Virtual Power Plants: What Are They And Can They Make Batteries Pay?

I’m really excited to have this opportunity to tell you about Virtual Power Plants. I’m virtually beside myself with excitement. That’s not just a horrible joke. I’ve actually written little bits of this post in a variety of houses and used t’internet to store each file in the cloud. Once I’m done pasting them all together I’m sure you won’t be able to tell the difference between this and an article that was centrally generated.

A Virtual Power Plant — or VPP for short — enables many separate battery systems to act as one.

This allows the high-level VPP operator to run them as though they were one large power plant. A VPP can:

- Sell stored solar power to the grid.

- Get paid for helping keep the grid stable.

- Suck up grid power when it’s cheap and sell it later for a profit.

These are three things a home battery normally can’t do1 and so has the potential to make an unsubsidised home battery systems go from being a waste of money to possibly paying for themselves.

In South Australia, which now has a big fat solar battery subsidy, all systems that want to receive it must be capable of joining a Virtual Power Plant. The subsidy is large enough to have a major effect on the entire Australian market and means most home battery systems will soon be VPP capable no matter what state they are sold in. Once the electronics for this sort of thing becomes standardized it should be very cheap.

As an example of what I mean, I have a toy that has more computing power than a 1980s supercomputer. Don’t be fooled by the trendy, fake, retro patina.

It’s name is Tonto X-23

I’ve already written about the Tesla VPP that’s being trialed in Adelaide and the Sonnen Flat VPP. Later I’ll write about the AGL one but I’ll probably get someone else to write about Simply Energy’s S.M.A.R.T. Virtual Power Plant because I’ll probably be sick of it by then. In this article I’ll cover:

- The two broad types of VPP — privately owned and company owned.

- How VPPs help home batteries pay for themselves.

- Why we can expect electricity retailer VPPs to try to rip us off.

- Battery wear and tear.

- How VPPs could become redundant.

VPP Potential

It remains to be seen how important VPPs become, but they may become standard for these reasons:

- They may be the only way households can obtain benefits VPPs provide.

- Electricity retailers may ensure they stay the only way household can get these benefits so they can profit from VPPs.

I hope the second point above transpires as far too cynical.2

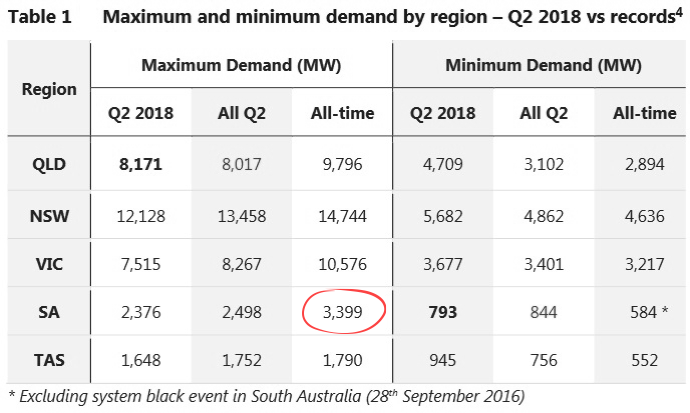

Virtual Power Plants have the potential to become major players in the nation’s power supply. The South Australian government is subsidizing 40,000 home battery systems, all of which must be VPP capable3. If they all become part of a virtual power plant and are able to output an average of 4 kilowatts of power each, that would be equivalent to a 160 megawatt peak power plant. It could provide around 5% of the state’s highest ever grid demand.4

(Image: AEMO)

Maybe we’ll eventually install far more than 40,000 battery systems. If one in five South Australian homes installs a system that can offer an average 4 kilowatts of power and they all join a VPP it would be able to provide 533 megawatts. That would effectively make it the second largest power plant in the state and able to supply close to 16% of South Australia’s highest ever grid demand. And if every house had a battery system that was part of a Virtual Power Plant we could shut down most of our power stations.

VPPs will only be able to give their maximum power output for two hours or so, but that’s still enough to make a huge difference.

