Solar feed-in tariffs are what you get paid when your rooftop solar power system sends energy into the grid. Their value will decrease in the future. This is inevitable. As more solar capacity is built it will drive down the price of daytime electricity.

But solar feed-in tariffs won’t disappear any time soon and will exist for years to come. While there may be ups and downs, the overall decline over the next 5-10 years should only be moderate. Even in the far future, for as long as we’re still doing the whole buying and selling thing that has been so popular over the past few thousand years, electricity from rooftop solar panels should still be worth something, even though it may not be much.

Because I don’t expect their price to plunge, I am confident you can buy solar and get a reasonable solar feed-in tariff for the entire payback period. This is under 5 years for most households. But I do recommend assuming they will decline modestly, just to be on the safe side. This will, of course, slightly extend the payback time.

Image: Space Cop — a movie so bad it’s really very bad.

If I Am Wrong — Hooray!

If I am wrong about solar energy taking many years to drive feed-in tariffs down and instead solar is installed so rapidly it quickly drops them down to almost zero, then my response would be:

Yahoo! Mission accomplished1

Sure, I’d feel a bit stupid, since it’s the opposite of what I said would happen, but a world in which solar power is that cheap is a world where fossil fuel will be mostly eliminated from electricity generation. I’ll tolerate having egg on my face if the reduction in global warming means birds won’t be laying hard-boiled eggs in the future.

Regrettably, this doesn’t seem likely to me. Solar energy will be cheap enough to drive out fossil fuels, but the process will take years and feed-in tariffs won’t be eliminated any time soon.

I Assume Solar Electricity Won’t Be Stolen

I’m going to assume that in return for exporting clean solar electricity to the grid, people will receive a feed-in tariff that is within spitting distance of being fair and reasonable compensation and the electricity won’t simply be stolen.

I know there will be some pessimists who will think I am being naive about this2. But if the powers that be couldn’t eliminate solar feed-in tariffs back when Tony Abbott was PM and using the full force of his charming personality to ensure no icecap remained unmelted, then the chances of them pulling it off now seem small. Much of the population now have rooftop solar panels, as well as businesses, and I doubt politicians will want to piss off that many people.

I’m not going to go into any depth on what makes a solar feed-in tariff fair and reasonable, because that’s a can of worms I don’t want to open.

I’ll simply state:

- A kilowatt-hour generated from a roof in a town or suburb is worth more than a kilowatt-hour generated by a coal power station in Tarong, Gladstone, or Mt Piper because it doesn’t require long-distance transmission.3

- How much of local distribution charges solar-electricity should pay is a topic of lively debate that I won’t go into.4

- Solar energy has clear health and environmental benefits over fossil fuels that do not pay for those costs.

- As a goddamn minimum, a kilowatt-hour of rooftop solar electricity has to be worth at least as bloody much as a kilowatt-hour generated from coal.

Note that when I talk about electricity prices in this article, I’m referring to average wholesale electricity prices and not the higher retail electricity price you have to pay on your bills.

We Will Adapt

One reason feed-in tariffs aren’t about to disappear any time soon is that society will adapt to lower daytime electricity prices:

- Homes and businesses will shift some of their electricity consumption to the day.

- Increasing amounts of energy storage capacity — mostly batteries — will make use of low daytime prices to charge up.

- Our remaining coal power stations will be shut down.

Consumption will shift to the daytime: Large businesses are already taking advantage of lower daytime prices and will take even more advantage if prices fall further. Lower feed-tariffs give households an incentive to shift consumption to the day to take more advantage of their rooftop solar electricity generation. This will become easier as home energy management systems improve and fall in price.

Energy storage is increasing: Lower cost battery cells, such as the ones used by Tesla, are now around $150 per kilowatt-hour. While there’s more to battery storage than just cells — they have to be wired together into packs and need supporting electronics — their cost has fallen a long way and the decline is clearly going to continue. While the installed cost of home batteries is still too high to make financial sense for most Australians, home and business battery storage has a lot of potential. We’re also likely to end up with a huge amount of mobile battery storage in electric vehicles.

Thermal energy storage may also be used and pumped hydroelectricity capacity will be increased by a large amount if the proposed Snowy 2 scheme goes ahead.5

Because this energy storage will be sucking up cheap daytime electricity and discharging it during the evening and morning peaks, it will limit the fall in daytime prices while also helping keep them down during evening and morning peaks.

