Is it reasonable to expect a “8-15% return on investment” on a Powerwall 2?

Last month, Lyndon Rive, Tesla’s Vice President for Energy Products, stood up in front of a large group of people, including me, and promised the Powerwall 2 will deliver a return between 8% and 15%.

I was way too busy guzzling free fizzy water to write down Lyndon’s exact words, but luckily a much more professional reporter did. Lyndon said:

“ it’s a good investment for home owners, between 8-15 per cent return on investment and a function of …security and insurance.”

When you promise returns on a product that you are selling it is very important to use the correct language1 so that your audience are not misled.

Strictly speaking the term Lyndon used: “Return On Investment” does not inherently account for the amount of time during which the investment in question is taking place. So he is literally saying that if you buy a Powerwall 2 for $10,000 you will get between $800 and $1,500 back in profit.

Total. For the life of the Powerwall.

I’m sure he doesn’t mean that2. That would be silly as I don’t know anyone who would consider $80-$150 a year over 10 years as a good profit from a $10000 investment.

So What does he mean by “between 8-15 per cent return on investment”?

I honestly don’t know. And that’s the problem – we have to guess. Under Australian Consumer Law, he’s just made an express warranty about the Powerwall 2 based on what a ‘reasonable’ person would believe. So it is important.

I contacted Tesla directly and asked them to show their work. Twice. They ignored me. I think I might be in the naughty corner as far as Tesla Australia is concerned.3

Did He Mean “Rate of Return”?

A layman may think that Lyndon means a Powerwall 2 will provide you with savings equivalent to 8-15% of the purchase price every year for a specified time. Accountants/investors call that a “Rate of Return“.

But rate of return is meaningless without a specified time period. So I have to assume he actually meant “Internal Rate Of Return” when he said “Return on Investment”4.

He Probably Meant “Internal Rate Of Return”

Internal rate of return (IRR) for an investment is the percentage rate earned on each dollar invested for each period it is invested. If you don’t understand that last sentence – don’t worry. All you need to know is: it takes into account the length of the investment and the amount of return. With a wall of silence from Tesla, IRR is my best guess as to what Lyndon actually meant.

So is it reasonable to promise 8-15 per cent IRR on a Powerwall 2?

I can’t for the life of me see how he can get those numbers with reasonable assumptions. I’m calling BS.

At its current installed cost Powerwall 2 owners will be lucky to break even, let alone make money. I simply cannot see how it is possible to get an 8% IRR with typical use. And suggesting people can get 15% is a hell of a stretch.

So let’s go through best and worst case scenarios for Powerwall 2 IRRs and see what range we actually get.

The steps will be:

- Establish the initial investment.

- Estimate the Powerwall 2’s lifespan. Best case and worst case.

- Determine what the best and worst annual return possible is.

- Ask Bill Gates to calculate the resulting IRR5

- Never again believe anything Tesla says without verifying it first.

Step #1 Establish The Initial Investment

According to Tesla, the estimated installed cost of a Powerwall 2 is $10,000 (extra for backup functionality).

I don’t believe them.

In the real world, where high-quality solar installers have to turn a profit, you will be quoted $11,000 – $13,000 installed without backup.

Let’s call it $12,000 for a Powerwall 2 without backup.

But wait…

Lyndon said:

“ it’s a good investment for home owners, between 8-15 per cent return on investment and a function of …security and insurance.”

I remember this bit from the launch event, he waxed lyrical about how you were not just buying a financial return, you were buying the peace of mind that backup brings.

Good installers tell me that when Tesla gets around to releasing the backup module6 it is likely to add about $1,300 to the installed cost.

So in the real world, our initial investment is now $13,300 for a retrofitted, fully installed Powerwall 2 with backup, fully installed by a quality installer.

Step #2 Estimate Its Lifespan

Worst case: The Powerwall 2 has a 10-year warranty7. So for Lyndon’s worst-case scenario (8% IRR), I’ll use the worst-case lifespan: 10 years.

Best Case: For the 15% IRR, best case, I’m going to assume we get lucky and the battery lasts 15 years. That’s a big call for Tesla’s NMC chemistry. But I’m trying to be generous here.

Step #3 Determine The Best & Worst Real Life Return

Worst Typical Case: The worst case – in terms of lower returns on a battery – is where the difference between your Feed In Tariff and your Usage charges are lowest. The actual worst case, then, is the Northern Territory where there is zero difference.

But I won’t be that mean, I’ll simply go for a typical case where the savvy solar owner has done their homework. If you shop around in Adelaide for example, you can get a 12c Feed-In Tariff from Origin and 31c/kWh imports.

Because a Powerwall 2 is 89% efficient, Adelaideans will lose 13.2 cents of Origin feed-in tariff if they store one kilowatt-hour of solar electricity, but by using the battery, they save 31 cents. A net saving of 18 cents per kWh.

With a little under half the deterioration allowed for by its warranty, the Powerwall 2 will supply an average of 11.5 kilowatt-hours of stored electricity a day.

If all that capacity is used, every day – a very generous assumption – then in the first year the Powerwall 2 will save $755.

Best Case: The two capitals where a kilowatt-hour of stored electricity has the highest value are Sydney and Perth. In both cities, households on time-of-use tariffs pay around 50 cents a kilowatt-hour during peak periods.

In Perth, the feed-in tariff for solar electricity is 7.1 cents while in Sydney it can be as low as 6 cents if you can’t be bothered to shop around.