Privately Owned Vs. Company Owned Battery Systems

VPPs come in two basic types:

- Company owned: A company such as Tesla owns the battery system and installs in your home for free.

- Private ownership: You pay for a battery system and opt into joining a VPP in return for some form of compensation. For current trials this is often a reduced battery price.

Company Owned Battery Systems

Tesla is trialing a VPP in Adelaide where they install a Powerwall 2 along with rooftop solar in housing commission homes. The tenants pay nothing for this and receive electricity bills that are around 30% less than what they were paying before. Tesla owns the electricity generated and controls the use of the battery to maximise the amount of money they can make from their VPP.

The fairly recently elected SA Liberals have said the initial trial is going ahead but I have doubts it will go further than that. The new state government is subsidising 40,000 VPP capable battery systems and that has got to hurt what Tesla’s VPP will earn. I think the SA government will be happy to let the Tesla VPP wither on the vine — which is an appropriate metaphor for the wine state. But maybe Tesla will still manage to pull it off despite the extra competition. They have achieved great things in the past. It’s just these great things achieved in the past all happened in the future relative to when they promised them. Tesla may switch to a privately owned Virtual Power Plant model to take advantage of the SA battery subsidy, but their recent Powerwall price increase won’t help sales.

Privately Owned Battery Systems

At the moment if you want to join a VPP it is likely you’ll have to do it by buying your own battery. Right now you can get a Sonnen battery and join Sonnen Flat5 or you can take part in a VPP trial which — as far as I am aware — are only available at the moment in and around Adelaide. But I suspect trials will either be carried out in other parts of Australia or electricity retailers will have gained so much experience that fully formed VPPs will spring forth like Athena from the head of Zeus.6

With private ownership you buy the battery and receive a financial incentive to join a Virtual Power Plant. For those able to join Sonnen Flat the advantage is you will have all your electricity use — up to a limit — supplied for a flat rate. Depending on your circumstances this can be much better than paying for grid electricity normally. In current trials electricity retailers will heavily subsidise the battery system cost in return for occasionally controlling it. I know one person who is part of the AGL VPP trial and he says they never use his battery. But it is a trial so it’s possible he’s part of a control group.

SA Battery Subsidy + VPP Trial Subsidy = Dirt Cheap Batteries

The South Australian battery subsidy can apply to batteries that are already subsidized as part of VPP trials and so it may be possible to get them dirt cheap in January when battery systems other than Sonnen can receive the subsidy. I’ll look into this and let you know what kind of deals are available.

Spoiler From Finn: If AGL’s LG Chem + SolarEdge offer gets approval for the SA subsidy and they have any left come January – it should be free. If the Powerwall 2 is added as an approved battery under the SA subsidy, then you should be able to get one fully installed from Simply Energy for $1,299 from January. That’s a pretty good bloody amazing deal.

3 Ways VPPs Can Make Money

Companies would not be spending resources trialing VPPs if they didn’t think they could make money from them. It’s not like in 1492 when an Italian loony could rock up to the King and Queen of Spain, declare he thought the planet earth was the size of mars, and get three ships to sail to India. These days it has to be clear there is profit to be made before money gets put into projects.

There are three main ways Virtual Power Plants can make money:

- Electricity arbitrage: This is buying electricity when the price is low and selling when it’s high.

- Ancillary Services: Virtual Power Plants can be paid to provide services that stabilize the grid.

- Ripping you off: An electricity retailer isn’t going to hand over all the savings your battery provides them unless they have no choice.

It’s Arbitrage!

Arbitrage is simply buying low and selling high, which is far more effective at making money than vice-versa. This graph shows the wholesale price of electricity in South Australia yesterday:

The lowest price is highlighted and came to $15.99 per megawatt-hour, which is 1.599 cents per kilowatt-hour.