The generating mix will change: As solar capacity expands we won’t keep operating all our current fossil fuel power stations. We’ll start shutting them down, starting with the coal power stations that are most costly to run. Every time one bites the dust it will provide a boost to electricity prices and feed-in tariffs, followed by a fall as the price increase encourages the construction on additional renewable capacity.6 This will continue until there are no more coal power stations to close.

Solar Farms & Rooftop Solar

There are two main forms of solar power that supply energy to the grid:

- Distributed solar power systems

- Large scale solar farms

Distributed solar: I usually refer to distributed solar as rooftop solar, because that’s where you usually find it. But it doesn’t have to go on roofs. It can go on the ground, walls, windows, or anywhere the sun shines. So under the carpet’s no good.

With rooftop solar there is a home or business underneath the solar panels making use of the electricity that’s generated before any is sent into the grid. It’s only the surplus power that’s exported for a feed-in tariff, although most solar homes these days produce considerably more solar electricity than they consume.

Solar farms: There is nothing at a solar farm to use the electricity produced, so all output is supplied to the grid.7 The exception is if there’s on-site battery storage.

Solar Farms Can’t Eliminate Feed-in Tariffs

Solar farms are built to make money. While most of the people involved in these projects want to save the planet — very few have a vested interest in destroying it — they’ll only get the resources required to construct them if they make a reasonable profit. For this reason, solar farms can never eliminate solar feed-in tariffs.

Even if the cost of large scale solar falls by half over the next 7 years — which is not impossible as it’s only taken around that long in the past — it still has to make money to be built. So while enough large scale solar could be constructed to drive average daytime electricity prices down to almost zero, no one would do it because it would drive electricity prices down to almost zero.

Solar Farms Can Drive Feed-In Tariffs Very Low

While solar farms can’t eliminate feed-in tariffs, they can drive them down a long way. At the moment the world’s lowest-cost solar electricity will come from the Al Dhafra solar project in the United Arab Emirates (UAE). This huge 1.5-gigawatt solar farm will be built in return for just 1.35 US cents for each kilowatt-hour it produces. At the current exchange rate that’s 1.9 Australian cents.

This solar farm is expected to begin supplying power in the second half of 2022. But this doesn’t mean in just two years time solar farms can cause the average price of daytime electricity and feed-in tariffs to fall to under 2 cents per kilowatt-hour in Australia. This is because:

- The project is in a very sunny location.

- Solar farms here are unlikely to receive a 30 year Power Purchase Agreement (PPA) as in the UAE.

- If solar farms could be built at that price here, it would still take years to construct enough capacity to drive average daytime electricity prices down that far.

The Best Solar Locations Aren’t Near East Coast Cities: While Australia has locations that are just as sunny as the UAE, they are a long way from population centres. Perth comes close to being an exception, but a solar farm in the UAE will still produce 6% more energy than an identical one near Billionairetopia. For most of Australia, the choice is either to build solar farms in locations that considerably less sunny or build long-distance transmission lines that will raise costs. This means even if all else was equal, solar farms couldn’t be built here for the same low cost.

Their PPAs Are Bigger Than Ours: The UAE solar farm has a 30 year Power Purchase Agreement that guarantees they will receive 1.9 cents per kilowatt-hour for 3 decades. PPAs here are generally much shorter, with many being around 10 years. A shorter PPA means the price per kilowatt-hour will have to be higher and this is another reason why solar feed-in tariffs unlikely to plunge in price. Costs are more likely to be front-loaded.

Electricity contracts such as PPAs play a big role in stabilising wholesale electricity prices and may be a major reason why prices generally haven’t fallen as far as I expected due to the pandemic.

Coal Plant Closures Will Boost Prices

Increasing renewable capacity — both wind and solar power — is pushing down wholesale electricity prices and this has already driven some fossil fuel generators out of business. Coal power is particularly vulnerable because, unlike gas, it’s inflexible and unable to easily shut down during periods of low electricity prices. A typical Australia coal power unit can only cut its output to around 60%. Because stopping and starting increases wear and tear and maintenance costs, Australian coal power is poorly suited for competing with renewables, which have far lower operating costs and infinitely lower fuel costs8.

This will result in coal power stations being driven out of business. But they won’t all shut down at the same time. Instead, it will be a more gradual process and each time a large one closes it will boost the price of electricity and thus feed-in tariffs.

An example of this occurred in November 2016 when the owners of the Hazelwood brown coal power station in Victoria announced it would close down in March 2017. This came as a surprise because the highly polluting power plant was expected to operate for years to come. But it had simply become too dangerous for workers and had to cease operations. This unexpected closure has been a major contributor to the high wholesale electricity prices we’ve had since then.

