Image: Tesla

Long ago, when the internet was made of nothing but stone knives and bearskins, it sounded like this, and looked rubbish:

A long time ago on an internet far, far away Finn paid a Romanian $60 to design a website.

Around the same time, some commentators claimed residential solar power made no financial sense because large solar farms were cheaper. Sometimes they would go into a rant about how rooftop solar only existed because of subsidies. I never bothered to reply. I didn’t think it was worth the trouble, as the Australian internet was particularly primitive at the time. Our bearskins were still wrapped around live bears.

While these people seem to have disappeared from Australia,1 every now and then an American pipes up to tell us we’re doing it wrong.

And now some Australians are claiming the same about batteries. They insist home batteries make no sense because big-ass batteries, like the Tesla Big Battery in SA, are so much cheaper per-installed-kWh they’ll drive home batteries out of existence.

While it’s true big batteries can be built and maintained for less per-kWh, it is not true that they will out-compete home batteries forcing them out of the market. We will end up with a mix of large and small batteries and I predict, in the medium-term, most battery storage will be in homes, businesses, and vehicles.

There are two big reasons why big batteries won’t dominate:

- The difference between retail and wholesale electricity prices. Small-scale batteries are ‘Behind The Meter’, just like rooftop solar panels2. So when a building uses energy from its own battery it saves the retail price of electricity. Retail prices are, on average, much higher than the wholesale price of electricity. Big batteries can only earn wholesale prices for selling kilowatt-hours into the grid.

- A Behind The Meter battery can provide backup power to the property that is behind the same meter. If the grid goes down, having a big battery on the other end of the grid won’t help your home.

Because the Australian internet is now so advanced3 and capable of downloading dozens of cat pictures every day, I am now taking the opportunity to officially reply to people who insist big batteries will beat home batteries. As a bonus, my arguments will also apply just in case there is anyone still around who says rooftop solar power makes no sense because of large solar farms.

Wholesale Vs Retail

There are two4 ways solar farms can sell their electricity:

- Sell on the wholesale electricity market and receive whatever the market price is at the time.

- Have a Power Purchase Agreement (PPA) that pays a fixed price. Most solar farms have these. The amount is based on what wholesale prices are expected to be – weighted by expected output. This should be similar to the average price the solar farm would receive if it sold its output on the wholesale market, but without the uncertainty.

The average wholesale electricity price is far less than the retail price charged on your power bills:

Sources: SolarQuotes Retail Electricity Plan Comparison Tool (after any discounts, include GST, and are for standard tariffs), AEMO

The reason the retail price is much higher than the wholesale price is that it includes the wholesale price plus a heap of other costs. Here are the components of your electricity bill:

- Wholesale prices: Paying generators to provide electricity.

- Long-distance transmission: High voltage transmission lines used to move power long distances.

- Local distribution: Local electrical substations and poles and wires that provide electricity to homes and businesses.

- Metering: Installing and reading meters — reading meters is getting cheaper due to increasing use of meters smart enough to read themselves.

- Environmental Policies: The main one is our Renewable Energy Target that subsidises large scale solar and wind farms as well as small scale rooftop solar power. These subsidies are being phased out.5

- Retailing: Billing, sales, customer inquiries, devising devious new methods of confusing customers, etc.

Once everything else is added on, the wholesale price is only a modest slice of your bill.

When selling energy, a utility-scale battery will only receive the wholesale spot price, but when a home battery’s energy is used in the home (behind the meter) it saves the retail price of electricity.6

Time-Of-Use Tariffs

The retail charges on the previous chart are for standard tariffs, i.e a flat rate per-kWh. Time-of-use tariffs, which vary the per-kWh charge throughout the day, have the potential to increase the return from a home battery but are not as effective as some think. Usually, if a home has solar panels and no battery they are better off with a standard tariff, but if they get a battery they should definitely consider if they’d be better off changing to time-of-use.