Because a Powerwall 2 is 89% efficient, a Sydney home with a 6 cent feed-in tariff will lose 6.7 cents of feed-in tariff if they store one kilowatt-hour of solar electricity.

But by using stored solar during a peak period they can avoid paying 50 cents for grid electricity. This means they will save around 43.3 cents. But since peak rates only occur on week days the best average possible over a week would be a saving of around 34.4 cents per kilowatt-hour of stored solar electricity.

It is impossible for a Sydney home to fully charge a Powerwall 2 with solar electricity during the day and then use all the stored power in the period when grid electricity is most expensive every day for 18 years. But I’m going to play make believe for the benefit of Tesla and pretend it can do just that.

With a little under half the deterioration allowed for by its warranty, the Powerwall 2 will supply an average of 11.5 kilowatt-hours of stored electricity a day. This will provide an average of $3.96 cents in electricity bill savings or $1,444 in the first year.

In Perth it works out almost exactly the same.

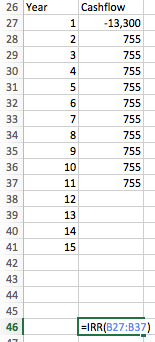

Step #4 Work Out The IRR

The maths to work out the percentage IRR from a list of cashflows is quite tricky, so I’m going to use Microsoft Excel’s IRR function. I assume the code was personally handcrafted by Bill Gates and is therefore likely to be correct.

Typical case (no electricity price inflation):

Calculating IRR – 10 year life, typical FiT no elec price inflation.

So for a typical feed-in tariff, a 10-year life and no electricity price inflation the IRR is -9%. You will lose money.

But analysts I spoke to last week are expecting retail electricity prices to increase at least 10% per year for 3 years just to catch up with already increased wholesale costs.8

So let’s do the calculation again assuming 10% electricity price increases for 3 years, then 3% for the following 7 years and a static FiT.

Typical case with electricity price inflation (10% for 3 years then 3% but ignoring general inflation):

Excel gives me an IRR of -4% in this scenario. Still losing money on the battery despite rampant electricity price rises and no accompanying Feed-In Tariff increases.

Let’s now move on to the even more generous assumptions and see what the best case is.

Best case with 15-year life, very high prices, very low FiT, perfect utilisation, but no electricity price inflation:

This almost perfect storm of assumptions gives an IRR of 7%. Still less than Lyndon’s worst-case figure of 8%.

But we can still add rampant electricity price inflation and no FiT increases, so let’s do that.

Absolute Best case with rampant electricity price inflation:

Best case is a 15 year life, 10% electricity price inflation for 3 years followed by 3% thereafter, Australia’s highest electricity prices and lowest FiTs which never increase with wholesale prices. This is a scenario that is highly unlikely to reflect reality, but it does make the returns look good. Although not as good as Lyndon’s with an IRR of 12%.

What If It Is Charged With Off-Peak Power?

But what if Lydon Rive assumed the Powerwall 2 would be charged with off-peak electricity as well as solar power? Well, in this case, with astoundingly optimistic assumptions, it just makes things worse.

Again I’ll be very kind and assume the Powerwall 2 is completely cycled twice a day, once using stored off-peak electricity and once with stored solar electricity. Again, this is impossible, but Tesla has shown it isn’t concerned about reality, so I don’t see why we need to be. As the stored off-peak electricity would displace shoulder electricity and not peak electricity, the average saving per stored kilowatt-hour would be around 20.7 cents. Because the Powerwall 2 is being cycled twice a day, keeping the same assumptions, this means it won’t last as long. In Sydney, this comes to a saving of around $1,739 a year for 9 years, which is an IRR of 3.4%.

The results for Perth are worse because of their higher off-peak electricity rates.

Making wild claims about space flight and $150k supercars is cool. Misleading pensioners is not cool.

Tesla’s mission is:

to accelerate the world’s transition to sustainable energy

And boy, that is an important mission. The survival of the species depends on it.

But they can achieve that without misleading cash strapped homeowners about the returns of their home batteries.

I totally understand that one of Elon Musk’s successful strategies is to claim the seemingly impossible, and then it eventually happens. Just look at SpaceX. Just look at how amazing Tesla cars are.

The problem is that Down Under, Tesla Energy can’t compete with Aussie solar panel installers on cost and efficiency. So they are going hard on batteries instead. It seems to me that their desperation to move Powerwalls in Australia is clouding their judgement when it comes to their claims of financial returns.

There are plenty of early adopters in Australia that are buying batteries for lots of good reasons and I applaud them. The early adopter market gets excited over technology, helping grid stability, and blackout protection – not financial returns. So there’s no need to gild the financial lily when selling batteries in Australia right now.

The good domestic installers who have a great existing business installing solar know this. They offer solar and batteries but do not make wild claims about battery payback.

An anecdote from the Powerwall 2 launch

At the glitzy Powerwall 2 launch last month, I sat next to a gentleman who was probably mid-60s. I asked him what brought him to the launch. He said had put down a deposit for a Powerwall 2.

I said that was exciting – and asked him why he was buying a PW2.

He said: “I don’t want to send all my solar to the grid, I want to use it at night and save money.”

I asked what kind of return on investment he was expecting. He said he had no idea.

I asked him if he was confident that his new battery would pay for itself.

He said he was very confident. He said he was convinced he would get a good return and he trusted the brand.