Projected Coal Closures

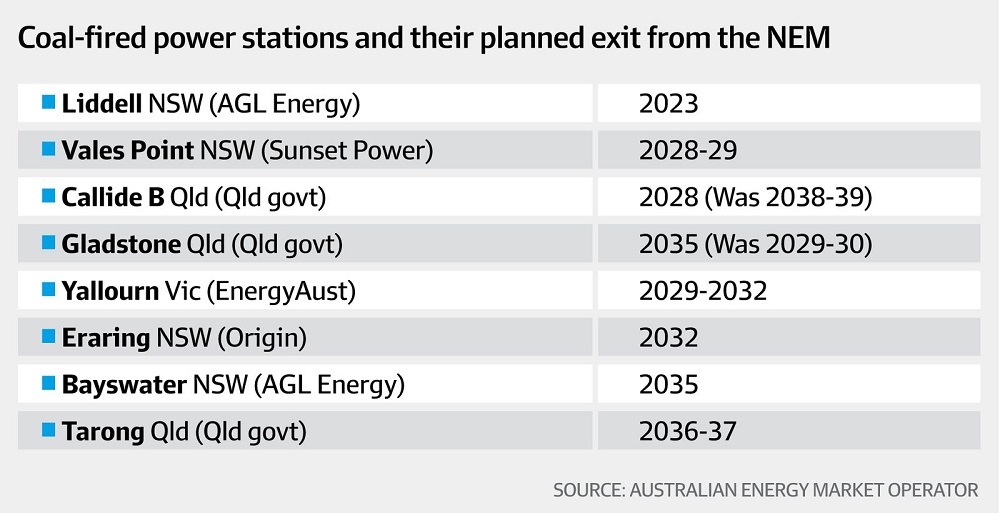

Here is a list from October last year of projected coal plant closures. But I regard any coal power predictions beyond 5 years as being fictional:

Image source: Financial Review who got it from the AEMO

While the chart makes it appear coal power stations will be operating for many years to come, in reality they’ll be shut down as soon as they stop making their owners money. For some of them, that point is coming soon. Thanks to the pandemic, it may already be here.

Despite the current economic downturn caused by the coronavirus, renewable energy projects are going ahead in Australia and taking advantage of considerable falls in the costs of solar panels and wind turbines. While the price of coal has fallen, this doesn’t affect the majority of Australian generation using stranded coal that can’t be exported. This means the pandemic has reduced the price of electricity without reducing the fuel costs of these coal power stations, while also lowering the cost of building renewable capacity. Record low-interest rates also favour renewables, as they are high capital and zero fuel cost sources of generation.

Without an economic recovery, I expect to see a general fall in wholesale electricity prices and feed-in tariffs until the Liddell coal power station is closed in 2023 — assuming it doesn’t occur sooner. This will boost wholesale prices, which will encourage more renewable capacity to be built, continuing the cycle by lowering prices until the next coal power station is shut down. After the price increase from the Liddell closure is over, I expect coal power stations will be lining up to be allowed to exit the market. Each fresh closure will cause a temporary boost in wholesale prices and feed-in tariffs, although the effect will tend to be smaller each time.

It will take years to replace all of Australia’s coal generating capacity that currently supplies around 70% of our grid power, so there will be a considerable period before feed-in tariffs drop to a possibly permanent low level. We know from their past behaviour that Australia’s lowest-cost coal power stations will keep operating even when they only receive an average of around 2.5 cents per kilowatt-hour.9 While coal power is inflexible, it can still ramp up in the evening when electricity prices are higher and ramp down when electricity prices are low. So unless the government requires them to pay at least a portion of their health and environmental costs, it may take a long time to drive all coal power from the grid.

While the current Federal Government has me feeling a little pessimistic about our chances of rapidly driving out coal power, I am sure it will happen faster than they expect. A few reasons to be optimistic are:

- The falling cost of battery storage is likely to reduce coal power profits by reducing electricity prices during peak periods.

- Rooftop solar has a lot of potential to help drive coal out of the market.

- Expanding wind power capacity is frequently driving prices below coal’s operating costs in the very early morning.

- The more time that passes, the more likely we are to have leaders who recognize the true costs of using fossil fuels.

- As with Hazelwood, we’re likely to have more coal power stations that unexpectedly deteriorate beyond the point of economic repair. But hopefully, they’ll go with a whimper and not a bang.