Wholesale Electricity Prices Are Volatile

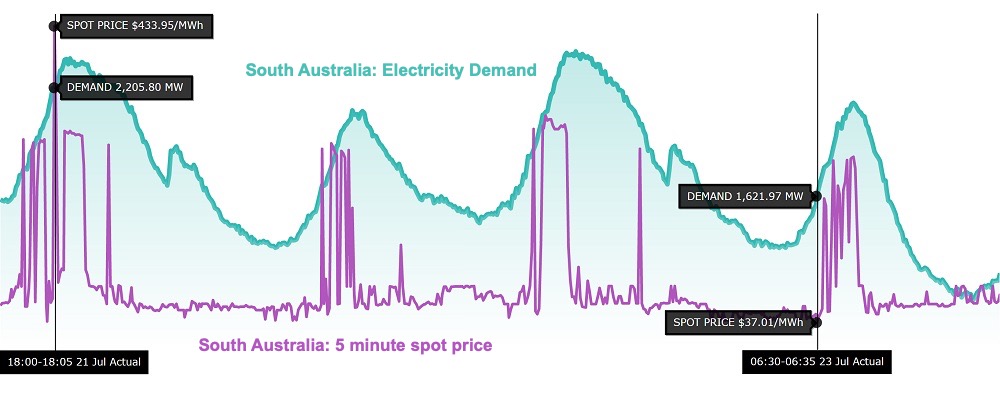

Wholesale electricity spot prices are volatile and can swing wildly. Here’s the 5-minute spot price for the South Australia wholesale electricity market over several days last week (July 2020). The highest spot price of 43.395 cents per kilowatt-hour is shown, as well as the lowest of 3.701 cents:

These 5-minute prices aren’t what retailers pay for the energy they on-sell at retail rates. The actual price is the average of the 5-minute prices in a half-hour period with a price cap limit. But on the 1st of October 2021we will change to 5-minute settlement.[1. Update 29th July 2020: I originally wrote the change to five minute settlement was would occur on the 1st of July 2021, but I’ve been informed it’s now delayed until the 1st of October 2021.] This will improve the return from batteries, but by then there will be enough battery capacity to considerably reduce the volatility in wholesale prices and this will reduce the amount of money that can be made.

But 5-minute settlement will still improve the return from home batteries that can buy and sell on the wholesale market via a Virtual Power Plant or VPP. VPPs could greatly improve the return from batteries, but they could also be used by retailers to rip people off, so be careful when signing up to one.

Wholesale Electricity Prices Can Be Negative

UPDATE 28th July 2020: I made a mistake with the maximum prices given below. I have corrected the passage below, but it was a stupid mistake and I apologize for it. If it was the first time I had done something like this I might not feel so bad, but I’ve done this sort of thing before.7 I will try not to let you down in the future.

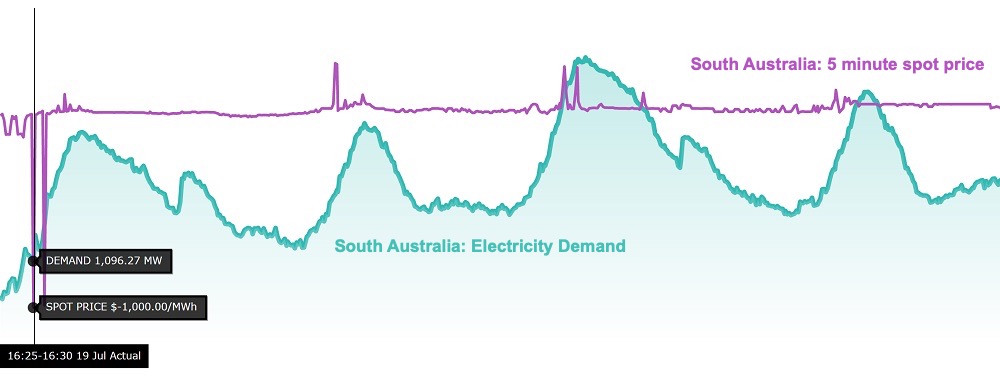

The highest 5-minute price above is 43 cents per kilowatt-hour but this page from the Australian Energy Market Commission gives the Market Cap Price for this financial year as $15 per kilowatt-hour. But wholesale spot prices can also go negative, as this graph of SA wholesale prices starting on the afternoon of the 19th July 2020 shows:

While it may seem odd for prices to go negative,8 it occurs when too much electricity is being fed into the grid and has two advantages:

- Anyone directly exposed to spot prices will use as much electricity as they can because they will be paid to use it. This includes utility-scale batteries and home VPPs.

- It encourages generators to reduce output because they have to pay to generate.

The graph shows electricity prices hitting negative $1 per kilowatt-hour, which I believe is the lowest 5-minute price possible. This means the maximum difference between the minimum stem price and the market cap price is $16 per kilowatt-hour. In practice, it’s not going to be easy for a battery to make this much because after charging up at the ‘maximum’ minimum price it may be months before it can be sold at the maximum normal STEM price. But it is possible for the price on the wholesale spot market to be much higher than the retail price.

