Will a grid connected Powerwall 2 beat a term deposit as an investment?

Update: read about the newly arrived Powerwall 3 in Australia

Tesla has announced the impending arrival of the Powerwall 2 at a promised price point that, on the surface, looks very compelling: $10,150 fully installed1, or 23c per warranted kWh.

It seems particularly impressive when you consider that in Sydney and Perth, time-of-use tariffs can go to 50c per kWh during peak periods.

That’s 23c for electricity from a battery vs. 50c for grid electricity. Surely that makes the Powerwall 2 a no-brainer investment for people on such a tariff?

I decided to look a little deeper into the economics of using Australia’s cheapest battery2, on Australia’s highest grid tariffs. Unfortunately I found that high peak rates are not nearly as good for the economics of the Powerwall 2 as they seem.

Read on to discover why.

Where are the highest electricity prices in Australia?

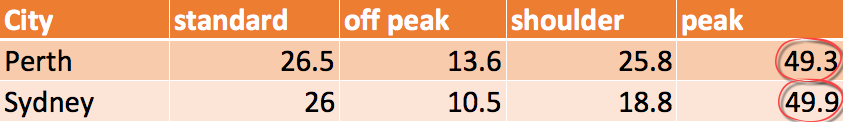

The highest per-kWh electricity rates in Australian capitals are time-of-use tariffs in Sydney and Perth:

Cost per kWh of standard and Time of use tariffs in Sydney and Perth.

Or for those of you that prefer charts:

As you can see, the peak rate in both cities is almost the same.

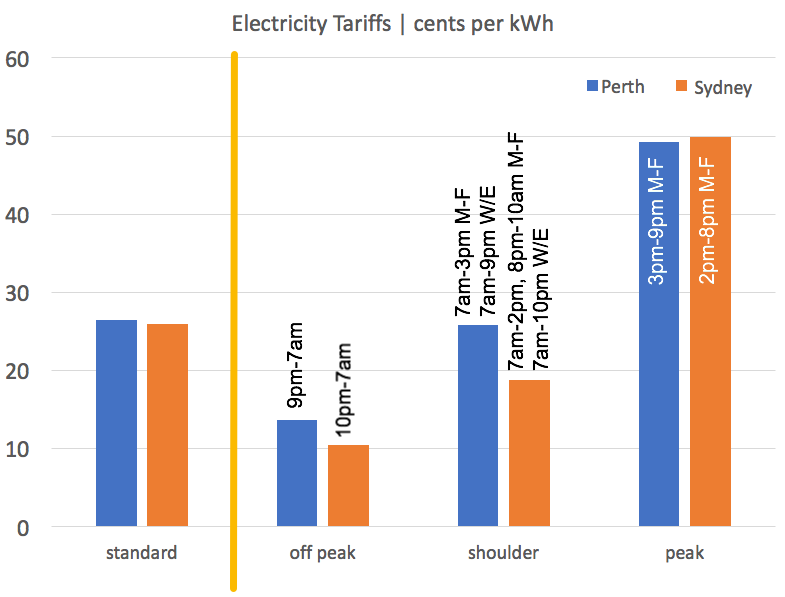

It Has To Beat A Term Deposit

If I had $10,150 to invest I could put it in a term deposit in the bank and let it earn interest. At 1.5% after inflation, then after 13.5 years I would have $12,430 in today’s money.

Or I could invest it in a Powerwall 2…

and then put the money it saves me on my electricity bills in a term deposit.

Most people are going to require the return on a Powerwall 2 to be a lot better than the return on a term deposit to be worth the cost and the risk. But being better than a term deposit is the lowest bar it has to clear to be economically worthwhile for anyone at all.

But it turns out it has trouble even clearing that.

In order to estimate how much money a Powerwall 2 might save I have made the following assumptions:

- The total installed cost of a Powerwall 2 is $10,150.

- It is fully cycled once per day.

- Over its lifetime it will provide 50% more stored electricity than it is warranted for.

- Its operates for a total of 13.5 years before dying.

- Current electricity prices and feed-in tariffs remain constant in real terms.

- Perth’s feed-in tariff remains at its current rate of 7.1 cents while Sydney’s is assumed to be 6 cents.

- On average the Powerwall 2 is charged with 75% solar electricity and 25% off-peak electricity.

- The round trip efficiency of the Powerwall 2 is 89%.

- Interest on a term deposit is 2.8%.

- Inflation is 1.3%.

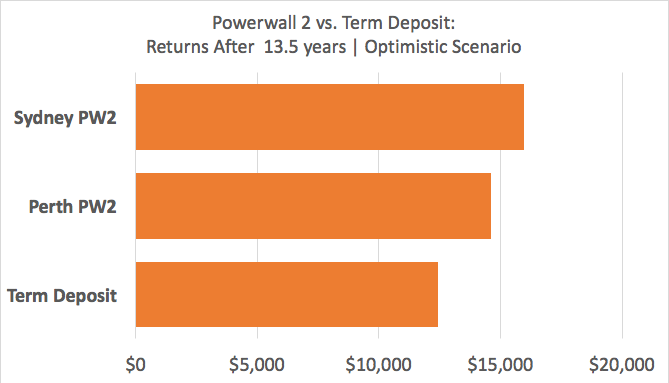

Powerwall vs. Term Deposit Returns: Very Optimistic Scenario

Using these assumptions, after 13.5 years I can save around $23,790 on electricity bills in Sydney and $22,370 in Perth with a Powerwall 2.

But because my initial $10,150 investment in the Powerwall 2 is now worthless I would actually only be about $13,640 ahead in Sydney and $12,220 ahead in Perth.

But, to make a fair comparison, I should also put all the savings from electricity bills into a term deposit. When this is done the total savings of a Powerwall 2 owner in Sydney would be $15,950 and in Perth they would be $14,600 ahead, which puts the Powerwall 2 clearly ahead of a term deposit in both cities.

Case closed? Unfortunately not. There are several reasons why the savings from using a Powerwall 2 on a time-of-use tariff are unlikely to be this good.

Why Powerwall 2 Savings Will Be Less

In practice, the savings I’ve just calculated will be lower for the following reasons:

Reason #1 You Must Compare With A Standard Tariff

For households with large solar systems and no battery storage it is usually cheaper to be on a standard tariff, but if a Powerwall 2 is installed the best tariff in Sydney or Perth will change to a time-of-use one.

So the amount of money saved with a battery is the difference between the new time-of-use bill and the old standard tariff bill. Comparing time-of-use-without-batteries with time-of-use-with-batteries is the wrong comparison.

The correct comparison is:

Money saved = Standard tariff bill without batteries – Time-of-use tariff bill with batteries

What is totally wrong is:

Money saved = Time-of-use tariff bill without batteries – Time-of-use tariff bill with batteries

After taking into account feed-in tariffs and efficiency losses, using one kilowatt-hour of stored electricity would reduce a time-of-use tariff electricity bill by around 42 cents in Sydney or 39 cents in Perth. But the real saving might only be 32 cents or 29 cents. The exact amount will depend on the household’s electricity consumption and the only way to know how much you are saving is to take your electricity bill and work out how much you would have paid if you had been on a standard tariff without batteries and use that as your comparison.

There may be some people with large rooftop solar systems who would have been better off with a time-of-use tariff before they got batteries and so this will make no difference to them. But these people are probably very rare.

Reason #2 There Are No Peak Periods On Weekends

Time-of-use peak periods are only available on weekdays. The lack of weekend peak periods means people are faced with the choice of whether or not to use their Powerwall 2s on Saturdays and Sundays. Doing so will result in the same amount of wear and tear per kilowatt-hour as using them in a peak period, but for much less return.

