Beware Of Salespeople Making Ridiculous Electricity Price Increase Predictions

A rooftop solar power system is an excellent investment for any home that isn’t at the bottom of a well or otherwise suffering from major shade problems. Earlier this year I wrote an article on payback times in Australian capitals but it’s already out of date as they pay themselves off even faster now. The sun didn’t get any sunnier but solar power did get cheaper. Actually the sun got less sunny, but don’t worry, that’s just a normal part of its 11 year cycle. (It will be decades before solar panels drain enough energy from the sun for it to go out altogether.)

Unfortunately, despite solar power already having an excellent return, some solar and battery salespeople just can’t help gilding the lily by providing potential customers with estimates of savings that include huge increases in the future price of grid electricity. It’s common for these lily gilders to assume annual grid electricity price increases of 10%. There is a technical term for this kind of exaggeration and the term is bullshit. But I’ll leave it up to the experts to decide if it falls into the utter, complete, or pure categories.

The reason it is bullshit is not because after just a few years it would be cheaper to use a diesel generator in South Australia than grid power, but because while Australia has suffered huge increases in grid electricity prices over the past 10 years they have been at an average annual rate of around 7.4% and not 10%. The only way to get a 10% figure is to pick a period of rapid electricity price increase and ignore what happened before and after. And that is not a statistically proper thing to do. It’s a case of lies, damned lies, and salespeople.1

I will explain why I think the most appropriate estimate to use for electricity price increase predictions is 0% real increase. This means it should be assumed electricity prices will simply keep pace with inflation. I’ll also explain what is likely to happen to solar feed-in tariffs over the next few years.

But before I go into this, I’m afraid my identical twin cousin, Donald, wants to talk to you. I didn’t want him bothering you, but he insisted. He’s hoping one of you can help him out, so I’ll turn the article over to him for a few paragraphs…

Would You Like To Buy A Car?

Hey there! It’s great to not see you! The name’s Donald and have I got a fantastic offer for you!

Today, for a very limited time, I have a beautiful Tesla electric sports car for sale. Let me tell you, I’ve driven a lot of great cars, but this car is the best. It’s almost brand new. Sure, I may have gently bumped it against a cow, but you can hardly see the mark and if you buy now I’ll throw in a free esky full of steak! It’s a steal at only $100,000. That’s far less than what it was when I stole… I mean, when I bought it new.

Now I know what you’re probably thinking, $100,000 is a lot of money and maybe you’re not sure you want to spend that much. But trust me, I’m telling you, this car will save you money. It’s all electric. You’ll make your money back through savings on petrol in no time! You might say you only spend a couple of thousand dollars on petrol a year, but let me tell you, its price is about to go through the roof! And I can prove it to you with maths. Take a look at this graph of the price of oil:

Image: Oil Sands Magazine — But not the pony. (Don’t know how that got in there.)

As you can clearly see, from 2007 to the middle of 2008 the price of oil more than doubled. If this trend continues, — and trust me that it will because my word is worth far more than real evidence ever could be — in one year the $2,000 you spend on petrol now will become $3,500. The year after that it will be $6,000. In five years time you’ll be spending $31,000 a year on petrol and in just 10 years you’ll be spending $473,000 on petrol annually. Clearly, you’d be nuts not to buy this beautiful car from me, along with an esky full of meat, for the low price of only $100,000. Cash. Preferably in a brown paper bag…

Okay, you can stop right there, Donald. We’ve heard more than enough. I’m sure no one here wants to buy your cow killer. And what have you done with that graph? Here’s what it looks like in full without the pony:2

Image: Oil Sands Magazine (No pony this time, but I hear the centrefold’s pretty slick.)

Now people can see the full graph it’s clear the run up in price you mentioned was only temporary and you cherry-picked the dates to make the price rise that occurred appear as dramatic as possible.

But since graphs have been brought up, I’ll show everyone some that are relevant to the topic of future electricity price increases. But first I’ll warn everyone this article isn’t for the faint-hearted. Things are going to get pretty graphic.

Residential Electricity Price Increases

Here’s a graph I stole from ABC News. It shows the increase in residential electricity prices since the middle of 1990 but it only goes until the end of the 2016-2017 financial year. It would be nice if it was completely up to date but I couldn’t find a better one to steal and I have far too many cartoons to watch to take the raw data and make my own graph. It shows the real increase in household electricity prices. This means the effects of inflation have been removed:

(Image: ABC News)

The yellow line is the average for Adelaide and the eastern capitals and is called “National” despite leaving out Perth and Darwin. It shows that in the final 10 years of the graph the average electricity price increased by 63%. That’s a hefty amount but it doesn’t mean the average annual increase was 6.3%. Instead it was only 5% on account of maths.3

But these figures have had the effects of inflation removed. During that period the annual average inflation rate was 2.4%. This will make the average annual electricity increase including inflation 7.4%. I don’t care how hard you think maths is, you do not get to round that up to 10%. Only physicists get to do that.

10 Years Is Not A Magic Period

There is no particular reason for basing estimates of future electricity price increases on just the past 10 years. If we look at 20 years instead we get a very different answer. Instead of a 5% real annual increase it’s only 3%. Looking at the past 30 years gives an ever lower figure. If anyone wants to argue we should look at the past 10 years instead of 20 or 30 because the recent past is going to be a better indicator of the future then they need to explain why looking at just the final 4 years on the graph wouldn’t be even better — a period in which electricity prices have declined in real terms.