A home battery can play the wholesale market by joining a Virtual Power Plant, but it’s also possible through an electricity retailer that passes through the real-time wholesale rate, such as those nice folk at Amber Electric.

Benefits Beyond Buying & Selling Electricity

Batteries can provide a whole stack of benefits beyond buying and selling electricity through what’s called “revenue stacking”.

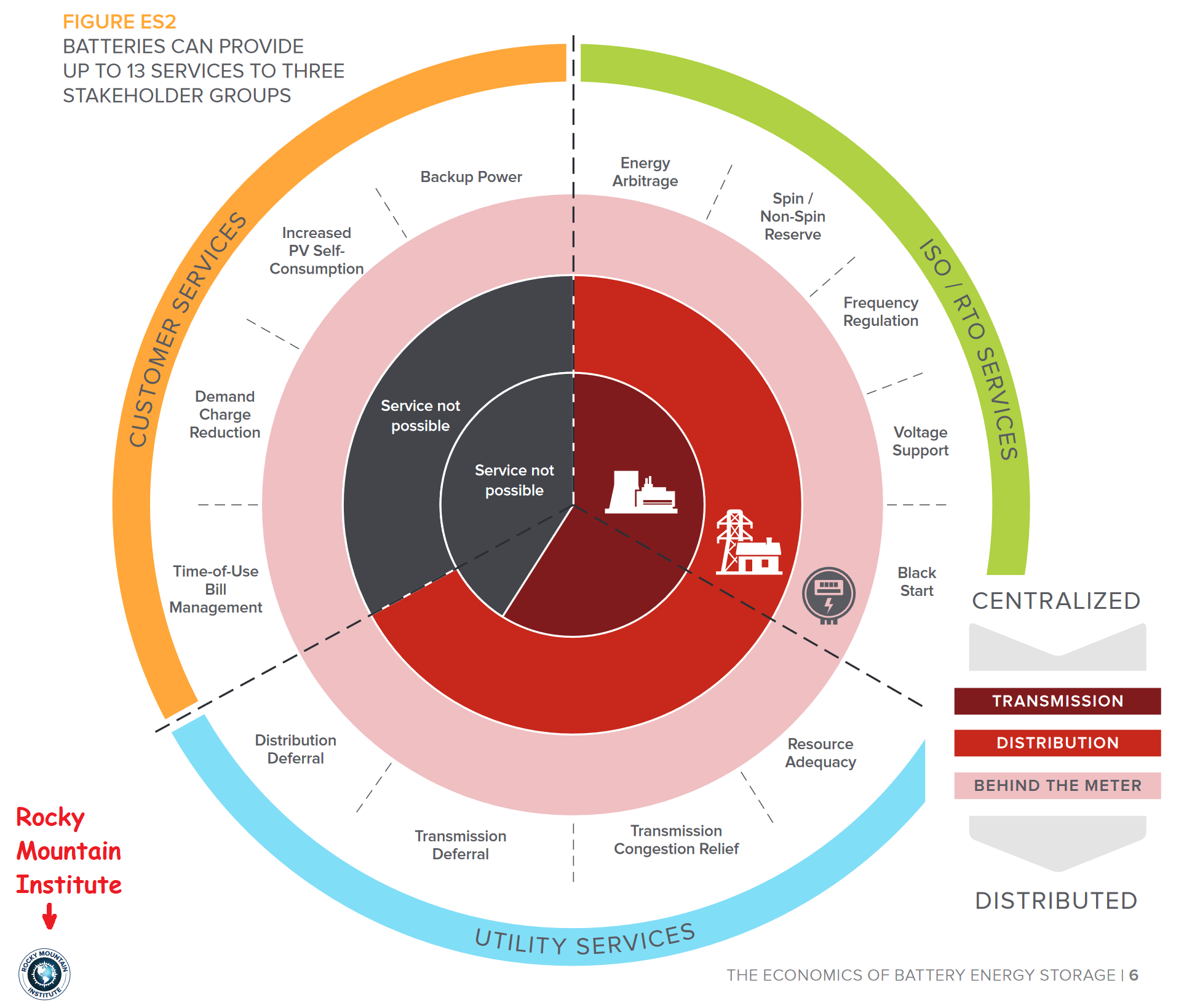

The Rocky Mountain Institute, a sustainability organization in Americaland, has a graphic displaying 13 different services batteries can provide. See page six of this report.9 It divides batteries into three categories based on their location:

- Transmission: These are big grid batteries, typically located away from population centres. The Hornsdale Power Reserve in South Australia — or Tesla Big Battery as it’s often called — is an example.