Rooftop Solar Can Almost Eliminate Feed-in Tariffs

I’ve mentioned how solar farms can’t eliminate solar feed-in tariffs because no one will build them if the electricity they produce won’t be worth anything. But distributed solar power could mostly eliminate feed-in tariffs because people will still have an incentive to install it no matter how low feed-in tariffs get. In this article, I explain how it can still make sense for homes and businesses to get rooftop solar panels even if they receive no solar feed-in tariff.

If solar feed-in tariffs fall then — all else equal — people will have an incentive to install smaller solar systems. But if rooftop solar continues to decline in price then homes and businesses may never have an incentive to reduce system size, even if feed-in tariffs fall to just a cent or two per kilowatt-hour. Especially when battery storage begins to pay for most homes and businesses.

If the cost of rooftop solar falls low enough, people will have an incentive to install enough to meet their daytime use and charge their battery for night time consumption even on cloudy days. This means when it’s sunny these homes and businesses will send a huge amount of surplus solar energy into the grid, dropping electricity prices for most of the day down to zero.10. So while it shouldn’t eliminate feed-in tariffs, rooftop solar could drop them so low they are close to zero.

How Low Will Rooftop Solar Go?

Rooftop solar has been falling in price ever since the Earl of Sandwich first told his servant to bring him a slice of roof between two solar panels,11 but it’s not certain this trend will continue. Presumably, at some point, it will become a mature technology and its rapid cost declines will slow to a crawl.

Just how rapidly rooftop solar power will push down feed-in tariffs depends on how optimistic you are about price declines. Some are convinced rooftop solar will continue its rapid fall in price for a decade to come and before long we’ll have 34% efficient panels that will last a lifetime. Others believe we’ve just about scraped out all the green goo there is in this avocado and think silicon solar panels are almost at their limits and there is nothing better on the horizon.

I’m somewhere between the two extremes, but even if the cost of rooftop solar power declines at the same rate over the next 10 years as it did over the past 10, it will still take a considerable number of years before enough can be installed to push daytime electricity price close to zero.

What Does This Mean If I Want Solar?

If you are planning to get rooftop solar installed, I think it would be prudent to allow for a modest decline in feed-in tariffs, but I don’t think there is any need to assume they’ll disappear or even fall a long way in the time it takes a typical system to pay for itself.

As an example, let’s say I’m considering getting solar here in Adelaide and I use the SolarQuotes Solar & Battery Calculator to estimate how long it is likely to take to pay for itself. (I’m just getting solar power and not worrying about a battery for now.) If I use the default numbers that come up after I put in my postcode, it will assume my solar feed-in tariff is 15 cents. This is based on solar feed-in tariffs that are available now and it assumes I am smart enough to pick a good one. I could use our Electricity Retail Plan Comparison Tool to find an actual plan and use the electricity price and feed-in tariff from that, but I’ll stick to the defaults for now.

Using the default figures for 6.6 kilowatts of north-facing solar panels, the calculator tells me it will pay for itself in 3 years and 4 months. That’s pretty damn good. But I haven’t accounted for the possibility of solar feed-in tariffs falling. I’m very confident they won’t disappear over three or four years, but to be cautious I’ll assume they’ll drop 4 cents by the time the system pays for itself. To account for this I tell the Solar & Battery Calculator that the feed-in tariff is 13 cents because this is halfway between the feed-in tariff now and the feed-in tariff I expect when it has finished paying for itself.

With a 13 cent feed-in tariff, the calculator tells me the simple payback time will be 3 years and 7 months. That only increases the payback time by 4 months or 8%, so even with my assumed fall in feed-in tariff it still doesn’t take much time to pay for itself.

You can enter whatever feed-in tariff you think is best, tailored to your own personal level of optimism or pessimism. Just remember to enter the average value you expect the solar feed-in tariff to be over the payback period and not what you expect it to be at its end.

Solar Feed-in Tariffs Will Fall But Not Fast

Solar feed-in tariffs will fall but, unless there are major changes in how the government accounts for the health and environmental costs of fossil fuels, these falls are not likely to be large over the payback period of a typical rooftop system. For most Australian households this is under 5 years. While I expect the overall decline to be gradual, I don’t expect it to be smooth and there are likely to be some ups and downs. Because we have a lot of old coal capacity to replace I expect it will be over a decade before feed-in tariffs fall a long way and I expect them to never actually disappear, although if enough rooftop solar power is installed then over the longer term they may become insignificant.