The period in which electricity prices soared for the sky like some kind of rocket man has been over for years now. I’m in rural Queensland at the moment and Ergon’s per kilowatt-hour charge is two-thirds of a cent lower than it was last year. While definitely not everyone has received a decrease, no one’s getting the crazy increases we were being hit with 7 years ago.4 They are not likely to return because:

- Gas prices have long since finished their huge run up in price resulting from the opening of east coast export facilities.

- Increasing renewable capacity, including rooftop solar, is helping keep wholesale prices down.

- Energy storage is falling in price and becoming more widespread.

- Electricity prices have become a major political issue.5

But you don’t have to take my word for it. You can take someone else’s word for it.

Professional Forecasts

Here’s a graph from a 2017 report by Jacobs Analysis. It’s their mid-range prediction for residential electricity prices and has been adjusted for the effects of inflation:

Clearly they are not perfect at predicting as we haven’t had the huge electricity price increase over the past year they expected. But despite this inaccuracy I’d still say they’re probably better at this than the average battery salesperson. As the graph shows, they don’t see a return to massive price increases all the way out to 2037.6

Future Wholesale Prices

More evidence that electricity prices probably aren’t going to rise comes from the price of future contracts for wholesale electricity. Future markets operate on the principle of pay now — get later. A large user of electricity can put down their money and buy a contract that guarantees them electricity at a fixed rate in the future and lets them eliminate uncertainty. This graph was made by the ACCC using the future prices for wholesale electricity on the first of June this year:

They expect prices to be higher in summer, but this is normal and the peaks get lower over time. As you can see, there is not a significant change in the average price of wholesale electricity in the futures market over the next two and a half years.

Wholesale Electricity Prices Are Heading Down

If the people flogging futures contracts are keeping their prices fairly constant over the next two or three years, then it seems reasonable to assume they aren’t expecting much change in the price of wholesale electricity. But that’s not quite how it works. Because they want to make a profit, the cost of a futures contract will always be a little higher than what the person selling it expects the wholesale spot price of electricity to be when it comes due. Also, the further in the future you want the electricity the harder it is to predict what the price will be and so they increase their margin to allow for that uncertainty. This means if the people selling future contracts hold their prices more or less constant it actually means they expect wholesale electricity prices to fall.

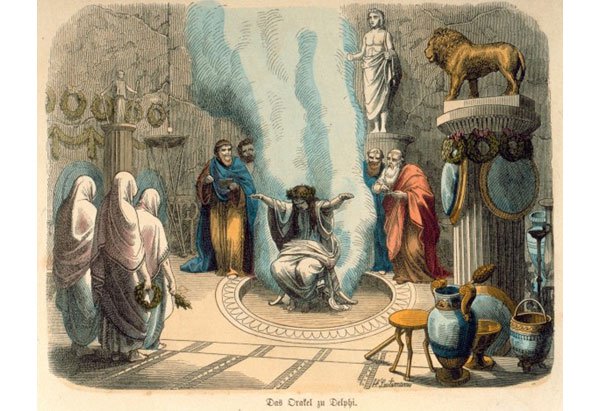

This does not mean they expect electricity prices to fall by a large amount. Competition keeps their margins thin and prevents them from making a huge profit. But they are expecting a downwards trend and I’m inclined to agree with them on this. The future markets definitely aren’t always right, but they are our best method of predicting the future and are probably more accurate than Greek women huffing volcanic fumes.

“Beans, beans, the magical fruit. The more you eat, the more you toot. The more you toot the better you feel, beans, beans for every meal!”

Solar Feed-In Tariffs May Fall

If wholesale electricity prices fall then solar feed-in tariffs may also fall. This is a something that generally isn’t mentioned by the sort of salespeople who make padded predictions about electricity price increases. As the fall in wholesale prices is only likely to be mild over the next two to three years, there shouldn’t be much downward pressure on feed-in tariffs. But wholesale prices could fall more during the day than at night and so increase the likelihood of feed-in tariff cuts. On the other hand, it is possible for solar feed-in tariffs to increase if some of the additional benefits of rooftop solar panels are priced in, similar to what currently occurs in Victoria.

Battery salespeople often don’t mention solar feed-in tariffs at all. Because they have the effect of reducing the return from batteries they may simply not mention them in the hope their customer — or in this case victim — won’t realize they make the return from a battery much worse. This is crappy behavior and puts the installer in a precarious legal position. Under Australian consumer guarantees it is required that goods…

So if an installer tells you a solar battery will save you money and gives you a savings estimate that doesn’t account for the effect of feed-in tariffs, then you are entitled to a refund if you don’t save as much as they indicated. I wouldn’t be surprised if there are many new battery owners in Australia entitled to a refund because they are not getting the savings promised to them.

Salespeople Should Assume No Electricity Price Increase After Inflation

I say the most reasonable approach for salespeople to take when predicting future grid electricity prices is to simply assume they will remain constant in real terms. In other words they will just keep pace with inflation. I actually expect electricity prices will gradually decline, but assuming they will keep pace with inflation is simple and easy for people to understand and so should be the method that’s used.

If salespeople want to want to include a high and a low estimate as well that’s fine, but the estimates should be reasonable and they should point out there is no good reason to expect electricity prices to increase as opposed to hold steady or fall.

When it comes to solar feed-in tariffs, salespeople should point out that at the moment they look more likely to fall than increase unless the methods used to determine them are changed. Battery salespeople need to correctly describe the effect feed-in tariffs have whenever they give information on the potential return from a battery system.

The bullshit needs to stop. Using an estimate for annual electricity price increases that can only be obtained by cherry-picking a period in the past and ignoring what happened both before and after is flat out lying to customers. Consumer law will entitle people to refunds if this is done and the people who mislead customers this way are no better than my cousin Donald who takes pleasure in manipulating others by getting them to accept figures that support his agenda.