With an 89% efficient AC coupled Powerwall 2 and Perth’s 7.1 cent a feed-in tariff, replacing peak consumption with one kilowatt-hour of stored electricity will reduce a household’s electricity bill by 41.3 cents, but using it to replace cheaper shoulder consumption will save less than half that at 17.8 cents.

In Sydney, with a 6 cent feed-in tariff and an identical Powerwall 2, replacing peak consumption with one kilowatt-hour of stored electricity will save around 43 cents, but replacing shoulder consumption will save less than a third that at around 12 cents.

Reason #3 Peak Periods Are Short And Often Sunny

In Sydney weekday peak periods are from 2pm to 8pm and in Perth they are from 3pm to 9pm. At six hours long this may seem like plenty of time for a large household to use all the energy stored in a new Powerwall 2, as its average output would only have to be 2.25 kilowatts and it can manage a continuous 5 kilowatts.

But because peak periods start while the sun is still shining, any household with enough rooftop solar to regularly fully charge a Powerwall 2 will normally still be producing a considerable amount of solar electricity until late in the afternoon. This limits the amount of time during a peak period a home will need to draw upon battery storage.

The earliest the sun ever sets in Sydney is around 4:53. If we assume rooftop solar production falls off enough for a household to start drawing on battery power once the afternoon is two-thirds over that will only leave 4 hours and 46 minutes in which to use a Powerwall 2’s stored energy.

In the middle of summer in Sydney the sun doesn’t set until the peak period is finished for over a month and a half. If battery power is drawn on once the afternoon is two-thirds over, there will only be 2 hours and 13 minutes to use all the Powerwall 2’s stored energy on the longest day of the year. This would require an average power output of 6.1 kilowatts which is 1.1 kilowatts above its continuous output. This might be possible on account of how its average power output should be higher than its continuous power output, but the number of households that would regularly draw that much power while their solar system is still providing a portion of their electricity use would be extremely small. Possibly even non-existent.

The situation is a little better in Perth. If they start using stored energy once the afternoon is two-thirds over, on the day with the earliest sunset of the year they will have 5 hours and 22 minutes of peak period to draw from their Powerwall 2. And on the day with the latest sunset they will have 3 hours and 20 minutes. This makes for an average of around 4 hours and 20 minutes each weekday, with the advantage the sun will always set before the peak period ends.

The short amount of time available to to use stored energy during peak periods means anyone installing a Powerwall 2 whose electricity consumption is even remotely normal, will have to be resigned to only using a portion of its capacity during peak periods and the rest during shoulder periods if they want to use it at high capacity. If they only use stored energy during peak periods then they will have to use it at low capacity and will hope it operates for an extremely long time past its maximum warranty period in order to pay for itself.

Reason #4 Tariff Arbitrage Will Get Harder Over Time

The cost of battery storage is rapidly falling so it should not be long before it becomes commonplace. And if electric cars become popular they will add a huge amount of storage to the grid.

But if battery storage increases, people will use less peak and more off-peak electricity and this will the cause the price difference between the two to decrease and harm the economics of battery storage using Sydney and Perth’s time-of-use tariffs.

So if you think battery storage and electric cars are going to take off over the next few years and you are also counting on peak prices remaining at around 50 cents a kilowatt-hour over the next 15 years to pay off your Powerwall 2, then you have some cognitive dissonance issues to deal with.

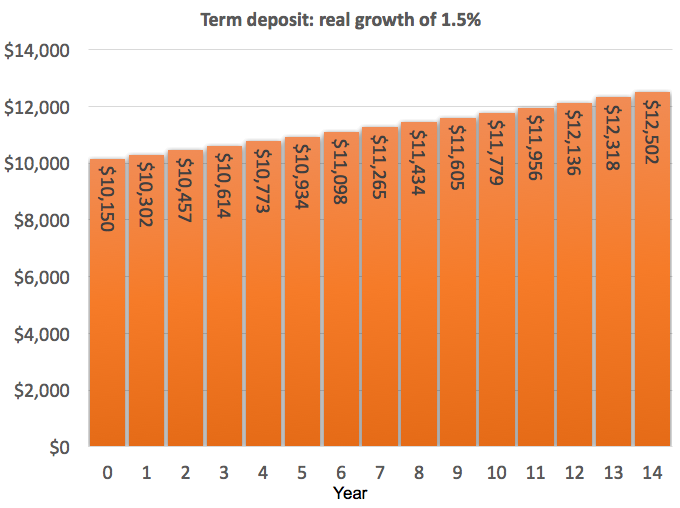

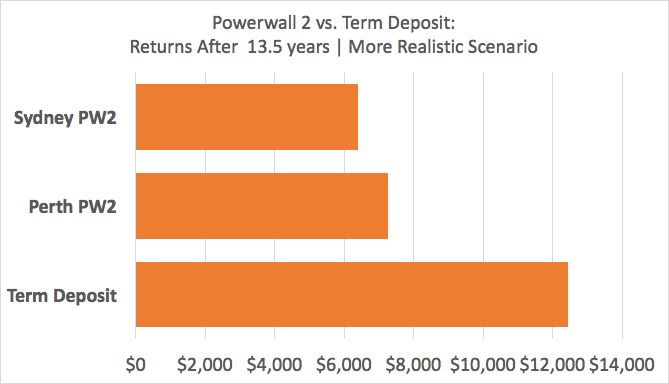

Powerwall vs. Term Deposit Returns: More Realistic3 Scenario

Because it will be so difficult to use all its stored energy during peak periods, I think a household that cycles its Powerwall 2 daily would be doing very well to drain it 50% during peak periods and the remaining 50% during shoulder periods.

I can calculate just how much in today’s money they would have if they invested $10,150 in a Powerwall 2. The results are:

Term Deposit Only: $12,430

Powerwall 2 In Sydney: $6,390

Powerwall 2 in Perth: $7,260

As you can see, the results are horrible. In Sydney a Powerwall 2 leaves households around $6,000 worse off than just putting the money in a term deposit. Perth does a little better because of their higher shoulder tariff, but they are still around $5,200 worse off.

And those calculations are comparing time-of-use tariffs before and after. If the household would have been better off on a standard tariff before the Powerwall 2 was installed, which is likely, then the outcome would be even crappier. So under real world conditions, it looks very unlikely that a typical home cycling a Powerwall 2 once per day will beat a term deposit.

It Is Possible To Save Money With A Powerwall 2 – But The Stars Have To Align

It is difficult to beat the return on a term deposit by installing a Powerwall 2 using my assumptions, but it can be done provided a household’s electricity consumption is extremely unusual and time-of-use tariffs remain as high as they are now. Even if you are confident you can use most of a Powerwall 2’s output during peak periods, you will still be at the mercy of changes in electricity prices that are out of your control. So you will not only have to be unusual, you will also have to be lucky.

Footnotes

- Grid connected – no backup ↩

- Per warranted kWh, cycled once per day, assuming Tesla keep their word, they have a long record of not delivering on promises. ↩

- But still optimistic ↩

RSS - Posts

RSS - Posts

Yet another great article Ronald – so tempted to invest but holding off for a Powerwall 4 that can be used to directly charge my future EV from the PV. Given my plus 70 age want to see the roof able to used by next occupant in these multiple ways.

Who knows but 24M and NEC might come up with much cheaper and denser batteries in the not too distant future:-

http://planetsave.com/2015/06/28/lithium-ion-battery-breakthrough-could-cut-costs-50/

Then again there might be local community owned Mw scale storage by then?

Speaking of 24M the following link contains information about a sulfur based battery developed by MIT professor, Chiang.

http://news.mit.edu/2016/battery-challenges-cost-and-performance-1102

Such developments indicated that distributed energy storage will emerge and along with block-chain technology we will have PV systems sending energy to appropriate size home batteries, hot water service, the EV AND the MW scale local storage facility.