- Distribution: These are used to support and provide services to local grids. They vary a lot in size but generally don’t come close to large utility-scale batteries.

- Behind the Meter: These are residential and commercial batteries such as an LG Chem RESU or Tesla Powerwall you might buy for your home or business.

Of the 13 services, only Behind the Meter batteries (the pink ring) can do them all, provided they participate in a suitable Virtual Power Plant.10

The 4 services that only Behind The Meter batteries can provide are:

- Backup Power

- Increased PV Self Consumption

- Demand Charge Reduction

- Time-of-use Bill Management

The first two are the main reasons people buy home batteries — people like the idea of having power in a blackout and want to use their low-cost solar energy at night.

The third — Demand Charge Reduction — only applies to businesses that have to pay a demand charge based on the maximum amount of power they use. While there have been attempts to introduce demand charges for households, they haven’t caught on and I don’t approve of them because of the extra layer of complexity.

The final battery service — Time-of-use Bill Management — minimizes bills by discharging or reducing grid electricity consumption during peak times11.

When the value of these four services is considered, if home batteries can be installed at a low enough cost, utility-scale batteries will never stop them from being worthwhile. Even if we could build big batteries for just 1 cent per kilowatt-hour, it would still be economically worthwhile to pay to install Behind the Meter batteries in homes and businesses.

A Quick Example

If a home battery has the following characteristics:

- A standard tariff of 25 cents per kilowatt-hour.

- A solar feed-in tariff of 10 cents per kilowatt-hour.

- Round-trip efficiency of 90%.

- An average of 5 kilowatt-hours of grid electricity displaced each night12.

- The battery provides no benefit other than reducing electricity bills.

This would save an average of $1.25 a day, less the solar feed-in tariff that is forgone by charging it. With battery losses, the lost feed-in tariff would come to 50 cents for a total saving of 75 cents per day or $274 a year. Assuming a simple payback time under 7 years for the homeowner to consider it worthwhile, then if the battery could be installed for under $2,000 it will be worthwhile, no matter how cheap big grid batteries get.

While $2,000 is far cheaper than any installed 5 kWh+ battery available at the moment, many people will be happy to pay more when they consider the battery’s other benefits, such as buying and selling electricity on the wholesale market and backup power.

Unfortunately, even with these added benefits, home batteries are unlikely to pay for themselves at their current prices, with the possible exception of South Australia where there are hefty subsidies from both the government and VPP operators.

Batteries Will Benefit Everyone

Provided batteries fall enough in price, it will make sense to put them in homes no matter how cheap big batteries get. If a home battery can back up a home, earn credits from a VPP and save enough money on electricity bills, why wouldn’t people get one?

At the moment less than 1 in 100 Australian homes have batteries and far fewer are in Virtual Power Plants. But when we get to the point where 1 in 100 households have a modern home battery that is part of a VPP there will be a significant benefit to the grid. All those batteries will be able to provide as much power as a medium-sized power station. They can also absorb the same amount of power when renewable supply exceeds grid-demand.

When we get to the point where 1 in 20 or 1 in 10 homes have a battery system it will be a huge benefit when it comes to managing the grid.

This will help keep electricity prices down for everyone connected to the grid. It will also reduce any pressure to move from simple standard tariffs13 to more complex time-of-use tariffs, utterly confusing demand tariffs and other exasperating arrangements. This will help make Australia a happier and more relaxed country.

Large scale adoption will require batteries to fall in price, but I have no doubt this will happen. It’s just a matter of time. So far, it’s been a heck of a lot of time. But when I look at the relatively low cost of battery cells today and consider how far solar hardware has fallen in price over the years, I’m going to bet batteries become a heck of a lot cheaper over the next decade.