Footnotes

- But I’m only referring to lying salespeople here. There are plenty of honest ones out there and if you are one I salute your rectitude. (Note well: Rectitude is NOT a dirty word.) ↩

- What is it with you and My Little Pony, Donald? It’s time for you to put childish things behind you and finally grow up. Then you’ll be mature enough to appreciate She-Ra Princess of Power like I do. ↩

- Because it works like compound interest a 5% annual increase will result in a 63% increase over a 10 year period. ↩

- Well, Western Australia is actually probably in line for another stupid increase. ↩

- I was also going to write that spending on transmission and distribution infrastructure is now less wasteful, but I felt as though I would be lying if I wrote that. I can see excellent opportunities for money to be wasted in this area in the future. ↩

- This is actually only one of three predictions they made. This is the mid-range or “neutral” one and they also made a high and a low prediction. If you want to get a good reputation for prognostication make lots of predictions and simply fail to mention the ones you got wrong. ↩

RSS - Posts

RSS - Posts

“It will be decades before solar panels drain enough energy from the sun for it to go out altogether.”

You might want to be careful making statements like that – some 2-bit (or even 3-bit) media organisation might take it at face value and all of a sudden there will be wide-spread reporting about “the sun going out in just a few short decades according to trusted solar experts”……..

I’ll have to do a follow up report in Autumn pointing out that levels of solar radiation are clearly declining…

“Actually the sun got less sunny, but don’t worry, that’s just a normal part of its 11 year cycle. (It will be decades before solar panels drain enough energy from the sun for it to go out altogether.)”

Scarily there are people who might actually believe that. Scott Morrison might steal it for his election campaign. ROFL.

Clint and Mondo,

You are BOTH wrong I think. The ‘rumour on the street’ is that the outcome of a unexpected early Federal Election and the future energy policy of the government then elected will both be known on April 1, 2019, The sun will then simply give up in despair and stop shining altogether.

It might be time for incentives for west and east facing solar panels.

In the same way there is time of day charging now we have smart meters, we can have time of day tolling for feed in tariffs, so that they are a function of the average wholesale price per 15 minutes or half hour.

As the ideal roofs for north facing solar are filled with panels and those that are left are not suitable because of overshadowing from buildings or trees, the time will come when the largest impact on carbon emissions will come from additional panels located to take best advantage at earlier and later times of the day as at the moment there are many great spots for east and west facing panels to be installed. Feed in Tariffs should be higher for the evening peak than for most other times as that is when there is little solar available and it is also a time of high demand. Many roofs that are shaded to the north may not be shaded to the north east or north west or to the east or west. Remember too that in summer the sun actually rises south of East and sets south of West so panels aligned slightly north of east or west will be reasonably productive if they are elevted at the right angle for the sun in the direction they are facing (but remembering that in the scenario I am positing they will not work much of the time if they are pointed north if north is shaded).

Perhaps the trend to promoting east and west facing panels will start in the far north of Australia and gradually come further south and may never reach Hobart.

Given how much cheaper panels are now compared to say 5 years ago, maybe east or west facing panels have a payback period now similar to that of North facing panels 5 years ago.

The other area for more progress is the establishment of solar farms working in from the periphery of established grids. Eg Nygan has a solar farm that replaces energy flowing along the transmission lines from eg Lithgow to Nyngan. The Nyngans solar farm is made big enough to service Nyngan and to fill the existing transmission line to Dubbo, Dubbo then gets a solar farm big enough to service (after allowing for electricity from Nyngan) Dubbo and fill the existing transmission line from Dubbo to Bathurst. Then perhaps ditto for Bathurst and the transmission line from Bathurst to Lithgow. This strategy delays the need for new transmission lines to bring solar to the largest cities. Eventually it becomes more worthwhile to build transmission lines because the solar farm would otherwise be too less productive and the savings in transmission lines don’t cover the lost production from mislocating the solar farm.

East or west facing panels will produce roughly around 14% less energy than north facing ones so they are definitely worthwhile. South facing panels will produce about one quarter less and so can pay for themselves, though they have much higher output in summer than winter.

In my case the west facing panels have worked out at 89% of the north facing panels.

As most of the power is generated while I am home and using it rather than the North facing panels, which are mainly putting it into the grid……I think the west facing panels are better value.

Check this post on my blog to see how I worked this out:

http://anewhouse.com.au/2018/12/the-value-of-west-facing-solar-panels/

Hi Paul

We actually have 1 x 3+kW string of panels on an East-facing roof, and another on the opposite, West-facing roof. However, the pitch of the roof is only about 15 degrees, so here in Perth at this time of year I’m finding our inverter clamps at a solid 5kW output from about 10 am to 3 pm – produces about 45 kWh/day.

However – if I’d known 2 years ago what I better understand now – I’d have asked for the panels to be pitched up another 10 degrees of so – to allow useful power to start earlier and finish later. This would effectively “load-shift” our breakfast and dinner energy consumption into the generation profile (otherwise we have to have breakfast too late, and dinner too early). Because our tariff is about 3.6 times our FiT, a little loss of total generation would be of little consequence (save much more on using our PV power, than the loss of FiT).

Oh, the benefits of hindsight – I suspect sourcing the hardware to tilt the panels, and implementing this, may swamp the benefits gained.

The production of residential solar must increase faster than large solar farms. If it doesn’t then the feed in tariffs will drop to a point where residential battery storage will look better than what it is now but i cant see being viable for many years to come. Residential solar helps keep the big providers honest but when the supply is greater than the demand its game over for “power to the people”

Really informative article on solar power generation. Over-estimation is really an issue and people need to be cautious about it. Thank you and keep up the good work.