This is going to become a must as EVs become the dominant form of personal transport

A good articl;e and much of the necessary detail. One piece not so well covered is the “using car for home use”

The flaw is that people expect to get in the car ready to go to work. This means, flattened from leave work to go to bed time, and recharged o/night ready for the morning drive.

All good, except the car is now getting two charging cycles per day, one of which o/night might be deep occasionally.

Who is prepared to risk resale value of a car based on the kids computer use draining the car?

Same issue as resale valuation on home batteries. You look for Bible/Koran whatever on back seat of a car – only driven to worship. I guess with house with LED’s or whatever that shows the battery was hardly used, perhaps a historical usage record assessed by some smart software eventually

Whatever though, I doubt people will use cars except for if they really have to because its the three days of gloomy cloud period and need to get through a bit at the end. Otherwise, again, the software must deal with prioritising battery first, and most would opt for a dud and dark house than a dud car half way to work, even if they can top up on the way – but enough to get home too, and manage the next evening as well?

Hi Ronald,

Could you please do a calculation for the Perth A1 tariff which I am quite sure that a lot of people are on. Its 24 cents per unit at all times. (Syngery)

Stuart

Hello Stuart. With Perth’s 7.135 cent feed-in tariff and an 89% efficient Powerwall 2, each stored kilowatt-hour of solar electricity used will reduce electricity bills by 16 cents. Using the same assumptions as in the article, after 13.5 years the a Powerwall 2 owner would have around 50 bucks. That is, investing in a Powerwall 2 would result in a loss of around $10,100. Compared to a term deposit that’s a loss of around $12,400.

“Reason #2 There Are No Peak Periods On Weekends”

Haha. Been waiting years for penny to drop on this one. All our so called ‘experts’ on solar and batts have totally ignored it, been ignorant of it, plain stupid or maybe all of the above.

Congratulations Ron on being the first to ‘out’ this point. I am impressed as well with the economic analysis’s of various systems you have been cranking out. I suspect there is some basic business accounting training lurking behind this. I have not been able to fault anything you have put up thus far.

Not sure if you have been successful converting Finn to your methods, I tried a couple of years ago and failed dismally 🙂

Easy Tiger!

Loving these scenarios. As mentioned, if you are in an area where you only have one choice for your tariff and there are no solar rebates at all, the math is a little better. 47c/kWh peak. We use much more than that so assume you use 13kW each day from Powerwall2. Weekdays at 47c/kWh and weekends at 17c saves you (($6.11 x 5 = $30.55) + ($2.21 x 2 = $4.43) x 52 weeks = $1,819).

At that rate, the payback period is 5.6 years or an 18% return on your money.

Giving the cost reductions, capital values (due to lower costs) rise by approximately $12,000 at the end of the first year, so you get you money back on resale values as well as saving money each year thereafter. Interest rates on business loans are approx 6% but a net return of 13% is worth dipping the toes in. Now, if only we can find an installer for our region?

Ronald, it sounds like regardless of which hulking battery storage solution is chosen, or EV is purchased, that with the energy monopolies getting greedier and greedier, one thing is for certain besides death and taxes — people are going to need a damn reliable solar system to insure that they can at least have the Sun on their side! I believe decentralized power aka microinverters are the right way to build your solar solution — I have 73 Enphase microinverters, 6 separate solar strings, and even if I experience a microinverter failure, my solar system never stops working. I think with all the battery storage and EV’s that we are gravitating towards, the energy monopolies are just licking their lips thinking of how their concocted TOU rates and demand-charge fees will bring them more revenue. A failed solar system means charging your batteries from THEIR grid, and that is going to be costly, so people MUST have a reliable solar system, a modular and scalable one that they can keep adding to as their budget permits. Enphase Energy in Christchurch, New Zealand, should be a spot all the People are aware of. Cheers from the USA where the People just won!

Would your calculations change if you had a tesla model s to charge up every night? Would having a model s to charge at night make it more worthwhile having a power wall 2 or less worthwhile?

Charging an electric car with energy from a Powerwall 2 would make things worse. People on time-of-use tariffs can use off-peak electricity to charge electric vehicles for about 10.5 cents a kilowatt-hour in Sydney or 13.6 cent in Perth. In both cases people would be better off using their stored energy to avoid shoulder consumption rather than charge a car as they’ll save more money that way.

And cheapest of all would be to charge an electric car directly with solar power during the day. The majority of Australian cars are parked at home for most of the day, so many people should be able to manage this.

Yes, and be careful about V2G. Wears the car’s battery out.

http://evtc.fsec.ucf.edu/publications/documents/HI-12-16.pdf

The type of Vehicle to Grid (V2G) described in that paper is just strange and wrong. But sending electricity from a vehicle into the grid during a critical peak when it can be worth over $10 a kilowatt-hour is not so bad and can be less than one dozen hours a year. Also, using a battery at (very) low power should have little effect on it. Of course, once enough batteries are connected to the grid it will pretty much eliminate high electricity prices during critical peaks.

There is nothing odd about that data, Ronald. Reposit and their “Terabytes of data” were not the subject of the experiment, but general use of an EV battery for storage purposes. That particular cell is the same as in the Tesla, and NCA. Tesla’s warranty is 200,000 miles. According to The Idaho National Labs, at 60mph, the car consumes 272Wh/mile. Total aggregate is just 54MWh.

Spending that storage on the house or grid, costs more in increased EV running costs than it returns in tariff. To paraphrase the data in simpler terms, the average EV uses 7.5kWh/day. Even 1kWh/day is a significant proportion of the battery’s useful life.

Average discharge rate in an EV is small compared to 85kWh capacity, so a household load isn’t insignificant.

The increased capacity loss is perhaps surprising, but large capacity batteries made from high energy density NCA, aren’t well appreciated for what they are, leading to mythology around exceptional cells.

Smaller EV batteries using LG’s NMC cells, for example, have a total aggregate of around 40MWh. In those cases, V2G has less effect, because calendar aging

tends to be greater than the effect of discharge, but can still cost.

Calendar aging is good reason for not considering extension of home storage batteries beyond the warranty, BTW. Ten years is a very long time for general Lithum-ion.

I agree there is nothing odd about the data. But I do think someone attempting V2G as described in the paper in Australia would be doing something strange and they would be doing something wrong – if they wanted to make or save money.

The study is about the value of EV batteries as DES, not profit. Replacement Tesla battery is USD$12,000 = $16,500.

Say 50MWh = 33c/kWh. Evaluate that, and the lost vehicle fuel offset. Does not pay. Flash in the pan Reposit requires the battery to be online,where sometimes the $10 Jackpot is paid out.

Smaller, higher discharge batteries could perhaps be used,

but larger >60kWh will definitely suffer.

No you must understand. If you have an electric car to charge then you have to change your first reason:

Reason #1 You Must Compare With A Standard Tariff

Instead of comparing time of use tariff plus battery to standard tariff without battery with an electric car that uses about as much electricity per day driving as your household does means you actually have to compare ToU tariff with battery with ToU tariff without battery. Of course youre not going to charge the car with the battery.

I mean *misunderstand*

Which ever tariff would give the lowest electricity bill before batteries are installed is the correct comparison. This will usually be a standard tariff for homes with large rooftop solar systems, but it could be a time-of-use tariff. If having an electric car would make a time-of-use tariff cheaper for a household before they install batteries then that would be the correct comparison.

Australian cars are driven an average of 42 kilometers a day and need to be charged with one kilowatt-hour of electricity to give them around 5.5 kilometers of range. That means an electric car will require an average of around 7.6 kilowatt-hours of electricity a day. On average in Australia that can be provided by a little under 2 kilowatts of solar panels.