Now I don’t know the financial position of this gent. $13,300 may be a drop in the ocean for him. Or it may be a big financial stretch for him. But I do know, from talking about batteries in public forums, that most of the audiences are made up of over 60’s who are not rich, but are prepared to invest in batteries because they feel it is the right thing to do.

People who understand batteries, warranties and financial returns have a duty to objectively explain what Australians can expect from their $10,000+ battery investment. And this little blog strives to do that. Big players like Tesla should strive to do the same.

Footnotes

- As an engineer, not an accountant I have been guilty of mixing up ROI and IRR too – it’s easily done ↩

- Yes I am being anal. Most people mix up Return On Investment and Rate Of Return in normal conversation. But one of the highest paid CEOs in Silicon Valley really should know be careful with this stuff. ↩

- As an amusing aside, I went to the Powerwall 2 launch in Melbourne last month. I went up to 4 different Tesla employees for a chat and was met with “I’m really sorry Finn, but we are under strict instructions from Management not to answer any of your questions”. Tesla is bloody hard work I tell you. ↩

- Getting this wrong is a bad look for a top executive. That’s like Elon Musk getting kW and kWh mixed up ↩

- He’s better at these things than me ↩

- Which being AC coupled will not be suitable for extended outages – for reasons I’ll go into in another blog post ↩

- With caveats – but let’s keep things simple ↩

- Ronald will soon publish a blog post that hypothesises that increasing wholesale prices do not make grid-connected storage more attractive because they will also push up FiTs – but I’ve assumed FiTs are stagnant – another generous assumption. ↩

RSS - Posts

RSS - Posts

Great post Finn! I suspect his “ROI” estimate isn’t just for the battery, but for a newly-installed solar system that *includes* a Powerwall 2. On the numbers we’ve been crunching, including a battery increases the annual bill saving, but extends the payback time and reduces the IRR and NPV (Net Present Value). It looks better in 4 years’ time though…

Yes – adding a battery to solar makes the payback worse than solar alone. I call this blended payback – and I think anyone using it should disclose the payback without batteries for the customer to compare. Expect a post on ‘blended payback’ soon.

I probably have a small disagreement with you here Finn. Grid connect is great for supply authorities and of some use to those who got nice feed in tariffs of 48c /kwh. At 6c / kwh it is a real problem especially for those of us who stumped up more for German equipment. I give Ergon a lot more energy than I get back but pay handsomely for the privilege of supporting their broken down system..

A nameplate 24kwh battery system has certainly changed the dynamic for us. The main advantage I get from the combined system I now have is stable voltage, power factor and wave shape and at night when running on batteries more stable frequency. During the last cyclone it also came into its own by making the 5kva diesel running during daylight both more efficient and keeping power 24/7.

And yes it actually pays its way.

Thanks for the take on Powerwall 2, compared with what I used to remedy the Ergon rort it is twice the price , half the capacity and is not stand alone without the items I already have. Being Lithium based I would expect however the Kwh capacity on the nameplate may be more realistic (based on power tool experience at least)

How about 10,000 plus 1,500 over the life of the battery. that’s the way I took his comment and that’s not unreasonable.

You DO get the value of having the battery over it’s own life.

What’s your return on an auto that you drive, the value is in the use of the car.

This battery gives you the value of the use and over the life of the Powerwall 2 and you recover the costs plus a little.

“You DO get the value of having the battery over it’s own life.

What’s your return on an auto that you drive, the value is in the use of the car.”

Thi s is exactly what most people miss. Most people do not buy a car and say what is the ROI or IIR on a vehicle that constantly loses value and keeps you forking out money at every turn (gasoline, insurance, maintenance).

A solar system does just the opposite. It displaces energy thus giving you money back at every turn. You not only get value in its use, but also get the benefit of a cleaner environment and built in security. Its one of the best places to put your hard earned money if only you can get past that first time cost! Yet people buy $200,000 homes and go in debt for 30 years and do not blink an eye. Go figure!

Huge fan of Musk, so it’s quite saddening to learn that Tesla’s PW2 doesn’t stack-up… . Reality bites. 🙁

Here is the thing. If all you care abut is IRR and ROI than solar may never be for you. When ROI and IRR comes up when selling a solar system 99% of the time I never close the deal. Why? Because people looking for a great ROI or IRR are looking for like 20% a year and 5 year “paybacks”. Virtually impossible to achieve with any solar grid tie system and even harder to achieve with a battery based system. These people only look through an economic lens and they miss the big picture.

But here is the thing that I have found out . I like to have customers who look at solar as a LIFESTYLE choice. To me that is exactly what it is and how it should be marketed. The energy saving and the energy independence comes as a bonus that you simply cannot put a price tag on. Musk is marketing solar and EV as a lifestyle issue and that is one big reason he has been successful IMO.

Keep in mind that there are so many things in one’s life that you buy and all that item does is COST you money and NEVER give ANYTHING back. The renewable energy world always gives back, but of course it is is not free , but once you pay for whatever it is you buy it gives back for up to a lifetime (30-40 years) On the other hand in the fossil fuel world it takes and takes and takes and give nothing back. Your choice!

“The energy saving and the energy independence comes as a bonus that you simply cannot put a price tag on.”

Tesla Energy’s lifestyle division has evaluated the priceless feeling of independence, as an advance payment of $13,300.

Independence???? NEVER while you’re connected to the grid.