Hi Ronald

In a similar vein (or truthfulness), and with full respect for your work, while simple payback times appear to show the value of rooftop PV to individuals (particularly those who got in on the 46 cent/unit FiT), I remain unconvinced that they are the best, most efficacious technology available for those who do not, or can not have their own rooftop PV – or even for the Nation as a whole.

In my view, payback should be calculated on the true, overall cost of implementing a given technology. For rooftop PV, this should include the true cost of the system, including the value of the STC’s – which to my mind come back to us in one way or another as increased power charges (or less reduced, and if PV is so good, wholesale prices should already be reducing very significantly). Your earlier calculations put a typical simple payback in Perth of 7 years – in my specific case, with 2 years of data and using only the present tariffs forward, my payback calculated to 4.3 years. However, if I then re-calculate using the actual cost of the system (before STC rebates), this goes out to about 8.5 years – which to my mind shows considerable risk of not ever realising a return (if panels fail, for example, and need replacement – or the inverter fails).

And this is before we add in the National impact of the need to run baseload power stations well sub-optimally – or the need to upgrade network capacity if this is required to prevent local over-voltages, etc. After all, SOMEBODY has to pay for these costs.

We have already seen the impact of rooftop PV intermittency, on the life of gas turbines – and we know even nasty dirty coal-fired stations are having trouble with demand-following. Dealing with these types of factors should really be costed to PV – and this will increase the payback time negatively.

I noted the AEMO’s study on 100% renewables shows the demand could not be met with a combination of a wood (biomass) burning, pumped hydro, rooftop PV, geothermal, Utility-level PV, biogas mix, etc., which in itself appears to be almost deliberately avoiding the concept of benefits of scale. To get around this, they introduced the concept of “demand flexibility” – which means really that we cannot necessarily have power when we want it – so involves a loss of convenience.

I note that as Germany started phasing out Nuclear, they significantly increased their reliance on Gas (although this is also reducing, as PV is increasing – but I’d suspect much from Utility-level sources). They import about 50% of their energy – much probably Nuclear-derived (from France), and some Hydro (from Scandinavia?). I’d think it difficult for Australia to do likewise – much is to do with Scale and Population Density, and of course availability across sovereign borders.

Meanwhile, our Utility here in Perth accepts my export energy at the FiT rate of 7.135 cents/unit – then sells it to our neighbours at 25.752 cents/ unit – what a rip-off, as we are all paying the Supply Charge. As an aside – this is what surprised me, when they tried to “fob me off” several times after I pointed out our local inverters were being heavily throttled due to high grid voltages (since fixed).

Levelised costs for rooftop PV in the UK and US appear to show rooftop PV as being one of the most costly forms of energy production available – which to me is not unexpected, due to the small scale installations that necessarily involve quite high added relative costs. To me, Utility-scale PV (with single-axis tracking) makes heaps more sense (economies of scale). Others have pre-empted me (Germany, USA authors), but it seems more sense for us, with massive natural gas reserves, to transition from coal, to natural gas-fired thermal plant with cogeneration and other cleaner and more demand-responsive gas plant as needed and feasible, while progressing to increased levels of renewables where economic to do so.

I still feel that Nuclear, with upcoming GenIV technology, will make a comeback – and I tend to disagree with you Ronald, that “no-one has yet built an economic Nuclear plant” or words to that effect. Why otherwise, with all the history of nuclear, would the UK be planning to build 19 GW of new nuclear power capacity – with the first new reactors expected to be operational by the mid-2020s? At 70 billion pounds Stirling? Why does the USA have 99 commercail reactors, with a net capacity > 100 GW?

I fear we are advancing headlong towards heavily increased energy costs, with less convenience, and lower peak power capacities.

Because energy consumption correlates well with quality of life, I feel we need to be looking at minimum power generation costs – after all, the USA got to where it is in the World, by exploiting the low cost of abundant sources of coal (and iron) – although which they are now paying the price of in terms of mercury being found in mothers breast milk, and increased radon (I think) from the burning of coal in power stations – not to mention the massive loss of life involved both in the supply chain (coal mining accidents), and from lung cancer due to emissions form coal-burning stations.

Let’s by all means get away from coal, but let’s not throw the baby out with the bathwater as we do so.

But lucky me – if our Perth power prices are to rise again soon, this will reduce the payback time of my system (already half-way paid for – if I only include the cost to me, which has been subsidied by others).

PV seems a self-fulfilling prophesy – higher tariffs > better payback – before long, we will all be able to justify batteries…!

But now, I understand the AEMO has forcast Perth will need to curtail PV generation – or else they may ask us to participate in a system that lets them shut off pool pumps, air conditioners, etc – i.e. demand modulation.

For interest, Curtin University is conducting a trial, whereby customers can offer their FiT to local neighbours without PV, in a bidding arrangement. Seems great – I could receive more for my FiT, and they could save on normal tariff costs. Just a pity – I’m not in the small trial area…!

Apropos “They import about 50% of their energy – much probably Nuclear-derived (from France), and some Hydro (from Scandinavia?)”

Just last week, Germany agreed to allow in wind power from Denmark. (Yes, not infrequently, they generate more than 100% of national requirements.)

When the international energy corridor is built, Europe intends to begin renewable energy supply from north Africa. That’ll take time, though. The Noor plant, the world’s largest CST plant, is now powering around a million Moroccan homes, has 7.5 hours energy storage, and saves 3/4 megatonnes of CO2 emissions annually. Their plan to be 42% renewables-powered by 2020 shows how backward we are here. It’s going to cost a bit to go to many multiples of 100%, but replacing all that imported fossil fuel puts them on the path toward helping power Europe. There needn’t be any poverty in Morocco then.