Footnotes

- Note that I certainly wouldn’t respond in this crude way. ↩

- After all, in WA it is normal for households with inverters over 5 kilowatts to receive no compensation for solar electricity they send into the grid. ↩

- In a few years it is possible South Australia will produce so much energy from rooftop solar that at times it will exceed state consumption and some will be exported to Victoria, but over the next 7 years this is only likely to be a tiny fraction of the total amount of energy generated by rooftop solar. ↩

- The word “lively” means “idiotic”, right? ↩

- Snowy 2 is a pumped hydroelectricity scheme that — as far as I can tell — doesn’t make financial sense. It’s not a Banjo Patterson poem that has been supercharged so it’s twice as powerful: There there was was movement movement at at the the station station for for the the word word had had passed passed around around… ↩

- This is how markets work. It’s amazing how many politicians are shocked and horrified by the normal functioning of markets when a coal power station shuts down. ↩

- Assuming the grid can take it. There may be times when generation is forced to curtail output. ↩

- If you want to say that wear and tear on wind turbines and solar inverters acts like a very low fuel cost, that’s fine. But solar panels are kind of unique in that using them to generate electricity results in less wear and tear than not using them because they don’t get as hot. ↩

- South Australia’s Northern Power Station was an expensive-to-run coal generator and required a price of 5 cents per kilowatt-hour to remain in operation, but that was considered too high for it to remain in operation. If they had known Hazelwood was going to close it would be another matter, but that’s business — you take your chances. Or you get a politician to change the rules in your favour. Either one. ↩

- Some of this solar electricity production may need to be curtailed, but if clean solar energy generation is reduced before fossil fuel generation then that is stupider than a man called Dan Druff naming a lamington after himself. ↩

- I may have my anecdotes mixed up here. ↩

RSS - Posts

RSS - Posts

RB: “I Assume Solar Electricity Won’t Be Stolen

I’m going to assume that in return for exporting clean solar electricity to the grid, people will receive a feed-in tariff that is within spitting distance of being fair and reasonable compensation and the electricity won’t simply be stolen.”

Sadly, you can’t assume that, Ronald.

I’m still fighting Synergy, on behalf of six tenants whose FiT rebates have, in fact, been ‘stolen’.

I’m typing a long list of FOI requests right now.

I’m afraid solar is very hard done by in WA.

What are your thoughts on the impact that increasing behind the meter consumption has on the costs the distribution network needs to recover from all the electricity consumers who cannot install solar PV (renters, apartments, low income etc)?

Distributors earn a hefty chunk of their income from per kWh charges, but only for energy that passes through the meter to the consumer.

As behind the meter consumption increases, presumably cost recovery has to be spread over the rest?

Billionairetopia – WA appear well ahead of the game in terms of low FiT.

So – you expect wholesale prices will go up, as coal stations are shut down – as these will respond to market forces.

So – by implication cheaper solar power, will cost us more?

From my viewpoint, we simply MUST get rid of coal power – and normally you’ll have to pay more to achieve this result.

All seems a bit muddled to me.

This is already built into the system with the daily supply charge. Anyone who uses less grid electricity for whatever reason, whether because they got solar, sold their old plasma TV, or just made an effort to use less electricity will end up paying more per kilowatt-hour for grid electricity they use. Including the daily supply charge I often pay over 50 cents per kilowatt-hour of grid electricity I use. While I’m not a fan of this, it’s what we have at the moment.

I guess I see a difference between those who can only reduce grid imports via reducing consumption (’cause they can’t afford it) vs those who reduce imports because they can afford and/or have the opportunity to have solar PV. The impacts seem skewed to me.

Re your comments about the value of household PV exports to the local grid since it’s not transmitted as far as from a remote power station.

How much is that value above the wholesale price?

I guess there are swings and roundabouts as the grid needs additional investment to support the flow of energy in directions it wasn’t set up for. e.g. where I am there is a low export power limit. For that to change I’d need to fork over close to $50k to the local distribution company for upgrades, and even then it might still only add 1-2kW to the limit because there are other transmission roadblocks further upstream.

Billionairetopia…! – WA appear well ahead of the game in terms of low FiT.

So – you expect wholesale prices will go up, as coal stations are shut down – as these will respond to market forces.

So – by implication cheaper solar power, will cost us more???

From my viewpoint, we simply MUST get rid of coal power – and normally you’ll have to pay more to achieve a result like this – if not, surely the coal operators would change allegiances to make more money?.