This is the same graph but with the highest wholesale price of electricity in the evening highlighted:

It was 21.5 cents per kilowatt-hour. As a household in South Australia is likely to be paying around 37 cents per kilowatt-hour for grid electricity, they’d probably prefer to use that stored energy themselves than send it into the grid. But yesterday was a pleasant spring day. At times, especially on hot summer days, the wholesale price of electricity can go over $14 per kilowatt-hour. If you are a skilled math guy like me you’ll know that $14 is at least 3 times more than 37 cents. So a VPP can tell households, “Most of the time the energy stored in your battery is all for you. We just want to discharge it for maybe 50 hours a year.” If in that 50 hours they discharge 250 kilowatt-hours at an average wholesale price of $5 they will receive $1,250 in payment from the electricity market.

Important detail: One good thing about selling electricity to the wholesale market is the sold electricity will reduce the household’s grid electricity consumption first and then the surplus will go out into the grid. The VPP still gets paid for all the electricity it discharges from its batteries as the market doesn’t care if you use that energy or your neighbor does because it will still cut the demand for grid electricity.

Ancillary Services

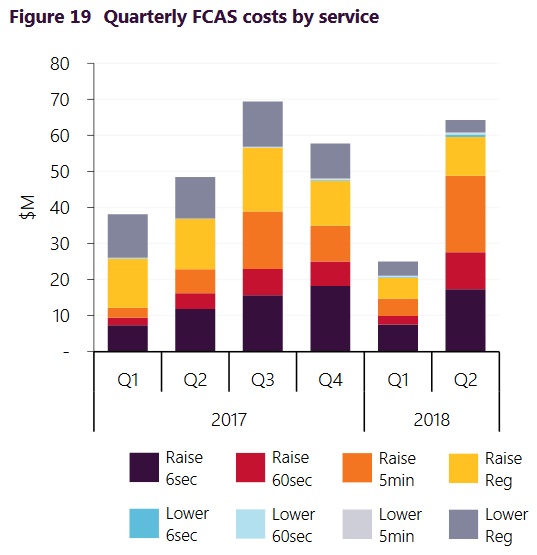

VPPs can receive payment for providing ancillary services that improve grid stability. Rather than go into a long spiel about ancillary services I’ll just briefly cover Frequency Control Ancillary Services or FCAS.

In Australia, Europe, and all sensible countries the grid frequency is 50 hertz. Japan is only half sensible so only half the country is on 50 Hertz. The United States’ grid is on 60 hertz on account of George Washington having six fingers on each hand. Australia tries to keep its grid frequency between 49.9 and 50.1 hertz. But when the demand for grid electricity suddenly rises the frequency decreases. By supplying battery power VPPs can prevent this. There is also a payment for consuming power when the demand suddenly drops. This payment is tiny compared to providing power, but can still be useful.

This graph shows how much FCAS earns and how most of the payment is for response in the first 5 minutes:

(Image: AEMO)

While an individual household may already be discharging their battery at its full power when FCAS is required, on average there will always be many batteries in a Virtual Power Plant operating below full capacity and so it will always be able to give a good, hard, 5 minute FCAS. Because a 5 minute discharge will hardly be noticed, this service has little cost to the household while providing revenue for the VPP.

Diminishing Returns

While ancillary services can currently provide a significant amount of revenue, the amount of battery storage in South Australia is already decreasing FCAS earnings. It may not be long at all before the FCAS market is completely FCASed up from the point of view of people trying to make money from it.

The same applies for electricity arbitrage. The more storage capacity installed the less money batteries will be able to make on the wholesale market. And batteries aren’t just competing with each other but with other forms of energy storage such as pumped hydro and solar thermal.

Because of these diminishing returns we can expect fairly continuous downward pressure on VPP compensation. As batteries will continue to fall in price installed capacity should still increase, but currently installed systems that looked like they would pay for themselves, thanks to being part of a VPP, may end up being money losers.

Ripping You Off

If your battery saves an electricity retailer a net $1,000 a year by being part of their VPP then maybe the retailer will pay you $1,000 a year in compensation.