Hi Eric

Yes, and many have complained that at 18 cents/unit levelised cost of energy (LCOE), this Noor plant’s power is too expensive.

In the modelling study below, the LCOE was shown to range between 7.95c/kWh and 42.58c/kWh, depending on parameters – with the lower figures not being realizable due to exceeding the Carnot limits, or the combination of parameters not being feasible in a single power block. The supercritical CO2 Brayton Cycle operating at 560degC was predicted to achieve the lowest practical LCOE, at 12.14c/kWh (or 11.8). Still a little too expensive? Some commentators have said Google switched their investments from CST to PV, as PV gives a better LCOE (I guess utility-level thin film PV – because I think rooftop PV is closer to 15 c/kWh or more when analysed to include all true costs)

https://eprints.qut.edu.au/109557/

I’m also wondering if 7.5 hours is enough energy storage, if power is going to be drawn throughout the night? Extra storage will have a negative impact on the LCOE – increasing costs.

It also appears the practical limit to a power block size is 100MW – worth comparing this to the 1 GW = 1,000 MW normal thermal plant single turbine size.

Ian, as the Noor plant sells energy at 19c/kWh, its cost is most likely in the 12 to 15c range you favour so much. Granted, the original 3.5h storage, now increase to 7.5h, does increase costs as well as utility., but are you comparing CST with 7.5h storage to PV cost with none?

With 97% of energy needs previously satisfied by imported fossil fuels, the trade balance advantages of local renewable generation are stark. For now, it is doubtless nevertheless cheaper to run a fossil fuel powered generator for midnight loads, presumably at a tariff which reflects the foreign exchange cost. If that encourages installation of batteries at customer premises, well and good.

The current plant occupies 7.5 square km, so yes it would seem more efficient to plonk another one down beside it, rather than raise the 248 metre high tower to half a km for another 7.5 square km of reflectors around the perimeter. And yes, it it partly shares with PV a distributed nature, as opposed to the lumpiness of a coal or nuclear powered turbine. That is arguably an asset in Australia, where distributed power generation suits our large distances and small population.

Hi Eric

I’m not sure I favour 12-15c/kWh, and I understood the 19c/kWh figure was the cost, which I thought the LCOE referred to – the C being Cost – is this not correct?

Anyway, what you say about storage reinforces my thoughts about the high “true” cost of rooftop PV.

Maybe CST and the utility-level PV (using thin-film techology, as mentioned by Ronald) are far cheaper options than rooftop PV – which I’d think very likely. This would make them better options for transitioning to renewables – but I’d think our 1st imperative is to get away from coal – so temporarily using natural gas, with less CO2 production as well as the other contaminants from coal, should help prevent large tariff increases during transition – as other newer technologies mature.

You might be interested to know that GenIV nuclear reactors allow scaled back sizing, in modular turn-key packages, which would be ideal for many of our smaller population centres.

We’ve already seen that offshore wind power – which I’d think provides much of Denmark’s power (that they can now export over-capacity to Germany) – is more expensive than onshore wind – and even this is not cheap.

I realise we must all expect to pay significantly more to reduce greenhouse gases – but shouldn’t we be going for the lower cost, more practical options?

The advantage of rooftop PV to our Government, is that we stump up a significant proportion of the Capital cost and fund employment, then the Utilities can make money by selling back our FiT for a cost-free significant profit. All up-side for them, as it effectively disguises increased taxes and charges.

Hello Ian

In response to your concerns about the cost of PV solar this can be resolved with the use of a market mechanism.

What we want is not solar panels or wind turbines or coal power stations or nuclear reactors. These are just means to an end. What we really want is electric power when we want it. And an efficient way to get this is to use a market that reasonably approximates how a market would work under ideal conditions. With an electricity market it is up to the generators to select the lowest cost way to provide electricity. It’s also up to the individual generators to cope with competition and take advantage of technology changes which may alter what is the lowest cost form of generation. If households chose to generate electricity they can also compete.

Of course, in addition to getting electricity when we want it, we also want that electricity not to harm our health or damage the environment. Again market mechanisms can help as the cost of externalities can be priced in. Fossil fuel generators should be charged a price for every tonne of CO2 or equivalent they emit that is equal to the cost of removing that CO2 from the atmosphere and sequestering it long term. They should also pay for the health problems they cause.

As I’m sure you’re aware, we do have a National Electricity Market or NEM and this does allow different generators to compete with each other. It’s not perfect, but it does work. What we don’t have is externality pricing. If coal power had to pay to remove the CO2 it emitted this would cost perhaps 7 cents per kilowatt-hour for coal power and perhaps half that for gas depending on the generator. Estimates for the health effects of fossil fuels vary but it may be 1 cent per kilowatt-hour for coal power. As you can probably see this dwarfs STC payments which are a less efficient method of reducing health and environmental damage.

So we already have a system in place for determining the most efficient mix of generation — if the cost of externalities are not accounted for. Obviously we need to fix that part of the system as soon as possible as what we have in place is far too inadequate to make economic sense.

Many thanks Ronald for helping me clarify my thoughts concerning power generation. I 100% agree that what we really want is reliable, cheap, readily available, healthy, and convenient power, to maximise our living standards whatever the technology mix needed to achieve that end. I guess my concern was that subsidies and politics tend to cause severe distortion of the market – making it difficult to see if we are being “sold a pup” – but I do see that charging dirty generators for STC’s is making them pay for the impact their production is having on CO2 and health – it is sort of providing something as least, to cover some of the “externalities”.