Again with the assumptions,young Ron.

eg. Why would anyone anyone lock in their cash to variables like a miniscule 2.8% term-deposit return or count on a low inflation rate remaining low?

Try recalculating your arithmetic using the approx. 10% (including 100% franking) you can get by buying bank-shares. Not only is the return consistent, but the shares are always fluid:( ie you can dump them in minutes)…and there’s always a good chance of capital gains if you can afford to wait a few weeks/months. The bottom line is: I STILL don’t see any advantage in any of the expensive ‘power-wall’ options over lead-acid battery-banks, but plenty of disadvantages.

ps…. Needless to say the lead-acid battery option refers primarily to a stand-alone system. Regardless of what FiT arrangements you have your connection-to-grid charges will negate the profit from any benefit. And will at some point not even compensate for the connection charges.

It’s what we used~ in the old days ~ used to call a ‘mug’s game’.

Actually I’m struggling to find anywhere to park cash at 2.8%. I must be in the wrong bank !

Hi Chris…

A bit behind the times (STILL trying to point out the benefits of getting out of a system that (like any system) is only concerned with making a profit from YOU! Go independent; ie stand-alone.

As stated (and perhaps not clearly enough) the stockmarket is a neverending source of wealth ~ which requires just a dash of common-sense an the ability to ignore the ‘experts’ (ie. staying OUT of the ‘system’.) Ask yourself: if the ‘experts are so clever, how come they’re working for a living?? 🙂

To deal with any spare cash (even small amounts, since it all operates on ‘percentages’, not actual dollars), open a FREE tradiing account with, eg, COMSEC (google it up) and BUY bankshares.(at least to begin with). The major banks make a point of paying about 6% pa in dividends (varying a bit depending exactly on how much you paid for the shares on the day you bought them), fully franked. That means the return is about 10% pa. without even having to get out of bed….. and you just KNOW the government can’t afford to let the banks go broke, so there’s a sort of unstated guarantee from the government that your money is safe. But it gets better! Since the banks all go ex-dividend at different times you can, with a bit of luck in timing, buy the dividend of all four major banks (and probably most of the minor ones) in a single year. ie. get a 40% return on your money over 12 months. And it can get better than that, too (14 years without a losing trade supports that claim), but may leave it there. get back to me if you want to talk. [email protected]

G’day Ronald

I just read this good article today – well done.

As far as WA is concerned, two of your assumptions are probably invalid.

“5 Current electricity prices and feed-in tariffs remain constant in real terms.”

Given our current state Gov’t has managed to gouge electricity prices (57% increase over three years until last year) whilst wrecking our credit rating / budget by overspending on rubbish (i.e. a stadium with no parking which will take 5 hours to empty – using their own figures) and intends to sell Western Power “to balance the budget they stuffed up” I cannot see electricity price increases here being anything but way over the inflation rate as soon as the March election has become history.

“10 Inflation is 1.3%.” If trump does any domestic stimulus (pump priming) or trade wars with China (both appear likely) then inflation is likely to be well over 5% p.a. over the next three years or so. WA still has a largely resource based economy, so any flow on effects will be exaggerated here.

Both of those would swing the break even towards batteries.

My only certainty is that batteries will hit a break even for most people sometime over the next three years due to price drops in battery tech and rises in electricity charges – especially “admin / grid connection charges” in WA.

Arron

Was it Von Clausewitz who said no battery cost estimate survives contact with reality?

If electricity prices in WA continue to rise in excess of inflation then, at some point, Powerwall 2s at their current installed price estimate will start paying for themselves. But the correct time to install batteries would be when the cost of electricity means they start saving money. There is no economic point in doing it before its profitable.

My estimate in the article assumed all prices remain constant with inflation, whether it is 1%, 10% or Weimar Republic style. It’s simplistic assumption, but it has the advantage of being simplistic.

The decreasing cost of battery storage means WA grid costs can be reduced by installing storage in rural areas and taking some users completely off-grid. But whether or not this will be enough to offset other increases in that state is not clear.

“The decreasing cost of battery storage means WA grid costs can be reduced by installing storage in rural areas and taking some users completely off-grid.”

Interestingly Western Power has said recently that it can save itself ~$400m vs the cost of maintaining thousands of kilometres of grid infrastructure by doing exactly that. As a benefit, the reliability of the power will go up – it’s not so good right now in some of those places.

Why do we look at battery installation as an investment rather than a cost saving initiative. In the realistic scenario for Sydney the Powerwall 2 installation saving is $6390.

If I choose to invest in a term deposit instead of installing the Powerwall 2 I’m still paying for electricity. So I will pay an extra $6390 for my electricity over this period. So my term deposit option will give me $12430 – $6390 = $6030 in total. Less than the savings I could enjoy from installing the Powerwall 2.

Am I missing something?

If a someone doesn’t invest in a Powerwall 2 then they won’t get the electricity bill savings it could have given them. All they will have is the $10,150 the Powerwall 2 would have cost, plus interest they earn if they put that money in a term deposit in the bank.

If they did buy a Powerwall 2 then they would get savings on their electricity bills, but they would be $10,150 poorer. With the assumptions I used in the article, the savings on electricity bills, plus the interest they earn, would only equal around $6,930 in Sydney after 13.5 years which is when the Powerwall 2 is assumed to stop working.

So after 13.5 years a person putting the cost of a Powerwall 2 in a term deposit would have about $12,430 and a person who bought a Powerwall 2 would have a total of around $6,930. The term deposit clearly comes out ahead.

If the sole purpose of these new technologies is to compete with existing generation, transmission and distribution technologies that exist within a web of subsidies, regulations, habits, deceptions, rorts and externalising of costs then they will have a difficult time getting a foothold.

However, if these new technologies provide benefits and solutions that go beyond the day to day consumer dollar savings AND we want them to have chance of rapid uptake BECAUSE they lead to additional benefits and solutions then we need to rethink the whole energy paradigm.

As the planet continues to heat and our fate becomes ever clearer can’t we apply just a bit of our brain power to more than simple sums?

would be great toi build all those model variables into an online calculator – feedin tariffs, location etc so we can come back time and again an re asses our own situation – thatd be worth paying for lol

Some very interesting comments about the cost analysis of the Powerwall 2.

But, what a lot of people are forgetting are two intangible factors of the Powerwall can provide that no amount of money will buy.

1. The environmental factor of shifting power to night time use, thus reducing the need/size of base-load generators at night.

2. The sheer convenience of freedom to being able to use the “free” electricity at night time to do household stuff such as ironing, cooking, washing without having to watch the solar monitor to maximise one’s self consumption. No longer need to set one’s activities by the sun’s presence. No more having to set things to timers to take advantage of off-peak rates on TOU or having power diverters for hot water systems. This will suit day workers to a T.

I worked my pay-off would be about 6.5 years provided that electricity prices same the same as they are now on Endeavour Energy TOU. If they rise, when payback will be lower. So, I can’t wait to get the Powerwall 2. Of course, the only thing that has to be paid is the Daily Supply Charge for the convenience of being connected to the grid to buy some electricity (hopefully mostly in winter for heating) and any excess export (which I expect will happen in Summer). It’s a shame that we can’t bank electricity and get back in future for no difference in price (like in some US states) where true NEM takes place.

Another thing people forget is why FiTs are lower that retail price is that little thing called Power Factor. Not all loads are resistive and some reactive power must be supplied by the grid to run motor/inductive loads. The household meter does not read reactive power (VA), only true power (Watts). So, the utilities/generators can’t recover renvenue from meters that can’t read reactive power, which the generators must supply regardless. PV Inverters run at Unity PF (1) and can’t really supply Reactive Power (VA) otherwise they become really inefficient in doing so. Grid connections also help with startup power – as some motors will require 7x the running current for a very short period of time and some inverters can’t do this. So, it’s a small price to pay to have grid connections for these situations.