Or, more likely, they will try to keep as much of that $1,000 for themselves as possible. Competition between retailers may limit how much they rip you off, but we’ve seen how confusing they make their electricity plans so I have zero confidence they will not do everything in their power to pay households as little as possible unless there is unusually effective regulation stopping them.

Wear And Tear On Your Battery

While a VPP only needs to spend a limited amount of time using your battery to make money, it will still contribute to wear and tear. Some batteries are more resistant to deterioration than others. Many, including the LG Chem RESU and Tesla Powerwall 2, only provide a limited number of kilowatt-hours before their warranty ends. But lithium iron phosphate batteries may be warranted for the first of 10 years or 10,000 cycles and so should be very suitable for use in a Virtual Power Plant. Before joining you should consider how much the extra wear and tear is likely to cost you.

VPP: Service Providers Or Parasites?

Provided the amount you get ripped off isn’t too bad it can make sense to join a VPP if you own a battery. In most of Australia it is not possible for a household to independently sell battery power on the wholesale market. Amber Electric is the only retailer I am aware that allows this. Right now they are only available in South Australia and the Ausgrid network in NSW, but they say they intend to spread to the other eastern states. Battery systems would have to be made capable of independently responding to price signals to take advantage of this, but that’s something we know software can do these days.

While one home solar battery can’t be relied on to always be able to provide ancillary services as a VPP can, it could receive a direct payment for being able to provide ancillary services most of the time. So if all Australians had the option to sell electricity at wholesale prices and to also receive direct payments for the ancillary services they provide, it would not be necessary to join a Virtual Power Plant. Battery systems would basically function if they were part of a VPP but there wouldn’t be a middle man between them and the grid taking a cut. Wouldn’t that be nice.

(Added January 16, 2020: Compare Virtual Power Plant offers with our new VPP comparison table)

Footnotes

- Although if you join Amber Electric you will be able to sell electricity to the grid for the wholesale price. ↩

- And hopefully when I reread this in the future it won’t make me decide I need to start taking cynicism boosting supplements. ↩

- Either VPP capable out of the box or with little extra modification. ↩

- The state’s highest ever grid demand appears to have been permanently lowered by the spread of rooftop solar power, but that may change if it ever hits 50 degrees here. ↩

- I don’t know how far along Sonnen is in using Sonnen Flat as a VPP in Australia. This is something I’ll have to add to my long list of questions to ask if Sonnen ever takes me out on a date. ↩

- According to a Greek myth, Zeus had a really bad headache so he asked his son to hit him with an axe in an attempt to cure it. This caused his daughter Athena to leap out of his head. And I thought my family was messed up. ↩

RSS - Posts

RSS - Posts

Yeah about the Powerwall 2 being almost free. This presumes you will be able to source one.

Excellent point!

Argh, the good old law of “Diminishing Returns”. What you have in that section covered my long term concern with all this.

As far as generating cleaner energy is concerned then that is great but if most households had their own Solar and batteries then a VPP makes very little sense. Who would want to buy your excess power? No-one (or very few). It would basically cover your own consumption usage. Retailers would drop any feed-in tariff to a pittance with lots of excess excess power availailable in the community.

The whole idea of VPP must surely end when the market is capable of supply more than what is needed. You would eventually be compelled to have Solar and Battery or pay probably very high prices from a electricity retailer.

I think the only time to make any money out of Solar (if that is one’s goal) is now before everyone jumps on the wagon. We really should not be thinking of it as a personal money making exercise but instead free power for yourself once the system has paid for itself.

I pay $0 for Electricity bills (in credit) and have no battery, money from exporting works for me atm but that too will of course change.

Thanks Ron. I am a big fan of customer owned and managed Off Grid Microgrid’s: and they come with a set of customer developed rules and regulations. But:

Externally administered – Homeowner VPP’s Ahead – Drive Cautiously.

Cooperative Building Societies became very popular over banks many years ago when it became starkly apparent that the banks’ shareholders (and middlemen) were favored over the banks’ customers, in the carve up and distribution of any business trading profits.