In my particular case, for PV, I was credited 129x$38 = $4,902 in STC’s and will displace about 105,000 kWh in 12 years use (allowing for panel degradation over time, and 85% transmission efficiency from the coal plant).

At the 7 + 1 cent/kWh you have suggested for externalities, this works out at an externalities cost of 0.08 x 105,000 = $ 8,400 – wow, Western Power got off cheap, nearly half price (we burn mostly coal, and other nasty things here in the West).

On top of that, I will export 78,000 kWh over the same 12 years, that if our FiT of 7.135 cents/kWh stays the same will cost them will cost them $5,565.

Most of this power will be consumed locally (many neighbours and local shops and businesses do not have PV), so with a transmission efficiency of say 90%, they will then sell 78,000 x 0.9 = 70,200 kWh back to the local community at 25.752 cents/unit (or more, for businesses), realising them $18,078 in return – a profit of at least $12,513.

What a great business model – pity I can’t set up a “paper” business that buys and sells PV-exported power – so I could just sit back and line my pockets.

I can see why you think the present market system is broken.

When I got quotes for my system, one the companies provided their financial “model” to demonstrate the financial benefits. That was nice of them however most assumptions or inputs were tweaked to make the return look far more favourable than it realistically would be.

It was silly. Partly because I have a solid bullshit detector, but also because had the model been presented with realistic inputs and assumptions the result would have still demonstrated a very good and worthwhile return.

The problem is, by presenting bullshit in one aspect of the sales process I wondered about the rest of their offer. Sure enough the technical solution was also found wanting. It wasn’t bad but there were others who clearly thought about it more.

I built my own model, added missing performance elements and factored in more plausible inflation factors.

I decided the most suitable option was no change in prices for first 2 years, then 2% CPI after that. Turns out that this year’s prices are in fact less than last year’s.

For FIT I decided to leave it flat but would also look at the outcome with FIT gradually reducing.

No model assumptions could make a battery look good *in my case*. FIT could be zero and it’s still not enough. Batteries simply cost too much. 2-3 times too much.

Which brings me to the other bullshit tactic used:

Modelling a PV + battery system together to make the extra spend on a battery appear worthwhile.

Tweak the assumptions and well voila you can make a battery system look half OK. Problem is the PV component of the investment is doing all the heavy lifting, while the battery is a literal as well as a figurative lead weight.

It’s quite a clever trick but you should always model the PV system on its own, then model what adding a battery brings to the equation. It’s quite revealing – and will often point you to either not bother with the battery or to consider other uses of the resources such as means to reduce energy use (e.g. investing in efficiency measures, lowering heat transfer losses). Or if the battery has other specific functions of import to you other than saving money (e.g. you want a UPS / backup solution) you can at least place a realistic price on that function.

Of course there is a 3rd tactic some play on themselves – and that’s using more energy than is necessary when the PV is producing because that also makes the return look better than exporting the excess. It is of course a false economy. Sensible load shifting is sound strategy of course.

Looks like you really did your research and made some sensible assumptions there. Combining the return from solar and batteries to hide the fact that batteries are a money loser is definitely a major deceptive tactic in battery sales:

https://www.solarquotes.com.au/blog/blended-payback/

Glad to hear they weren’t able to take you for a ride.

Thanks. The other comment I would make is when doing modelling it’s a good idea to do a sensitivity analysis.

By that I mean seeing how much the outcome changes for say a 5% or a 10% change in each input assumption.

Sometimes a 10% change in one assumption only alters the outcome (be it payback, ROI, or IRR) by a much smaller proportion, while other factors result in a larger proportional impact.

This way you can see which assumptions and inputs matter most and are worthwhile seeing if you can nail them down more tightly if possible, or at least know the scale of impact if your predictions are wrong. While other inputs you realise you need not be so concerned with having a perfect assumption.

Hi Ronald

Synergy in WA is pushing batteries on their website – I think giving the option to include them as part of an overall package with the rooftop PV.

https://www.synergy.net.au/About-us/News-and-announcements/Battery/When-is-the-right-time-for-you-to-invest-in-battery-storage?utm_id=eml024022258008014014

The good thing is, so long as any potential purchaser has the will to follow it through, that they provide a Calculator – what I did notice, for a 5kW system, that adding a battery increased the payback time from 4-5 years, to 10-12 years!

I’ve contacted them by email, to say this could be misleading to many customers, especially if they haven’t “read the fine print”, or are unable to understand the impact of the calculation.

Perth’s time-of-use tariff is now the best in the country for the economics of battery power, but even with it batteries won’t save a normal household money once capital costs and efficiency losses are accounted for:

https://www.solarquotes.com.au/blog/batteries-time-of-use-tariffs/

However, it is getting close. But if Synergy is saying batteries can save a normal household money overall, even if they do say it takes 10-12 years it sounds like it could definitely be a case of false advertising.

Hard to get to Synergy WA’s PV model – but one thing I did note:

*Estimated savings calculated using the current Home plan (A1) tariff and Renewable Energy Scheme Buyback rate. Estimate assumes 80% of system output offsets electricity consumption and 20% is exported. Actual savings and ideal system size may will vary based on your specific circumstances and the way you use energy*.

Seems they may have gotten their use assumption backwards – you’d have to be a really high user, to consume 80% of PV generated power – we use about 21% – similar to Ronald’s model.

Their potential savings would be greatly exaggerated, and likely payback period much more than the quoted 4-5 year figure.

Appears a bit like Ronald’s shonky salesman.