All seems a bit muddled to me.

Ian Thompson,

You state:

“From my viewpoint, we simply MUST get rid of coal power…”

The compelling evidence I see indicates we/humanity simply must rapidly reduce ALL human-induced GHG emissions.

See my comment at: https://www.solarquotes.com.au/blog/nt-net-zero-mb1597/#comment-744755

Climatologist Professor Will Steffen lists on pages 2-3 of a Supplementary Advice document some of the projected impacts on Australia at a 3°C temperature rise and concludes with:

“The list could go on, but the point is that the high-probability impacts are severe, presenting very large challenges to our health, well-being, economy, livelihoods, and natural ecosystems. Australia at a 3°C temperature rise would be largely unrecognizable compared to 20th century Australia, and would be one of the toughest continents on the planet for humans to thrive upon.”

See: https://www.ipcn.nsw.gov.au/resources/pac/media/files/pac/projects/2020/03/vickery-extension-project/comments/expert-submissions-provided-on-behalf-of-edo-nsw/200714-w-steffen-supplementary-expert-advice.pdf

Former Australian Chief Scientist Professor Penny Sackett gave a presentation to the Independent Planning Commission NSW (IPCN) concerning the proposed Narrabri CSG Project on Jul 23, outlining the escalating risks of dangerous climate change.

See transcript pages 46-53: https://www.ipcn.nsw.gov.au/resources/pac/media/files/pac/projects/2020/03/narrabri-gas-project/public-hearing/transcripts/200723_day-4_narrabri-gas-project-public-hearing.pdf

The consequences of humanity not rapidly reducing human-induced GHG emissions increases the risk of civilisation collapse within this century.

See: https://www.ipcn.nsw.gov.au/resources/pac/media/files/pac/project-submissions/2020/03/narrabri-gas-project/20200729t173857/itd–ipc-narrabri-gas-project-presentation-30-july-2020.pdf

How do you put a price on that?

We can see the same effect in electricity markets before wind and solar were significant, although it was often obscured by rising electricity demand. But the basic process was there. A new, lower cost, power station would be built and drive one or more older power stations out of business and then the reduced supply pushes prices back up again.

Ron:

Is there a distinction between Solar Farms that enter into PPA’s to sell their output (under terms and conditions), and Rooftop Solar owners who get a Solar Feed In Tariff, in who actually pays the cash to the Solar owner for the electricity exported to the grid in both scenarios?

Are these payments made up of a number of separate contributions not widely advertised?

And who are the parties that contribute to PPA payments and FIT payments and what s each parties contribution to the overall payment to owners?

Having a clear understanding of these questions will underpin what is likely to unfold for PPA and FIT payments moving forward

Have you any inside knowledge on that please Ron?

Lawrence Coomber

I am no expert on PPAs, but there are different types. My understanding is utility scale solar and wind farms generally have PPAs with large electricity retailers. They can have different conditions, length of PPA, CPI adjusted or not, who gets the Large-scale Generation Certificates (LGCs) created, requirement to curtail when electricity prices are zero, etc. Generally, reverse auctions for PPA prices are a common why of getting renewable capacity built around the world. The two main source of revenue for large scale new renewable capacity are selling wholesale electricity and creating LGCs.

Thanks Ron.

Large Scale PPA arrangements and LGC’s are well known about.

Domestic roof top FIT is more opaque.

Who pays for the Domestic FIT?

Understanding that precisely and you can see where FIT is heading; and why.

Lawrence Coomber

This Victorian report describes how solar feed-on tariffs there are determined.

https://www.esc.vic.gov.au/sites/default/files/documents/FDP%20-%20Minimum%20feed-in%20tariff%202020-21%20-%20Final%20decision%20-%2020200110.pdf

There is a table on page 31 giving a breakdown. Victoria is interesting as the feed-in tariff takes into account more components than other states. Whether it takes them into account correctly is another issue.

I live in Canberra. ACTEWAGL has unilaterally reduced my solar tariif from 11c to 8c from this month. It is a huge percentage decrease in one hit. I was about to increase my panels but this high decrease took away all the incentive.

I live in the northern New England region and Origin Energy dropped the FiT from 21c to 18c then the rider was this was for the first 8kWh per day. Anything over that will be purchased at 8c

Batteries are starting to look attractive. 😉

And diverers become more attractive too (for hot water heating)

This month in Sydney Origin have dropped their Solar Boost from 21c FIT to 12c and AGL have dropped from 22c FIT to 9.5c

That is a 43% less with Origin and 57% less with AGL – in one month.