For one thing let’s not forget the spiralling and entirely dependent cost of the ‘service to property charge’ ~ a figure NONE of the bean-counters seem to recognise.

Solar panels are dirt cheap these days, and reasonably good lead-acid batteries can be bought anywhere for down to about $1.50 per ah:- or about $125 per kwh….so 10kwh for $1250. Even generously DOUBLE that to accommodate a 50% (or less) DOD = $2500. Expect to replace the whole thing every 3 years = $$7500 over 10 years.

…..and you’re STILL paying only the ‘transport-and-install’ costs of a gee-whiz system that not only keeps you dependent on the grid & grid/operators but can be rendered into a ‘completely-fucked-and-useless’ condition by the smallest malfunction.

ps……if any of you want to buy a coat-hanger-shaped bridge, send me a small deposit (cash: small-denomination used notes) and I’ll send you details about where/when to pick it up.

Fair dinkum!

Ronald,

The AC powerwall is warranted for 37MWh. Capacity is 13kWh, falling to 70% at 10 years. From that, the average daiily capacity and aggregate are derived.

Say the battery reaches 0% at 10 years. Even at that extreme, average capacity would be calculated as 50% (6.5kWh) producing 23.7MWh, or 64% of the warranted 37MWh.

90% at ten years: 12.35kWh, (45MWh) 119%, 12.6 years

80% at ten years: 11.70kWh (43MWh) 116%, 13.8 years

70% at ten years: 11.05kWh (40MWh) 108% 14.1 years

60% at ten years: 10.4kWh (38MWh) 102%, 14.9 years

50% at ten years: 9.75kWh (36MWh) 97%, 15.7 years

40% at ten years: 9.10kWh (33MWh) 89% 17.8 years

etc

How long would it take to reach 56,700 kilowatt-hours, (150%) and what would be the final capacity?

Maybe it’s because I have just gotten up and the sun hasn’t risen here yet, but I don’t understand your question. If you are asking how long say a business operating under a best case scenario would take to get 56,700 kilowatt-hours of storage out of a Powerwall 2, well, as a complete guess let’s say it decays to 80% by the time it supplies its warranted amount and it decays down to 70% by the time it has supplied 150% and all this happens in a straight line because I’m too bleary for anything else. In this case, it would take around 13.8 years. If it just scrapes in at 70% capacity by the time it has supplied the warranted amount of storage and falls to 65% by the time it supplies 150% it will take about 14.3 years.

But for a household? Well, it’s a big battery and in real life rather than best case scenario land it might only get cycled around 0.4 times a day. In this case we’re more looking at years of operation until the internal inverter or something else carks it. Again, a complete guess, but let’s say it lasts 15 years before dying and its capacity never gets too bad, then it would have supplied around 28,900 kilowatt-hours of storage over its lifespan. If it costs $12,000 to install, then dividing that by kilowatt-hours of storage supplied gives 41 cents, which is kind of pricey.

Now then, why did I wake up so early? There has to be a good reason.

Ronald,

From your answer, I get:

“80% capacity, 37MWh 70% capacity,

56.7MWh at 13.8 years.”

An addtional 19.7MWh, for 10% loss. (+ 3.8years?)

5MWh storage/year for 10% off the capacity.

If it scrapes by:

“70% capacity, 37MWh.

65% capacity, 56.7MWh at 14.3 years”

An additional 19.7MWh, for 5% loss ( +4.3 years?)

4.58MWh storage/year, for 5% off the capacity.

From the list I posted, and rounding to the nearest MWh, each 10% change in capacity produces an average difference of 2.4MWh over 10 years; which is incompatible with the above 56.7MWh totals, where the rate of capacity loss has to significantly improve.

To a first approximation, capacity loss will be exponential, because the loss

per cycle is a percentage of the former value. A linear decline would be the

same fixed amount for each cycle. However, a small rate of exponential loss,

approximates the linear. In that case, reaching 70 or 80% at 14 or 15 years, means capacity retention must be 90% or more at 10 years, not 70%.

2.4MWh over 10 years is just 650Wh day, yet reduces capacity by 10%. The

warranty would be very sensitive to use. On the otherhand, the owner is unlikely to fully cycle the battery, leaving a wide margin for Tesla.

The usual 80% limit isn’t arbitrary. It closely follows the point where power output falls to 70% from increased cell resistance, which also reduces

efficiency. Further, when under load, cell voltage falls, and extractable capacity is lowered ( rate dependence). It’s not the same battery with 80% remaining,

but an exhausted battery.

When operated in the “anything else” category (37MWh or 70%) the 37MWh

limit may be reached within 4 years, at which point the batttery will be exhausted, primarily from the mechanical wear and tear of cycling.

Calendar effects also degrade batteries. When advanced, their influence increases faster than those from cycling. That is why Lithium-ion batteries

can operate for some period, then rapidly fade away.

“Solar self consumption” limits use, and extends the putative 37MWh to more than 10 years, where again, the battery will be exhausted.

At 10 years, cell resistance will have increased by one means or the other, and it won’t matter now much capacity remains, because the battery will be exhausted. To avoid rate dependence and power limits, warranted capacity will be defined at a low power output. Tesla do not specify that value, but for many home battery warranties, it’s 0.2C.