As another Perth “customer” or “Synergy Sheeple” my partially & randomly shaded to the north* my 2013 3Kw system with mini-inverters cost an extra $2,000 (i.e. $5,000 compared to $3000 – a massive %age increase) to cope with the locale. Over the first three years it paid for itself in full despite sending a nett export of just over 2Mwh into the grid at the paltry feed in tariff (FiT) of 7.1cents per Kwh (unit) compared to the slug of 23 cents, then 26.7, now near enough to 30 cents per Kwh for imports.

If I spent the same $5,000 today on an unshaded 5Kw system in a better location it would actually take a lot longer to pay off. Why? The daily supply charge (segue to gnashing of teeth) has doubled whilst the likely increases in power cost per Kwh (as Ronald correctly stated) will be minimal and the FiT is also not likely to alter.

Back to batteries – given outages about once a month which are “more than mildly inconvenient” it is not really an economic decision so much as a practical one. To provide a standard interactive UPS big enough to do the whole house from companies like Emerson (i.e. from the IT sector) would cost more than a complete new solar panel system with adequate battery backup inbuilt. Sometimes the whole is more (relevant) than the sum of its parts.

Nuclear – Apart from China (no real solid figures available), no recent nuke plant has been even close to budget, most have ultimately failed to go ahead and cost a huge amount for a worthless hole in the ground (i.e. N Carolina). Your British flagship example is already way over its original budget, so it is on the same trendline. US is currently closing a few (circa 20 at the moment?) of their 450 plants each year. All nuclear power plants need to be refuelled every 18 months or so, which takes them off the grid for roughly a month – i.e. this needs to be taken into account when developing realistic “uptime” figures (note: they are quietly ignored). They are only economical when run at 100% capacity as their fixed costs (like labour) cannot be reduced as their output drops. Even the “recently revived via legislation” New Jersey plants are being subsidised at over $US1 billion each per year to remain open. As if that is not bad enough, the US has an enormous stockpile of waste which they cannot seem to get rid of and the most recent estimate (Energy Biz online) was over $US27 billion just to place it all in one non secure spot. At another zero to that cost to store it somewhere convenient for the next few millennia? Where do I sign for that? Oh, and while I am at it, the fusion reactor in the sky is not exactly the cleanest of power plant either – so if that technology ever works I suspect the shielding cost may be as astronomical as the rest of the construction bill. Micro nuclear reactors in items like submarines or space stations may make sense, as power plants I see a sunset due to economics, not any environmental concerns, followed by a twilight nightmare of accumulating waste costs. Looking at teh whole picture that way is also illuminating.

shaded to the north*: actually 4 panels to the east, 8 to the north, west is fully shaded, so no panel there wold be useful.

Hi Arron

Wow!, you certainly got a great system, for it to have paid for itself in 3 years.

Could you please share some details of how this payback period was arrived at?

I’m very interested, as my 6.24kW system appears to be perfoming well, but even at twice the size of your system, will only Generate about 30 MWh in 3 years – my 3-year export, even though we self-use a paltry 21%, will be only about 23MWh – barely more than your system, at twice the system size. What are we doing wrong? Were you reciving the 46 c/kWh FiT?

My ears pricked up. when you stated the longer payback for a 5kW unshaded system today was a consequence of the doubled Supply Charge.

Why so? While the Supply Charge can be offset with funds from the FiT, what bearing has this on the payback period? As far as I can see, the Supply Charge simply increases the cost of our power each month – it has no impact on payback?

Nuclear cont’d: These two links from Energy Central (i.e. the actual industry, not the political viewpoints) which I just found in today’s email are interesting.

https://www.energycentral.com/news/heres-what-could-happen-diablo-canyon-once-it-closes?utm_medium=eNL&utm_campaign=WEEKLY_NEWS&utm_content=482524&utm_source=2018_12_14

“What will the decommissioning process look like?

Short answer: “lengthy and complicated.”

According to the report, the process will include decisions on big-ticket issues like long-term storage and removal of spent nuclear fuel, and would likely take decades. An example timeline provided in the report lists activity going through 2076.

Naturally the costs are $US 4 billion just for that one plant closure.

https://www.energycentral.com/news/us-must-start-scratch-new-nuclear-waste-strategy-stanford-led-panel-says?utm_medium=eNL&utm_campaign=WEEKLY_NEWS&utm_content=482524&utm_source=2018_12_14. Done by Stanford Uni.

“The U.S. government has worked for decades and spent tens of billions of dollars in search of a permanent resting place for the nation’s nuclear waste. Some 80,000 tons of highly radioactive spent fuel from commercial nuclear power plants and millions of gallons of high-level nuclear waste from defense programs are stored in pools, dry casks and large tanks at more than 75 sites throughout the country.”

That makes the mere $US40 billion in their Nuclear Waste Fund look pretty paltry, doesn’t it?

I really wish pro nuclear posters would take a good hard look at the worldwide industry figures before pushing their barrow. One can only dream…

Hi Arron – re- Nuclear

I’m not “pushing a barrow” – but I still think we have a DUTY to consider all forms of technology – whether it be PV, Wind, Wave, Wood burning, CST, Nuclear, of even digesting pig manure for Biogas.

There are of course many issues with nuclear, but the good side of the coin is that they produce HUGE quantities of energy, day, night, windy, sunny of raining – without contributing at all to CO2 production.

Those 75 waste storage sites around the country in the U.S., are mostly actual sites at the various nuclear plants – yes, they store it on site, because these are secured, and because protests and regulations and the like prevent them from transporting the waste elsewhere. 80,000 tons appears like a big figure – but is only just over 1,000 tons per site (average) – which in the overall scheme of things is trivial.

