high discharge rates (like in EVs and heavy home loads such as ACs/heating/ovens ,etc). And, on top of that, lithium-ion battery can do deeper DoD for more cycles than lead acid batteries.

Sure, you can fix the delivery rates and cycling performance by putting more lead acid batteries in batches of serial/parallel setups. And generally speaking you would need about 3-4x as many lead acid batteries to deliver the same energy/cycling rate as a single lithium battery. So, the advantage of a lithium battery system is that there is less cabling, less weight and battery management required for the same energy delivery system. Ideally, a 10% DOD would achieve the maximum cycling lifespan of a lead acid battey. Thus, this means for all batteries to achieve 10% DoD, you need 10x more batteries. That is a huge capital upfront cost. And then, do lead acid batteries come with 10 year warranties?

In my opinion, lead acid battery is not really designed for long term, heavy daily discharging.

I know for a fact that lead acid battery performance vary at different loads. I look after about 100 UPS in a network infrastructure using same UPS models/batteries. I can tell you now that for two identical UPS/batteries with different loading do not correspond to expected run times. The UPS with double the load does not run half (more likely to 1/3rd) than the UPS with half load.

I’ve calculated the retail prices of heavy duty AGM lead batteries, they are on par (meaning you need 3-4x lead batteries) with lithium batteries if one was to compare the energy delivery and expected cycles based on discharge rates. There is no real advantage in having a lead acid battery system, cost wise. It’s more messy with more cabling and bulky.

The only reason, I suspect, why people praise the “virtues” of lead acid batteries for a home battery storage system is because they got it really cheap somehow or free even. Of course, anything for free is the best product but that does not mean technically they are the best.

Otherwise if they were so good, why didn’t the industry offer on grid home battery systems earlier using lead acid batteries (if they were cheap enough to begin with?) before lithium batteries became more available. The main reason? It was bulky and messy and took up too much room. Lithium batteries solved that problem quite easily. So, something is amiss why lead acid battery systems were not generally available for on grid storage. Inverters and battery management systems have been around for a while, so it can’t be that.

But flow batteries are even better, they offer 100% DOD for 10 years. But they are too expensive. Unless one can get it for free, then it’s the best.

People are badly misinformed about battery technology. But who cares which one it is if you get it for nothing (or very cheap). $$$ trumps performance in this case but that does not mean lead batteries are better cost or performance wise.

Yes Ron I agree:

Lead acid is a strong choice for long life storage systems (480 VDC nominal) managed properly, and particularly in off grid applications that require maintenance free with no user intervention necessary, and DC coupled (and controlled) to a ripple free and appropriately sized Solar PV source.

What ages all batteries is current and power quality issues. Both charging and discharging. It is hardly worth considering any other parameters beyond (Current – Charge/Discharge control) and (Depth of Discharge DOD control) as having more than a minor influence on performance or longevity on a (well monitored and controlled) constantly operating (higher nominal voltage – lower current) power generation system. Further performance advantages can of course be achieved by integrating an array of Super-capacitors to work in tandem with a lead-acid battery bank.

Of course there are a few important common sense safety requirements easily implemented and enforceable in design, a main one being that a reasonable maximum ambient temperature is not exceeded for battery banks.

There are considerable benefits in designing Solar and Inverter and Battery Storage Systems that operate at higher nominal voltage and lower current than those systems that we commonly see.

Lower current equals less component stress; lower operating temperatures; significantly smaller diameter cabling and associated fuses and protection devices. And importantly much improved system safety due to lower DC currents.

Algorithms for high current charging and discharging for ELV Lithium battery stacks looks interesting on the spreadsheet, but prove to be problematic in practice, and that is why (along with other reasons) there is an arbitrary “battery stack swap out” regime in place as standard for EV’s globally.

Additionally, EV electric drive chains are heading north of 1000 Volts in those jurisdictions that have managed to get their heads around the benefits of higher voltage technologies, and renewable energy storage technologies are direct spin-off technologies from the EV industry.

Lawrence Coomber

I’ve had a Powerwall 2 installed in SA under the VPP program and must say its been excellent.

Excellent until the grid voltage turns the solar and Powerwall system off at >258v, someting that I didn’t know until I had the battery installed happens almost every day.

SAPN are adjusting the transformer after considerable correspondence with them but this will take a further 3 months.

I’d love to have off peak and peak power usage here in SA, its peak all day long!

Hi Lee

If you want to tell me about how the SA VPP program is working out for you please email me at [email protected]

People would probably be interested in an article describing what it involves for a household and your thoughts on it.

Hi Ron,

You sure about Synergy being the most expensive in the country?