Footnotes

- Possibly because, for a long time, rooftop solar power was cheaper than large utility-scale solar despite being the other way around in every other country. ↩

- Behind the meter means that they are on the building side of your billing meter, not the grid-side ↩

- We finally got around to peeling the bears. ↩

- Besides selling electricity, wind and solar farms can also make money by creating Large-scale Generation Certificates (LGCs) — one for every 1,000 kilowatt-hours generated. At the moment these are worth 3.9 cents per kilowatt-hour, but their value is expected to fall rapidly and may be worth less than 1 cent per kilowatt-hour by 2024. ↩

- Rather than subsidise renewable energy it would make more economic sense to make fossil fuels pay for their health and environmental costs, but for some reason, the Howard Government didn’t go for that and gave us a Renewable Energy Target instead. ↩

- While there are exceptions for homes and businesses that are zero exported limited and can’t send their surplus solar electricity into the grid for a feed-in tariff, in most cases the energy used to charge the battery is not free and this needs to be accounted for when determining battery payback. ↩

- An order of magnitude mistake is why my third wife left me. I didn’t think there was that much difference between $1,000 and $10,000 but she would probably say I shouldn’t have given any money to goatsinbikinis.com at all. ↩

- Some people are under the impression that only renewables result in negative electricity prices, but they are a feature of grids that are all fossil-fueled as well. Renewable energy can contribute to greater periods to negative prices if they have an incentive to continue to produce electricity when prices are negative, such as creating renewable energy certificates. ↩

- The report is 5 years old, which makes it positively ancient when it comes to battery technology, but the graphic still holds up. ↩

- Technically they can only participate in a black start if the grid managers include them in that involved and carefully planned out procedure. And since batteries don’t provide spinning reserve as they don’t spin, they’re not likely to be invited to help with black starts any time soon. South Australia had to do one of these two and a half years ago after a statewide blackout, and boy did some people lose their minds over it. ↩

- and potentially charging during off-peak times ↩

- Its actual usable capacity will be considerably more than just 5 kilowatt-hours. ↩

- Unfortunately, while standard tariffs could be very simple, electricity retailers make them far more complex than they need to be. If retailers want people to accept more complex tariffs the first thing they need to do is simplify existing ones and eliminate unnecessary complexity. But for some inexplicable reason they seem opposed to letting people clearly see which retail plan is best for them. ↩

RSS - Posts

RSS - Posts

Mate you’re seriously hung up on the payback mathematics…right now with the world the way it is, payback with a seriously inflated Aussie Dollar is way down the pecking list compared to something like energy security.

What if you don’t actually care about backup power? I grew up with things like electricity backouts and strikes, occasional gas failures and so on. In my adult life, living in several city and regional areas, I have had nothing like the issues I experienced when younger. Electricity outages are rare in my experience (except during huge bushfires on two occasions and then that is the least of one’s problems), not enough for me to spend money on a solution for.

I have a large (9.3kw) solar system, am not a heavy user (although have a secondary dwelling here as well) and get substantial feed-in tariff credits and never have a bill to pay. At the moment, I cannot see a reason to install a battery, but if they were much cheaper and larger maybe I would.

DC: “…get substantial feed-in tariff credits…”

Which could fall to almost nothing, if a state government with anti-solar ideology ‘achieves power’.

Still fighting Synergy, on behalf of seven tenants who were cheated of their solar feed-in-tariffs… . Should I be surprised that W A Consumer Protection, funded by the state, does not assist in holding the state-owned monopoly electricity provider to account?

RB: “…home batteries are unlikely to pay for themselves at their current prices…”

That’s correct…

But what if Elon’s recent claim that _energy_ earnings will be as great as EV income is based on breakthroughs like the million-mile battery, which appears to offer a battery life of 73+ years… meaning double or triple the current warranty expiry?

OK, Battery Day has been put off until mid-September. There are several possibilities for this postponement:

1.) Tesla still has a lot of PW2s left in stock*;

2. ) There would be immediate consumer demand for MMB tech.,

which supply could not possibly meet. We’d cease buying… and wait;

3.) MMB technology still needs a few tweaks;

4.) Tesla / TSLA timing of announcement of this initiative has financial

implication for the company and / or the stock.

Hoping to buy a future PW3 (or 4, or 5) with a thirty-plus-year

longevity and a 25-year warranty… .

* Don’t laugh. Toyota won’t bring the RAV4 PHEV to Oz with so many

Rav4 HVs in stock…

Lessor says “* Don’t laugh. Toyota won’t bring the RAV4 PHEV to Oz with so many Rav4 HVs in stock…”

They were never bringing it to Australia anyway. They haven’t bought a single PHEV into the country because they also have the Prius Prime and at least one other PHEV. The RAV4 PHEV is a compliance vehicle for the US and maybe they’ll sell some in Europe for some EB credits.