Has anyone considered going off-grid altogether? With the cost of solar system installations dropping so much, I wonder how risky it would be to go off grid if you purchase a battery system as well. From what I can gather, maintaining a grid connection is the thing that most adversely impacts ROI calculations.. I would love to see an article that discussed this.

I would have loved to Vivian. I used to want to get a ‘finger’ solar system. (Install it and show the energy retailers the finger). I have solar and a battery and currently produce more than I use. However, the law of diminishing returns has raised its head. Electricity is effectively at no cost for me as my FIT more than covers my service charge. My service charge gives me access to what is in effect another very large battery. Putting further solar or battery would cost heaps and going off grid would mean I’d lose my diminishing FIT anyway.

3 years into having solar and(heavily subsidised) battery it was an excellent decision. Within another 3years the whole system will have paid for itself anyway. I am a low enough form of life to accept this and not go off grid. ?

My cousin, in SWWA, has been off-grid for 40+ years… wind and solar, with a generator for back-up. He recently installed a very large (very, very expensive!) battery system, to replace long-suffering deep cells.

Personally, we’re awaiting Musk’s Battery Day announcements (mid-September). Musk has flagged these announcements as game-changing.

If new Powerwalls incorporate million-mile batteries, as some expect, this may indeed be a game-changer. It’s rumoured, for example, that MMB life will extend to 73+ years… meaning, if true:

a.) Battery storage _will_ pay for itself;

b.) Warranties will (at least) double, perhaps treble;

c.) Those of us exasperated by Synergy’s systemic abuse of custom…

and continual l-o-n-g power failures, will dump WA’s monopoly

electricity provider, pronto.

Our family will be among the first to buy this more promising technology

and flee-the-grid. 🙂

Hey Ronald (or Finn)! I think it’s time for an article (update) on the best solar plans/FIT in NSW. AGL dropped their FIT on 1 August, which has dated your last article about their Solar Savers product. And Origin has reduced their FIT significantly compared over the last 12 months too (WAY more than estimated in this article above, over the entire life of a solar system). I suspect the best option might be Amaysim ATM, but would love to read your analysis. Thanks SQ team 🙂

Ronald,

Good article thanks. But, I was disappointed not to see any mention of the role of VPPs in your futurescope. I would think they will be a growing element in solar output and would be able to negotiate with generator networks for a reasonable solar FIT for their members, and themselves of course.

For VPPs to become truly effective , a lot more folks will have to get batteries though and be happy to put control of them into the hands of others.

Glad to hear any thoughts you may have. Cheers.

Excess power is a resource to be used. Ideally we can’t have too much, and it gets put towards charging batteries, pumping water uphill, cracking water for the hydrogen and oxygen, heating water, etc. The idea of it being worthless and a problem will go away at some point.

Off the Grid: – “United we can participate – divided we are powerless”.

Vivian there is growing interest in going off grid reliably, cost effectively, with a very long life smart solution, that requires no user intervention at all, that guarantees permanent power 24/7 x 365.

A tough design specification might be the response: but that response would be entirely due to the lack of experience in that sector of the commentator. Quite understandably though of course, as very little professional renewable energy technology graduate/post graduate engineering qualifications and expertise in specialised off grid solutions design, integration, and installation, has been acquired in the Australian RE industry (at smaller scale at least).

There is change in the wind though: as there must be because we have fallen a long way behind most other countries in professional RE engineering status.

Returning to the subject: there is not much discussion throughout the energy industry about off grid microgrid solutions for example, because it is a low volume market, but there will be a lot of activity seen in this sector in 2021 for normal suburban households to consider.

Consider this scenario Vivian; which is happening widely elsewhere (but not yet in your suburb):-

At the domestic level this “off-grid microgrid” solution has a multi DC source backbone created from the collective solar PV resources of some neighbouring homes, business places, etc “the microgrid cluster”.

The sum of the solar PV resources can easily be “topped up” to the design required system size by adding to the existing sum as a single PV addon or a number of PV parts, divided between the “the microgrid cluster”.

The solar PV resource is supported by a battery storage resource that works in tandem with the solar PV. It can be a “single build battery storage system” or a connection of a number of battery storages available within “the microgrid cluster”.

