Don’t let soaring power bills kill your business – commercial solar can slash your bills.

Business is a kind of miracle where humans put aside their natural desire to screech and fling stuff at each other to work together to achieve common goals. And the most common goal among businesses that are still in business is making money. Unfortunately, focusing on this has led to some undesirable consequences such melting the icecaps.

If our civilization wants to continue as an ongoing concern then we need to make money in a way that doesn’t damage the environment. Fortunately, I know something that can help business both make money and protect the environment and that something is commercial rooftop solar power.

Do you want to protect the world from becoming a global sauna? Well, every kilowatt-hour of electricity generated by a commercial solar system reduces fossil fuel generation by around 1 kilowatt-hour. Do you want to be so rich you’ll be able to hire a battalion of chimpanzees to fling stuff at people with less money than you? Well then I can’t really help you, apart from suggest you get some therapy. But I can tell you it is possible for even small businesses to save thousands of dollars a year by investing in commercial solar and this should get you at least part way along the road to untold riches.

Commercial solar is often the best investment a business with an unshaded or mostly unshaded roof can make, because:

- The cost of rooftop solar power has fallen a long way.

- The cost of electricity has never been higher

- Feed-in tariffs are usually available for surplus solar electricity businesses send into the grid, and…

- Commercial solar is tax deductible.

In this article I am going to concentrate on commercial solar power for small businesses. While the main difference may seem to be one of scale, systems over 100kW raise a number of issues that don’t apply to small businesses.

How Large Is Small Scale Commercial Solar?

With one quick internet search I came across three legally important definitions of what a “small business” is. For convenience I’ll borrow the the Australian Bureau of Statistics definition which says a small business is one that employs under 20 people. Generally a workplace with 19 or fewer people is not going to have a whole lot of roof space for solar panels. While they don’t have to go on the roof, that’s often the only practical place for them. As a result, I would say commercial solar systems for small business will generally be from 5 kilowatts to 20 kilowatts in capacity.

While most businesses these days have three phase power, it is still possible some commercial properties will only have single phase. Without paying for the expense of an export limited system, this will limit the business to a 5 kilowatt inverter with a maximum of 6.66 kilowatts of solar panels.

Unfortunately, if a business is off the main grid in a rural area that has Single Wire Earth Return (SWER) power lines, they will generally either have to pay for a system that can export limit or make do with a very small solar system.

Solar Electricity Self Consumption

Using energy from a rooftop solar system saves a business more money than sending power into the grid. This is because the cost of grid electricity is higher than the feed-in tariff received for providing solar electricity to the grid. Because of this, the higher the portion of electricity from a solar power system that a business consumes itself, the faster it will pay for itself. But a small system with a very rapid payback time is not one that will save a business the most money in the long run. While it is possible to try to calculate the perfect sized system, many businesses are going to run out of suitable roof space first and so have the decision on how large their system will be made for them.

The Simple Payback Time Of Small Scale Commercial Solar

A simple rule of thumb is business investments have to pay for themselves in 7 years to be worthwhile. It’s only a rough guideline but surprisingly accurate for a wide range of capital equipment including cement mixers and sausage machines. Because the cost of borrowing money has been relatively low for a long time, some people say this rule of thumb should be extended to eight years or more.

Of course, some people take rules of thumb further than others…

The simple payback time is simply how long it takes the savings from a rooftop solar system to equal its original cost of installation. It’s a fairly rough measurement as it leaves out a lot of detail, but it has the advantage of being simple and easy to understand, so I am going to run with it.

