Image: seagul

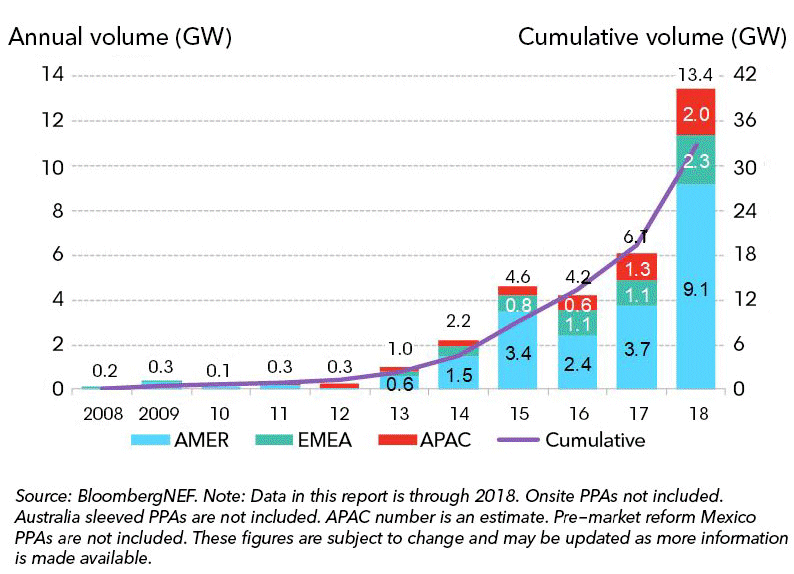

BloombergNEF (BNEF) reports corporations across the world entered into agreements covering 13.4GW of renewable energy capacity in 2018, more than double 2017’s figure of 6.1GW.

BNEF states clean energy contracts were signed by 121 corporations in 21 different countries over the course of last year.

More than 60% of the 13.4GW figure occurred in the U.S., where 8.5GW was purchased, nearly triple the amount signed in 2017. In the Asia-Pacific (APAC) region, companies inked a record 2GW of deals. Practically all of this occurred in India (1.3GW) and Australia (0.7GW).

In the image above, it mentions that Australian sleeved power purchase agreements are not included. So, what is a sleeved PPA?

In the image above, it mentions that Australian sleeved power purchase agreements are not included. So, what is a sleeved PPA?

There are three main types of PPA, on-site, direct (aka sleeved or physical) and financial (also known as virtual, synthetic or contract for difference). Just briefly:

- In an on-site PPA, a developer builds a facility on the buyer’s property and electricity is supplied direct to the premises. The developer pays for the installation and assumes the responsibilities for its operation and maintenance.

- In the case of a direct PPA, the seller delivers renewable electricity to the purchaser from an off-site facility, usually via an electricity retailer intermediary. In a direct PPA, the purchaser takes legal title to the energy.

- In a financial PPA, the buyer pays a fixed price for renewable energy from an off-site facility, but the electricity generator sells the energy on the open market. If the price received is higher than what the buyer has paid, it receives the difference. If the price is lower, then the buyer pays the difference.

BNEF’s head of corporate sustainability, Jonas Rooze, says clean energy and decarbonisation targets align with overall corporate strategies of companies serious about sustainable growth, while creating a huge number of opportunities for renewables developers, utilities and investors.

“Corporations have signed contracts to purchase over 32GW of clean power since 2008, an amount comparable to the generation capacity of the Netherlands, with 86% of this activity coming since 2015 and more than 40% in 2018 alone,” stated Mr. Rooze.

More from BNEF’s 1H 2019 Corporate Energy Market Outlook can be found here.

2019 has also started out strong for corporate power purchase agreements. A couple recent deals we’ve covered in the last week or so relate to Google and Facebook.

While renewables-based PPAs are proving to be very popular among corporates as a way of reducing energy costs and slashing emissions, for smaller businesses in Australia installing and owning solar panels on the rooftops of their premises can achieve the same. Given the plummeting costs of solar energy in Australia, these days if a business can afford to pay its electricity bills then it can afford commercial solar power.

RSS - Posts

RSS - Posts

Despite the ‘negative propaganda’ campaign constantly underway by the coal, natural gas, and nuclear industries against renewables, its good to see that more and more businesses and even entire countries world-wide are turning to the truly renewable energy sources such as solar, wind, hydro, pumped hydro etc, simply because the economics are so compelling.

Just a few examples are: Amazon – which is busily adding roof-top solar panels to its distribution centres through-out the world, including the UK, In October 2017 the company announced that its ‘Amazon Wind Farm Texas’ was now operational and supplying 1 million megawatts a year to the grid.

Ikea has been progressively installing PV arrays on the roofs of it’s large USA stores since at least 2012, and currently markets solar systems itself in the UK.