I’ve been on TOU since I had my solar installed in 2011 (4.75kW) and have a Solar Hot Water system (which doesn’t need boosting for 8 months of the year). My solar PV system is due to break even in about 6 months and with the loss of the NSW FiT (20c), need to find better ways to maximise solar use (but economically and convenience).

I think too much emphasis is on the bean counting and the economic benefits. We must also look at the non-fiscal benefits of battery storage to evaluate its true purpose – and not just being a cash cow with $$$.

Parking cash in a bank serves no environmental purpose at all, it does absolutely zip for it.

Don’t forget the not insignificant factor of never having a blackout. Haven’t had one for years, but then I live relatively close to a major city. Could be the deciding factor for people on grids less reliable.

You’re absolutely right.

We’re on a rural property and not on town water – just rainwater and pump. Not much fun being the shower all soaped up and the power grid goes down !!

Also, I use a CPAP machine for my sleep apnoea – not fun waking up in the middle of the night struggling to breath when the grid goes down …. then struggling to go back to sleep after removing the CPAP mask …. and then feeling really, really crap the next day from the disturbed sleep but mainly from not being able to use my CPAP machine.

ROI is a legitimate consideration and most definitely should be considered, but it shouldn’t be the ONLY consideration. Evidence of the negatives of only considering the financials with respect to investments are everywhere to be seen vis a vis poor service in shops, governments departments, long hospital waiting lists, even longer waiting on music on hold when trying to speak to a real person when ringing organisations, etc, etc.

… Further to my earlier post, I now have another reason to swap my current 12 panel 3Kw 6 mini inverter system around. DC optimisers on every panel and a matching central inverter combined with a few lead acid batteries as a stop gap which are enough for our (modest) night time usage of 3Kw.

Why? A brief, minor storm caused widespread power blackouts here in the west. I lost nearly four hours of work. Due to crazy W.A. electrical regulations my current system needs mains to work – even though it was daylight and all panels were fine…

Swapping out mini inverters to a central big one turns out to be only marginally more than running an (incredibly overpriced) isolation switch which complies with former crazy regs.

Given the widely reported worldwide increase in storm damage, any system that is not standalone in the case of a blackout is not worth purchasing anymore.

Not every decision is solely based on economics.

Enjoyed the article, only thing I wonder have you considered that any money earned re the term deposit is taxed at marginal rate of 40% this would impact the value of investment return. While any money saved via not paying for power may also be impacted positively by that money not being post tax. Unsure of the tax rules but would this affect the the final values?

Nice to see Tax thought of in these workings. How about what a genuine Carbon Tax will do to these “Normal Electricity Bills”. Crystal Ball stuff I know, But a CT is coming soon.

With prices rising on July 1, would you be able to revisit this post with updated calculations? It feels like it’s going to be worth it more and more these days.

http://www.news.com.au/finance/small-business/electricity-price-rises-locked-in-from-july-1-2017/news-story/0bad2dcddc1a3040c4abbf07d25cb7fc

Hello Nick. Because feed-in tariffs are rising along with electricity prices the economics of home batteries may not improve. It’s possible they will even get worse. I wrote about it here:

https://www.solarquotes.com.au/blog/when-electricity-price-hikes-dont-improve-the-economics-of-batteries/

Once I’m sure all the price increases for the new financial year are in I’ll have at look at the damage and see how the economics of batteries and rooftop solar have fared.

Thanks Ronald, I appreciate the response!

Ron et al,

I am not sure why there is any need at all to have all this talk about assumed investment yields, when thinking about the cost benefit of battery storage within on PV grid connected system. For my simple mind it is just a matter of comparing the costs of storing a unit (kWh) of energy using different methods. The Grid or a Battery. That is after all said and done, in effect what we pay the electricity retailer as a difference between the FIT and the use tariff.

In the example of Synergy in W.A.

We feed PV power to them at 7.135c/kWh and buy it back at night at 26.5c/kWh. The difference of 19.365c/kWh is the cost to us of Synergy storing whatever Kwh from our PV system that we fed into the Synergy system. In this case of the Tesla battery, you have assumed Ron, the “Powerwall 2” will store a number of kWh’s during its warrantee life at 23c/kWh. It is easy to see that on your assumption it is cheaper to pay Synergy to store your excess PV power up to the warrantee life. But a quick calculation will tell you that if the Powerwall actually lives to store 16% more than it’s warrantee, then you actually break even on the cost of storage.

Some writers in other blogs have made the assumption that these storage batteries will actually store as much as 50% more than is given in the manufacturer’s warrantee. If that proves to be a fact, then in its lifetime the Powerwall storage cost per kWh comes out well below the Synergy 19.365/kWh.

I actually think the LG RESU 10H figures come out better than Tesla’s Powerwall 2.

Hi Neil. When someone is trying to decide if they are better off buying batteries or using the money to pay off the home loan, it is important to look at more than just warranted cost per kilowatt-hour. (I generally do assume batteries will provide 50% more stored electricity than what they are warranted to when determining how close they are to paying for themselves.)

Comparing

“Money saved = Time-of-use tariff bill without batteries – Time-of-use tariff bill with batteries”

You forgot to add benefit of having very low night tariff on Time-of-use. How much it worth for particular household is hard to estimate.

I’m using lots of electricity at night on winter for heating. So having Telsla battery allow me to use cheap night electricity on Time-of-use without been ripped off during peak time. Does it makes it worthwhile investment is totally different question,

A modest proposal:

1) Buy $10,000 of Tesla shares;

2) Wait a couple of years until the price of the batteries drop due to lower production costs;

3) As the price of the batteries drop, sales will increase, and the value of the company and your shares will rise;

4) Sell enough of your Tesla shares to buy a power wall at the reduced price.

This will leave you with a power wall and a piece of Tesla. If the price of the batteries drops 50% (to $5,000) and the price of the share rises 50% (to $15,000) you can sell your shares, get your money back, and have a free power wall, plus you will let product glitches get worked out on other people’s dimes.

Other than that, I agree with Ronald Brakels that the cost of ownership is too high at present.

No matter how I look at it, I reach the conclusion that the effective size of the battery is the energy burned from sundown to sun-up:

Even at the 5kW limit for household solar systems in WA, I generate well over 30kwh on sunny days, more than I consume over 24hr, and only burn maybe 5 KWH sundown to sun-up: (1.4 kWh for a fridge, 1.2 kWh for (6 hours x 200W) of lights, plus 2.4 kWh for (4 hr x 600W) for a computer and TV ). Everything else is gas.

Since I run the AC during the day, the house and contents are cool, and I can turn off the ac when the sun is down . The solar cells cover the energy requirements of the ac and normal house draw, so the battery does not contribute to the load during the day. The 5 kWh consumed from the battery overnight is recharged in the morning when the ac isn’t needed (so net grid consumption is still zero), and the pv panels provide more energy than is consumed the rest of the day.

So in summer I effectively have a 5 kWh battery (maybe add a bit to allow PV production time to ramp up in the morning).

In the winter I use the RC system to heat, so my battery would always be discharged. It starts out empty in the morning, and since I burned more than I consumed during the day it doesn’t get charged, and is empty at night. Its effective size would be about zero.

In the spring and fall, with no ac or heat and good PV production, I send a lot to the grid. But I still only consume 5 kwh at night, so the battery would always be 2/3 full, just llike in summer, and the benefit of the battery is again 5kWh/day. Once the battery is topped off, I still sell the rest to the grid, and the minimum output of the photo-voltaics is nearly always greater than the system draw at any given time during the day, so no load leveling benefit.