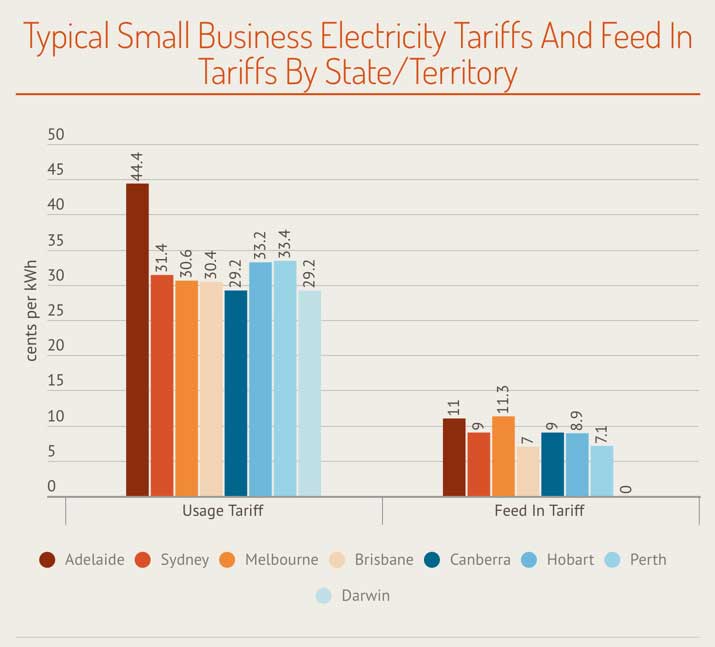

Small Business Electricity Charges And Feed-In Tariffs

We can work out the simple payback time for small businesses by first looking at what they are charged for grid electricity. Origin Energy is the largest retailer in Australia and displays its standing offers for small businesses that use less than 438 kilowatt-hours a day on their site. The per kilowatt-hour charges and solar feed-in tariffs they offer in Australian capitals are:

- Adelaide: Charge per kilowatt-hour = 44.4 cents Feed-in tariff = 11 cents

- Sydney: Charge per kilowatt-hour = 31.4 cents Feed-in tariff = 9 cents

- Melbourne: Charge per kilowatt-hour = 30.6 cents Feed-in tariff = 11.3 cents or more

- Brisbane: Charge per kilowatt-hour = 30.4 cents Feed-in tariff = 7 cents

- Canberra: Charge per kilowatt-hour = 29.2 cents Feed-in tariff = 9 cents

In Tasmania, Western Australia, and the Northern Territory, electricity retailer competition has been kept out for better or worse. Well just better actually, as I can’t see any any advantage for consumers in states that have it. Examples of electricity plans for small business their capitals are are:

- Hobart: Charge per kilowatt-hour = 33.2 cents Feed-in tariff = 8.9 cents

- Perth: Charge per kilowatt-hour = 33.4 cents Feed-in tariff = 7.1 cents

- Darwin: Charge per kilowatt-hour = 29.9 Feed-in tariff = 01

Assumptions

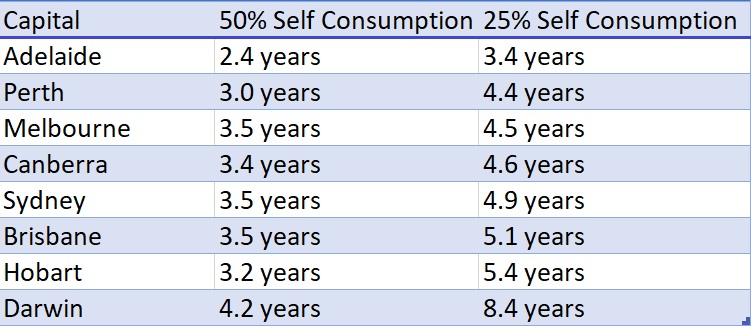

Using the above prices and feed-in tariffs, I will calculate the simple payback time for commercial solar for a business that self consumes 50% of the electricity their solar power systems generate and for those that self consume 25%. I will use the following assumptions:

- The cost of a solar power system is $1,000 per kilowatt of panel capacity. This comes to $1 per watt.

- Solar generation is equal to the amount given by the PVWatts site for north facing solar at a 20 degree tilt.

- The benefits of commercial solar being tax deductible are ignored.

