Tenants who ‘invest’ in AGL’s Offsite Solar are emotionally handcuffed to their tariffs for 7 years

If you are lucky enough to own an unshaded roof over your head, solar power is a no brainer.

Millions of homeowners have realised this and, for those who have done it right, they are living a life free of energy bill worries for the foreseeable future.

But what about the 30% of Australians who rent? They are seemingly stuck having to pay electricity retailers for overpriced, dirty grid electricity.

Over the last few years a number of innovative companies have created products to try to address this injustice, allowing landlords to install solar panels and share the benefits with their tenants.

Unfortunately the weak link in all these schemes – to date – is they rely on a landlord being prepared to spend money on their investment property. I spent most of my life renting, and my experience of landlords is they are loath to spend even one cent more than they have to on their properties. Every landlord I ever had was pathologically tight; focused only on increasing their ‘yield’ by minimising any expense on their properties.

If you ever meet me down the pub, ask me to tell you about taking my last landlord to the South Australian Civil and Administrative Tribunal. He refused to get covers installed on the halogen downlights that were literally causing the insulation to smoulder1.

Because so few landlords are willing to spend on their properties, any solar-for-renters scheme needing the co-operation of a landlord has a severely limited market.

AGL to the rescue?

Last month AGL put out a press release proclaiming:

AGL has launched a new product that makes the savings from solar energy available to people living in households without traditional solar rooftop panels.

As a company that is committed to making energy more affordable for our customers and helping them manage their bills, AGL created this product to help the Australians who are not able to access the savings that solar energy can provide…

We believe this is the only product of its type in Australia available for the 80 percent of Australian households that do not have solar, including people who are renting, living in apartments, have unsuitable roofs, cannot afford it or move too often to justify the cost.

Customers who sign up to AGL Offsite Solar for $1 a day in the first year receive bill credits of about $50 per year plus loyalty credits of $33 per year in years two to seven.

This is how it works: AGL own a commercial solar system on a factory in Wagga Wagga. They will ‘sell’ you the output of one of those solar panels for a 7 year period. The benefits come as dollars deducted from your electricity bill – which has to be an AGL bill.

So does this AGL ‘Offsite Solar’ scheme allow tenants to finally share the benefits of solar energy without getting the landlord involved?

Short answer: no. Longer answer follows.

7 News Asked My Opinion

A couple of weeks ago, 7 News asked me for an opinion on the AGL scheme, prompting me to look closely at its details. You can see their final report here.

Unfortunately they didn’t have time in a 90 second segment to drill into the details of the Offsite Solar scheme or for me to justify my criticism of it – so I’ll do that now.

The Devil Is In The Detail.

In a nutshell here’s the deal:

If you take up the scheme you pay $365 in your first year (no more to pay). Then you get approximately $50 back from AGL in year 1 (the actual amount depends on the measured output of the solar power system you have bought a part of).

In years 2-7 you continue to get the $50-ish plus a fixed $33 ‘loyalty bonus’. So, you get about $83 in years 2-7. The benefits stop after 7 years.

AGL say this represents the cost and benefit of owning one 250W solar panel for 7 years.

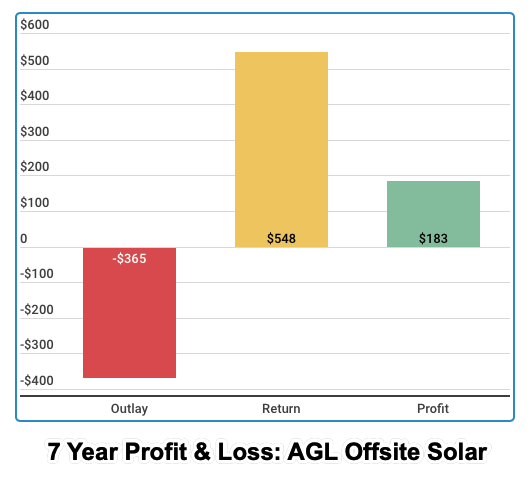

You pay $365 and get back $548 over 7 years. Subtracting the two gives a modest $183 profit (ignoring inflation). That’s about a 5.8% return on your money.

The AGL scheme offers a moderate return. Figures ignore inflation.

Hmmm, 5.8% – that’s better than the bank will give you! It looks like an OK investment at first glance.