Moving beyond banks to Insurance Companies; Credit Card Companies; Old Age Care Facilities; Superannuation Companies; etc and we might conclude that what might seem to be ingenious business plans leveraging pooled financial resources to the mutual benefit of all of the contributors, have often proven to have a “60 Minutes moment” and not be the case going forward despite the seemingly “great intentions and expectations” of the initial brain-wave.

Homeowner VPP systems don’t have the hard-wired attributes that ensure any tangible benefit is guaranteed for the homeowner. And if the enthusiastic VPP proponents think otherwise, then they should quite happily and enthusiastically inform the masses at every opportunity. I haven’t seen anything so far that gives any insight to the homeowner case.

What many ordinary people may have lost sight of in the mum and dad “storage euphoria era” is that the homeowner becomes an intrinsic part of a bigger business enterprise that’s focus is (as it must be) on the enterprise’ profitability (above and beyond the enterprise shareholders and middlemen costs carve up), and it’s the customer who picks up the tab as collateral damage as the forgotten and lowest ranked creditor, and their interests will be deftly overlooked with “fine print” terms and conditions.

It is no good launching headfirst and “waiting until things settle down” with VPP business models.State Governments need to establish “VPP Customer Participation Guarantee” legislation before the fact not after. Only then can we all participate happily and in full knowledge of dedicated “VPP’s Rules of Engagement for Contributing Customers”.

Lawrence Coomber

Hi Ronald

It seems Western Power (WA) – has “An Australian-first” battery trial – in Mandurah (about 1 hr drive south of Perth).

A VPP? Go to this link and scroll down:

https://my.synergyconnect.net.au/home

Oh, I am (also) a cynic – motto “There are no free lunches”

Just got my Sept-Oct bill – exported 1,476 units (no GST credits), imported 246 units, but the Supply charge was nearly as much again as the import charge, so we still have to shell out (although, only $28).

Michael has written about it here:

https://www.solarquotes.com.au/blog/wa-powerbank-trial-mb0813/

Rather than using privately owned batteries in peoples’ homes, up to 8 kilowatt-hours per household will be stored in one large battery and people will be able to access their stored energy after 3pm. For this they will be charged $1 a day. So on days they use their full 8 kilowatt-hours of storage capacity they will effectively be paying 12.5 cents per kilowatt-hour plus the 7.1 cents in feed-in tariff they will miss out on for a total of 19.6 cents. (Presumably they won’t be charged for losses.) That can pay for itself if the average amount of stored energy people use is high enough which will partially depend on their solar systems producing enough solar energy. This won’t always be the case as there are an average of 100 cloudy days a year in Perth.

If a person or company had no trouble being flexible with the truth and misleading people had a large battery that was used for grid stabilization or other uses and wanted to make money from households as well, they could tell people they had 8 kilowatt-hours of storage in it and then ignore that and use the battery in whichever way was the most profitable for them. Then if there wasn’t enough stored energy left in the evening to meet the household’s demands they could just give them power from the grid.

Not that I’m saying that’s what’s going on here. I don’t know the details of how it works. That’s just how I would do it if I was a terrible person.

In the event (if it ever happens) that the VPP things and battery subsidies, extend beyond South Australia, and the NEM, into the Wild West, I am wondering whether a household battery system that is connected to a VPP, can still effect islanding(?). whereby (from my understanding, when the grid suppy goes down, through scheduled outages, local hoons amputating power poles, or, poer poles otherwise falling down, etc, etc, etc, the household can be isolated from the dead grid supply, and, still have an electricity supply from the household battery system backup and rooftop photovoltaic system.

And, it will be interewsting to find whether AGL, which has a presence in the Wild West (although, at present, AGL is apparently, in the Wild West, only interested in trying to get gas billing customers), will do anything here, as it has apparently done in the eastern states, getting involved in domestic rooiftop photovoltaic systems and associated storage battery systems.

According to AEMO, South Australian Consumption is crica 12,500GWh.