Just quoting a salesperson I asked about the Rav4 PHEV, while examining the RAV4 on display in a Perth shopping centre.

We drive a Rav4 when visiting BC Canada. My wife is interested in the PHEV.

I’ve advised that if parking a Cybertruck is an issue for her, it’ll probably park itself. I’ll cross the Rav4 Prime off her shopping list… .

2) if it half the price, yes, if it double the price…

Lessor – “Should I be surprised that W A Consumer Protection, funded by the state, does not assist in holding the state-owned monopoly electricity provider to account?”

Have you forgotten that, in the state demolition derby of the current WA state government, the WA “department of consumer protection” was dismembered, and hidden in a toilet of the all-powerful Department Of Mines – where, for the sole benefit of the mining companies, the state “economic stimulus” is being directed?

WA – where the mining companies rule…

Oh, and, what is that black faecal matter that mining companies bring up out of the ground (no, not the glowing, pulsing, faecal matter named uranium, with which the ALP is obsessed with poisoning the people for generations to come) – it is the stuff of filthy polluting combustion based power stations, that vomit their filth all over the place.

Do you really expect what is left of consumer affairs in WA, to act against the interests of its master and owner – the mining companies?

Completely agree with you on _all_ the above, Bret.

Well said.

And below: “…the bodgy power poles THAT DO NOT STAND UP STRAIGHT, and house many termite families …”

OMG, you could be talking about the street we live in… .

Poles’n’wires… cause bushfires…

19th-century technology at a time when we face crisis after crisis… !

One aspect that the above article does not sufficiently emphasise, is the aspect of the possible benefit of behind the meter batteries, in terms of energy arbitrage, where the controlling inverter is appropriately configured.

From what I understand, something like a Goodwe GW6048ES inverter can be configured so that all electricity generated by a domestic rooftop PV system, in excess of the household load, can be directed into charging an available BESS, and the stored energy can be discharged, to supply household load when sunlight is not present, and, any excess, can be released into the grid, at a sustained rate.

Whilst I am not able (insofar as I am aware) to include an image file with this submission, some of the graphs of the daily electricity generation of my rooftop PV system, make me wonder what the effect would be on the grid circuitry, if every house on the street, and in the suburb, had electricity generation variability, as shown in some of the daily generation graphs. Especially, with this being the SWIS grid, which, apparently, is extremely delicately fragile (is it true that the transmission lines are made from recycled 5A fuse wire?), and with the bodgy power poles that do not stand up straight, and house many termite families (state housing, here, involves housing multiple families in the same residences), that are probably strained by the load of the extra electrons running around chasing the termites.

The big batteries can not have the benefit of behind the meter batteries, in terms of the energy arbitrage effect on the local grid circuitry – the wires, fuses, etc, along each street/road.

Two huge omissions here. One, the new German/Swiss energy vault technology, cheaper than batteries, you can built them anywhere and will last forever. Two, VTG and VPP in conjunction with the coming 4000 (or more) cycle car batteries will change everything. I see Tesla, in the UK, has already applied for, and been granted, the worlds first VPP licence in the world.

Cryogenic air battery looks even better then energy vault.

4000 cycle batteries sound really good, though they probably have heard about “Osborne effect” and won’t bring it too quickly..

Just wondering aloud Ronald.

FCAS services are currently primarily the domain of big batteries, and as I understand this is the major source of revenue for the Hornsdale BB, not price arbitrage. Tariff arbitrage isn’t the driver of big battery profits.

While home batteries can also provide some level of FCAS service, it can only be done via a VPP and hence the financial benefits to the household will only be a fraction of whatever the VPP operator earns from such a service.

Of course as more big (and small in VPP) batteries join the grid, the extra competition for FCAS will reduce the income potential of this service.

Also you mentioned batteries *generating* power. I know it’s being a bit pedantic but batteries can only store and discharge electrical energy, not generate it.

We can only hope prices will drop but I still think it’s a long way off. As for backup power there are other very reliable and cheaper solutions than batteries.

IMO the growth in EVs sales (and their battery packs) parked in home garages will significantly outpace the rate of home battery installation. EVs will mostly represent a grid demand unless there is some consistency amongst auto manufacturers with a V2G standard.

I just can’t see a home battery making financial sense for a long time (except for households offered big incentives). I hope I’m wrong.