The Simple Payback Period Can Be Under 3 Years

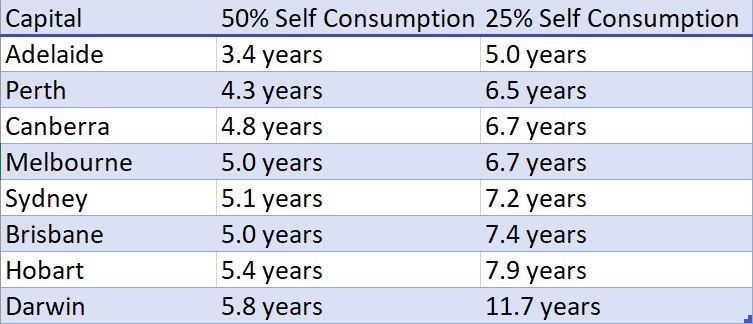

With these assumptions we get the following results:

As you can see, Adelaide is a clear winner, while for systems with 25% self consumption the only place that does not have a simple payback time of under 6 years is Darwin. This is because businesses there are generally not permitted to export any power to the grid, causing all their surplus power to go to waste.

It seems clear to me, given the above assumptions and especially because I have ignored the benefits of its tax deductibility that commercial solar for small businesses can pay for itself in any Australian capital. This includes even Hobart, which is the worst city in Australia for solar power.

A More Pessimistic Estimate

What’s that? You think my estimate may be a little too optimistic? You think that if you want to survive in business it is important to consider the downside possibilities and that things may not be as rosy as in the assumptions I made? Well, to that I can only say — quite correct. Clearly, you’re no dummy. While the stars are definitely aligned in the favor of small scale commercial solar power at the moment, that may change and it is worthwhile considering what the simple payback period may under less favorable conditions. So I’ll determine what it would be if:

- Electricity prices were lower.

- Feed-in tariffs were lower, and…

- Solar system output was lower.

Commercial Solar Is Unlikely To Become More Expensive

Fortunately, we don’t have a Donald Trump dumping punitive tariffs all over imported solar panels2, so solar suddenly becoming more expensive is something that’s probably not going to happen. While it is always possible the Australian dollar will fall and push up the cost of panels and inverters, I don’t see solar power suddenly getting more expensive before you have a chance to install it as being a real risk. I expect its price to continue to gradually decline, even with the STCs that reduce its price slowly being slowly phased out3.

Electricity Prices And Feed-In Tariffs May Fall

Lower electricity prices and feed-in tariffs are a real possibility. I expect both to fall, at least slightly, over the next couple of years. Victoria’s minimum feed-in tariff already looks set to fall from its current 11.3 cents to 9.9 cents from the 1st of July. So I will recalculate the simple payback times with the assumption there has been a 10% fall in electricity charges and a 20% fall in feed-in tariffs.

System Output May Not Be Ideal

I used the figures provided by the PVWatts site for north facing solar panels at a 20 degree tilt. But I find the PVWatts figures a little optimistic compared to what’s usually obtained in real life. In addition, it’s not always possible to install solar panels facing north. East or west facing generally produce around 14% less electricity over a year than north facing ones, but the amount will depend on location. In addition some sites suffer from shading for part of the day. So I will assume the annual amount of electricity generated will be 20% less than what PVWatts says north facing panels at a 20 degree tilt will produce. This will cover panels facing east or west with mediocre output, or north facing panels with enough shading to to significantly reduce their output.

Still No Benefit From Tax Deductibility

While the ability to deduct commercial solar power is generally a major benefit, there are still many businesses that currently pay no taxes and may not require any further deductions to continue to not pay any. So I will continue to assume no benefit from tax deductions.