40,000 batteries each discharging an implausible 10kWh day, for an even less likely 365 days a year totals 145GWh or 1.16% of consumption.

Allowing for charging losses, the grid would be deprived of ~160GWh to charge the batteries, wasting >29GWh to keep the battery and inverter warm.

Within 10 years, the batteries will be worn out, to be sent to Malaysia along with the other not re-cycled batteries. The emissions and energy consumption of battery manufacture will be off-shore, so out of sight.

At $10,000 a pop, cost is $400 million for 40,000 Lithium-ion environmental Trojan Horses.

Ronald, there will be a fourth revenue stream for VPPs if the proposal to introduce a demand response mechanism into the wholesale market gets the nod from the AEMC (see https://www.aemc.gov.au/rule-changes/wholesale-demand-response-mechanism). Basically the VPP could become a demand response aggregator, paying participants where they can use their batteries behind the meter to reduce their normal (baseline) grid consumption during spot market price spikes.

the AEMC will issue a consultation paper on Thursday. How bout a blog post (pretty please)?

Along the lines of VPP I’ve often wondered, Ronald, if I could register myself as a power supply business and sell the solar power from my system and battery to just one customer and therefore claim the cost of purchase, installation and ongoing depreciation, administrative costs etc and anything else that qualified as a legit tax deduction (including hiring a sub-contractor to get up and clean the panels every few weeks (sorry Brian)). Possibly even an overseas junket to ascertain the latest trends in solar.

The customer and subcontractor of course is one and the same person – i.e. me.

I really need Bernard Black’s (Black Books) accountant to advise me further.

It’s certainly an interesting idea, but as far as I am aware, that sort of thing doesn’t work for rental properties so it’s even less likely to work for a private residence.

On a house size solar system cleaning panels would not pay for itself. Nature put the grime there, Let nature also remove it when it rains unless of course you had a sand storm and it needed immediate action.

Then there is the problem if a tiled roof with cleaners stomping all over them and cracking tiles causing leaks not to mention insurance costs in case they fall off the roof.

I always get a kick out of door to door sales ppl that offer to do a roof inspection for free (even when I have a do not knock call sign). Of course they would find broken tiles that were fine 5 minutes ago. Yes, I know I’m cynical.

After having the bejesus scared out of me with a quote from Sonnen on the SA subsidy deal – circa $13,100 plus $1800 for black out protection after subsidy, I enquired with Simply Energy, my retailer on joining their VPP.

S.M.A.R.T Storage Plus 15 $9,400.00

Installation $2,335.45

Subsidy* -$5,100.00

GST $663.55

TOTAL PAYABLE $7,299.00

The battery is a Tesla Powerwall2 with built in single phase inverter and includes black out protection, installation and GST provided you contract supply for 5 years (15% tariff discount) 10 cents feed in tariff. If you cancel within the five years a graduated penalty applies based on the time of cancellation starting at $5500. So even if it turns out to be a bummer deal, it costs no more than Sonnen, plus we are out of the VPP and can also swap retailers.

The sales guy was pretty honest and forthcoming with information, agreeing that come January when Sonnen loses exclusivity then the SA subsidy could perhaps be added to the Federal VPP subsidy although nothing is certain. So maybe delay, but who knows what would happen with battery pricing as arbitrage kicks into gear. It both subsidies can apply then the installed price could be $2299!

A wrinkle in all of this is that we have three phase to drive our monster a/c which wouldn’t be able to utilise the battery so just lights and power would be connected – I guess in reality you wouldn’t want to connect a 13Kwh capacity battery with 3Kw output (have I got that right?) to an a/c anyway as the battery would last under an hour. Still musing over that one.

At $7299 based on our usage profile the payback is 10 years, although we would have some protection against inevitable tariff increases so maybe I’m a bit bearish on that number – it could be a worse case scenario.