I assume Tesla is pretty good at estimating the life of its battery cells. (But I could be wrong about this.) And the average Powerwall 2 will be able to handle a “worst case” situation from the warranty point of view which would be a unit that is fairly rapidly charged and discharged with an average of around 0.78 cycles a day so that it hits its kilowatt-hour limit at pretty much the same time as it hits its 10 year limit. This means it will get the maximum dosage of usage degradation + calendar degradation, and I presume its battery capacity at this point will be some small margin of safety above 70%. How likely it is that battery performance will fall off a cliff after this point will depend on whether or not it has been lovingly crafted to have an extended life beyond its warranty or if they have just done everything they can to get it over the warranty finish line without giving much of a damn about what happens next.

I have an opinion on which is most likely, but as I see no reason to infect this Wanitjunkupai season* with my cynicism I’ll leave it up to readers to decide.

Because the Powerwall 2 is a big battery, the average household that installs one is likely to cycle it less than 0.5 times a day on average. As a result, a Powerwall 2 may last households considerably longer than the 10 years it is warranted for, but the more time that passes the more chance that something vital will fail, resulting in a dead Powerwall, even if there is some life still left in the battery. How long could could a home that cycles their Powerwall 2 around 0.4 times a day expect it to last beyond 10 years on average? I have no idea. I could make a guess, but again I’ll keep my cynicism to myself.

* In South Australia Easter unofficially marked the start of reptile hibernation in the past, but of course global warming is mucking around with this.

Hi Finn – I am one of those “over 60’s that installed solar panels and is happy with the results (just 2 1/2 years old) got a low FiT ($0.061) in NSW and from different readings on the PW2 – looks good but the freaking cost is way, way over my retirement funds so I am holding up until 2020 to see if prices go down on the major battery outfits and see what the overall cost will be.

Keep up these excellent blogs.

The cost of batteries personally imported from China puts a totally different complexion on energy storage. Australian battery retailers are having a lend of purchasers.

Yes Minister!

How do the sums stack up Finn when you get absolutely no feed-in tariff despite returning well over the 12 kWh to the grid each day, you are charged $0.54 kilowatt (or is that kilowatt hour?) during peak times and you definitely use a lot more than the 11.5 kW available in the PW2 each evening?

Me thinks that represents a saving of $0.54 x 11.5 = $6.21 per day = $2,266 per year. On an installation cost of $13,000, that equals a return of 17%. Significantly better than the interest I am paying the bank!

The Labour Govt in Qld is keeping energy prices increases low for households (voters) but slugging small businesses like mine. Rumours suggest a 20% price increase this year alone, so that ROI gets better each year. Did I miss something? Where do you get em?

Hi John. What is your postcode and what tariff are you on?

Hi Finn. 4650 Tariff 22 which is supposed to be cheaper as we are classified Big Business.

Hello John, Ronald here. In your situation where you are running a small business, receive no feed-in tariff, and pay through the nose for grid electricity, a Powerwall 2 may be a good investment.

Looking at tariff 22A I see you have to pay a painful 52 cents a kilowatt-hour or 54 cents in your case in the summer months of December, January, and February from 10:00am till 8:00pm. Outside of this period you have to pay around 26 cents a kilowatt-hour.

Assuming you can always fully charge your Powerwall 2 with solar electricity and have no problem using all the stored energy before 8:00pm once solar output starts to drop off in the late afternoon, then during the summer months a new Powerwall 2 could save you around $7 a day and for the rest of the year when you are paying about 26 cents a kilowatt-hour for grid electricity a new Powerwall 2 will save you around $3.40 a day.

Allowing for deterioration in battery capacity, that should total to around $1,430 a year. Assuming the Powerwall 2 delivers 50% more stored energy than it is warranted for it will last 13 years. Depending on your cost of capital you may or may not find that worthwhile.

I will mention a couple of caveats. Unless your solar system is ginormous you won’t be able to fully charge your Powerwall 2 on cloudy days or even charge it at all, given that electricity will need to be used during the day. This will prevent you using it at full capacity and so reduce the return. Variability in power consumption can have the same effect. There may be times, perhaps if the weather is beautiful, when your electricity use will be unusually low.

So a Powerwall 2 could be a good investment for you, but it will depend on your circumstances and what happens to electricity prices in the future.

In case anyone else is reading this, I want to make it clear that John’s situation does not apply to households. Homes will have difficulty using all the stored energy in a Powerwall 2 during peak periods, they receive solar feed-in tariffs, and they only have to pay an arm and a leg for grid electricity, not four limbs and an ear.

I believe my household will greatly benefit from a powerwall 2 because some days we can use up to 50kWh, half of which is used after the sun goes down. On the best of best days, in the middle of summer, our solar can generate 45kWh. The worst day we have had so far was when Cyclone Debbie came through and the thick cloud reduced our production to 8kWh. Normally a rainy day will yield 16kWh. If not for Ergon limitations, I would have installed even more solar! Even during cooler months when the air conditioners are not working as hard, 13.2kWh from a fresh powerwall 2 would barely cover our night time energy requirements as our daily totals always exceed 30kWh. Where I am in North Queensland, it is extremely sunny 85% of the time, I do not understand how you can say John’s situation does not apply to households because as far as I am concerned, the powerwall 2 will be beneficial to me. I pay 27c import flat rate from the grid. I don’t understand the export price factor, because you can’t have it both ways, you either export it, or put it in the battery. Assuming I am able to fully discharge the powerwall 2 every night, I can save money even without factoring in electricity price increase. After 10 years, batteries will be so cheap and diverse, i’ll get the powerwall 10 for $1000!