But an EV which can perform the same functions would be way more attractive for those of us who are at home most of the time. The EV battery can perform a dual role.

Oh my goodness! How embarrassing! I’ve changed “generate power” to “provide power”. Now let’s never speak of this again so no one will ever know I made such a stupid mistake!

I do think there is a lot of potential for electric cars to provide vehicle to grid (V2G) services and they could be a major behind the meter application of battery storage.

Yes, V2G, utilising MMBs will be a game-changer… particularly for retirees. Hopefully warranties will reflect the increasing longevity of storage.

In 2016, Paul Nahi of Enphase Energy said storage was where solar PV was 7 years ago, so we still have a ways to go. In addition, hasn’t the COVID hoax really shown what centralized power truly means? The ideologies of self-reliance and independence are what individual resi solar + storage systems symbolize. Since late 2013, I have not had a utility bill — sure, a monthly $34 facility charge, but my NEM agreement pays me back annually such that I am ahead. Back then, I was permitted for 8,500 Watts, but after installing that and seeing how it only put a small dent in my utility bill, I installed 20,000-Watts of solar. I figured it was my home not the banks, and surely not the governments, so why not — who would know? Self-reliance and independence is hard to obtain these days, but without resi solar and storage, people will never truly be free from the power plantation or power fiefdom they are peasants on. Decentralized power is the only way. Ironically, a year ago, the utility company finally figured it out using Google Maps, but it’s easier to ask for forgiveness than permission.

What about a middle ground where the DNSP is allowed to buy and sell energy locally.

It would be a common sense move allowing medium size batteries at substation level.

Economies of scale and allowing more rooftop solar penetration

They already have the real estate and infrastructure …wires and poles and could trade at prices between the wholesalers and retail levels. Excess solar bought at say 12 cents at midday and sold back at 22cents after dark.

Easy simple safe and ready to go.

Just need to convince Angus.

“These 5-minute prices aren’t what retailers pay for the energy they on-sell at retail rates. The actual price is the average of the 5-minute prices in a half-hour period. But on the first of July 2021, we will change to 5-minute settlement, ”

Wasn’t that delayed 3 months? So it would be 1st October 2021?

“The graph shows electricity prices hitting negative $10 per kilowatt-hour, the lowest price allowed. ”

Isnt -$1000MWh equal to -$1 per kWh?

“The maximum 5-minute price above is 43 cents per kilowatt-hour, but it can go as high as $23.50 per kilowatt-hour. ”

Isn’t the maximum $15,000 per MWh or $15 per kWh?

https://www.aemc.gov.au/news-centre/media-releases/schedule-reliability-settings-2020-2021

Also I forgot to link the delayed 5 min settlement link

https://www.aemc.gov.au/rule-changes/delayed-implementation-five-minute-and-global-settlement

I appreciate the links. Thanks again.

I have added a correction to the article. (Now I’m hoping not too many people read this one.)

Thank you for pointing that out. I’ve made a bad error there and I have corrected it. I appreciate you letting you know because the longer my mistakes remain up there the worse I feel.

All good Ronald 🙂

Got to keep you guys accurate. I only know the the minimum and maximum as I’m a customer of Amber with a tesla powerwall 2.

So you have to keep an eye on prices every now and then

Just a little nit pick but your article still states July 2021 for 5 minute settlement, the link above says its been delayed to October 2021

I hadn’t realized they had changed it. Thanks for that. I’ve updated the article.

Have you had a look at community batteries, which are installed with area transformers in suburbia with a sufficient number of solar installations? WA has installed several, Ausgrid in NSW is going to. The justification is that a community battery that can store say 500kWh is considerably cheaper than 500kWh installed behind household meters. The household exports excess solar generation to the grid as usual which is used to charge the community battery. The stored energy is then sold back the households when the sun goes down. Some tricky accounting, required but the overall cost is claimed to be substantially less. The community batteries also add to the resilience of the network, and may defer upgrade costs.

Ron,

Is this the solution to provide cheap household backup? While at the same time reducing polluting land fill?

https://thedriven.io/2020/10/24/where-do-old-electric-vehicle-batteries-go-to-die/

Do we just need to up-cycle battery systems from electric vehicles? Either from crashed EVs or batteries at their end of (vehicle) life?

Looks like a great opportunity for an entrepreneur and a great benefit to the planet.

I think old EV batteries will go into larger energy storage systems, as in the link, while homes are more likely to buy new batteries because of safety and liability issues. While a neighborhood battery could technically back up a large number of houses, I doubt systems capable of doing that will become popular here.