I’m pretty happy with Simply Energy overall and changed from AGL a year ago after the usual stuff ups over promised discounts and overpricing together with screwing us over on feed in tariff prices. However, if anyone has had a quote for the AGL VPP I would be interested in comparing apples.

Cheers.

The good news is your air conditioner probably doesn’t use as much energy as you suspect. During the day you can cool your house down while your solar system is still producing power and in summer at night you will probably draw an average of 1 kilowatt or less to cool three rooms, although it will depend on how efficient your air conditioner is and how well insulated your home is. The Tesla Powerwall 2 can provide 5 kilowatts of power and stores 13.5 kilowatt-hours when new, so it’s a pity it will only be able to provide one-third of your air conditioner energy consumption at night.

Hope you can get an excellent price in January.

Thnx Ronald.

Ron is correct Malcolm, and depending on a few other key technical specifications of your A/C plant being ticked off, there might be a couple of other cost effective and long term efficiency options available for you to consider for this circuit or mixed circuit going forward, including:

(1) Run the A/C direct from an independent PV string via a single or 3 phase VFD (whatever suits the AC). Depending on A/C size, situation and location, maybe a 3 kW+ string might be about right, and it might also be auto controlled (or load shared) with an element HWS (optimised use of available PV power).

(2) Same as (1) above but add a VFD to the existing PV array, or a part of the array DC bus.

Best of luck with your power plant going forward Malcolm

Lawrence Coomber

Thnx Lawrence.

The HWS is a single phase heat pump which is on a programmable timer set to heat during solar collection. I wanted a Fronius OhmPilot connected but they are not used much yet and there is an issue of distance from the inverter, so I went for the tried and tested method. Cheaper too!

The A/C is 3 phase, wired accordingly on a dedicated string. Cooling is not really an issue because as Ron says we can cool the house during solar collection. We are on the SA South Coast with cool evenings so just overhead fans will move the air around for comfort. The A/C is also our heating source where it gets to be an issue because winter evenings are chilly and I can’t run the A/C off the single phase battery – unless you have another solution? I’m not a sparky so what’s a VFD?

Another wrinkle is that our power is delivered at the top end – around 253W according to the electrician who plugged his meter into an outlet. I think this has blown the odd light here and there and messed up a sensitive runon switch in one of the wet area extractor fans. The electrician is going to balance the phases across the strings sometime soon. The box is out the front of our house, so I’m not surprised we get the full bottle, so I may need to speak with SAPN to see if they can throttle it back a bit.

Happy if you have any ideas or suggestions. Thnx again..

Malcolm your setup sounds great.

Regarding VFD’s; more RE solutions engineers should be learning everything about VFD technologies and how they can be applied in Solar PV system designs. It has been estimated that over 20% of the total global motor power consumption is wasted because of inefficient motor starting/stopping and the absence of dynamic motor torque control. This would be squillions of kWh.

A Variable Frequency Drive is a robust and efficient power circuit with a DC Input and an AC Output (1 or more phases).

Sound familiar? Yes you are correct, a Solar Inverter does that also. One key difference though is a VFD (when coupled directly to a Solar PV input source) can automatically adjust the AC power output (up and down) instantly according to the Solar PV Array output by dynamically varying both the AC output supply frequency and voltage to the connected load; the net effect being a variation in power consumption.

VFD’s are a very big deal globally for Renewable Energy systems design engineers, as they are in effect a ‘Smart Device’ in their own right, and operate as a Solar PV ‘Power Saving and Energy Distribution Management’ device.

Rotating machines are one obvious application for VFD’s; for example Solar Pumping systems. Our Solar PV Off Grid irrigation and water pumping systems are set and forget solutions managed by nothing more than a VFD (with some feedback sensor inputs – plus remote instruction SMS capability included).

VFD’s have three outstanding attributes when they are integrated with Solar PV solutions. (1) They are used to ‘manage and save power’ and can be applied to many circuits include motors (reduced starting torque/current for one), heating elements (excellent temperature controller with sensor feedback), battery charging (CC/CV), and many other circuits and applications.