Hi Aaron. When determining how much money will be saved by installing a battery system it is important to look at the feed-in tariff. This is because batteries give households a choice between:

1. Sending a surplus kilowatt-hour of solar electricity into the grid for the feed-in tariff, or…

2. Storing a surplus kilowatt-hour of electricity for later use by the household.

If a household is in the Northern Territory where the feed-in tariff is equal to the cost of electricity then no money is saved by storing solar electricity for later use. Currently, if they send a kilowatt-hour of electricity into the grid they will get 25.5 cents for it. If they store it in a Powerwall 2 for use at night then after losses they will only save 22.7 cents. So even if the battery was free, they would end up losing money.

In regional Queensland households pay 27.1 cents a kilowatt-hour for grid electricity and receive a feed-in tariff of 7.4 cents. With the Powerwall 2’s round trip efficiency of 89% this means households will only save 18.7 cents for each kilowatt-hour of electricity that is stored for later use. So if a Powerwall 2 delivers a total of 56,700 kilowatt-hours of stored electricity over its lifetime, which is 50% more than it is warranted for, electricity bills would be reduced by $10,600 compared to not having a Powerwall 2. If the Powerwall 2 costs $12,000 or so dollars installed then clearly it won’t save money.

Wow! :- “So a Powerwall 2 COULD be a good investment for you, BUT it will depend on your circumstances and what happens to electricity prices in the future.”

Apparently horse-sense is not catching if you hang around with a horse.

Ever considered a job in politics, young Ron? Insurance? 😉

…..or, speaking as someone currently trying to deal with lawyers, The Law?

Thanks for your reply Ron! I see your maths checks out. What I would like to know is what if we switched to a TOU tariff? Which inflates import price to 61c/kWh between 3pm and 9:30pm during summer months and 21c/kWh the rest of the time? Is it cheaper then with a Powerwall, still cheaper without or cheapest to stick with our current set up?

On a time-of-use tariff, if a household’s electricity production and consumption line up in a way that let them use all or most of a Powerwall 2’s capacity before 9:30 pm in summer that would improve things a little as the average cost of each kilowatt-hour of grid electricity use avoided would come to around 31 cents instead of 27. But there wouldn’t be many households that could manage it. For those that could, if a Powerwall 2 supplied 50% more stored electricity than it is warranted for over its lifetime it would still reduce electricity bills by less than $13,000 at today’s prices.

Thanks!

Why cant they charege the battery overnight on off peak and isolate the battery during the morning shoulder and only use it during peak pricing times? The solar production is relatively small during the shoulder and early peak, depending on the orientation and slope of your panels and the time of year.

Having said that, I don’t disagree with the general thrust of your argument that the Telsa spokesperson has been cavalier (possibly to the point of deception.)

Great post Finn, and I agree, you have been very generous in your assumptions because on a series of cloudy days, you would have to recharge during off-peak (which adds a cost of 9-10 cents/KWh to the equation) and on a sunny day you would probably never save the full 11 KWh in fact because your panels are likely to cover the majority of your electricity needs. So using the full 11.5KWh every day on peak rate savings is indeed overly optimistic.

Distinguish between:

– Return on Investment – which is a dollar value

– Rate of Return on Investment, or Internal Rate of Return – which are percentages

If I put $10,000 into a bank account paying me 2% per annum, and keep it there for 24 months my Rate of Return on Investment is still 2% per annum, but my Return on Investment is $400. Expressed as a percentage, that $400 is a 4% Return On Investment. Sounds good until you realise it’s over two years not an annual rate!

Tesla could be telling the truth if it claims “A Return On Investment” of 8%-15%. ie over the life of the investment (the battery) you will recoup the outlay and gain an extra dollar value equal to 8% to 15% of the outlay. You say “Of course he doesn’t mean that2. That would be silly”

I disagree – it’s an achievable, defensible claim. Crucially, that’s more than you can say for any other interpretation.

The company would doubtless say that the difference in the dollar value between customers will be due to:

a) how much you paid for the (installed) battery

b) the life & efficiency of the battery

c) the cost of the electricity you used to charge the battery

d) the cost of the electricity you would have had to buy, if you were not able to source it from the battery

a) and b) my be easily quantifiable, but c) and d) will be different between each purchaser. If pushed, you or I or Tesla could easily give half a dozen plausible scenarios through which a purchaser can save $800 to $1500 over the life of the battery

An 8% (ie $800) return on a $10,000 investment over 10 years is a pathetic 0.9% per annum. People who purchased solar as a financial investment when the lead-in tariff was high will just laugh at the current economics of batteries. However people who buy a battery as a “lifestyle” choice may be quite happy with 0.9%. They may see it as helping save the planet etc, and as long as they are not actually losing money they could be content.

The danger, as you have said, is that naïve purchasers will buy these batteries expecting 8%-15% per annum ROI

Don’t forget you have to pay Tax on the interest earned from the money in the Bank. No Tax on the battery…

Also don’t forget you cannot file a claim for a deteriorating (and finally dying) battery. Neither can you insure the whole shebang against a lightning-strike…..among other risks.

By the way, what’s ‘Tax’?? 🙂

Incidentally, anyone who’d settle for bank-interest rate as a ROI would do better to invest their money on a cupful of brain-cells. Simply BUYING bank shares provides a return of about 10% ~ including the 100% franking.

Good point.