So my effective size of the battery would be about 5kWh spring, summer and fall and zero over winter for a REALLY good year. I get a return on investment of 5kWh x (0.2406-.07135) = $0.846/day for the non winter months, maybe 280×0.846 = $237/year (value in brackets is the cost to buy a kWh-the cost to sell it). Interest on $10,000 at a mortgage rate of 4.5% is $450, so for a mortgage holder you are paying 450-237 = $213/yr for the privilege of owning a depreciating asset. The buy-sell spread would have to be $0.247 to break even, and that would only occur is the battery lasted forever, with no service costs.

On the other hand, it would only take 1 outage per year where you lose your freezer contents to make up the cost differential. Sure, not likely for many (haven’t had an outage for years in inner Brisbane), but certainly not unheard of in many places.

I have installed a 5Kw solar system comprising 19 265w Q cells with Enphase m/inverters and Enphase Envoy S.

I have invested in solar because I am approaching retirement and decided to do it now whilst I have the income to reduce our power bill later when I’m on lower fixed income.

The economic pundits might say it’s not financially viable but it makes sense to me. I don’t think my future income will keep pace with the power prices.

I am now considering battery storage.

My current power import is approx 5-6Kwh per day(when A/C is not used).

Question.

1.Do I instal Enphase batteries or Tesla?

2.How will a suitable size Enphase setup compare in cost to Tesla?

3. If Tesla were the best option, will the Enphase Envoy “talk” to the Tesla battery and vice versa without some Tesla specific coms device and seperate monitoring/reporting software..

4. Will the Envoy see a Tesla as “just a battery” or will it get confused.

My research so far appears to show that an Enphase system scaled up to the Tesla’s capacity would cost as much or more and still not have the output capacity of the Tesla.

Is there someone out there who can answer my questions and comment on my thoughts as I need to know I’m heading in the right direction

Hi Phil.

I am afraid buying batteries now won’t save you money. But if you want to get batteries anyway, my thoughts are…

The Tesla Powerwall 2 is a big battery with 13.5 kilowatt-hours of storage when new. As you only use 5-6 kilowatt-hours a day you will not use it at less than 50% capacity, which will effectively greatly increase the cost per kilowatt-hour of stored electricity. For this reason the much smaller Enphase battery seems more appropriate for you. But because the Enphase battery only provides 0.26 kilowatts of power per unit, you are also likely to have difficulty using it at high capacity. But I think you are likely to lose less money overall with one or two Enphase batteries than a Powerwall 2.

2. The most cost effective setup would be 1 Enphase battery. This is roughly one sixth the cost of a Powerwall 2.

3. If you do get a Powerwall 2 it won’t be able to communicate with the Enphase Envoy, but you will be able to use its own battery management features.

4. I am afraid I don’t know what the Envoy will think of the Powerwall 2.

Hi Ronald ‘

Thanks for your thoughts.

It would seem that for simpicity, Enphase is the way to go.

I want to keep it simple ie. one intergrated system with single software and monitoring. .Enphase Enlighten and Envoy work well for me.

However to recover somewhere near the 5+kWh I import I would need say 4 batteries(4.8kWh).Please correct me if I have this wrong.

My peak consumption was 1.2kWh for one 15 min period during a cold over cast day with A/C running.

I have been quoted $2200 per battery+ installation so I would be up for $9000+

I know batteries are still a long way off from pay back break even point but this seems way too expensive.

My original premise was to reduce my power costs in the future when I am retired and on reduced fixed income.Probably I am essentially “prepaying” my future power bill.

Economically this doesn’t stack up either as $9000 over 10 years equates to $225 per quarter. Even if you deduct the $100 or so that the batteries may(?) contribute per quarter it still comes to $125.

Our existing solar setup has reduced our bill from $350-$400 per quarter down to around $150 (autumn qtr) so maybe batteries would reduce that by a further $75-$100.(5kWh/day)

I hope this not all gobbledygook and I haven’t dropped a decimal point somewhere.

I eagerly await your valued thoughts.

Cheers Phil

Hi Phil

Four Enphase batteries will only be able to supply you with 1.04 kilowatts of continuous power or 1.08 peak. So while it sounds like you don’t use a great deal of power, you are still not likely to not use four batteries at their full capacity. But, as they will gradually lose some capacity as they age, you may think of that extra capacity as backup. At a guess, maybe you’d be able to get 4 kilowatt-hours a day, possibly less, out of them. But with your envoy you should be able to get a good idea of how much battery capacity you will use. When your power use drops below one kilowatt in the evening the batteries will be, technically at least, able to supply all power consumption, and when it rises much above 1 kilowatt you would be drawing power from the grid.

This article is a little outdated now, but describes how the Enphase battery takes around 4.4 hours to fully discharge when used at full power:

https://www.solarquotes.com.au/blog/enphase-batteries-are-impressive-but-very-unlikely-to-save-you-money/

If you haven’t done so already, I suggest getting a few quotes through us to see what is available in your area:

https://www.solarquotes.com.au/

Hi Ronald,

I have read this blog/post and am interested to know your thoughts on this.

Your calculations were done some time ago and I am interested in your thoughts on a Solar & Battery system now that my rates are 0.4395 c/kWh, this is anytime use.

I am using 30kWh per day steady hour by hour. So I think that I may be able to cost effectively use a Solar panel Bank and a Tesla Wall or similar and be able to get a financial benefit.

I would like your thoughts on efficiency of the battery use in this scenario as I think that I could use the full capacity every day. I was looking at a 10kW panel system which I think can supply enough to supply usage and charge the Tesla.

I live in Port Augusta SA, over 300days of sunlight per year.

If you are in Port Augusta you should be able to get a better retail plan. This retail comparison tool may be of help:

https://www.solarquotes.com.au/energy/

Including discounts, you should be able to pay around 34 cents per kilowatt-hour of grid electricity you use or less. And you should be able to get a feed-in tariff of up to 16.3 cents a kilowatt-hour. Including losses this would result in a saving of only around 15.5 cents per kilowatt-hour of stored electricity used, which isn’t enough to make it worthwhile.

Even with a low 6.8 cent feed-in tariff the saving per stored kilowatt-hour would only come to around 26 cents a kilowatt-hour. If the Powerwall 2 operates well beyond its warranty and your average use is 10 kilowatt-hours of stored electricity a day for 15 years then, assuming everything remains constant and constant dollars are used, you will have saved around $14,200 on electricity bills. If the Powerwall 2 cost you $13,000 to install that’s about a $1,200 return over 15 years, which is not a good investment.

If you want a Powerwall 2 for non-economic reasons then money’s not a problem, but it’s not likely to pay for itself. I suggest installing as large a solar system as you can while making sure you have an electricity retailer that will provide you with your full feed-in tariff and not use tricks to try to limit what they pay.

G’day matey. We have recently had a 13.2kw system installed. Our daily kw usage was approximately 75kw per day.

We had been told that our return to grid (feed back) would be capped at 5kw. We are currently feeding 28kw back into the grid after our own consumption.

What battery would you recommend as our feed in tarif is 14c per kw, but as mentioned capped at 5kw.

Hello Liz

Well, the first consideration is how much electricity you use in the evening. Because you are a big user of electricity I’m guessing you’d have no problem using all the power in a larger battery.

Because you already have a solar system you’ll want one that is AC coupled so it won’t matter what kind of solar inverter you have.

Then you’ll want to decide if you want a battery system that can supply power during a blackout. But a generator may be a more cost effective choice for some people.

Our battery comparison table will let you compare systems:

https://www.solarquotes.com.au/battery-storage/comparison-table/

If you want a larger, AC coupled battery, then a Powerwall 2 may be a cost effective choice. It can be used during a blackout — if you pay extra. But they were difficult to acquire in the past and I don’t know what kind of a waiting period they have at the moment.