System designers for On Grid systems don’t need to over emphasise ‘energy saving’ design solutions to customers because the grid is always there to rely on, but Off Grid solutions or commercial ‘single circuit Off Grid – heavy current / low duty cycle equipment’ with battery storage, have very different imperatives that must be fully satisfied in system design and performance, and that is where VFD’s become an indispensable partner in good design practice.

Lawrence Coomber

Hi Lawrence

Just to re-inforce your comments about VFDs, I build my own 3-phase VFD from a $250 kit, to run my swimming pool pump (it has an older-style single-phase motor, with a centrifugal switch, that normally draws > 15 amps at startup). I found I could start and accelerate the motor very smoothly using the spare phase (which switches out as the speed comes up), with virtually zero starting surge current, and have programmed it to build speed over about 20 seconds to full speed – run there for ~ 20 seconds to purge the pipework etc., then slow down to a reduced speed that still provides good flow (the pool cleaner seems to work better this way). Before, the absorbed power was a shade under 1.4 kW, now a shade under 700W. The motor now runs much, much cooler, and I haven’t had to increase the run-time (I use a garden irrigation to set run times). Great for Solar, great for saving money. Has been operating now for 3 years or so.

Ian I use great examples such as yours when addressing young Solar PV equipment design engineers and manufacturers about challenging themselves through greater emphasis on creative thinking and innovative design from a total solutions perspective, which is what you have done in part.

Bravo Zulu for your comments Ian; and there is no more pertinent and useful Solar PV single circuit system design example (for a specific application) I know of, than the one you have created and set to work this last 3 years – very impressive stuff.

Best practice Solar PV solutions come from the boards of engineers focused on creative design and efficient use of the DC bus, and this strategy is increasingly important with battery storage now a mainstream partner with Solar PV.

I hope you don’t mind me plagiarising your design by making it into an info-graphic for my next gig addressing some (seasoned) RE manufacturing design engineers Ian. LOL

Lawrence Coomber

Thanks Lawrence – you are more than welcome to use the information.

The kit I used is from Altronics: https://www.altronics.com.au/p/k6032-1.5kw-full-induction-motor-speed-controller-kit/

Now $275, but $245 each for 2 (plus GST I guess).

Less use of centrifugally-switched motors these days, but the kit will also work with the now more common PSC (Permanent Switched Capacitor) motors.

My idea was published under “Circuit Ideas” in the February 2015 edition of the Silicon Chip magazine – so I guess it’s been in service for 4 years now, not 3 – and though it was built more as a hobby (my time not included), I’d say it has paid for itself by now.

G’day Fin and Ronald,

I think you’ve missed a key point here about VPP and the way they function or at least the way one major VPP operator functions that pays $1/kWh for dispatched energy.

They work on the AEMO market or pool forecast for the next day, so they send you an email and text message seeking permission and an amount of kWh’s you wish to make dispatchable. It’s worded something like; Tomorrow AEMO have forecast a possible pool shortfall in your area between 4PM and 8PM. How much of your 10kWh battery do you wish to make available to the grid?

Hang on… you just told the the grid may be unstable tomorrow… Common logic tell me that I might need that energy myself (if you’ve got back-up capability) ….now how much do you want to take a chance on? Not much!

Good point, Steven. Fortunately the odds of getting blacked out are still going to be very low, so in any VPP that is at all fair to the household the the payment received should be more than enough to make up for not having 100% control over the battery.

OK, but just wait until Mr & Mrs Battery owner have dispatched 4kW’s (or more) of their 10 kWh battery and load shedding or a black out occurs at 7:45 and they are sitting in the dark….. They will no longer be VPP energy dispatchers ever again!….. or through complacency, they just can’t be bothered responding to make a few $’s…. how’s your VPP going now?……. Only the retailer centric VPP like Sonnen flat will have complete access to your battery……. or the other one, unlikely but…. they work out that their VPP vendor is selling their energy and getting $6-7-8-9 or $10/kWh and they received $1 kWh