Quite right. If this battery last a measly 10 years (far less than is being touted)

that 8% – 15% runs out at POINT 8% to 1 POINT 5% per years.

…….Since it costs more than that (bank fees/charges/tax/etc) to run an account you’d, in fact, being paying the bank etal to take your money.

…..Not unlike paying the electricity provider a ‘service-to-property’ charge for accepting payment of your bill. (not to mention the incidentals ~ like the $2 ‘handling/processing’ fees.

Now, now Jack. You’re risking your credibility through exaggerating.

Over the last 12 months the Westpac share price has fluctuated between $29.40 and $35.05

The company paid $0.94 per share on 4 July and again on 21 Dec. Yes, those dividends are fully franked at 30% but those franking credits are worthless if you are a pensioner who doesn’t pay tax. Even if you can use the franking credits, that yield is more like 8% than 10%.

ME Bank pays 2.8% on “on-demand” deposits, with zero account-keeping fees. ING is similar. No risk of a loss from falling share prices. No cost of buying shares. No cost of selling shares when you need the money.

Bank deposits are low-risk, low-return. Bank shares are higher-risk, higher-return. Powerwall 2 looks like high-risk, low/negative-return.. That’s all you need to say.

To be sure, to be sure….exaggeration is a weakness of mine. I’ve been told so …er, millions of times.

However, given that I’m talking in generalities, I stand by the point made. (and for the record I do very much better than that; check out GEM : 67% capital gain, 6.7% div. 100% franked over a few months.)

Generally:- The major banks maintain a div. of about 6%, and how close you get to that depends on exactly when you buy. And sell. eg. Your fluctuations above produce a dividend range of from 5.4% and 6.4%. (and that ignores the capital gain of 16% over a few months). Franking is 100% ~ at the company rate of 30%)

Further, still in the realm of generalities:- Is there anyone who hasn’t ‘bought the dividend’ ~ which made it possible, with a bit of luck, to buy the annual dividend of ALL FOUR MAJOR BANKS. ie…about 24% pa. COMPOUNDING. (a quick look indicates that unfortunately they’re more in synch recently than they used to be.)

And by the way, shares in the major banks are NOT “high-risk”. They ALWAYS maintain that 6% plus return; and if the banks ever go bust so does the whole country/economy/currency, rendering money useless anyway…. aka: a lightning-strike draws no distinction between tier One and tier Forty-Seven solar panels, no matter how carefully one has chosen, the system’s fucked..

Smile!…. The situation may be desperate: but it’s not serious. 😉

Hello Finn, what is “back-up functionality”?

Thank you.

Hi Ilian,

Backup functionality is the ability to use the battery to power some circuits in your house when the grid goes down.

Full backup functionality is when you can charge your batteries from the solar panels when the grid is down, topping them up during the day.

Partial backup is when you can use the batteries, but not recharge them from the panels when the grid is down, so they may run out if the outage is more than a few hours. If you pay the extra for the PW2 with backup (although it is not released yet), you will get the latter.

Hope That Helps,

Finn

Wonderful thing: Independence!

Powerwall 2 Manual has some information.

https://www.tesla.com/sites/default/files/pdfs/powerwall/Powerwall_2_AC_Owners_Manual.pdf

Providing a link to the manual was very helpful of you, and looking at the manual I see Tesla isn’t being very helpful, as there is not a lot of information there. But it is something, so thank you.

I ran simulations using ATA’s Sunulator program on both the installed cost of my Powerwall 1 and a Powerwall 2. Because the total cost of the PW1 is lower than the PW2 (but more expensive on a $/kWh measure), I found the ROI on the original Powerwall much better… just food for thought.

I suggest “between 8-15 per cent return on investment”? means he’s creating a lot of free advertising/publicity via publications like this one.

…..where’s that bloody horse??! 😉

Hi I am trying to work my way through all this solar stuff and am wondering if it is worth any more having a powerwall if we are on a SWER line and are not allowed to export any power at all.

We pay approx 24.5c/Kwh for tariff 11 (general light and power).

Thanks

Hi Doug, not having a feed-in tariff improves the economics of battery storage. This is because each kilowatt-hour of solar electricity our rooftop solar system generates that doesn’t get used immediately is wasted and provides no economic return. So, provided your rooftop solar system generates enough surplus electricity, each kilowatt-hour of stored electricity you use will save you 24.5 cents. But, if your Powerwall 2 provides 50% more stored electricity than it is warranted for and then dies, it will have only saved you a total of $13,890 on your electricity bills, which I would not consider a worthwhile return on what may be a $12,000 or $13,000 investment. Increasing grid electricity prices will raise the amount saved.

But, looking on the bright side, this is the one situation in which home battery storage will provide a clear economic benefit at the moment by overall reducing fossil fuel use instead of increasing it, as is likely to be the case for homes that can export electricity.

Ronald,

From the last paragraph, do you think grid-connected home batteries increase GHG?

This paper suggests it does.

https://www.nature.com/articles/nenergy20171

I don’t know if there is a free version available, but I have read the paper and followed the source data. There may be some cases where grid mix may reduce the effect a bit, but they would be unusual. In general, it seems

home batteries increase GHG, even without considering the embodied GHG

of the battery.

Since they are also not economical, what remains? Back-up?

If the battery were also used for self-consumption, it would be inconvenient if the outage occurred when the battery were discharged.

