Image: CarbonTracker

54% of Europe’s coal fired power plants are already running at a loss and within 13 years, just about all of them are likely to meet the same fate says a new report.

CarbonTracker says companies expecting to operate their coal units beyond 2030 are putting their assets on a collision course with the Paris Agreement and the mega-trends of renewable energy, battery storage and demand response.

Currently, coal power represents 18% of total operating capacity and 26% of total generation in the European Union. However, its days are numbered and by bailing out sooner rather than later, electricity utilities could collectively avoid losses of €22 billion (around AUD $34.46 billion).

The forecast based on an analysis by CarbonTracker of a coal phase-out in Europe consistent with the goal of the Paris Agreement

The “Lignite Of The Living Dead” report states several factors will continue to undermine the economics of coal power in the EU, potentially making the fossil fuel based electricity generators “unusable” by 2030 – they would become stranded assets.

“The changing economics of renewables, as well as air pollution policy and rising carbon prices, has put EU coal power in a death spiral,” said Matt Gray, Carbon Tracker analyst and report co-author. ” Utilities can’t do much to stop this other than drop coal or lobby governments and hope they will bail them out.”

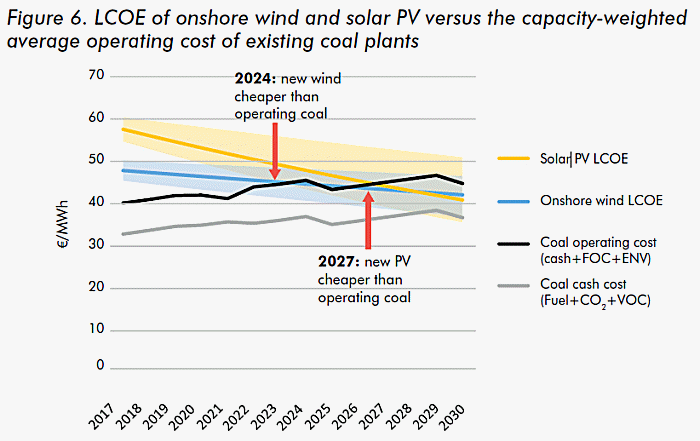

CarbonTracker says many utilities could be caught with their pants down. At this point, 27% of operating coal units in the EU are planning to close before 2030, but building new onshore wind and solar power projects will be more cost-effective than operating existing coal power stations by 2024 and 2027 respectively.

“Utilities with exposure to coal power in the EU are at a strategic crossroads: continue to invest in coal and hope governments will allow rent-seeking in the form of capacity and retirement payments, or divest and prepare for a low carbon future,” says CarbonTracker.

Ongoing capacity market payments, which are paid to ensure adequate generation resources are available to meet demand for electricity at all times, can’t be relied upon. The European Commission has proposed to prohibit coal from receiving capacity market payments by 2025.

As for compensation for early closure, CarbonTracker points to the Netherlands, where the government has implemented a carbon price and avoided paying compensation to asset owners.

That leaves lobbying to avoid regulations – something that could easily backfire on the sector given public sentiment and the Paris Agreement.

More from the Lignite Of The Living Dead report can be viewed here.

RSS - Posts

RSS - Posts

Speak Your Mind