Until you look at what you are losing:

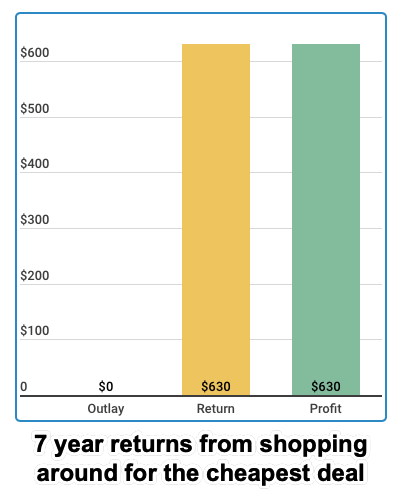

A condition of joining this scheme is you must stick with AGL’s tariffs for 7 years if you want to keep all the returns2. A quick look on the government’s EnergyMadeEasy website shows that a typical bill for a 2-person home would be $90 per year more with AGL compared to the cheapest plan from other retailers in VIC, NSW and QLD. If you live in SA, you will pay $70 more per year with AGL.

So, you can save $90 per year without spending any money simply by shopping around for cheaper energy retailers. That’s $630 over 7 years.

If an existing AGL customer simply shops around, here’s what they could save extrapolating year 1’s savings.

Compare the bottom graph with the first one.

AGL’s Offsite Solar doesn’t look like such a good deal after all.

Why is AGL offering ‘Offsite Solar’

I honestly don’t think AGL sat in a boardroom and got all empathetic:

“Hey guys, what can we do to help out all these poor renters getting screwed by energy retailers like us?”

It appears to actually be a clever way for AGL to cheaply ‘lock’ tenants into their tariffs for 7 years with ‘golden handcuffs’.

It uses the psychology of The Sunk Cost Fallacy.

The Misconception: You make rational decisions based on the future value of objects, investments and experiences.

The Truth: Your decisions are tainted by the emotional investments you accumulate, and the more you invest in something the harder it becomes to abandon it.

And AGL are cunningly using the good vibes that solar energy radiates to suck people into their trap:

“Hey tenants! Harness the power of the sun to reduce your bills!”

I think it is a real shame that it is such a shitty deal. Because at a high level, I think the concept is a good one. We need to remove the landlord from the process, and the only way I can think of doing that is to allow tenants to invest in solar farms, with the benefits coming off their bills.

An Alternative ‘Offsite Solar’ Scheme

There is another company about to launch such a scheme: SolarCloud 3. I don’t know the details of the scheme – so I can’t evaluate if it is worth doing yet – but I’ll crunch the numbers as soon as it is launched. It is not run by a big, bad electricity retailer – so that’s a good start at least.

In the meantime, if you are a tenant – and your landlord won’t invest in solar power – I can’t recommend the AGL scheme. Instead check a website like the government’s EnergyMadeEasy or even SolarQuotes’ own tariff comparison tool every 12 months or so and relentlessly look for better deals – you can save $100’s that way with no money down.

One More Thing From The AGL Press Release

Finally, I found this quote from AGL’s press release about its Offsite Solar scheme misleading:

We estimate customers will break even on their subscription in about 4.6 years, a faster payback period than traditional rooftop solar“

Solar payback depends on a number of factors. Lots of people buying solar today will get a payback faster than 4.6 years. But more importantly – when you own your solar power system it should keep paying for at least 25 years and not stop dead after 7. If you move house before 25 years is up, good quality solar will add value to your home. Not to mention avoiding the risks of being held emotional hostage to one electricity retailer’s tariffs for 7 years! To imply that this offsite solar scheme is a better investment that buying your own solar power system is absolute bollocks.

RSS - Posts

RSS - Posts

“…ask me to tell you about taking my last landlord to the South Australian Civil and Administrative Tribunal. He refused to get covers installed on the halogen downlights that were literally causing the insulation to smoulder…”

It’s more common than you’d think. The builder of two of our rentals screwed-up, placing downlights right up against wooden beams. We spent over $9K addressing these issues(!) It was dangerous (a fire hazard!) and expensive for tenants, as halogen lights kept *popping* before we realised it was a construction ‘fail’. Did the builder* assist us with the cost? NOPE.

* Did the fact that we have seven rentals built by this WA company help?

NOPE. We’re about to seek assistance through Australian Consumer Law, to address yet another construction fail… . Time for a Royal Commission into the building industry, perhaps?