Normally I tell people that battery storage doesn’t pay for itself, but since you have clean, green, solar electricity being wasted due to export limiting it could be both economically and environmentally worthwhile for you, provided the total cost is low enough.

Very Interesting Ronald.

The item that would have been exciting to see in BOLD letters

=========================

Please change the explicit number of $10k to a number that works.

=========================

What would a PowerWall 2.0 price must be or less.

I could fumble around for a few days, but as you have your model, could you please do a Goal.seek?

Very interested in the answer – pen and paper suggests ~$5,000 or 50% less.

Yes, if the cost is halved it pretty much becomes a sure fire winner. Looking at the prices for car battery packs it looks like we will get there.

wow.

That was fast. Is it really 50% less to be investment quality i.e. you ran the model or is it 55% or 60%?

What return did you target? I assume something like 10% p.a would make most folk sit up?

I just do not want to gloat that my Post it note sized scribble actually worked. Should I have guessed another number in other words?

Anyway..thanks

Nah, I just remembered that at the time I thought batteries would have to halve in cost again to be clearly economically worthwhile to a large number of Australians. But electricity prices and feed-in tariffs have changed since then and information about the actual efficiency of home batteries in practice has come to light. When there is another step downward in home battery prices I will revisit the subject of whether or not they pay for themselves again with all fresh information.

Hey Ronald, what do you think of this new article?

http://reneweconomy.com.au/tesla-battery-solar-now-significantly-cheaper-grid-power-51011/

Hi Nick

I say, beware of blended payback:

https://www.solarquotes.com.au/blog/blended-payback/

Rooftop solar is a great investment and rapidly pays for itself and when combined with batteries hides the fact they aren’t there yet.

Hopefully, it won’t be too much longer before home battery storage does pay for itself.

Hi There.

I’m an Architect and doing a comparison and recommendation for a battery system for Clients.

Taking out renters, Australian property ownership can roughly been divided into 50/50 Owner with/without a mortgage.

For the 50% of the population with a mortgage (including me, so personally very interested), and the old school and pretty well tested financial advice to put any spare cash on your loan/offset at a 3.59 (U-Bank fixed) – 3.75% (ANZ fixed) interest rate vs 1.4% Term Deposit, how would that stack up?

Repaying a owner occupier loan would attract zero tax on Capital Gains as opposed to 40% on a term deposit earnings as well.

Other factors are “market value” on the property and how a full solar system worth $XX at install, that say has 5 years life left would be priced and paid for by the market? Big can of worms there and very open ended!?

I reckon 10% of home buyers would understand the lifespan and financial mechanisms behind a solar system with batteries, so a RE agent would put a bit of shine on that aspect of a sale and probably get away without awkward questions in the main part!

Would the vendor get the full capital outlay back or say the % of life use or halfway? They are questions that need detailed market analysis comparing similar house with and without P|V/storage and ones I’ve tried to answer as the head of RND for various large Builders when trying to sell Eco houses, but often are too long a bows to draw.

Thanks in advance.

Brent Yttrup

Hi Brent

My advice for people looking for an economic return is to simply not get batteries yet as they cannot pay for themselves at their current price. This could definitely change within a few years, but the cost of an installed home battery system will still have to come down a long way.

Solar systems are a very different matter and can rapidly pay for themselves:

https://www.solarquotes.com.au/blog/solar-payback-times/

Generally they are the best investment available to households with unshaded roofs.

Seems everyone is getting excited but there are too many people opting for apartments rather than homes.

The other factor – re-sale value. Has the battery been thrashed, where is it on the life cycle? Due for upgrade / repair of degradation? Give a buyer a chance and the valuation will be 10% of cost.

The option for people investing in a solar farm and getting a “time share” type benefit of having ownership rights to renewable energy could change things, and doable now without waiting for breakthrough technology.

Then back to back with a utility scale battery system, then those on level 10 of a 50 level tower can make a difference and get access, probably even cheaper than a home owner as both still have to pay something for the grid.

Homeowners might be able to have both ..off grid benefits and if they store credits in utility scale during duck curve moments, might even be able to extend their power security for the “big” event

Hi Ronald,

Can you please give us the approximate break even point per (cents per KW) at which you believe batteries may become economical?

I understand it may include some assumptions, but it may still be a useful rule of thumb.

Thank you for all your posts

The cost of storage from home batteries will have to get below about 20 cents for them to pay for themselves in most suitable locations. But this cost per kilowatt-hour of storage should include capital costs and efficiency losses, so you can’t just go by the simple figures a battery salesperson might give you. Some people may be able to make batteries pay before this point, but that’s not likely to be a large portion of the population.

But there is a way home batteries can potentially pay for themselves at the moment and that is when they are used as part of a virtual power plant. So they may determine when home batteries pay for themselves.

Thank you for this infomation. Most kind of you.

On that basis, the DSV PV 13.5 (Solar Battery Storage Comparison spreadsheet) may be a consideration?

I wonder if you are aware of the Arvio Sirius Capasitor Module of 7.1KW?

You only have the 3.55KWH on your Battery Storage Comparison spreadsheet.

It is my understanding that their Independence Day system actually use two of the 7.1KWH “batteries”).

I know two guys who are involved at the technical side from the start with these and they are very positive. Our relationship do not require them to be, so it stimulated my interest.

I am looking at a battery option for a mobile platform with heaps of solar. Current lead acid batteries are to heavy (weight is a limiting factor in RV, caravan or even tiny house setups, as you have to be roadworthy and I have limited tow vehicle capacity – as would most people) and I am not game enough to use Lithuim, as the setup costs are significant and the risk of loss for me to great. So for that reason I am interested in the Arvio Product. Can you give me some insights into your thinking on this issue please?

Due to how I move and where I stay, generators are only a sometimes available option.

I wrote about the Arvio supercapacitor here:

https://www.solarquotes.com.au/blog/arvio-supercapacitor-battery-review/

Personally, I would hold off buying one until the results of independent testing are available. (If you can get your hands on some, I’ll happily publish them.)

Hi Ronald,

Thank you very much. I read your Arvio super capacitor review. It did not appear to refer to the 7.1KWH unit (it appears to suggest 2 x 3.55KWH units) which is not my understanding. There is a spec sheet for both the 3.55 and 7.1 KWH units. IF you want I can send it to you? This will also impact pricing, as total capacity is 14.2KWH in the Independence Day System under my understanding.

When do you think sufficient testing would have been conducted? Do you accept the tests by ARVIO?

Can you perhaps provide the link to your DSV PV 13.5 review. I’m struggling to find it. MAybe I need to improve my search techniques?

Thank you again and have a nice day.

Leon

There is a 7.1 kilowatt-hour module, but Paul said he decided to stick with 3.55 as it is much less cumbersome. While there might be some savings in making a larger module they are not going to be very significant and won’t have much effect on the cost per kilowatt-hour.

I haven’t seem any independent test results. Personally I want some sort of independent evaluation before buying any significantly new technology, but that’s just me.

I had a look at the DSC PV 5.0 and 10.0 a while back:

https://www.solarquotes.com.au/blog/dcs-solar-batteries/

Hi Ronald,

The battery comparison table…https://www.solarquotes.com.au/battery-storage/comparison-table/ needs updating.

It is quoted that the Tesla Powerwall is not a all-in-one unit. This is incorrect. It has a built-in inverter. It’s had a built-inverter ever since the Powerwall 2 was released, and that’s nearly 2 years ago.

Also, you need to compare features like Tesla’s Time Based Control feature that can control the battery’s ability when to discharge and recharge for ToU plans and not just battery capcity and power ratings.