In Australia at the moment, battery storage is definitely harmful to the environment and increases greenhouse gas emissions. I write about the problem here:

https://www.solarquotes.com.au/blog/does-battery-storage-help-or-hurt-the-environment/

The estimates I used are a bit crude and I am certain the figure for embodied energy is much too high for modern lithium batteries, but the conclusions still stand. In the future battery storage could help reduce greenhouse gas emissions, but it’s not the case today. The exception is where people are prohibited from exporting solar electricity to the grid. In these cases battery storage can provide an environmental benefit.

The only reason for people living on-grid to have battery storage is to have battery storage. That is, if they just like the idea of having batteries for some reason. Using batteries for backup in blackouts makes no economic sense compared to owning a generator. At the moment there is no rational reason for people who live on-grid and can export solar power to have home batteries, as they do not save money.

Ronald,

Do you have similar calculations for embodied energy due to manufacture of solar panels as well? From a good for the environment standpoint are solar panels a lot better than batteries in terms of payback (saved CO2 emitted) for their embodied energy?

For example if we assume a solar panel weighs 18 kilograms and go with your 2 kilograms of CO2 were emitted for each kilogram of weight in manufactured product we get 2×18=36 kilograms of CO2 per panel. Let’s say 15 panels for a 5Kw system giving 15×36=540 kilograms of CO2 for all panels manufacturing. Perhaps it’s much higher to make the silicon etc and where are the boundaries drawn in this calculation (i.e including mining the ores/minerals used to make the cells)?

From your linked report above “…Fossil fuel generation releases the equivalent of approximately 950 grams of CO2 into the atmosphere per kilowatt-hour…”

To make math easier lets say 1 kg for each fossil fuel generated kWh, 6 hours a day average sunlight so 30 kWh per day from the solar system saves 30 kg of CO2 being produced by fossil fuel generated power. At those numbers the embodied energy of solar panels is ridiculously low so perhaps you have more accurate numbers you can report or link to (or perhaps I am stuffing up the math somewhere)?

Want to understand the picture for the solar only installation and how much it is saving in terms of emissions…

Thanks.

There is an old post of mine here that covers this:

https://www.solarquotes.com.au/blog/solar-panel-energy-payback-whats-the-truth/

Hi James

I go into it a little here:

https://www.solarquotes.com.au/blog/what-everybody-ought-to-know-about-solar-panels-and-the-environment/

In Europe they have determined that solar panels pay back their embodied energy in about one year or less when installed in Sicily where one kilowatt of PV will produce maybe 1,300 kilowatt-hours a year.

Embodied energy counts the primary energy used to make the panels and presumably the supporting equipment such as racks, wiring, and inverters. So if electrical energy from burning coal is used, it doesn’t count the energy in the electricity, it counts the greater amount of energy originally in the coal. And should also include the energy required to mine and transport the coal.

Also, where electrical energy is used, most countries have less carbon intensive grids than Australia does. Even China generates a smaller portion of its electricity from coal than Australia.

Silicon used to make solar cells and the aluminium used to make the frames are very energy intensive materials to produce and one kilowatt of PV will average around 4 kilowatt-hours of generation a day in Australia.

So, since Australia is sunnier than Sicily, it should take less than one year for the embodied energy of PV to be paid back and since Australia’s grid is perhaps the most carbon intensive in the world, the amount of time required to payback the embodied emissions should be less. But just what the actual figures are is difficult to determine.

I call it snake oil…

If you buy a big enough system in WA you can delay if now completely make batteries redundant.

The only time batteries are a must is if you are looking for a large UPS solution.

Commercial applications such as Doctors and Dentists come to mind…

Is it just me – or does a Tesla PW2 with Solar Panels really only start to make REAL sense when you buy a Tesla car to recharge overnight?

I’m afraid charging an electric car with a Powerwall 2 doesn’t make economic sense because it will be putting wear and tear on the Powerwall batteries and so it is likely to be much cheaper to use off-peak electricity during the night or to directly charge from solar if it is parked at home during the day. But Tesla cars have such large batteries that it would be possible for a household with a large enough solar system to do a lot of their electric car charging on the weekend.

Well, have just joined the ranks so can test the economics first hand, Powerwall 2 installed 20/7.

Not set up quite right yet, picking up feed from new 3.2kW Tindo/Enphase micro system but not recording feed from existing 2.3kW string system (7yo) so cannot report on ‘real’ performance, will be rectified next week. App still ‘learning’ too I presume.

Also hope that I can tweak the system with my inputs as opposed to relying on the big Tesla in the sky to think for me? Wondering too whether one can access app style data on a Mac/PC environment – haven’t been able to find that one as yet?

Finally, as the band of PW2 owners grows, also wondering where the best blog site is? —-other than the excellent SolarQuotes of course, thanks Finn/Ronald et-al ;-))

Would appreciate any insights, thanks…

Ronald and Finn,

Thanks to you both for you’re response and links, certainly makes a strong case for getting a solar system for both economic and environmental reasons.

Must say I was surprised (and convinced) by your arguments against battery storage at this particular point in time. A casual assessment had me thinking it had to be a good thing to be able to use as much of the solar energy I was generated as possible for my own consumption. No energy wasted and why wants to get a measly 5 to 10 cents FIT instead of saving “my” energy for later use…

Yet, factoring in the surprisingly high embodied energy of the battery and coupling that to the emissions avoided by feeding the excess into the grid (instead of into a battery) even at low FIT level makes not just economic but environmental sense!