But due to the cost of connecting to the grid it is possible new housing developments will use battery and solar microgrids.

Why is it we have a government “Terrified” to be seem supporting Australian battery tech. University discoveries on new gen solar and battery tech seenpms tube as welcome as as a barbed wire enema .

20million vehicles in Australia, and new vehicles, 1million each year.

Electric vehicles have huge batteries for the long drive, but the daily drive 365 days a year is a very small 7kwh and easy to top up daily.

20million x 100kwh = 2,000 Gwh every day.

Fossil fuelled power is 25Gw x 24 hrs = 600Gwh if you are lucky.

shut downs for maintenance

flooded coal mines

accidents and repairs.

40% of grid demand is the home and when every Australian has its EV and rooftop it will be ‘red ink all over the books’ for the power companies.

We need to know where we are going because the nuclear lobby is trying to capture the industry, with government guarantees.

60 to 100 years locked in profits, and massive locked in costs.

Did I say 2,000 Gwh every day for free from the 20million roof top solar power systems.

Stephen Brickwood,

“We need to know where we are going because the nuclear lobby is trying to capture the industry, with government guarantees.”

Dr Alan Finkel, who is now special adviser to the Australian government on low emissions technology, said recently that it was “hard to see” Australia going down the nuclear power route:

https://reneweconomy.com.au/no-need-for-nuclear-power-to-reach-australias-climate-goals-finkel/

I saw a 60 Minutes Australia, 10 March 2022, with nuclear promoters talking about many things. But not the real matters.

On the ABC Insiders show recently the leader of the National Party, Barnaby Joyce was promoting SMR, nuclear plants.

Prime Minister, Scott Morrison walked about the floor of the national parliament house with a piece of coal in his hand and mocked and belittled the concerned people of Australia.

The question to my thinking is which enemy of the USA can not have their Nuclear industry to replace fossil fuel power?

And what is the military costs with this power source?

Which dictator?, Mr Putin is using both nuclear and fossil fuels, and threatening the world with nuclear weapons.

The nuclear is a concentrated energy source and needs a grid to distribute the electrical energy.

BUT x5fold demand means grids and plants x5fold !!!

80 SMR today and 400 in the future at $2billion each, plus each with a new grid. STUPIDLY big.

All to get power to the dispersed ends of the grid.

NONE of these matters are ever discussed.

They are all lost in their own specialties and their own financial backers.

The nuclear promoters just ignore these matters and keep talking up their biased view.

Alan Finkel totally ignored, it is terrifying.

Liz Hayes recently.

I’m curious to know what is the potential if every home (or 40-50-60%) with a solar system installed a 10kWh battery to be used in evening peaks based on the installation status Dec 2023. There are far too many variables to give a simple answer so some realistic assumptions would be needed. V2G EV would be a factor in the future but I think if we just consider 10kWh storage from whatever source for now. I’m only posturing the question as it would take some thinking and a long article of modelling to come up with some ideas. This has probably been done by organisations like AEMO in their planning so if anyone has a link to anything modelled, that would be OK.

Thommo, just look up AEMO’s latest Integrated System Plan. They model the impact of rooftop solar PV, home storage and EVs. It’s updated biennially. It’s actually a pretty encouraging outlook, provided it can be delivered (which is the primary concern).

The 2024 draft is available:

https://aemo.com.au/consultations/current-and-closed-consultations/draft-2024-isp-consultation

They have this summary (page 47):

• Solar generation continues to rise. Today, one-third of detached homes in the NEM have rooftop solar. By 2034 in the Step Change scenario, over half of the detached homes in the NEM would do so, rising to 79% in 2050, driven by ever-falling costs. At that time, forecast total rooftop solar capacity is 72 GW.

• Residential and commercial batteries are becoming more numerous as costs decline, with adoption forecast to grow strongly in the late 2020s and early 2030s. The Step Change scenario forecasts growth in capacity from today’s 1 GW to an estimated 7 GW in 2029-30, and then 34 GW in 2049-50.

• EV ownership is also expected to surge from the late 2020s, driven by falling costs, greater model choice and availability, and more charging infrastructure. By 2050, between 63% (Progressive Change) and 97% (Step Change) of all vehicles are expected to be battery EVs.

Pages 61-63 discuss energy storage including the levels of home and EV storage capacity in context of intra-day shifting.