There is a Business Management 101 adage, called “The fallacy of sunk costs”. Basically, this means we should not think “we’ve put $xxM into this, we just HAVE to keep going” – but instead think “how much more will we have to put in, and what impact will this have on the final profitability/economics outcome” – if unmanageable, you need to cut your losses – that is, change the project, or shut it down.

It is not at all uncommon for projects to go over budget, and many mines for example, have substantial remedial work requirements on closure. This does not automatically mean that they become uneconomic – sometimes it just means the payback is a little longer.

As far as looking hard at worldwide industry figures – do you really think the UK would not have done this? Do you really think they just thought “were going to build a big nuclear plant, whatever the cost and consequences”?

The numbers are all big. The Doel Plant is due for shutdown, but had it’s 2 smaller reactors come online in 1975, Doel 3 in 1982, and 4 in 1985. At a total capacity of 2.919 GW it is not Belgium’s largest plant, but it has an average generation of 21,670 GWh per annum – by my calculations, that’s an average availability of 85% – compare this with my PV effective availability of 18.3%. At 21,670,000,000 kWh per year, that’s 2,167,000 times as much as my 6 kW system can produce! Perhaps more than all the PV in Australia combined? At a true PV installed cost of ~ $ 19.5 Billion or more every 12-15 years! About 3 times the cost of an equivalent nuclear station.

Let’s look at this over the last 33 years, and retail the power produced at say 20 cents/ kWh. 21,670,000,000 x 33 x $0.2 = $ 143 Billion income.

That’s a lot of dosh – especially if the operating costs may be only 5 c/kWh (i.e. not counting capital amortisation). From 1 plant alone – the USA has heaps more. The planned Hinkley Point C nuclear power station in the UK is of similar size, with a projected lifetime of 60 years, so scalling from above, income ~ $ 260 Billion. At a predicted cost of ~20 billion pounds, say this is ~ A$ 31 Billion, and initial production ~ 24 pounds per MWh (~ 4 cents/kWh Australian), you can perhaps see why they’re interested.

“Wholesale prices are heading down” you say. Then why am I not able to take out an electricity contract with the rates fixed for a couple of years?

Maybe that is because “past performance is no indicator of future performance” as the Superannuation funds tell us.

Maybe the gentailers can see more clearly than anyone else what the prices are going to do in the next few years, as the End Of Life of coal stations gets ever closer.

I’d be happy for you to to say “Yes, you can get fixed priced contracts….”, but the Energy Made Easy (https://www.energymadeeasy.gov.au/) web site does not have “fixed rates” as one of its selection criteria; which tells me that no retailer is prepared to offer them.

As far as I am aware, the big three electricity retailers, Origin, AGL, and Energy Australia will offer fixed rate contracts for 2 years. Perhaps the Energy Made Easy site has a problem showing them? It’s also possible they may not be available in all areas.

But note that wholesale prices heading down is not the same as residential electricity prices going down. Not if distributors and retailers can convince regulators they need more money to deal with storm damage or for paying footballers with the number 9 on their jersey. But if you want to buy wholesale electricity at fixed rates you can. By the megawatt-hour. But if you’re not running a large business these future contracts are not very convenient and you’ll still have to pay for transmission, distribution, etc.

I was wondering while reading this thought provoking discussion from Ronald and Donald if the decline in electricity prices would be happening if renewable energy was not an increasingly portion of electricity production.

Hi Ronald, This is a great read – I really enjoyed it. A little more than 5 years since this was published… Time for an update now the crystal ball has reset? It would be really interesting to see where things landed from then ’til now.

Glad you enjoyed it. We have mostly worked through the price increases resulting from Russia’s invasion of Ukraine, so I’m expecting considerably lower prices in the future. Price falls will come from a gas glut, now much cheaper solar panel prices, and far cheaper battery storage. Renewables will continue to push down wholesale electricity prices. South Australia used to have the highest wholesale prices of all the states but for the past 4 or 5 years they’ve either been in the middle of the pack or below average. Battery storage will compete with gas outside of periods of exceptional demand and also reduce prices. Just how much of a drop in electricity bills consumers will see remains to be seen, but I’m expecting significant drops in real terms.

My future proofing on batteries was (fortunately, it turned out) delayed by a little thing called COVID19…Average usage – still about 15KwH daily, mostly daytime in summer.

The batteries were finally installed early last November ($10,000 for a nett 10KwH storage capacity). Not an economic decision (yet) and the 6.6Kw Sunpower / 3 phase Solaredge upgrade has been put on temporary hold – Solaredge have failed to lodge some “red tape paperwork” temporarily (I hope).

So my 2013 3Kw (Renesolar) panels are still on the “partially shaded” roof. FWIW, they are still around 90%+ of their 250W rating (given the shading it is difficult to measure, however the “historical seasonally adjusted output” has barely shifted since 2013).

As it was a temporary stopgap, I didn’t really expect much difference to my Synergy (WA) bills. For once, a pleasant surprise. Partially (probably) helped by the hottest summer for quite a while, both recent quarterly bills dropped by over $250. Even using some aircon on some days doesn’t seem to have had a huge impact.

Upgrading the panels so the batteries are fully fed each day will make some “summer difference” – the current setup goes from 30% charged at sunset (full day aircon on a 43 Celsius day) to 70-90% charged (ideal conditions). In winter the difference will be huge (more heating at night).

Will the batteries pay for themselves? A “definite unqualified maybe” (Richard Nixon). Is the backup power / lack of outages worth it – absolutely.

As you can probably tell, I still have mixed feelings about installing batteries today – even though the economics are way more compelling than 4 years ago.

Arron