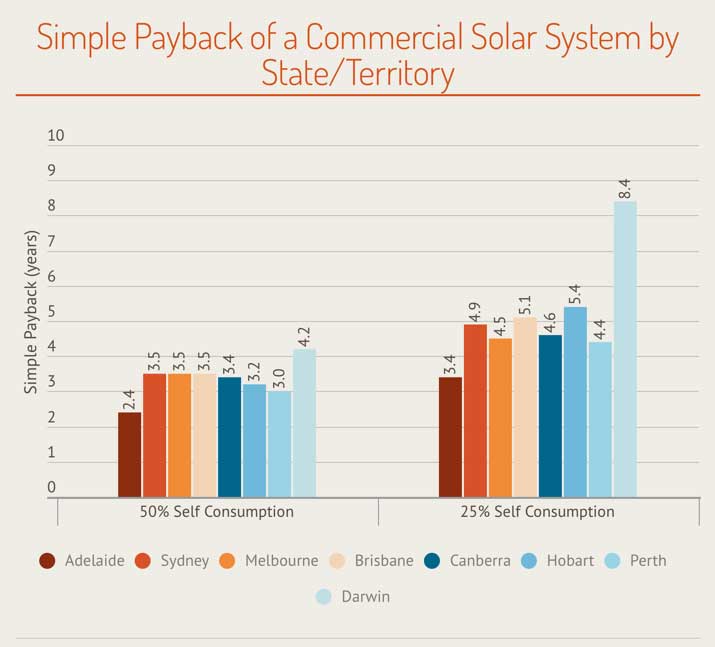

A “Not So Good Case” Scenario

What I am about to show you is not a worst case scenario. A worst case scenario would be far more severe and involve certain assumptions I’ve made about the presence of dark magic in the world to be erroneous. But this case is still pretty bad and involves the following assumptions:

- The cost of a solar power system is still $1,000 per kilowatt of panel capacity, or $1 per watt.

- Electricity charges per kilowatt-hour fall by 10% from their current level.

- Feed-in tariffs fall by 20% from their current levels.

- Solar energy generation is equal to 80% of the amount given by the PVWatts site for north facing solar at a 20 degree tilt.

- The benefits of commercial solar being tax deductible are, once again, ignored.

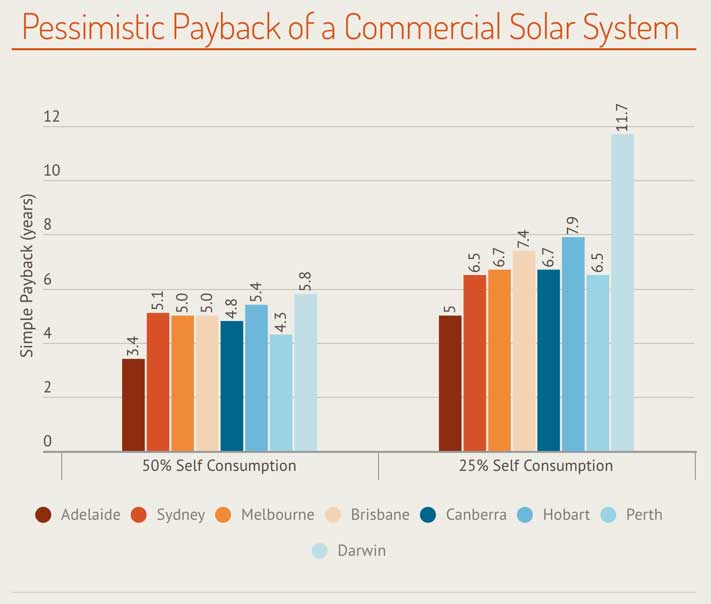

Under these conditions the simple payback time for small business commercial solar with 50% and 25% self consumption are:

So even using a set of fairly lousy assumptions, commercial rooftop solar with a self consumption rate of 50% still has a simple payback time of less than 7 seven years in every capital. With a self consumption rate of 25% simple payback nudges above 7 years in Sydney, Brisbane, and Hobart, but don’t go above 8 years anywhere except Darwin, thanks to the lack of feed-in tariffs for commercial solar power there. But provided the self consumption rate doesn’t fall too low, it is clear to me that a commercial rooftop solar system can pay for itself in every Australian capital and almost certainly in every Australian town or city on the main grid.

Beyond Simple Payback

There are more sophisticated ways of determining if rooftop solar is worthwhile for your business than just looking at the simple payback period and I may go into them in the future if people are interested. But if the largest system your business can fit on the roof is likely to result in a solar electricity self consumption rate of around 50% or less then you can be very confident it will be a good investment.

