![]()

What does the ongoing increase in the cost of polysilicon used in the production of solar panels mean for Australian solar buyers in 2021?

After falling below USD $7/kg in the second quarter of last year due the initial impacts of COVID-19, polysilicon spot prices shot up following a series of explosions at plant owned by polysilicon production giant GCL-Poly in July 2020. That month, a fire also occurred at the plant of another polysilicon manufacturing goliath, Daqo New Energy.

Prices reached around $12.50/kg by mid-September before the situation started improving. In early December, the polysilicon spot price was sitting at $10.59 per kg.

But this year has seen prices head north again to even higher levels than last year. There has been a significant spike from below $12/kg in February to $13.56/kg last week according to an update from Bernreuter Research.

![]()

This time last year, polysilicon spot prices were well within the $8 – $9/kg range.

Daqo New Energy Corp is one of the world’s biggest producers of polysilicon. The company has been doing very well from these price increases, but Daqo Chief Executive Officer Longgen Zhang commented last week polysilicon supply will continue to be very tight throughout this year.

Solar panels weigh around 21kg and while silicon is the star material, it only makes up around 550g of a panel – or a bit over 1kg if wastage is taken into account. So, it’s not a huge amount; but …

Shortages Not Confined To Polysilicon

JinkoSolar vice president Dany Qian recently stated solar panel prices have risen significantly in China since the second quarter of last year due to the tight supply of not only polysilicon, but also glass, silver and module frames. Solar cell and panel manufacturers don’t operate on huge margins, so upstream pricing pressure is being passed down to buyers.

And while a bunch of manufacturers have expanded and are continuing to expand solar panel and cell production capacity – including Jinko, Longi and Trina – having enough capacity to meet demand has also been a challenge. Ms. Qian says panel prices will continue to increase for the next 6 months or longer.

Impact On The Cost Of Going Solar In Australia

The good news is the situation isn’t increasing the cost of solar in Australia – yet. In fact, the cost per watt of a full system installation has dropped significantly since the same time last year.

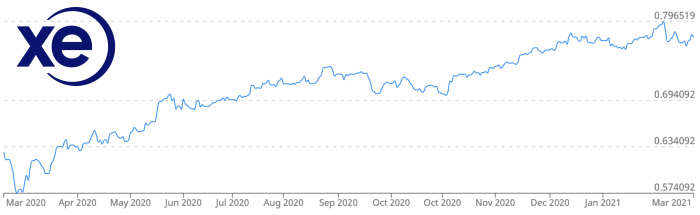

So, how have Australians been protected from these price rises? We can thank the strength of the Australian dollar against the US greenback.

A strong Australian dollar will continue to provide a buffer as materials supply and manufacturing issues are being sorted out, but if the last year or so has taught us anything it’s to expect the unexpected.

Added Note On Polysilicon

Raw polycrystalline silicon, usually referred to as polysilicon, is used to make polycrystalline *and* monocrystalline solar cells.

Trivia: Back in 2008, polysilicon spot prices reached a whopping USD $450/kg.

Related: Which Is Better – Polycrystalline Or Monocrystalline Solar Panels?

RSS - Posts

RSS - Posts

Adding to future price pressures on polysilicon is the fact that at some future point existing natural gas reserves will run out, or become uneconomic to extract.

According to this article in ‘Renew’, ( at : https://renew.org.au/renew-magazine/renewable-grid/goodbye-to-bass-strait-gas/

that may happen sooner than we think, The Bass Strait reserves have been running down for some 55 years, and there are no known nearby untapped reserves ( BHP and Exxon have now ceased further exploratory searches for other untapped fields in the area – none could be found).

A Victorian gas ‘supply gap’ of around 50% is expected from 2025 on-wards,

Future gas shortages seems a world-wide problem. To quote from the article:

“In California, the City of Berkeley passed an ordinance that all new homes will be gas-free. The United Kingdom Committee on Climate Change recommends that by 2025, no new homes should be connected to the gas grid. The Netherlands, which is situated over one of the largest gas fields in the world (now depleted), recognises the need to decarbonise 1100 homes (on average) every working day from now until 2050.”.

Here in Australia, even the major gas retailer AGL is now promoting the benefits of an all-electric home (see: https://discover.agl.com.au/your-home/setting-new-home-benefits-electricity-gas/ ); and highlighting the environmental benefits of making a switch from gas to all-electric.

State governments don’t seem to be fully on board yet though, and AGL’s attempts to gloss itself with a shiny ‘green’ varnish seem a little unconvincing.

This article here:

https://www.abc.net.au/news/2021-03-11/liberals-environmental-activists-oppose-agl-plant-at-crib-point/13235250

outlines AGL’s plans to develop a major gas hub at Crib Point in Victoria, and there’s been some hostile public reaction.

However, whether or not there’s been any ‘government’ involvement in the decision in order to promote job creation under the guise of also firming up baseline power is unknown.

All in all, in seems to me that there will be added upwards pressure on polysilicon prices due to solar PV replacing not only coal but also gas as a source of energy.

Des Scahill,

You make some pertinent points.

You state: “Future gas shortages seems a world-wide problem.”

I’d add that petroleum oil supply shortages seems to be a looming world-wide problem.

Per US petroleum geologist Art Berman’s tweet on Feb 16, world crude oil + condensate production has returned to the 2005-2011 plateau. Almost all incremental supply growth since 2011 was from the United States.

https://twitter.com/aeberman12/status/1361429207860002826

On Feb 12, Art Berman tweeted a graph showing US historical oil production from 1900 through to 12.0 Mb/d peak in 2019, then decline in 2020, and forecast out to 2050. The graph indicates US oil production is unlikely to regain the 2019 peak of 12 Mb/d.

https://twitter.com/aeberman12/status/1359950289068052490

Has global ‘peak oil’ supply passed? Hallock et. al. projections are so far shockingly accurate – See Figure 5: https://economicsfromthetopdown.com/2020/11/16/peak-oil-never-went-away/

Yet governments at all levels here (federal, state, and local), businesses, and the mainstream media seem to be oblivious to the ominous signs. Petroleum-dependent infrastructure works still continue to be planned and constructed – e.g. Western Sydney Airport.

It seems to me that there will be added upwards pressure on polysilicon prices due to solar PV replacing not only coal but also gas **AND PETROLEUM OIL** as a source of energy.

The YouTube video below titled “Can flying go green? | The Economist”, published Feb 11, duration 0:08:07, highlights some of the big hurdles. And that’s just aviation.