These clusters are easily formed between like-minded neighbours (and it will become quite common). A typical scenario (system sweet-spot) would be 5 neighbours (or neighbouring commercial units) with a common rear fence line (or roof) for a suburban solution for example.

This is an off the grid solution, the cluster has no connection with the grid. No fees, no charges, minimal annual maintenance costs for the “preventative maintenance system” contract with the overseeing installation contractor.

So all that is the quite understandable easy part – the solution technical parts are next; and this is where experienced power engineering expertise and best practice systems design, equipment, and integration comes in.

I won’t go any further; the outline is sufficient for you to start thinking more about the subject Vivian.

Discuss these points with your local energy engineer and all the best moving forward off the grid.

Lawrence Coomber

Only way to go Vivian. The key is that components are cheap, and beyond that you get to adjust your use to suit your personal requirements…

Peter Pfennig (above) gives a good feel for individual possibilities. (I installed a system which suited me ~ with a few variable adjustments ~ and paid for itself in jut under three years ~ back in the day when prices were much higher than now. However, one thing that Peter and others appear to have overlooked is that the iniquitous ‘service charge’ (which takes personal choice re. costs out of ones hands*) is not the only cost which needs to be taken into account. I see the ‘powers that be’ are about to launch a third effort to extract a fee for feeding power INTO the grid. Are you familiar with the term ‘milch-cow’? Y’can get me here: [email protected]

*How long would you shop at, say, Woolworths, if they charged you extra for the use of their shelves and and checkout tills, or the price of the trucks who transport their goods?

Vivian

What Lucy is advocating is an On-Grid System (which you already know about hence your question) complete with all of the grid activated controls; variable supply tariffs ($ up); various fees and charges ($ up); including daily service fees ($ up); plus the inevitable new fees for grid tie customers who export power (or have a PV generator capable of exporting power) – also ($ up).

Lucy what Vivian is curious about, is eliminating all of the On-Grid System Customer costs entirely, by cutting ties with the grid; closing her account with the grid; by having the overhead (or underground) grid service supply conductors removed from her premises point of attachment.

This scenario is what Vivian is interested in and is called being Off-Grid.

And of course it requires an Off-Grid Energy Generation System to be installed or be in place, to supply her load circuits accordingly, if she so chooses.

Lawrence Coomber

Just looking at renewing my solar contract with Origin Energy. It went from 21c FIT to 7c FIT. A mighty huge drop in price if you ask me. The only other company that gives 21c is ReAmped. 21c FIT High feed-in tariff is capped to the first 5 kWh per day. Seems to be dropping to push people to the limit to go to batteries.

Ned you sound a bit surprised about Origin reducing your feed in tariff?

There are only two possible directions for FITs to ultimately go over time: (1) Up, or (2) Down.

Option (1) Up: seems highly improbable. That locks option (2) in.

The take away point is clear for all to understand: FIT is a diminishing resource for all On-Grid customers: Only the time frame to get to zero FIT differs from place to place.

Lawrence Coomber

Good piece Ronald, lots of viewpoints there. Made me to think of an elementary question. Why is FiT offered? And what influences it? My understanding was it is an incentive driven by the 2030 target for renewable energy? Please enlighten me.

Kind regards,

Sid

Feed-in tariffs are separate from the Australian 2030 Renewable Energy Tariff. Originally high feed-in tariffs were offered by states to encourage the uptake of rooftop solar. At the moment feed-in tariffs mainly compensate households for the wholesale cost of electricity during the day, although there are other financial benefits to the grid from having distributed solar supply energy to it.

Feed in tariff….ZERO!

I’ve just begun looking to install solar on my new house being built. I’ve had two companies both try to complete a pre-approval for our solar and see what export we could get approve. Both came back zero! So we currently can’t get anything for the solar panels we plan to install. I will have to redo the numbers on a 0 cent feed in tariff now to see if this is something I should still follow. Why is this the case? Junortoun Victoria 3551

Sorry to hear you can’t export anything, Adam. There is a limit to how much solar power local grids can accept without being upgraded and it unfortunately sounds like your area has reached its limit. It can still be financially worthwhile to get solar, but it may be necessary to get a relatively small system to keep the payback time reasonable. I wrote about this here:

https://www.solarquotes.com.au/blog/zero-kw-export-solar/

Thanks for the response Ronald. Your linked article was a good read and makes sense. I’ll have to run the figures again on the system I was looking at size wise and try to get a more “right” size for our consumptions. Hmmm maybe I write to some local PM to get them to upgrade the network….I’m sure that won’t take long to change things. ?