Try this one… Click Energy (Vic company) for Endeavour Energy (distributor in NSW) – my area.

I contacted Click Energy to ask why their off-peak rates are more than double than most retailers (their answer was it was a management decision). So, for that reason I’m out (I was a customer with them for a while until they jacked their prices so high on the ToU plans).

But anyway, here are Click prices for their Solar Plan for NSW Endeavour Energy area.

GST incl (brackets are Synergy’s prices)

Daily supply fee $1.0340 ($1.015493)

Peak $0.5115 ($0.538714)

Shoulder $0.4411 ($0.282139)

Off peak $0.3520 ($0.148405)

FiT $0.17

Click’s only advantage is that their peak rate is just under 3c cheaper, but for all other fees, Click Energy beats Synergy’s prices hands down.

It’s mind boggling how Click justify their off-peak rates. They must have some poor contracts with the NEM or generators. Or bad bean counters in their office.

I don’t know what Click’s strategy is for their ToU pricing. Are they deliberately trying to scare customers off in not using ToU with them?

Now, granted Click Energy offers a 11% pay on time discount. But there is a gotcha, they will only apply the discount after the solar export FiT has been applied to the consumption charges. So, it reduces the charge amount. Then they apply the discount to the net figure. This does not apply to the supply fee. The discount is not applied to the unit rate. It applies once total usage and export charges are calculated. Then 11% applied and then the daily supply charge on last and then GST. Very sneaky. Even with a dubious 11% discount, it’s still higher than Synergy’s overall.

The only reason why you want to be on Click’s plan is the high FiT but you would need to generate a really high export. On top of that, Click Energy will only take customers with a 5kW inverter as the maximum size. So you couldn’t get the high FiT if you had larger inverters.

I would advise people to stay away from Click…. they are a bit dodgy.

Hi Graham

I can only speak for myself – but going from Synergy’s Home Plan (A1), at $0.2833 / unit (and the same Supply charge rate), to their “SMART” ToU plan, would cost me about 25% more in power charges. The Peak rate simply kills any saving on the lower off-peak rate – for how we use power.

At the same time, using batteries to “fill in” the Peak period would not save enough to nearly pay for themselves.

My biggest gripe, is the very low FiT of $0.07135. However, even with this low rate, which is not being indexed with inflation, during summer we can actually achieve a small credit result.

Hi Ian,

I understand your gripe about FiT.

It can’t be indexed to inflation because FiT is based on wholesale electricity market prices which varies between $0.06/kWh to $0.30/kWh on average depending on time of day. I have seen spot market prices reach $140/kWh (or $14,000/MWh) but they are fairly rare and usually in periods in high demand like in summer when the gas peaker plants are brought online.

In NSW, iPart determines a voluntary FiT rate based on past wholesale market prices and the predicted 12 months wholesale price trend (based on a number of factors such as new renewable plants coming online).

Not much you can do unless you become a “participant” in the NEM but that requires a lot of regulatory paperwork to be set up a NEM player to be with the big generators. However, you will be like a small ant to an elepant in terms of power generation and how much influence you would have on the market as an individual.

So, best bet to maximise the use of your solar output is to self consume as much as practically possible. If you can’t afford a home battery system, use the hot water system to absorb the excess power as the hot water system is essentially a heat battery storing hot water for later use. Even if you have to buy a smart solar diverter device for hot water systems (about $1k) it’s still 10x cheaper than a home battery system. What is your off-peak electricity rates? If it is more than your FiT, then diverting excess electricity to the hot water system is next best step (how you do it is another matter, depending on how smart or dumb it’s setup e.g, timer or smart diverter).

Thanks Graham

Yes, we have “load-shifted” as much as we can to PV-generation times – I even boil the kettle separately from running the toaster in the morning, to reduce import energy – have even thought about getting a lower-power (slower) kettle…! We have a 3kW irrigation pump, and watering rules require us to stop watering by 9:00am – so my timer is set to finish then. During summer we can do all the watering solely on PV, but in the shoulder seasons when we still need to water, some inport energy is unavoidable – I’ve emailed our water utlility (Water Corporation) about this – and they forwarded my email to the authority that controls this, together with a very nice response email – here’s hoping they can relax the time limits a little in the near-future.

Can’t re-direct power to our HWS, as it is solar and at this time of year I have to partly cover the panels to prevent it from boiling over – in winter I do use the booster, but almost-always only when the sun is shining.

Ron’s analysis of batteries with our WA “best?” time-of-use tariff, shows that in our case we are nowhere near the break-even point – much better to stay with our A1 home tariff, solar PV only.