Tax Deductibility

The tax deductibility of commercial solar systems provides considerable advantage over residential solar power. However, it’s hard to quantify as the value of tax deductions can vary between businesses and from year to year and their are multiple ways to handle the depreciation of assets. But it is definitely worth keeping in mind when estimating commercial solar’s value as an investment.

Install before 30th June 2018 To Write It Off Instantly

According to the Australian Taxation Office, if you install commercial solar for a small business before the 1st of July this year you can instantly write it off provided it cost less than $20,000. This can definitely make it worthwhile to install a commercial solar system sooner rather than later.

Quality Commercial Solar Power Can Cost Less Than $1 A Watt

I used a figure of $1 a watt for the cost of commercial solar systems in my simple payback period estimates. But for larger systems of 10 kilowatts or more where there is nothing about the roof that makes installation particularly difficult, it is possible to have installations done by a reliable installer using quality components for under $1 a watt. Of course, there is always the danger that you will get an unreliable installer, so I suggest using SolarQuotes and getting someone who has been vetted by Finn.

Just to be clear, I’m not saying it is a good idea to go for a cheap system. While there are those who say the tax deductibility of commercial solar power means it can make sense to go for a cheaper, less reliable system because the cost of repairs and replacements can be written off, the savings aren’t always going to be worth it. One resource that is always in limited supply in companies is attention and having a reliable solar system installed that can operate for a decade or more without anyone needing to give it a thought can leave people in a business free to concentrate on more productive things and is an important consideration.

Australian Consumer Guarantees

Australian consumer guarantees apply to commercial rooftop solar systems if they cost less than $40,000. Because of the protections they provide it can be worthwhile to buy a system that costs less than this or multiple systems for under $40,000 each. But most solar systems bought by small businesses will cost much less than $40,000 and so are covered.

What If You Don’t Own The Roof?

If you don’t own the roof, because of the high return and rapid payback commercial solar can provide it can definitely be worthwhile to come to an agreement with your landlord where you share the costs of a system. Unfortunately, some landlords are very difficult to deal with, so I’ll have to get around to writing an article on how to successfully hypnotize your landlords. I’ll start by practicing on chickens. But until I perfect my methods, it probably wouldn’t hurt to mention that installing solar can reduce air conditioning costs for tenants.

Footnotes

- Business with solar in the Northern Territory are generally limited to zero export, which means they are not permitted to send any solar electricity into the grid and so receive no feed-in tariff. ↩

- Although I’m sure Tony Abbott would be happy to dump on imported panels if he could get away with it. ↩

- Note that just because I think that rooftop solar power is likely to continue to fall in price does not mean it make sense to wait for it to become cheaper before getting it. You’ll lose far more by not saving money on electricity bills while you wait. ↩

RSS - Posts

RSS - Posts

Hi Ron,

100% agree with your assumptions and have the evidence to prove it. Wrapco installed a 57kw system in February 2014. Our 2013 electricity bill was $25,580. With solar installed our 2017 bill was $7,146. By my calculations without solar based on our growth and power price rises our 2017 bill would be circa $31,000.

Since 2014 we have made a number of additional changes to reduce energy use and and our environmental footprint. We installed a high efficiency air compressor, LED lighting everywhere, replaced aging ducted aircon with zoned split systems, use energy efficient motors and reduced manufacturing waste through more efficient production methods. It all adds up to us now having a far lower carbon footprint and in time we hope to be effectively carbon neutral.

Our initial install cost was $88,000 or $1.543 per watt. Cost to install was far higher than your calculations based on current PV prices. Yet to date we have saved over $55,000 based on our then 2013 power bill. The saving is well over $67,000 if all increases are accounted for. By the end of 2018 the install will have well and fully paid itself off. From then on we are earning/saving $24k plus per annum.

It’s a simple “No Brainer” to install solar if you are a small business. Also I am delighted that my neighbours in Braeside Victoria agree as there are now 4 new solar installations within 100 metres of our location. Cheers H.