Walmart and Target in the USA are also investing heavily in roof top PV for their stores. To quote from this 2018 article in PV Magazine USA (which you can read in full here: https://pv-magazine-usa.com/2018/04/23/walmart-to-host-solar-power-on-130-more-sites/

“In recent years, Walmart has been surpassed as the largest corporate installer of on-site solar in the United States. Despite having a much smaller number of total stores, Target has taken the lead. In 2017 the company widened this lead by installing 56 MW of solar on its facilities, versus a mere 5 MW at Walmart. However, Walmart is planning to bounce back. In an announcement last week related to its “Project Gigaton” to reduce supplier emissions, the retail giant announced that it will install solar on another 130 of its stores. This will to bring it to a total of 500 locations across 22 states and Puerto Rico.”

Denmark is heavily committed to wind power, and has at times of high winds generated their entire electricity needs and exported surpluses to other countries such as Norway, which in turn has used the cheap power to add to its own ‘pumped hydro’ reserves.

Portugal – which uses all three of wind, solar and hydro, and intends expanding further its generating capacity is now looking at possibly exporting its future expected surplus electricity too. ( see: https://www.theguardian.com/environment/2016/may/18/portugal-runs-for-four-days-straight-on-renewable-energy-alone ).

Here in Australia a recently released CSIRO/AEMO joint study – titled ‘GenCost2018’ – has found that: ‘Our data confirms that while EXISTING fossil fuel power plants are competitive due to their sunk capital costs, solar and wind generation technologies are currently the lowest-cost ways to generate electricity for Australia, compared to ANY OTHER new-build technology.

“At a global level, the investment costs of a wide range of low emission generation technologies are projected to continue to fall, and we found new-build renewable generation to be least cost, including when we add the cost of two or six hours of energy storage to wind and solar.’

For the benefit of those without a financial background, the term ‘sunk capital costs’ is used in the quote above to indicate that the original huge outlay needed to build existing coal powered plants was made so long ago, that the establishment/construction costs involved have now been fully recouped, leaving only ongoing maintenance and operating outlays to be recovered.

In the auto industry, Ford now powers its world headquarters with solar, and has installed EV charging points in its car parks for employees to re-charge their personal vehicles with. BMW in the UK now powers its auto manufacturing plants with solar., and Audi has been progressively introducing solar PV into its manufacturing plants since 2010. Firms such as Apple and Google now source virtually 100% of their energy from renewable sources.

Now if only Ford would make a couple of decent EVs for it’s employees to drive…

I wouldn’t be too optimistic at all about ‘plummeting solar energy costs’.

According to this Jan 2019 Reuter’s news article at :

https://www.reuters.com/article/us-davos-meeting-solar-gcl/party-is-over-for-dirt-cheap-solar-panels-says-china-executive-idUSKCN1PI2OQ

‘Solar panel prices tumbled around 30 percent last year after China, the world’s largest producer, cut subsidies to shrink its bloated solar industry, pushing smaller manufacturers to the brink of collapse.

To raise cash and stay afloat, manufacturers cleared inventory and diverted sales offshore, sending prices into a downward spiral – offering up a windfall for solar power generators and investors in solar farms. … Luo said solar panel prices were already stabilizing and he expected them to rebound by 10 to 15 percent as the Chinese industry consolidates over the next year or two. … At home, Luo said China was rapidly nearing the point where the solar industry could operate without any form of subsidy. He said northwest China, where sun was more plentiful and land less expensive, had already reached that milestone.

Most of the rest of the country would follow this year, before the age of subsidies ends completely in 2020, he said.”

What the above implies is that the cost of China sourced panels could go up somewhere between 10 and 15% in the next 12 months or so. Adding to that will be the effects of tariff barriers, the rundown of any existing stocks of panels held in Australia that were purchased at the lower price, and of course exchange rate fluctuations. ( seems more likely the AUD will go down vs other countries rather than up in the short to medium term ).

On top of that, who knows how panel manufacturers in countries other than China will react so far as their own pricing is concerned? As well, there seems to be a growing demand for ‘non-residential’ solar within Australia and elsewhere in the world, whereas up till now a high proportion of the demand has come from the household sector.

Your guess is as good as mine as to how this will all finally pan out so far as end prices to us humble Australian consumers are concerned. But given all the rather negative looking uncertainties – prices UP for solar PV systems rather than prices down seems more likely to me.

“prices UP for solar PV systems rather than prices down seems more likely to me.”

Depends – you just made a case yourself for increase demand. So if they ramp supply up to meet projected demand then prices could actually go down if the cost of raw materials is stable. OTOH if demand outstrips supply prices will definitely go up.

I think they’re fairly price sensitive so increasing the cost of panels by 10-15% will probably just result in less panels being bought. Also I think large scale solar probably buys on contract directly from the manufacturer rather than buying existing stock. And they would definitely only buy premium panels.