I believe not many battery systems that have this ability to control the battery functionality via an app. Most battery systems apps are just for monitoring. The Tesla Powerwall not only monitors but allows the user to control the battery’s operation in 3 modes – Backup, Self-Powered and Time Based Control. How many other battery systems on the market have this ability? Even Sonnen’s app is only for monitoring and it’s supposed to be Tesla’s main competitor.

This is a glaring oversight in the comparison table that could sway’s one decision when purchasing a battery system.

Hi Graham

On the battery comparison table “All in one unit” refers to if solar panels can be directly attached tot he system. This means it also performs the role of a solar inverter. Unforatunately, the Powerwall 2 doesn’t have this capability. While the table does state if a system is AC coupled, maybe the table can make it clearer that a built in battery inverter can save on costs.

Hi Roland,

Thanks so much for the great article, this analysis is very useful. I also had a question.

In the battery comparison table, it is stated that this entry was last updated on February 2019.

https://www.solarquotes.com.au/battery-storage/comparison-table/

I just wanted to confirm: Does this mean that the article now uses the time of use tariffs, and Powerwall II performance and costs from February 2019?

Hi Roland,

Thanks so much for the great article, this analysis is very useful. I also had a question.

In the battery comparison table, it is stated that this entry was last updated on February 2019.

https://www.solarquotes.com.au/battery-storage/comparison-table/

I just wanted to confirm: Does this mean that the article now uses the time of use tariffs, and Powerwall II performance and costs from February 2019?

Thanks and regards

Conrad

Hi Conrad

I’m not aware of any significant changes in the Powerwall 2 since the start of the year. I can tell you it is likely to cost at least $16,000 to have it professionally installed.

Hi Ronald

I have been quoted $16,300 to install a Powerwal l2 to my existing 10kW system.. I don’t have a years figures yet, but my Solar Power export ratio to Power imported is 5:1 over the last 3 months and 2:1 for last last 6 months..

We are are 24 hr house and the numbers look good for charging the battery.

I’m entitled to the $4,800 Vic rebate if my post code comes up..

Because this has to be installed on an East wall which is also a bedroom with the bedhead against the internal wall…. Is their an EMF or hum issue to worry about ?.

There’s not much to worry about from EMF. I wrote this article on it from solar panels and inverters (there is a battery inverter in the Powerwall):

https://www.solarquotes.com.au/blog/electromagnetic-radiation/

As for noise it is normally quiet, but when the fan and or cooling pump are working it can reach 40 decibels at 30 degrees according to the datasheet, but I’ve read elsewhere it can reach 50 decibels, which is 10 times louder. A dishwasher in use apparently produces 46 decibels.

A Powerwall 2 on the wall outside probably wouldn’t worry me, especially as it’s unlikely to use its fan or heatpump late at night, but other people are more sensitive to noise.

Ron… Thanks again… My installer can install the Powerwall 2 on the bathroom wall, away from the bedroom and they are happy with that and my concerns.

I’m now waiting for an official quote because when you go through the websites a Powerwall 2 has installed prices varying form 10k to 16k..to existing Solar system

Thanks Ronald.

My late night son is a musician and he is still asleep up until 1pm,, That’s what musicians do.. He cooks at night.. Goes to bed at about 6-30am

But I’m planning on future proofing the house for the children.. They are in their 50’s, no children and struggling like many with mortgages and living closer to their workplace.

So a day like today where the outside temperature was 31oC, it could be a problem. But I will wait for G-Store, my LG/Enphase installer to come back to me on their thoughts

tsktsktsk……. who on earth would voluntarily spend umpteen thousand dollars on a fpowerwall, when the alternatives are so much more attractive. I didn’t get my batteries from this crowd, but when, for LESS than $2 per ah (ie $150 per kwh storage) you can buy deep-cycle batteries with a FIVE YEAR WARRANTY, only a dill would pay a fortune for ‘powerwall’ type systems that (presuming nothing ELSE goes wrong) would be obsolete in five years anyway.

These are not only well-priced, but are well-tried and proven technology as well, and look well worth checking out. (My only reservation is the relativlely light weight of the units, but the guess would be that, since they’re 6 volts they actually weight 115kg as a 12-volt unit. Ample.

ps……if the link doesn’t appear, get back to [email protected] and I’ll forward the details.

https://www.aussiebatteries.com.au/off-grid-solar/battery-banks/6.6kwh-12v-550ah-agm-battery-bank-6v-cells

ps….. and ZERO installation costs. Borrow the half-witted chimp from the neighbours to set it up for you!

G’Day Ronald. Just an observation on the overall ‘content’ of the article… It focuses on the financial benefits only and does not appear to consider the reduction in carbon by using battery power rather than buying grid power.

So people (like me) are not so worried about saving or not spending $6000 over 13 years, but how much carbon has been saved instead.

Just a thought…

Hi Greg

At this time battery storage does not help the environment. This is because if electricity is sent into the grid for a feed-in tariff it will reduce fossil fuel generation by more than if it is stored in a home battery. This is because there are always losses when a battery is charged and discharged so less energy can be taken out than put in. But in the future batteries may be green as they begin to regularly store renewable energy that otherwise would have gone to waste. I wrote about this here:

https://www.solarquotes.com.au/blog/does-battery-storage-help-or-hurt-the-environment/

Ronald

I have ordered my Powerwall 2.. Installation Early April.. Feed with a 10kWh Enphase/LG solar system which has been producing for

Some amazing Melbourne Powerwall 2 users are already helping me with the productive use of the battery. Off peak etc.. Even though I did my financial sums, in the end it was a lifestyle type decision. We didn’t want to go to gas for cooking. My wife has to cook all of her own food and can’t eat takeaway etc..Allergic to all things. We didn’t get the battery rebate, our postcode didn’t come up, and ironically over 4 years, the extra aged pension I receive because the Powerwall isn’t an asset, we get back $4990 over 4 years..

I appreciate the comments about other batteries etc but at my age I want the backup of my installer G-Store and continue to build my relationship with them.

As I write this, my banks have just dropped their deposit rates to 1,3%..so as a high Electricity user, balancing the use is going to be a mental challenge.

Ron.. We have made a financial bonus since the last reply in this great post. Our interest rates at the bank dropped to 1/2% during Covid so I “invested” in two more PW2’s. Those rates are now creeping up, maybe 3%. We are enjoying 11% ROI with our power savings and part pension increase. The Goal Saver Account I set up when we started Solar in June 2019 sits at $21,000.

We have also enjoyed using 7-day Time of Use from AGL in Victoria and saving another 22% on our bill. Our Pedak rates are for 7 days from 3pm-9pm. Tesla added Time Based Control into their 70% warranty for AUS/NZ in March 2021, and by install date, the last of my PSW2’s is covered by that warranty. We have only been on ToU for 6 months and only imported 51kWh in that time. 20kWh of that was when Tesla “kicked”: in Storm Watch last month at Peak times.

An enjoyable/profitable journey. I have a copy of the warranty on PDF because it’s difficult to find on the internet because the 2017 warranty always pops up.

Hi Ron.

Great article. Your analysis tickled my financial analyst brain! I’d love to see your model and understand how it all works, but I suspect there’s some clever stuff you don’t want to share in there!

Anyway, any chance you could update the numbers now, given higher interest rates, increased PW costs, higher electricity tariffs and (I think this is right) the inability to now move back to a single rate when on a time of day based smart meter.

Cheers mate.

John

Hi,

I think this review is getting outdated now.

With different financial climate, latest Powerwall 3 using LFP chemistry, a different architecture, and more modern electronics, it would be good to get a new PW3 reviewed when it becomes available here (I’m not sure if it’s available in Australia or not yet).

Kind regards.

Oleg

Happy to help, here’s the latest on the Powerwall 3 in Australia.