The ACCC should look into this scheme. Any contract that involves buying something up front for future returns that in turn locks you in to a specific provider and pays you nothing if you leave the scheme seems anti-competitive at the very least. Plus it’s a lot of money to pay for what amounts to the output of a single 250W panel. That would value a typical 6.6kW system @ $9,636 whereas typically they range from $3000 – $6000 after STCs. A 6.6 kW system that stops after 7 years.

Surely you should be entitled to a pro-rata refund of the initial investment if you decide to leave the scheme? And why an arbitrary 7 year period?

I think all electricity retailers are dodgy, offering worthless discounts on jacked up prices, but AGL is going very low.

very helpful article giving the facts -what some coys will get up to

Fact of life, energy companies are offering up to 35% discounts, this means to offer that discount energy prices are 25% overpriced

I have had Solar Panels since 2013. My installer and I didn’t know what species of tree nor how quickly they would grow that our neighbour had when the panels were installed on my roof. They are tea Trees , a relative of the eucalypt. Only 1.5 metres high at installation time, no one realised what a problem they would become. The neighbouring hoiuse is owned by an investor who is a nasty piece of work. After 4 yeras in QCAT I have wasted my time and money. A tree Assessors Report was a disgrace and didn’t even have the right names and address on it and cost us jointly $500 each. My infeed losses are now $13,000. All provable from Energex Actual Invoices. QCAT conveniently ignores the facts, the lies the neighbouring property owner tells, and fails to follow Clauses in their own QCAT Act. They even commit Errors in Law-three and do nothing about it even on appeal. They like the rest of anything to do with QLD government are only about Revenue Raising and their latest is to try and get me to pay for the transcript of the final hearing and register it with them. As a retired Pensioner I do not have the money to waste as they hve shown that perverting the course of Justice is part of their modus operandi. The cost they are trying to make me pay is $1,300.00 just for the transcript. I have already paid out $600.00. California had a Solar Act 35 years ago and a neighbour whose trees shade your Solar can be fines $1,000 US a day. Any advice on this matter would be most appreciated.

Copper nails 😉

I have 140 acres of flat no tree low value land near Dublin running adjacent a bitumised road with powerlines and power is connected to the block.

Happy to offer that up as a solar factory as not getting any return on it at the moment

2 items.

Balcony Solar Units have been available for more than a decade. I have seen German ads where they have a double unit, attach it to their balcony Flower tray and plug the output into the nearest GPO and feed it straight back into the Unit.

I don’t know if they’re available here in Australia. But a quick Google shows ads dated 2011, for something similar available here.

And secondly the video supplied me with the answer to something that has puzzled me for nearly a decade.

Around 10 years ago I flew to Mildura from Melbourne. On the descent into Mildura I noticed some weird steel buildings but there was nothing else around them. I asked my hosts and they didn’t know what it was. That video showed those same buildings, now attached to lots of ground mounted Solar Panels. Back then it was obviously under construction.

Denis I hope you liked what you saw because you paid for it!

The Mildura Solar Concentrator Power Station was a proposed 100 megawatts (130,000 hp) concentrated photovoltaic (CPV) solar PV system to be built at Carwarp, near Mildura. It was proposed by Solar Systems in 2006 which was acquired by Silex Systems in 2010. A 1.5 MW demonstration plant was completed in April 2013.

It went bust and cost the Australian taxpayer an enormous amount that was granted to Silex by our Government to build it.

The true amount may never be known, but it is over a 9 figure amount.

I challenged Silex directors about the project in a 2013 public forum at the Melbourne Convention Centre (Australian Energy Conference I recall) and the directors deftly ducked the question and exited stage right very quickly.

Not a good look for the Solar Industry and some would argue not much has changed since.

Lawrence Coomber

Interesting. I was just reading about this AGL Offsite Solar scheme, did some back-of-an-envelope calculations and came to exactly the same conclusion. I kept thinking I must have missed something, but no, I guess it’s as bad as I thought. Disappointing, because as Finn says, the general concept is not bad. Surprising really that there are so few easy options yet in the market for renters and apartment dwellers. I guess (hope) that will change in time.

Thank you for the information you have helped me to see that as a renter that scheme is not an option for me the person who did the research has explained it in understandable language so I really see it all very clearly.. Thank you thank you ..i will not be signing up..